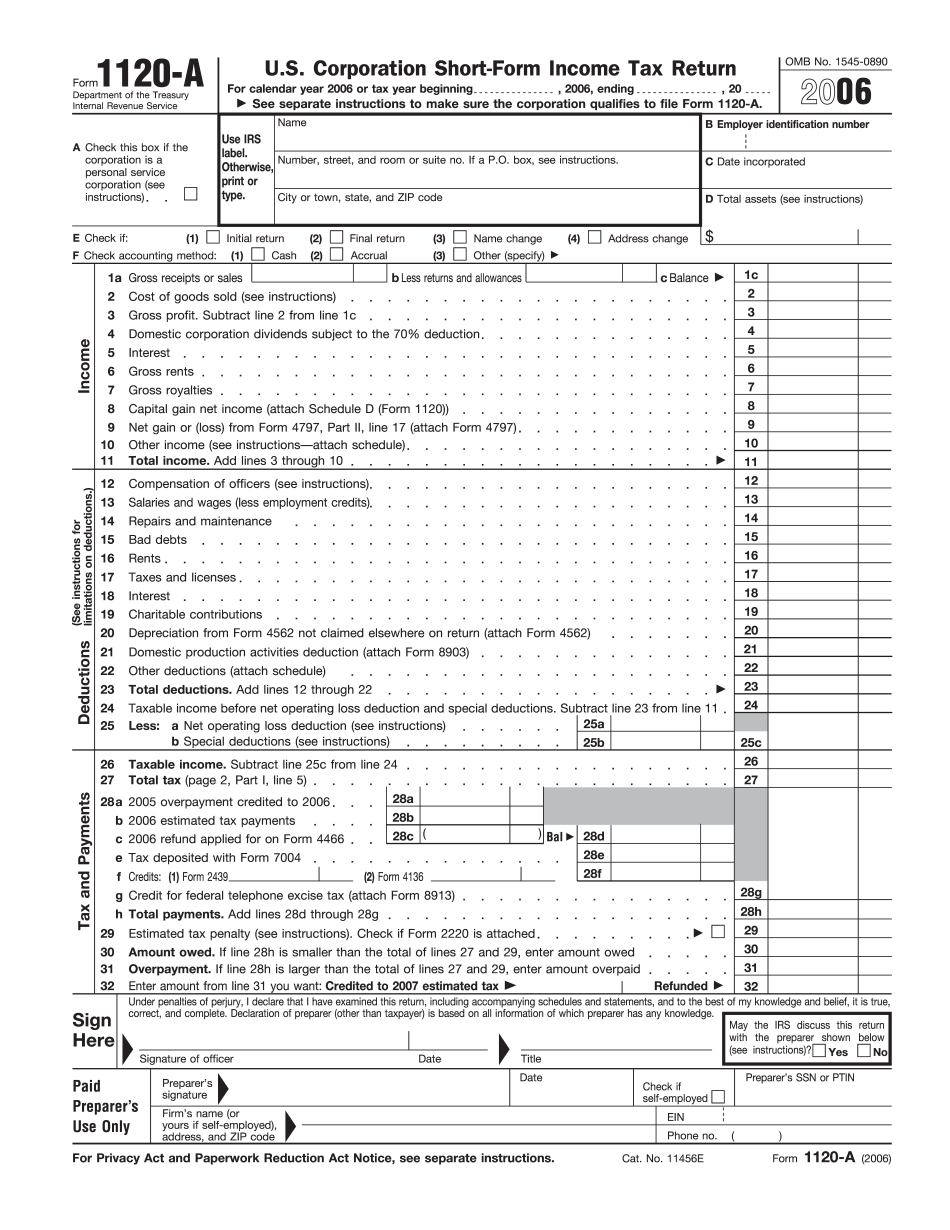

what is form 1120 s IRS Form 1120S is the tax return used by domestic corporations that have made an election to be treated as S corporations for that tax year The return reports income losses credits and deductions before they flow

What Is Form 1120 S IRS Form 1120 S is used to report income or gains losses tax deductions and business tax credits for an S corporation To elect to file as an S corporation a business must first file IRS Form 1120 S is an important tax document used by S corporations to report their income gains losses deductions and credits as well as to determine their tax liability

what is form 1120 s

what is form 1120 s

https://www.pdffiller.com/preview/5/514/5514464/big.png

How To File Form 1120 S For 2022 Restaurant Example YouTube

https://i.ytimg.com/vi/92k07jVR7vk/maxresdefault.jpg

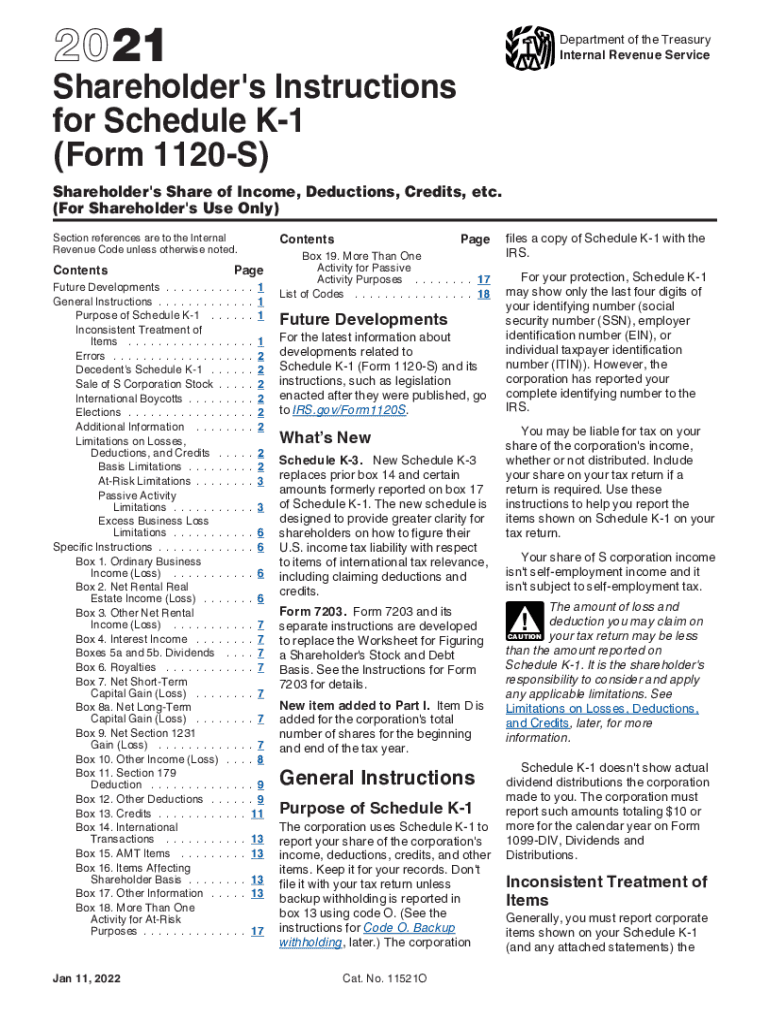

What Is K1 For Taxes 2021 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/584/735/584735907/large.png

Department of the Treasury Internal Revenue Service U S Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form 2553 to What is Form 1120 S Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax year

Form 1120 S is essentially the tax return for an S corporation Who Needs to File IRS Form 1120 S If a corporation filed Form 2553 to elect to be an S corporation and the Form 1120 S is a tax return form for businesses that are registered as S corporations Here s how to file it

More picture related to what is form 1120 s

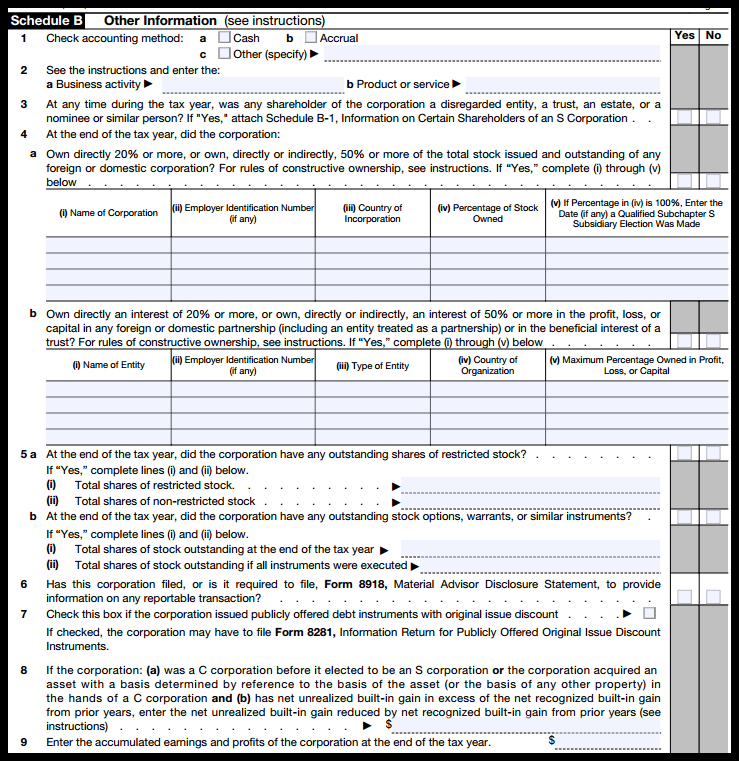

IRS Form 1120S Definition Download Filing Instructions

https://fitsmallbusiness.com/wp-content/uploads/2018/02/form-1120s-schedule-b.png

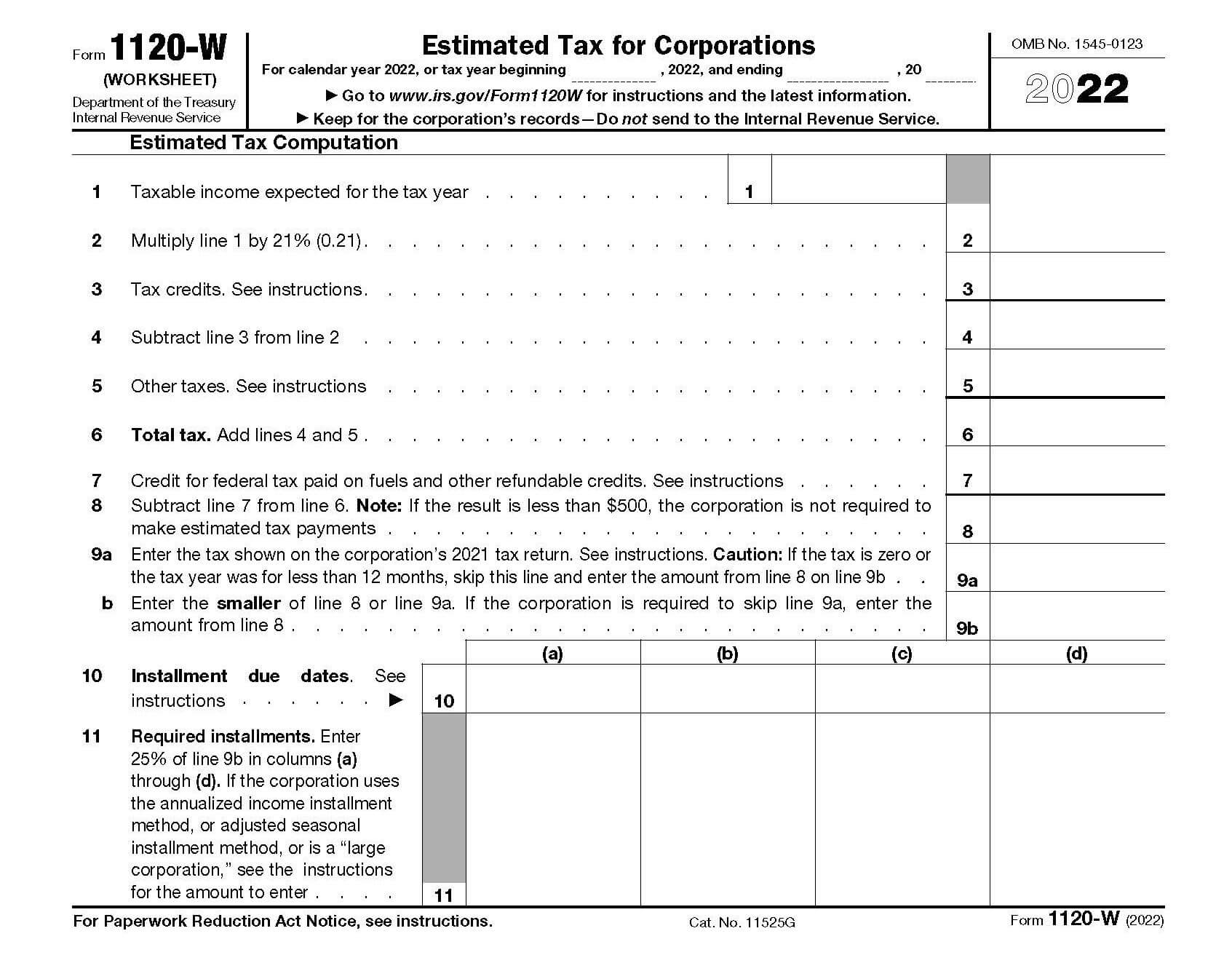

2023 Form 1120 W Printable Forms Free Online

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses 2023

https://www.freshbooks.com/wp-content/uploads/2022/03/1120-tax-form.jpg

Form 1120 S is a U S Income Tax Return form used by S Corporations S corps to report income gains losses deductions and credits to the Internal Revenue Service IRS Form 1120 S is crucial in reporting S corporations income losses and deductions It s essential to understand what this form is who needs to file it and how to do it

Simply stated Form 1120 S is the tax return of an S Corp that is filed despite the fact that the business doesn t directly pay taxes It supports the income or losses that will pass 1120S K 1 formally known as Schedule K 1 Form 1120S is an IRS tax form used by owners and investors of S corporations You can find a blank copy of the Schedule K 1 for Form 1120S on

Difference Between All Federal Tax Forms LoanBeam

https://hf-files-oregon.s3.amazonaws.com/hdpnylxsupport_kb_attachments/2022/04-26/e365095e-a1ee-45f4-b56d-b56ceb4798af/image-20220426100145-1.png

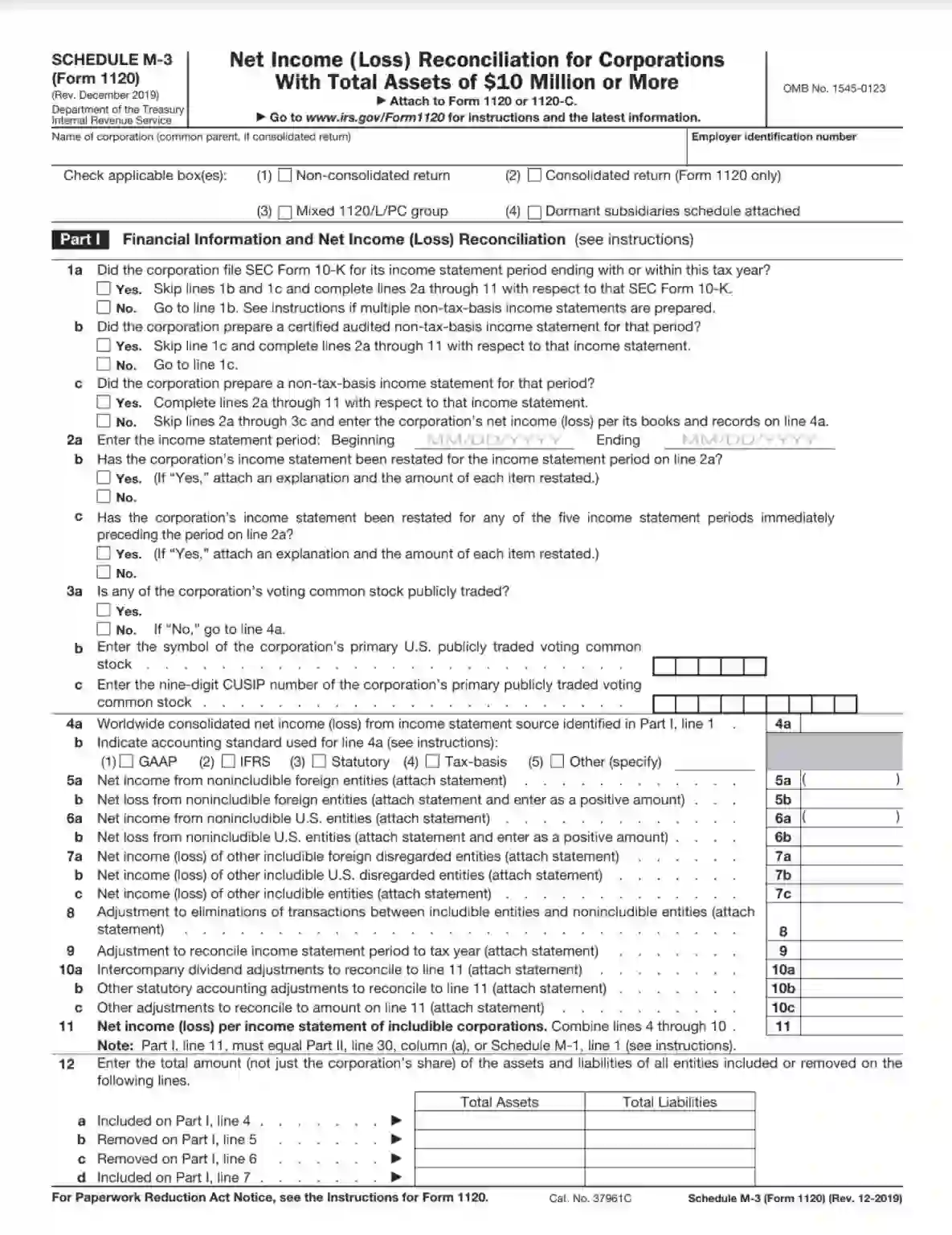

IRS Schedule M 3 Form 1120 Fill Out Printable PDF Forms Online

https://formspal.com/wp-content/uploads/2021/04/irs-schedule-m-3-form-1120.webp

what is form 1120 s - Form 1120 S is essentially the tax return for an S corporation Who Needs to File IRS Form 1120 S If a corporation filed Form 2553 to elect to be an S corporation and the