is form 1120 state or federal About Schedule UTP Form 1120 Uncertain Tax Position Statement Schedule UTP Form 1120 asks for information about tax positions that affect the U S federal income tax liabilities

Tax Form 1120 or IRS Form 1120 in its simplest form is the corporate income tax return It is used by C corporations C corp to report their corporate income tax deductions and liabilities to the IRS The IRS requires C Corps to file Form 1120 by April 15th of each year and neglecting to file Form 1120 on time can result in late filing penalties late payment penalties

is form 1120 state or federal

is form 1120 state or federal

https://gusto.com/wp-content/uploads/2023/02/Schedule-K1-1065-2022.png

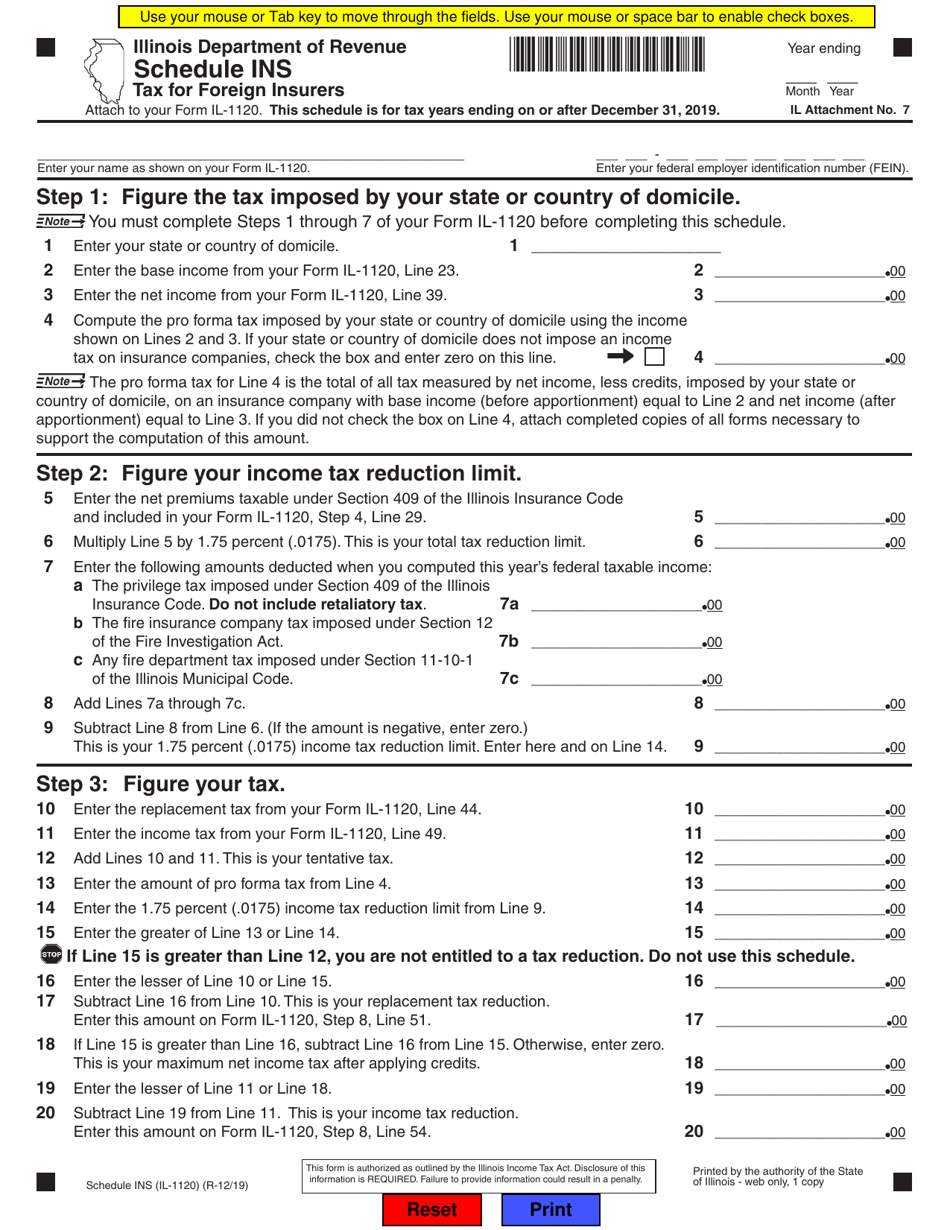

Form IL 1120 Schedule INS Fill Out Sign Online And Download Fillable

https://data.templateroller.com/pdf_docs_html/2024/20243/2024344/form-il-1120-schedule-ins-tax-for-foreign-insurers-illinois_print_big.png

IRS 1120 F Form Tax Templates Online To Fill In PDF

https://www.pdffiller.com/preview/460/871/460871940/big.png

Form 1120 is the standard document corporations use to conduct a federal tax return in the US They fill in the form with all their income deductions and taxes for the fiscal year All domestic US corporations have to submit For small businesses structured as C corporations Form 1120 is more than just a tax form it s a critical financial document that provides a snapshot of the company s fiscal

IRS Form 1120 is the U S Corporation Income Tax Return It s also used by partnerships but not by S corporations Find out how to complete and file it The 1120 form also known as the U S Corporation Income Tax Return is a document that corporations are required to fill out and submit to the Internal Revenue Service IRS annually

More picture related to is form 1120 state or federal

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue

https://www.irs.gov/pub/xml_bc/51221507.gif

3 11 16 Corporate Income Tax Returns Internal Revenue Service

https://www.irs.gov/pub/xml_bc/33500001.gif

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue

https://www.irs.gov/pub/xml_bc/51221511.gif

Key Takeaways All domestic US corporations must file Form 1120 unless they meet an applicable exception Form 1120 is used to report the income gains losses deductions and credits of a corporation and to Discover everything you need to know about Form 1120 including variations like 1120 S 1120 H 1120 F and 1120 W Learn about IRS instructions filing requirements and

3 Pro Forma Form 1120 The Required Cover Form Although the LLC itself does not report income or pay U S federal income tax pro forma Form 1120 must be filed as a cover form City or town state or province country and ZIP or foreign postal code A Check if 1a Consolidated return attach Form 851 b Life nonlife consoli dated return 2 Personal

Who Should Use IRS Form 1120 W

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

Irs Tax Forms 2022 TAX

https://www.pdffiller.com/preview/459/644/459644748/big.png

is form 1120 state or federal - For small businesses structured as C corporations Form 1120 is more than just a tax form it s a critical financial document that provides a snapshot of the company s fiscal