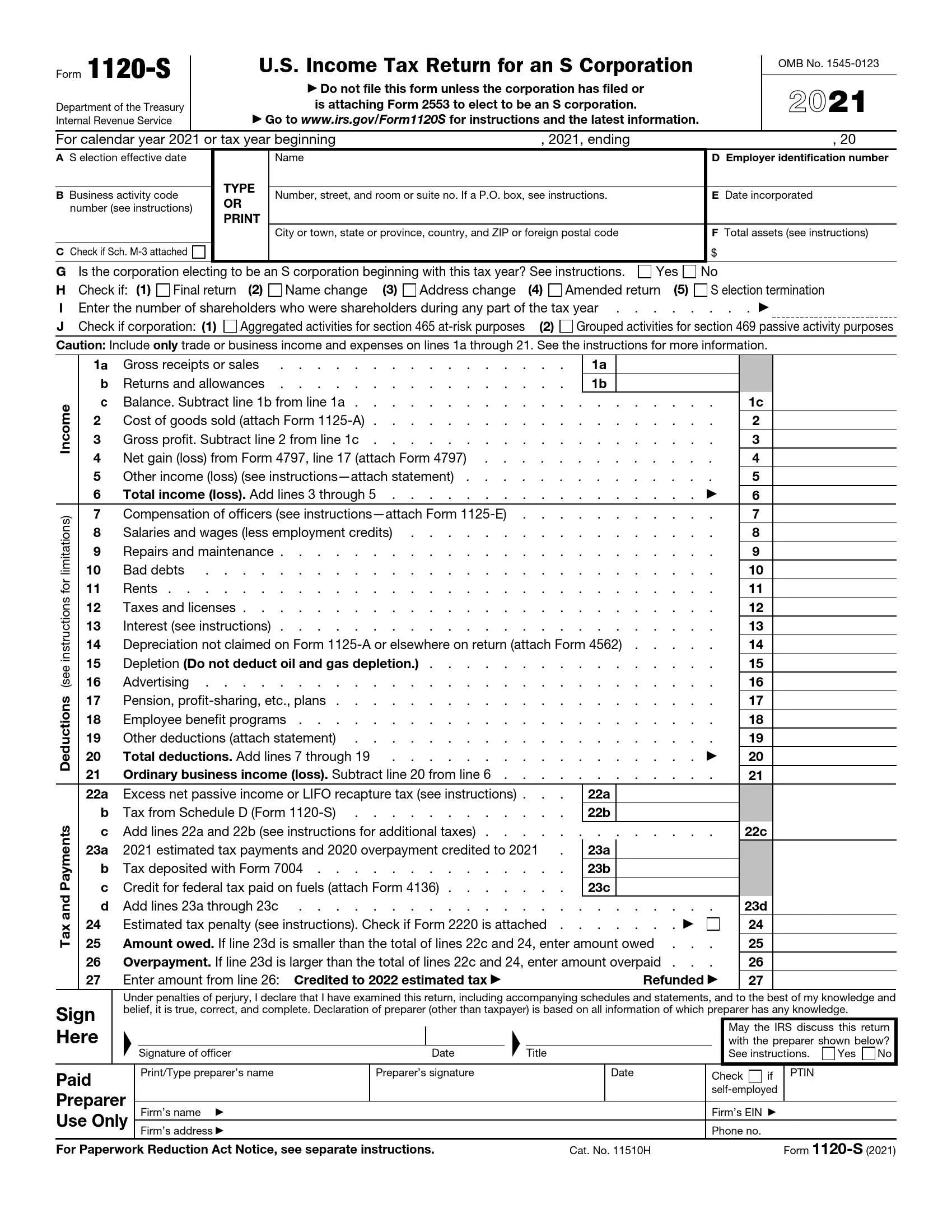

what is irs form 1120 s IRS Form 1120S is the tax return filed by corporations that have elected to be taxed as S corporations This tax form reports the corporation s income gains losses credits and deductions but the

Form 1120 S is the tax form S corporations use to report their income deductions and losses to the IRS An S corporation is a type of business structure that allows for pass through taxation IRS Form 1120S is a U S Income Tax Return for an S Corporation This form is used by S Corporations to report their income deductions and credits It helps determine the tax

what is irs form 1120 s

what is irs form 1120 s

https://i.ytimg.com/vi/92k07jVR7vk/maxresdefault.jpg

IRS Form 1120 Schedule L Balance Sheet Per Books YouTube

https://i.ytimg.com/vi/tAQ0u2bMZnU/maxresdefault.jpg

IRS Form 1120 S Fill Out Printable PDF Forms Online

https://formspal.com/wp-content/uploads/2022/01/irs-form-1120-s-2021-preview.webp

Form 1120 S is used by S corporations to report their annual income gains losses deductions and credits to the IRS The form facilitates the pass IRS Form 1120 is the U S Corporation Income Tax Return It s also used by partnerships but not by S corporations Find out how to complete and file it

In the U S C corporations report their tax information using Form 1120 A business organized as an S Corp will file a different annual tax form Form 1120 S S What is Form 1120 S Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the

More picture related to what is irs form 1120 s

2023 Form 1120 W Printable Forms Free Online

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

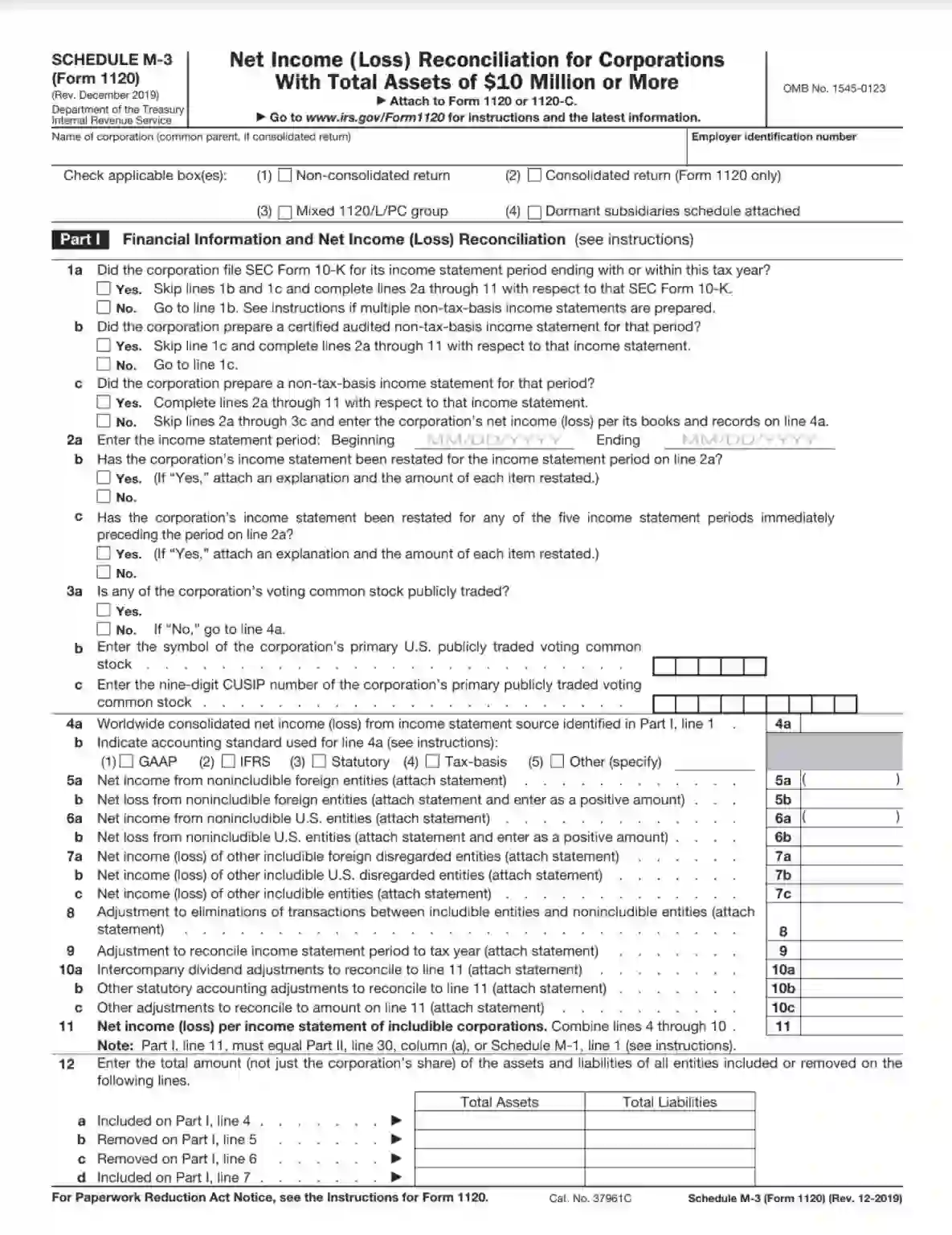

IRS Schedule M 3 Form 1120 Fill Out Printable PDF Forms Online

https://formspal.com/wp-content/uploads/2021/04/irs-schedule-m-3-form-1120.webp

:max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png)

IRS Form 1120 What Is It

https://www.thebalancemoney.com/thmb/-wWRc3-qPvbfC-d8ZzAm86DCMq4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png

Form 1120 S is how S corporations report how much they make to the Internal Revenue Service IRS So if your business is an S corp or taxed as one The IRS Form 1120 S is a tax document that you will use to furnish financial information to the Internal Revenue Service You ll need the 1120 S form to

Form 1120S is the tax form S corporations use to file their federal income tax return not to be confused with Form 1120 for C corporations Every S corp needs to file one IRS Form 1120 S is the tax form S corporations use to file a federal income tax return This tax form informs the IRS of your total taxable earnings in a tax

Free IRS Tax Form 1120 S Template Google Sheets Excel LiveFlow

https://assets-global.website-files.com/61f27b4a37d6d71a9d8002bc/63ec45b850c0540c81facd19_IRS Tax Form 1120-S Template.png

How To Fill Out Schedule K 1 Form 1120 S YouTube

https://i.ytimg.com/vi/GCzfxDlWGSY/maxresdefault.jpg

what is irs form 1120 s - 1120S K 1 formally known as Schedule K 1 Form 1120S is an IRS tax form used by owners and investors of S corporations You can find a blank copy of the Schedule K 1