what is schedule c form 1120 This content may contain information about tax financial and legal topics Such materials are for informational purposes only and may not reflect the most current developments These

Forms 1120 and 1120S are IRS forms used to calculate and file corporate income taxes Filing Form 1120 is mandatory for all C corporations S corporations must file Form Instructions for Form 1120 C Introductory Material Future Developments What s New Increase in penalty for failure to file Expiration of 100 business meal expense deduction Corporate

what is schedule c form 1120

what is schedule c form 1120

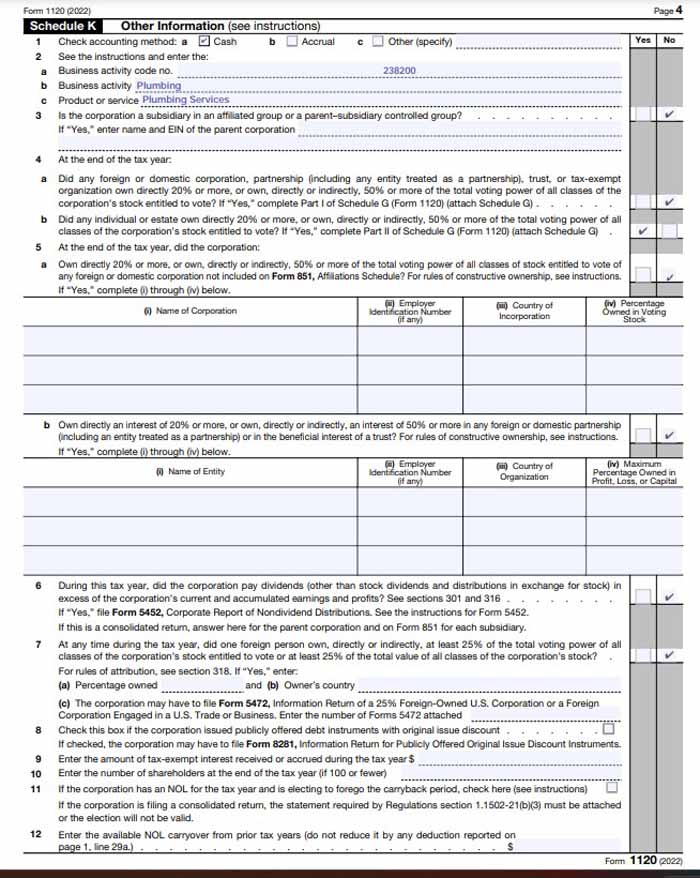

https://fitsmallbusiness.com/wp-content/uploads/2023/04/Screenshot_Form_1120_Schedule_K.jpg

K1 Form 2023 Printable Forms Free Online

https://gusto.com/wp-content/uploads/2023/02/Schedule-K1-1065-2022.png

What Is An IRS Schedule C Form Small Business Accounting Irs Schedule

https://i.pinimg.com/originals/a7/1e/49/a71e496a5c8613b0f9f59b9a38e60468.jpg

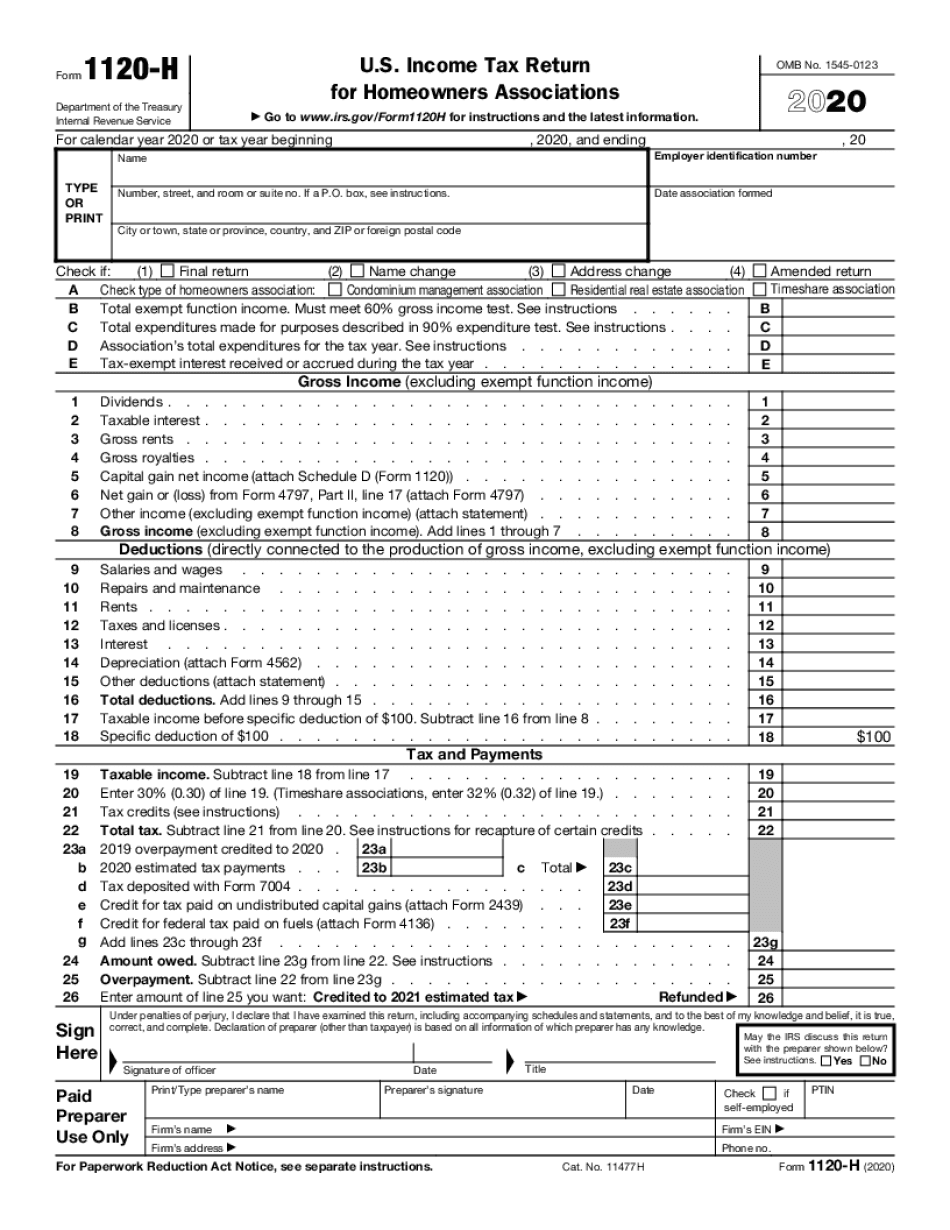

IRS Form 1120 the U S Corporation Income Tax Return is used to report corporate income taxes to the IRS It can also be used to report income for other business entities that have elected to be taxed as corporations such Go to irs gov Form1120 for instructions and the latest information OMB No 1545 0123 Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income

The IRS requires C Corps to file Form 1120 by April 15th of each year and neglecting to file Form 1120 on time can result in late filing penalties late payment penalties Learn all about Form 1120 C Corp filing requirements deadlines key components schedules and compliance for C corporations

More picture related to what is schedule c form 1120

How To Complete Form 1120S Income Tax Return For An S Corp

https://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Schedule-B-Other-Information.png

Manage Documents Using Our Form Typer For Form 1120

https://www.pdffiller.com/preview/533/156/533156818/big.png

3 0 101 Schedule K 1 Processing Internal Revenue Service

https://www.irs.gov/pub/xml_bc/33347002.gif

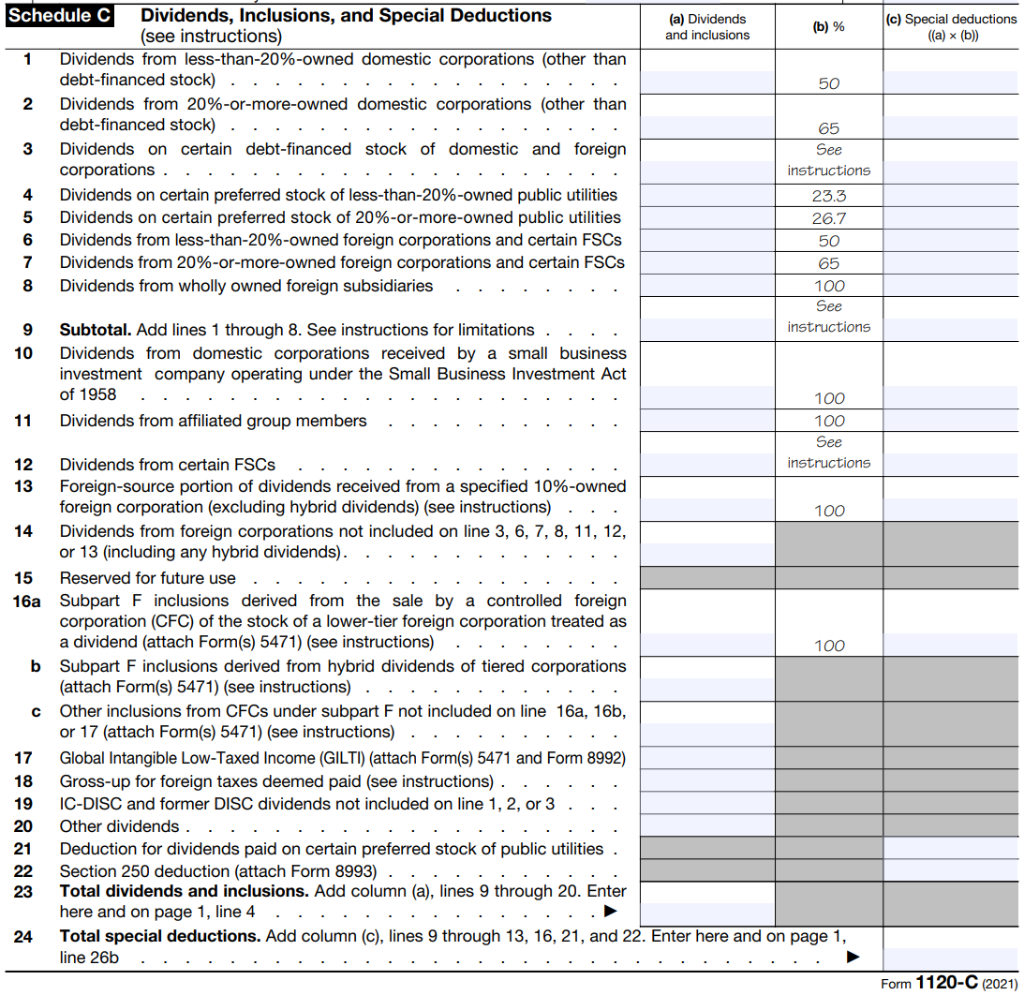

C corporations must file Form 1120 each year whether or not they have taxable income for that period Completing Form 1120 Corporations can create basic tax returns using most tax software programs Step 4 Complete Schedule C Dividends Inclusions Special Deductions Schedule C is used to report dividends interest and any other income from corporations in

Use Form 1120 U S Corporation Income Tax Return to report the income gains losses deductions credits and to figure the income tax liability of a corporation IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business The resulting profit or loss is

2023 Form 1120 W Printable Forms Free Online

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

Solved Required Information The Following Information Chegg

https://media.cheggcdn.com/media/8b3/8b342d81-f76c-49b9-a58c-04c656c2dc87/phpAnM7Pp

what is schedule c form 1120 - The IRS requires C Corps to file Form 1120 by April 15th of each year and neglecting to file Form 1120 on time can result in late filing penalties late payment penalties