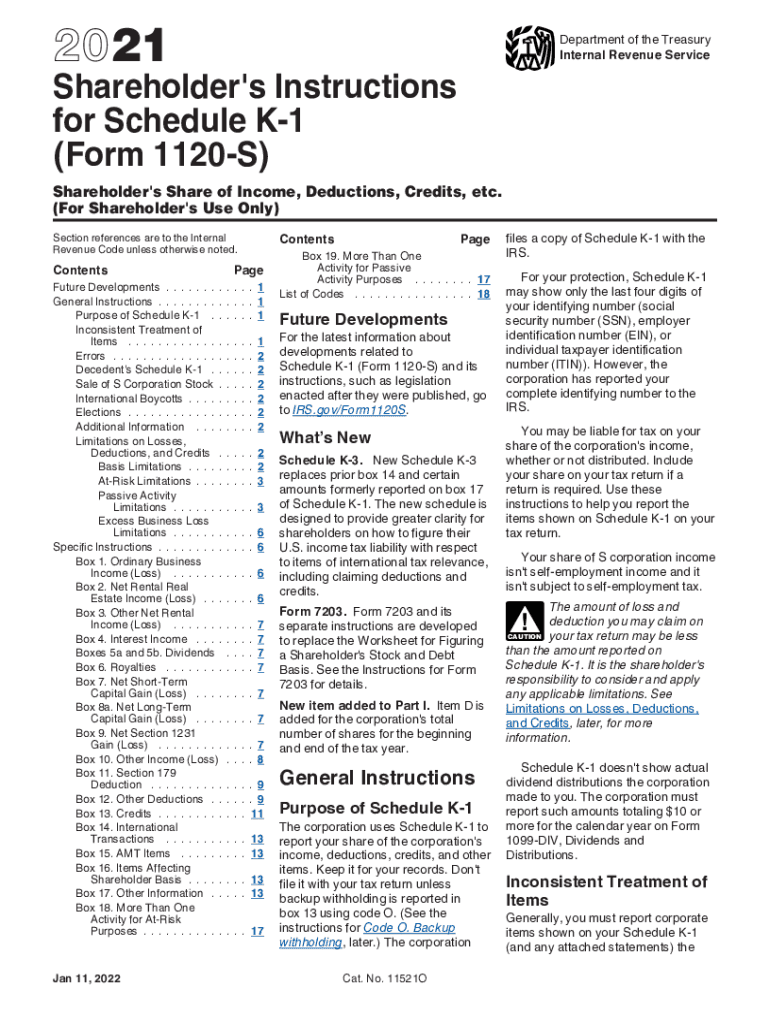

what is form 1120s schedule l used for Here s a line by line walk through of Schedule L for Form 1120 S so you can understand the mechanics behind this tricky business tax form

S corporations can generally electronically file e file Form 1120 S related forms schedules statements and attachments Form 7004 automatic extension of time to file and Forms Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations

what is form 1120s schedule l used for

what is form 1120s schedule l used for

https://www.pdffiller.com/preview/584/735/584735907/large.png

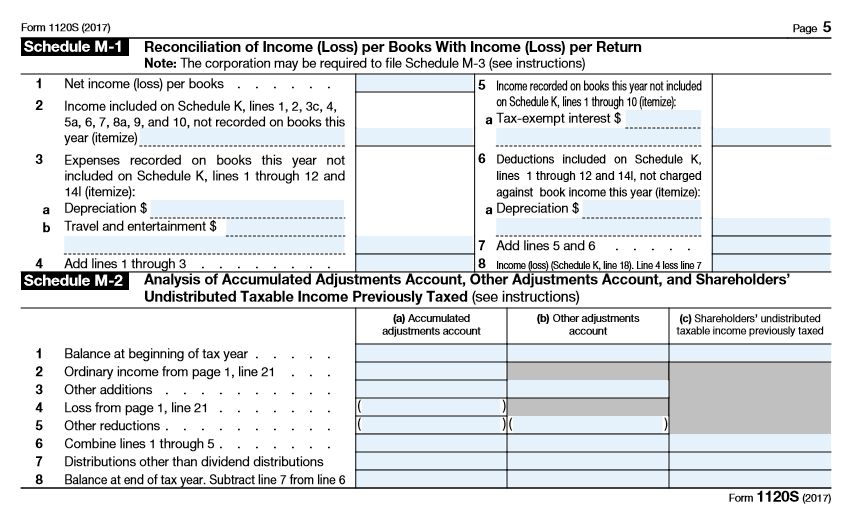

What Is The Purpose Of Schedule M 1 On Form 1120 YouTube

https://i.ytimg.com/vi/emJ0fkv-xzA/maxresdefault.jpg

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

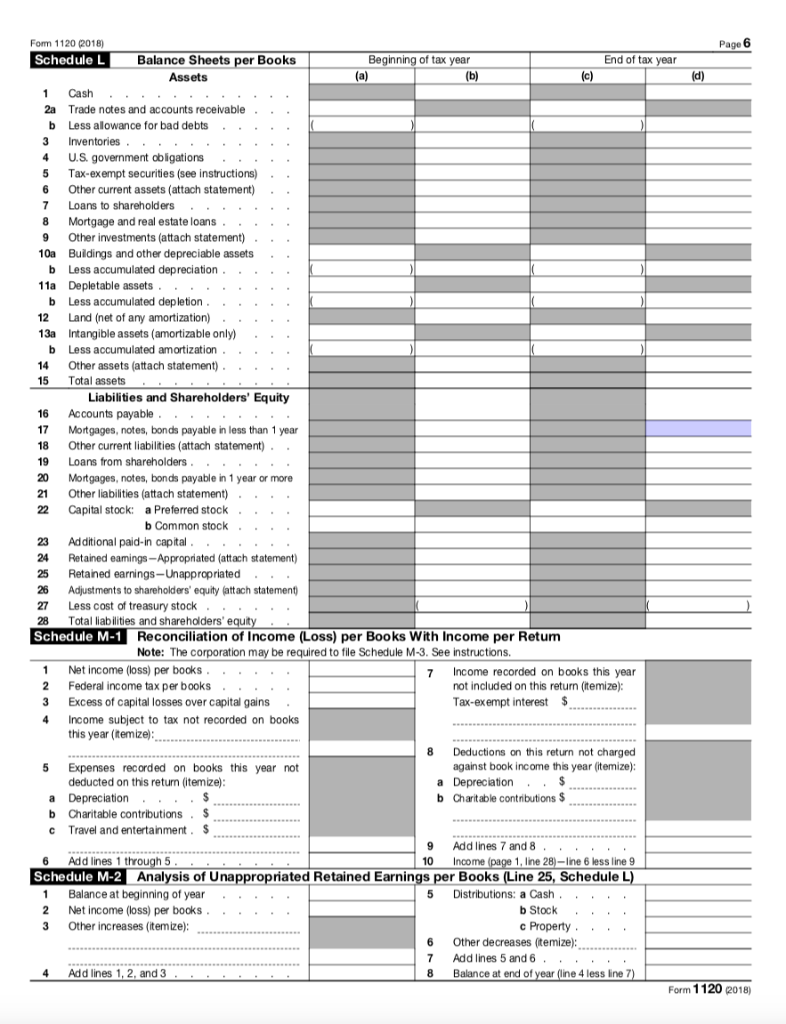

Schedule L is an essential component of Form 1120 used to report a corporation s year end balance sheet amounts The schedule breaks down a corporation s assets liabilities and shareholders equity into Learn what is schedule L and how to complete IRS Form Schedule L for your business s balance sheet and reporting transactions Useful for Form 1120S 1065 and 990

The purpose of Schedule L of Form 1120S is to provide the IRS with details of the assets liabilities and equity of the S corp The information for Schedule L comes from the S corp s balance sheet report The form is used to report income gains losses credits deductions and other information for S corporations Form 1120 S must be accompanied by Schedule K 1 which lists individual

More picture related to what is form 1120s schedule l used for

Form 1120 Schedule L Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/6/954/6954867/large.png

Solved I Need Assistance With Answering Schedule K 1 Form 1120 S

https://www.coursehero.com/qa/attachment/20141152/

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/e63/e63bdf49-a965-4ee6-b546-748f7b0fb889/phpzQ34qC.png

Form 1120S requires S corporations to provide balance sheet information if their total assets and income exceed 250 000 The balance sheet is part of Schedule L and includes details about the company s assets liabilities and Schedule L Book Basis The Schedule L should be prepared on the accounting basis the business entity uses for its books and records There are situations when the books are

What is Form 1120 S Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax This schedule is what will be used to allocate dollar amounts and other information from Form 1120 S to the shareholders Complete Schedule L If required complete Schedule L

Solved Form Complete Schedule L For The Balance Sheet Chegg

https://media.cheggcdn.com/media/d55/d554511f-f9ec-4044-b5c8-2895a840218d/phpBiYm9C.png

How Do I Fill Out Form 1120S Gusto

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-M-1-and-Schedule-M-2-1024x742.png

what is form 1120s schedule l used for - The purpose of Schedule L of Form 1120S is to provide the IRS with details of the assets liabilities and equity of the S corp The information for Schedule L comes from the S corp s balance sheet report