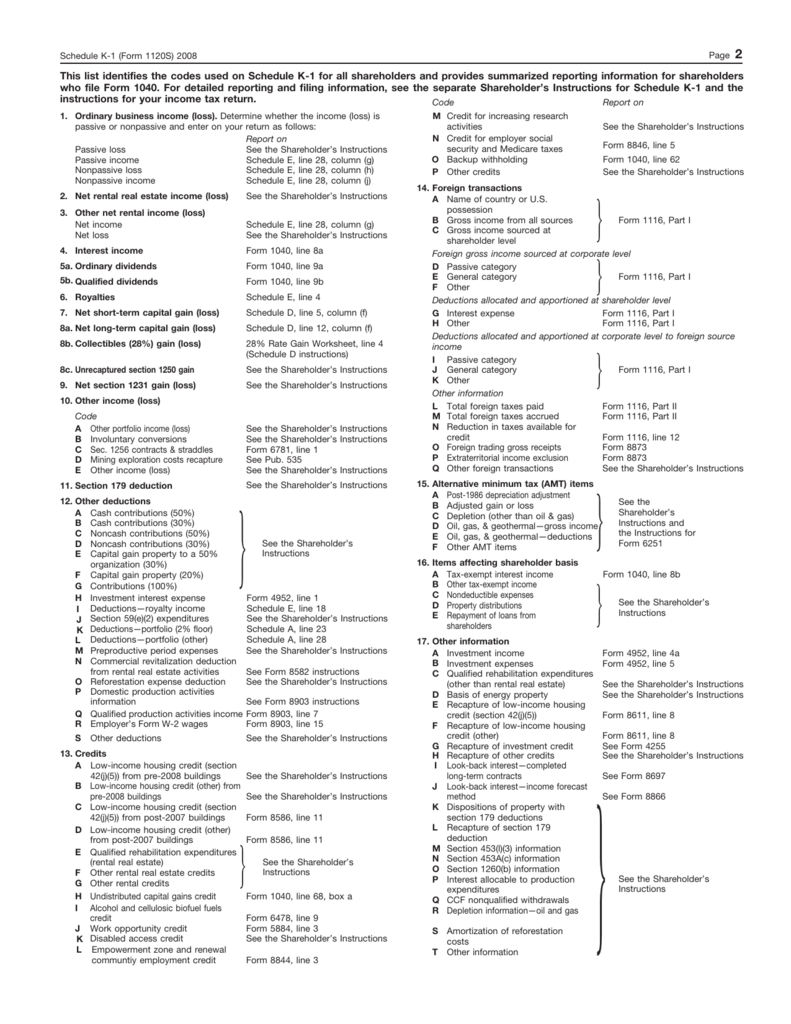

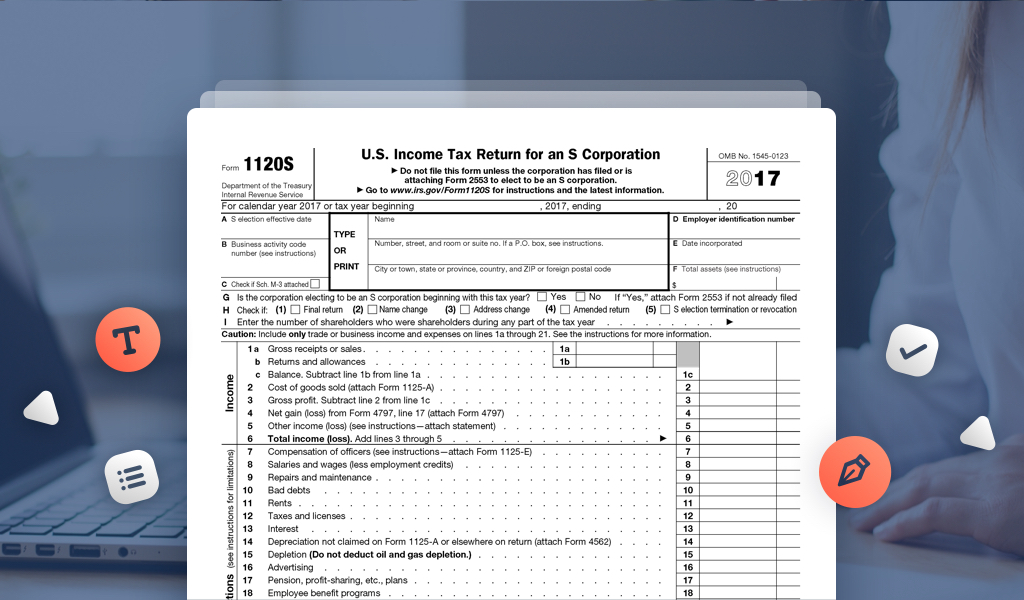

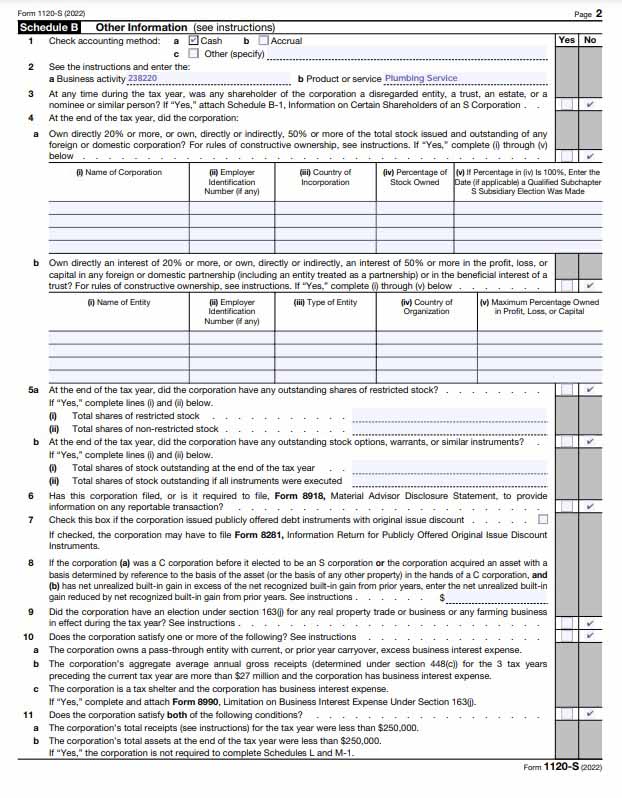

what is form 1120s schedule k 1 If you own an S corp or share ownership in one with others you ll use Schedule K 1 Form 1120S to report your share of income from the S corp at the end of the year Schedule K 1 is where you ll report your share of income

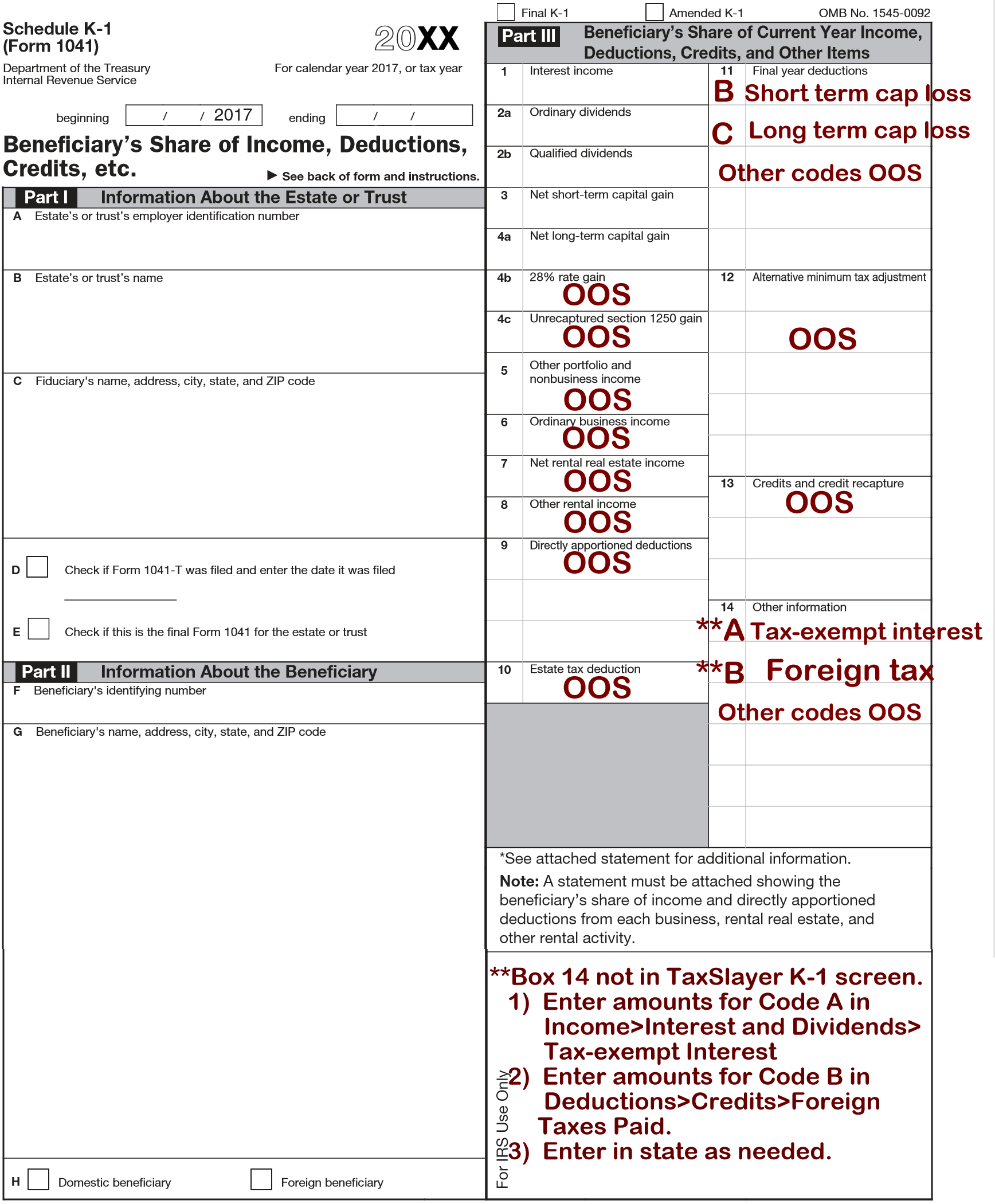

Enter the ordinary income loss shown on Schedule K 1 Form 1065 or Schedule K 1 Form 1041 or other ordinary income loss from a foreign partnership estate or trust Show the This comprehensive guide will give you a complete understanding of Form 1120S and Schedule K 1 including step by step instructions important considerations and common

what is form 1120s schedule k 1

what is form 1120s schedule k 1

https://s3.studylib.net/store/data/008734590_1-b2e2bdce47e04fa80e970e6f46880c78.png

Don t Miss The Deadline For Reporting Your Shareholding Income With

https://blog.pdffiller.com/app/uploads/2018/01/1120S.jpg

Schedule K 1 Tax Form Here s What You Need To Know LendingTree

https://www.lendingtree.com/content/uploads/2020/03/Schedule-K-one-instructions-for-partnerships-one.png

Schedule K 1 is an Internal Revenue Service IRS tax form issued annually for an investment in a partnership The purpose of Schedule K 1 is to report each partner s share of the partnership s What is Schedule K 1 Schedule K 1 is a tax document used to report each shareholder s share of an S corporation s income deductions credits and other financial information It is an integral part of Form 1120 S the annual

Schedule K 1 is an IRS form used and filed with Forms 1120S and Forms 1065 to report each shareholder s or partner s pro rated share of net income or loss from a pass through business It also reports various Schedule K 1 Form 1120S is prepared by a corporation as part of the filing of their tax return Each shareholder is provided a Schedule K 1 by the corporation

More picture related to what is form 1120s schedule k 1

How To Complete Form 1120S Schedule K 1 Free Checklist

https://fitsmallbusiness.com/wp-content/uploads/2023/03/Screenshot_IRS_Form_1120_S_Schedule_B.jpg

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 Db excel

https://db-excel.com/wp-content/uploads/2019/09/form-1120s-k-1-instructions-2016-2018-codes-line-17.png

K1 Form Malaysia Sample Ella Lambert

https://www.irs.gov/pub/xml_bc/33347002.gif

1120 S Schedule K Shareholder s Share of Income Deductions Credits etc Notice This form may be outdated More recent filings and information on OMB 1545 0123 can be found here Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations

Schedule K 1 Form 1120 S is a source document that is filed with the S corporation income tax return Form 1120 S After filing Form 1120 S the corporation gives each shareholder their What is Schedule K 1 Schedule K 1 is a schedule of IRS Form 1065 U S Return of Partnership Income It s provided to partners in a business partnership to report their share of a partnership s profits losses deductions and credits

Irs Form 1120s Instructions 2015 Form Resume Examples Free Nude Porn

https://www.contrapositionmagazine.com/wp-content/uploads/2020/10/form-1120s-k-1-2014.jpg

How To Fill Out Schedule K 1 Form 1120 S YouTube

https://i.ytimg.com/vi/GCzfxDlWGSY/maxresdefault.jpg

what is form 1120s schedule k 1 - Schedule K 1 is an Internal Revenue Service IRS tax form issued annually for an investment in a partnership The purpose of Schedule K 1 is to report each partner s share of the partnership s