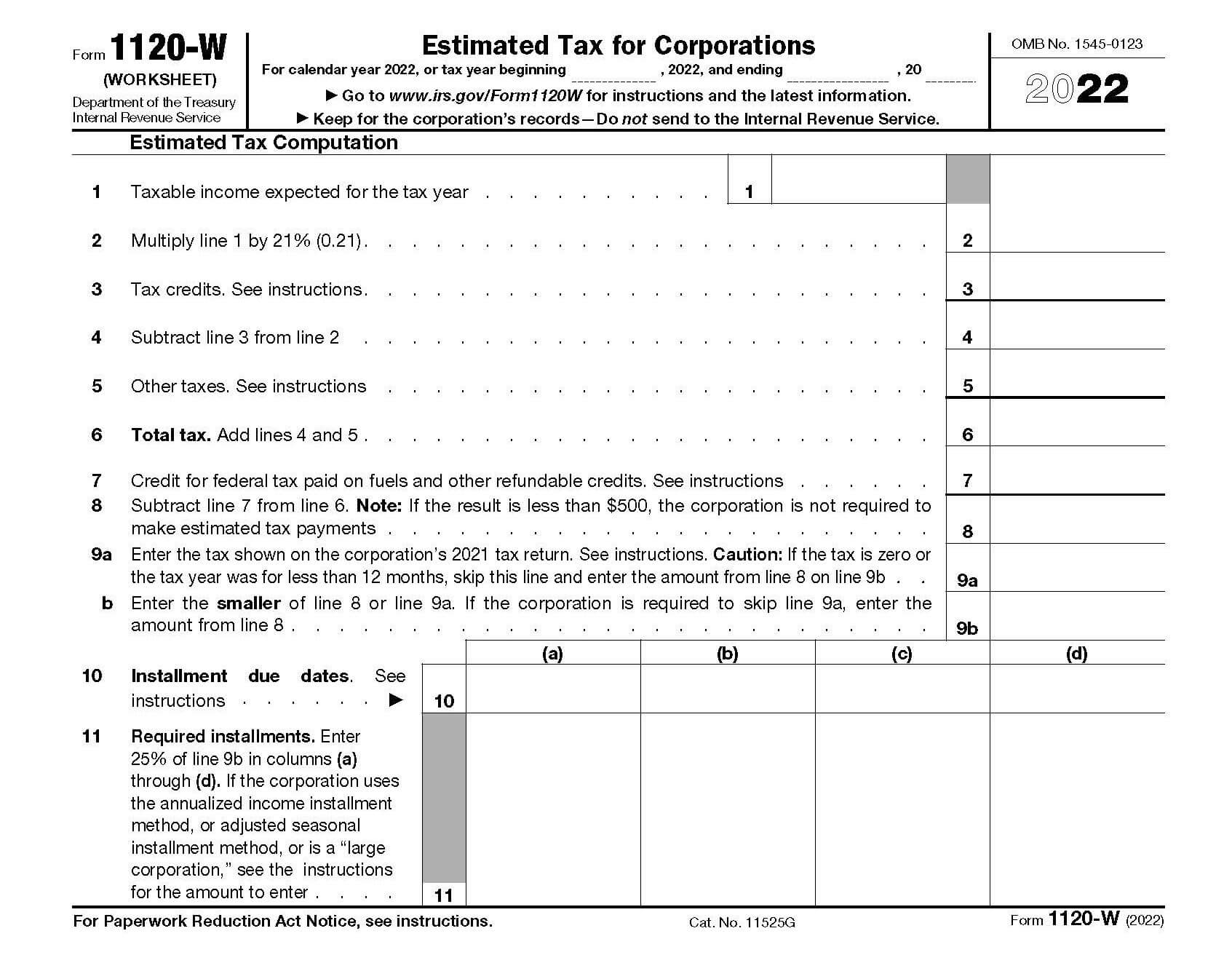

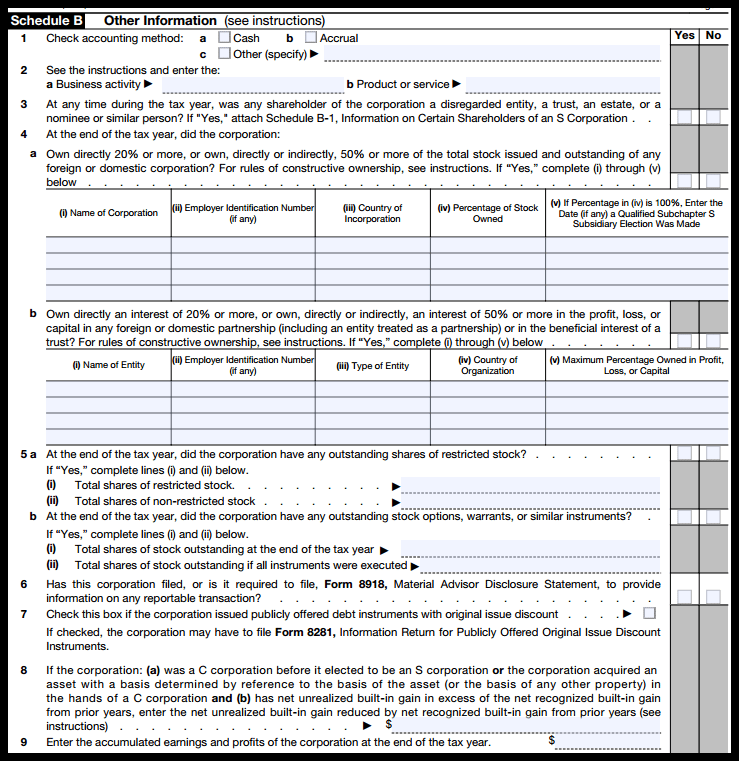

what is form 1120 s used for Purpose of Form Use Form 1120 S to report the income gains losses deductions credits and other information of a domestic corporation or other entity for any tax year covered by an

Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax IRS Form 1120S is the tax return used by domestic corporations that have made an election to be treated as S corporations for that tax year The return reports income losses credits and deductions before

what is form 1120 s used for

what is form 1120 s used for

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

Form 1120 S What IRS Form 1120 S Is How To Fill It Out

https://jt.org/wp-content/uploads/2022/08/image-1120-S.png

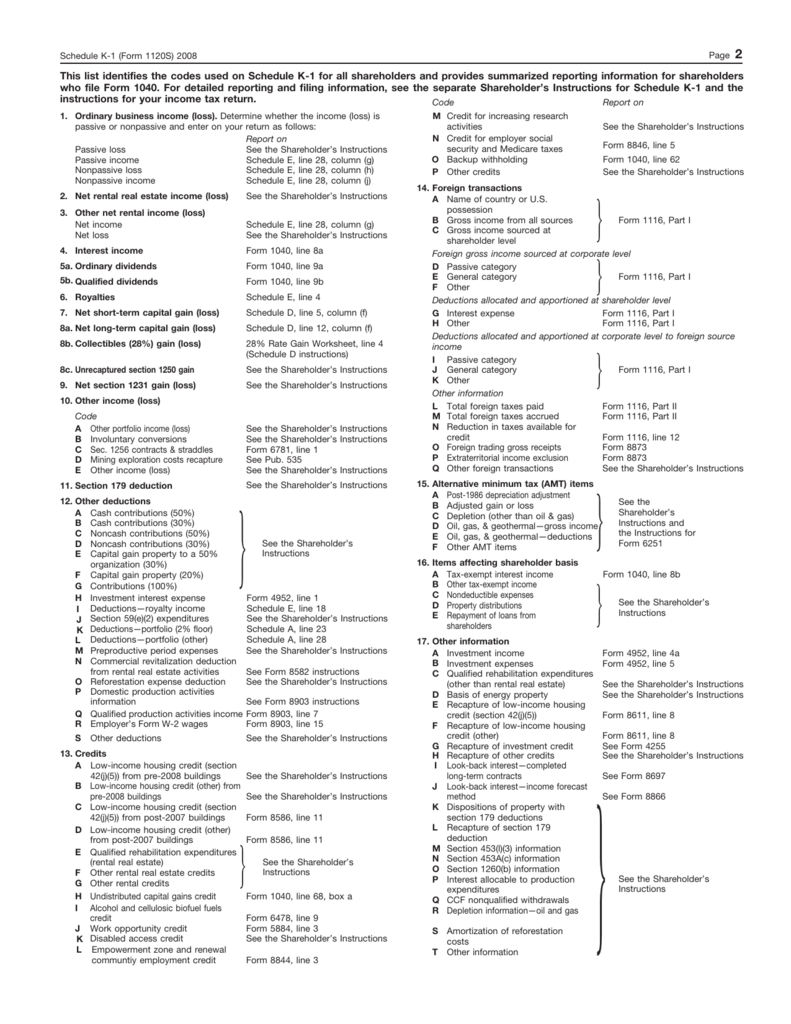

Schedule K 1 Form 1120 S Shareholder s Share Of Income Overview

https://support.taxslayer.com/hc/article_attachments/17604583957133

IRS Form 1120 S is used to report income or gains losses tax deductions and business tax credits for an S corporation To elect to file as an S corporation a business must first file IRS Form 2553 This form notifies the What is Form 1120 S Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains

What is Form 1120 S and who needs to file it Form 1120 S is the tax form S corporations use to report their income deductions and losses to the IRS Form 1120 S is used by S corporations to report their annual income gains losses deductions and credits to the IRS The form facilitates the pass through taxation unique to S corporations where income is taxed at

More picture related to what is form 1120 s used for

1120s Due Date

https://www.irs.gov/pub/xml_bc/51221503.gif

What Is Form 1120S And How Do I File It Ask Gusto

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-B-768x995.png

1120 JapaneseClass jp

https://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Schedule-B-Other-Information.png

Form 1120 S is a U S Income Tax Return form used by S Corporations S corps to report income gains losses deductions and credits to the Internal Revenue Service IRS A sample 1120 S form is available After electing to be an S corporation by filing Form 2553 the IRS requires you to file Form 1120 S This form is specifically designed for businesses with fewer than 100

Simply stated Form 1120 S is the tax return of an S Corp that is filed despite the fact that the business doesn t directly pay taxes It supports the income or losses that will pass Form 1120 S U S Income Tax Return for an S Corporation is a tax form that S Corporations use to report their earnings losses and dividends to the IRS Form 1120 S is

1120s Due Date

https://www.irs.gov/pub/xml_bc/51221535.gif

Schedule K 1 Instructions Examples And Forms

https://s3.studylib.net/store/data/008734590_1-b2e2bdce47e04fa80e970e6f46880c78.png

what is form 1120 s used for - IRS Form 1120 S is used to report income or gains losses tax deductions and business tax credits for an S corporation To elect to file as an S corporation a business must first file IRS Form 2553 This form notifies the