what is 1098 tax form used for Form 1098 is a tax document that shows how much mortgage interest you paid in a year It is sent to the IRS and to you by your lender or

Learn how to use Form 1098 to report mortgage interest of 600 or more received from individuals in the course of your trade or business Find out what is a mortgage who must file Form 1098 is used to report mortgage interest of 600 or more received by you from an individual including a sole proprietor Find out how to file download the form and

what is 1098 tax form used for

what is 1098 tax form used for

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

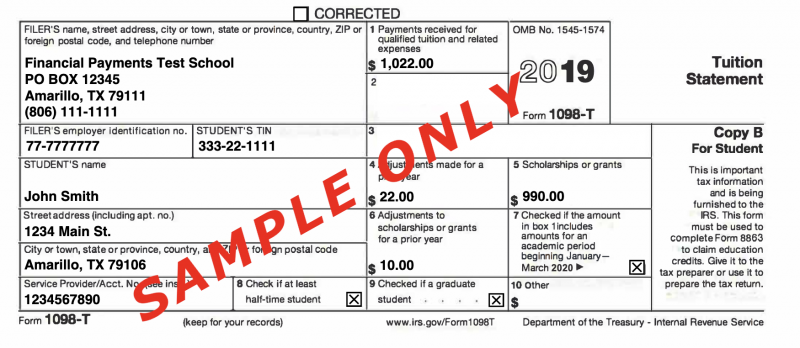

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

Learn about the seven types of IRS 1098 forms that report tax related information from your payments or donations Find out how to use them to claim deductions or credits on your tax return Form 1098 reports different types of payments or contributions that may be tax deductible such as mortgage interest charitable donations tuition expenses and student loan interest Learn the key facts and how to use the

Learn how to use Form 1098 Mortgage Interest Statement to claim a deduction for your home or rental property Find out what information to report who can deduct and how to split expenses for personal and rental use Learn what IRS Form 1098 is who needs to file it and how to use it to claim mortgage interest as a tax deduction Find out the filing deadline requirements and steps for payers and recipients of mortgage payments

More picture related to what is 1098 tax form used for

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

What s A 1098 T How To Pay For College

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

What is a 1098 Form A 1098 form often referred to as the Mortgage Interest Statement is an IRS tax form used to report various types of interest and related expenses that could be tax IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form

The whole purpose of the IRS Form 1098 is to ensure that borrowers can claim the appropriate tax write off from the interest they ve paid to their lender s each year When a lender Form 1098 is used to report mortgage interest or mortgage insurance premiums of 600 or more received from an individual in the course of your trade or business Learn who must file when

Tax Form 1098 T Office Of The Bursar

https://bursar.utk.edu/wp-content/uploads/sites/37/2022/04/1098-t-e1651503267111.png

Frequently Asked Questions About The 1098 T The City University Of

https://www.cuny.edu/wp-content/uploads/sites/4/page-assets/financial-aid/tax-benefits-for-higher-education/form1098t/gopaperless/1098t_go_paperless.png

what is 1098 tax form used for - Form 1098 is used by lenders to report the amount of mortgage interest mortgage insurance premiums or points you paid if it s 600 or more If you do not meet the 600 threshold your