what is irs form 1098 used for Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file Use Form 1098 to report mortgage interest of 600 or more received by you from an individual including a sole proprietor

What is Form 1098 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders IRS Form 1098 is a mortgage interest statement It s a tax form used by businesses and lenders to report mortgage interest paid to them of

what is irs form 1098 used for

what is irs form 1098 used for

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

File Form 1098 to report the refund or credit of the overpayment See Reimbursement of Overpaid Interest later Also use Form 1098 to report mortgage insurance premiums MIP of 600 or more you received during the calendar year in the course of your trade or business What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage interest is less than 600 your lender doesn t have to send you this form

What is the IRS Form 1098 The IRS Form 1098 is used to report payments on mortgage interest and mortgage insurance premiums MIP of 600 or more Form 1098 reports this information to the IRS for two reasons IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form

More picture related to what is irs form 1098 used for

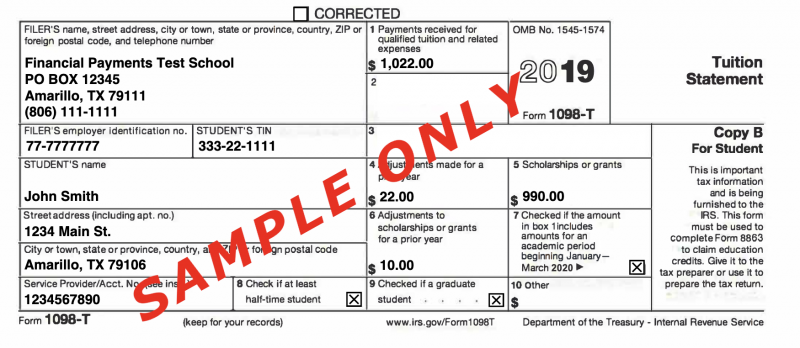

1098 T Software To Create Print And E File IRS Form 1098 T Student

https://i.pinimg.com/736x/7b/60/e5/7b60e5c162ada12b82686b6e50418967.jpg

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

What is IRS Form 1098 used for Lenders such as banks and financial institutions must file IRS Form 1098 Mortgage Interest Statement to report mortgage interest payments of 600 or more received during the year What is IRS Form 1098 IRS Form 1098 Mortgage Interest Statement is a document that lenders provide to borrowers at the beginning of each year This form reports the amount of mortgage interest and related

Form 1098 is an IRS form used to report mortgage interest paid for a tax year The mortgage interest form allows lenders to inform the IRS when more than 600 interest has been paid in a year Individuals also use 1098 to claim mortgage interest deductions when A form 1098 Mortgage Interest Statement is used to report mortgage interest including points of 600 or more paid to a lender for a mortgage

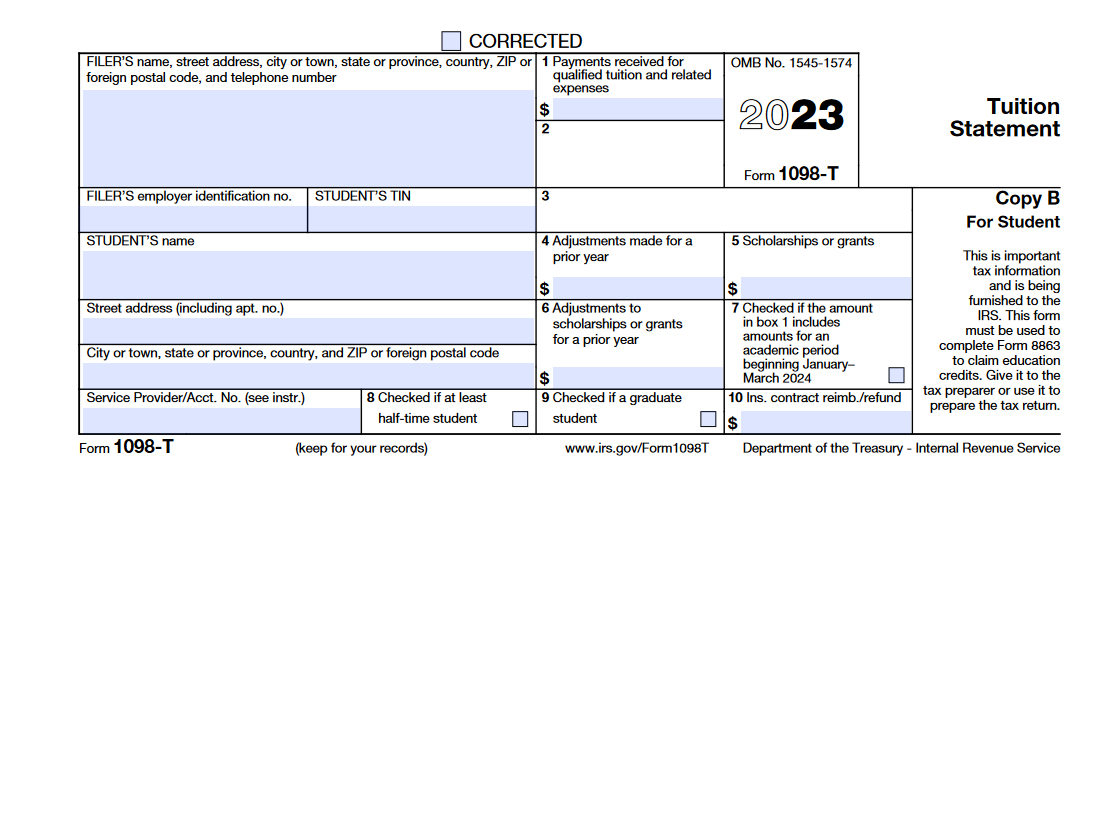

IRS Form 1098 T Tuition Statement Forms Docs 2023

https://blanker.org/files/images/form-1098t.png

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Form 1098 Mortgage Interest Statement And How To File

https://www.investopedia.com/thmb/I2hSqiwM-Z4WyzK-zDK4noFs5Zg=/1428x928/filters:fill(auto,1)/Form1098-5c57730f46e0fb00013a2bee.jpg

what is irs form 1098 used for - Why Is IRS Form 1098 Necessary The whole purpose of the IRS Form 1098 is to ensure that borrowers can claim the appropriate tax write off from the interest they ve paid to their lender s each year