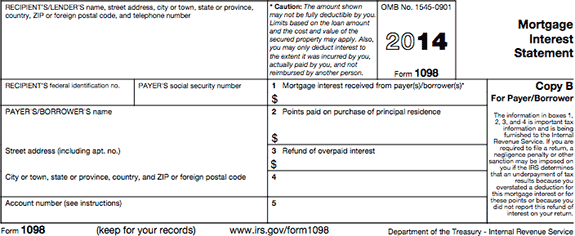

what is a 1098 tax form Form 1098 reports mortgage interest of 600 or more received by you from an individual including a sole proprietor in the course of your trade or business You

Form 1098 is issued to homeowners by mortgage lenders to report mortgage interest payments and other payments like mortgage premiums Businesses must file Form 1098 if they receive 600 or more in mortgage Form 1098 is used to report mortgage interest or mortgage insurance premiums of 600 or more received from an individual in the course of your trade or business Learn who

what is a 1098 tax form

/Form1098-5c57730f46e0fb00013a2bee.jpg)

what is a 1098 tax form

https://www.investopedia.com/thmb/I2hSqiwM-Z4WyzK-zDK4noFs5Zg=/1428x928/filters:fill(auto,1)/Form1098-5c57730f46e0fb00013a2bee.jpg

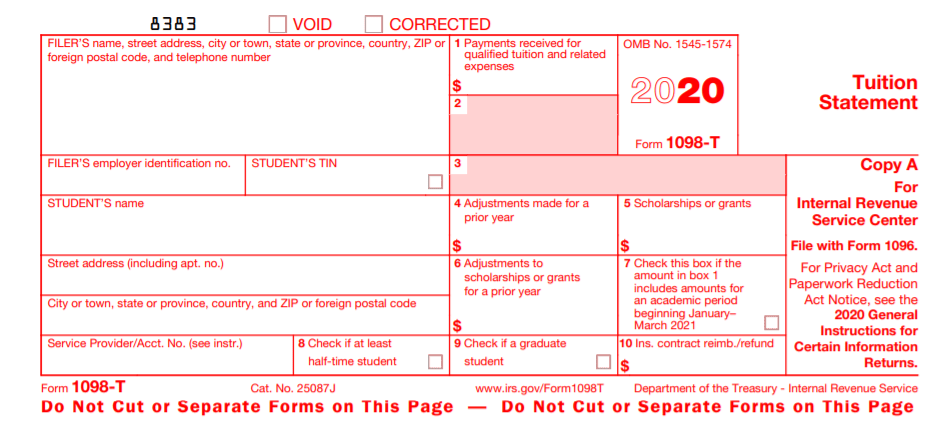

Understanding Your IRS Form 1098 T Student Billing

https://studentbilling.berkeley.edu/sites/default/files/styles/openberkeley_image_full/public/1098t_sample_2020.jpg?itok=9ehuNdu-×tamp=1610405644

How To Fill Out A 1098 Tax Form Check City

https://assets-global.website-files.com/600089199ba28edd49ed9587/61c1fc0b7d3cddd434a01aee_aXc-wHXrmSqfAm_dyqrgj9P39IAG8UZghdbxFstDxMeZkj_-0Yh5Nw2LcMrbVRmQEDMD3aqbryxnFBcOV4r_uFiQRdcA-Eiwuu0mrIQgfpfdr14uzNN-FdJbh6-JDA89pUe5uoAD.jpeg

Learn about the seven types of IRS 1098 forms that report tax related information from your payments or donations Find out how to use them to claim deductions or credits when you file your taxes Now let s talk about Form 1098 A form 1098 reports the amounts to the IRS and you receive a copy of the form that you may be able to deduct on your tax return 1098 Mortgage Interest Statement If you have a mortgage

IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form Form 1098 is an information return that shows the amount of mortgage interest and points paid or refunded by a lender to a borrower It is used to report this income to the IRS and

More picture related to what is a 1098 tax form

What Is A 1098 Tax Form 1098 C 1098 E 1098 T

https://www.moneycrashers.com/wp-content/uploads/2011/03/1098.png

What Is A 1098 T Form Used For Full Guide For College Students The

https://www.handytaxguy.com/wp-content/uploads/2018/12/1098-T-Tuition-Statement-Image.png

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage interest is less than 600 your lender doesn t have to send you this form A 1098 form often referred to as the Mortgage Interest Statement is an IRS tax form used to report various types of interest and related expenses that could be tax deductible

What is the IRS Form 1098 The IRS Form 1098 is used to report payments on mortgage interest and mortgage insurance premiums MIP of 600 or more Form 1098 Form 1098 is a reporting form sent to you by banks schools and other organizations to whom you have made certain payments during the year For example you

1098 T IRS Tax Form Instructions 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-1200x523.png

Frequently Asked Questions About The 1098 T The City University Of

https://www.cuny.edu/wp-content/uploads/sites/4/page-assets/financial-aid/tax-benefits-for-higher-education/form1098t/frequently-asked-questions-about-the-1098-t/2019-1098-T.jpg

what is a 1098 tax form - In this blog post we re going to cover something called IRS Form 1098 This form comes into play for anyone who is selling properties via owner financing and more specifically If owner