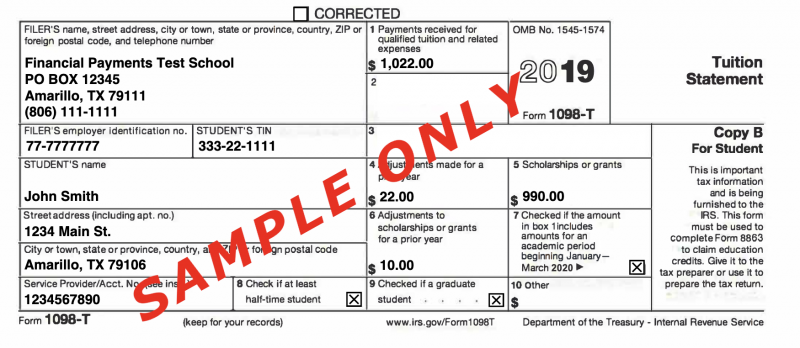

what is 1098 t tax form used for Among all of those docs you may notice a tax form called a 1098 T Don t be afraid by this document at all Form 1098 T is a Tuition Statement used to help you understand which education credits you may qualify for relating to tuition and other school related expenses paid during the tax year

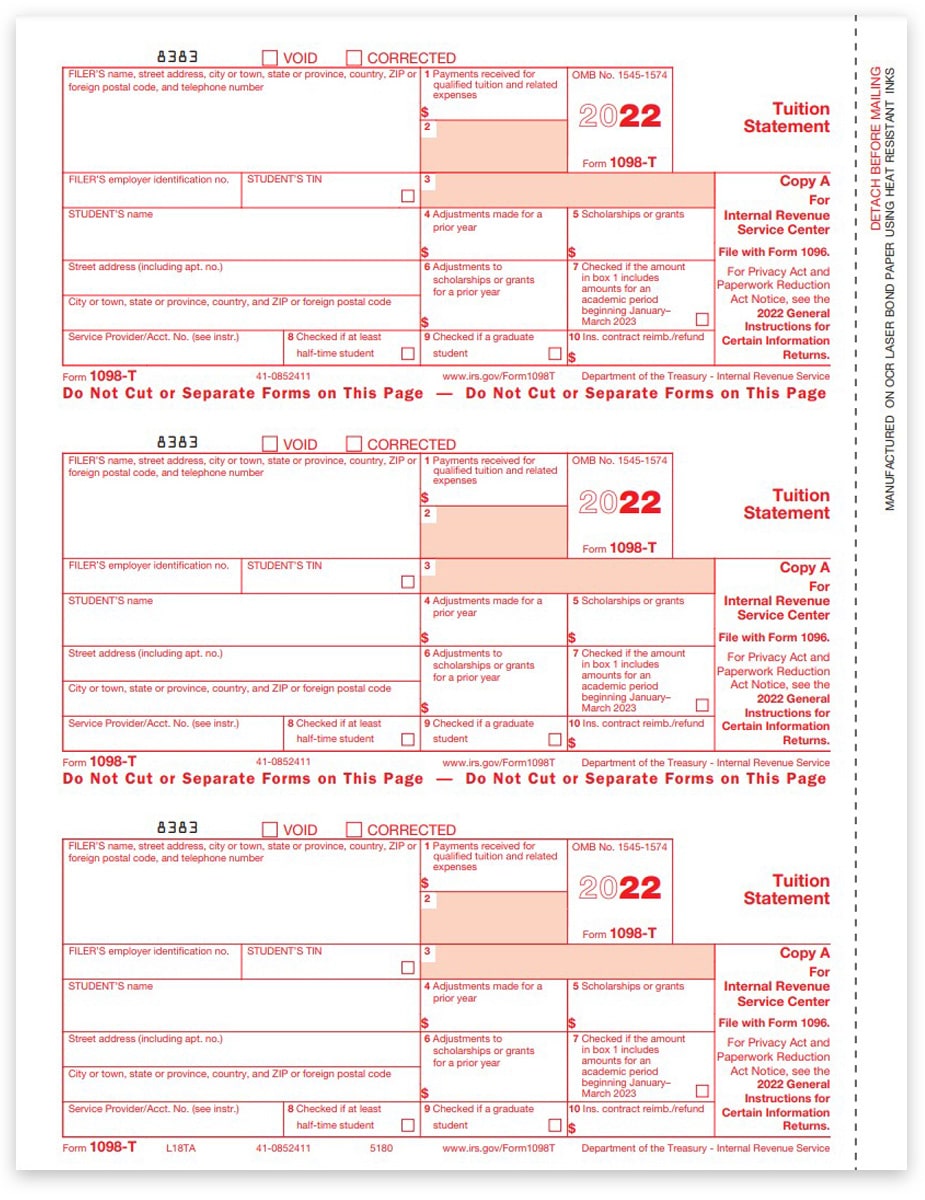

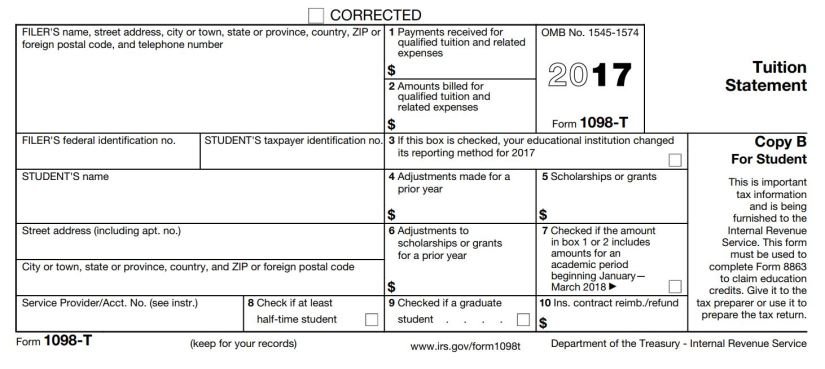

Information about Form 1098 T Tuition Statement including recent updates related forms and instructions on how to file Form 1098 T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax year The school reports the amount to you and the Internal Revenue Service IRS

what is 1098 t tax form used for

what is 1098 t tax form used for

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

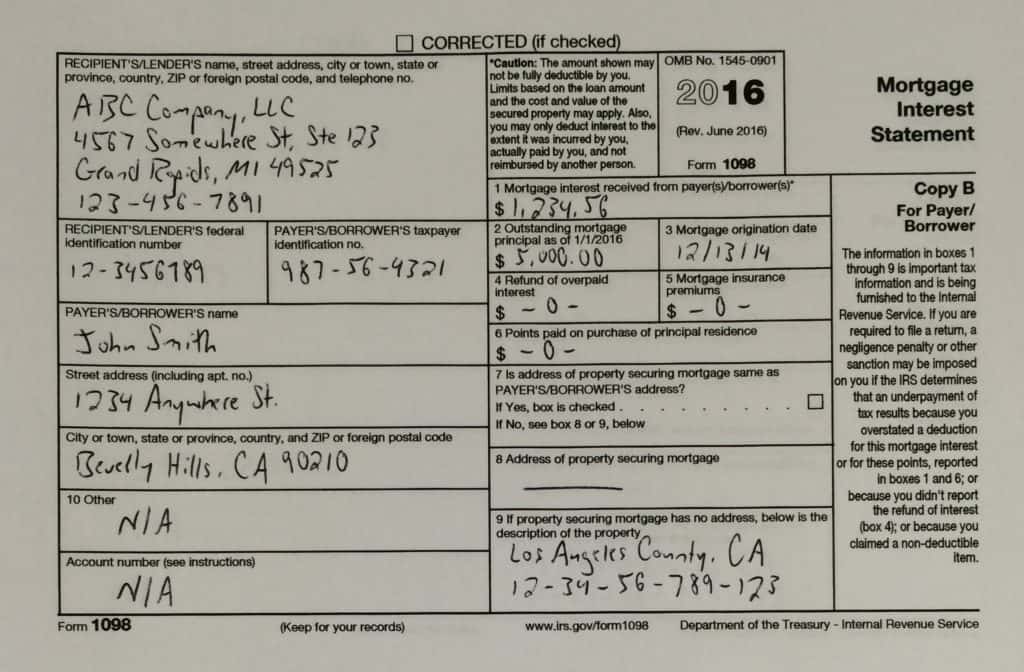

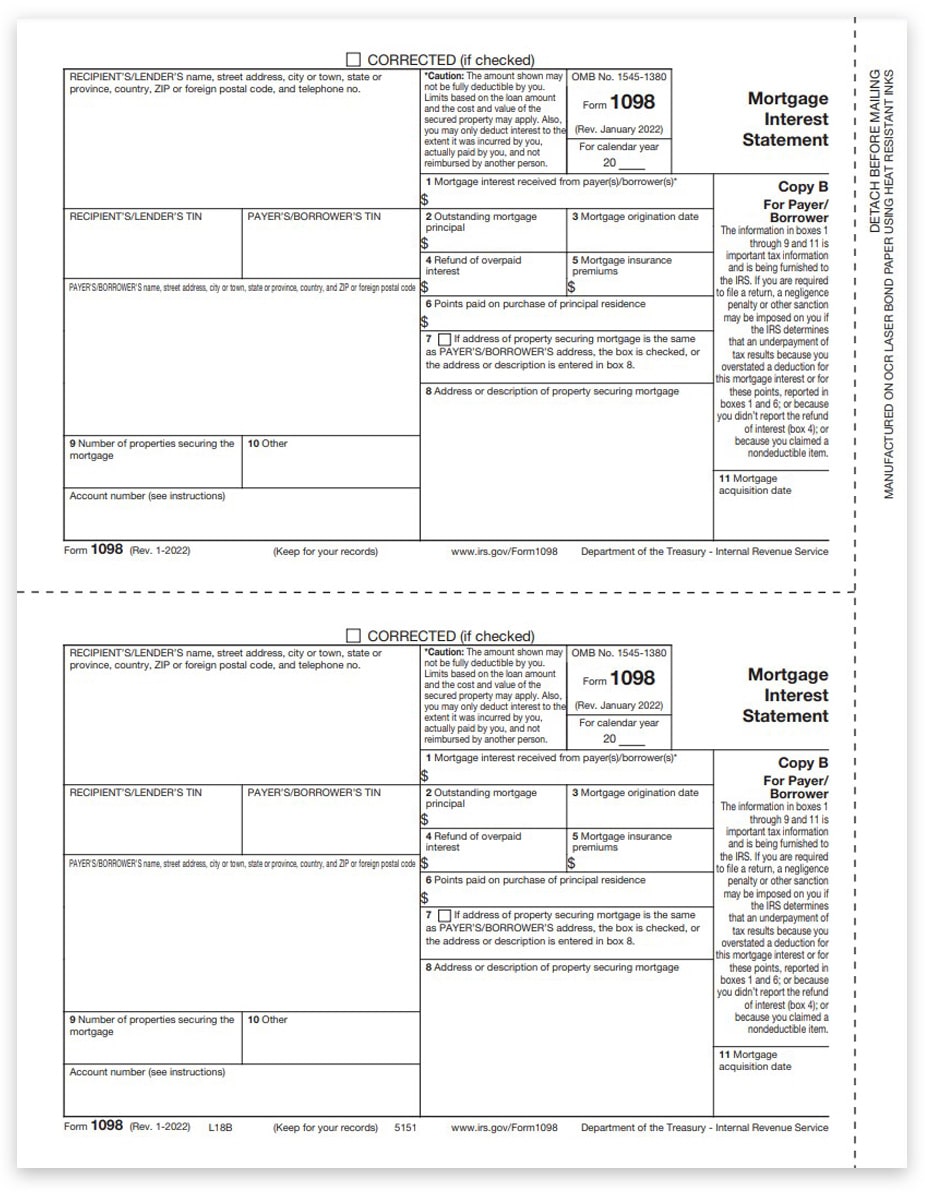

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

Why Form 1098 T is important to you It helps you identify eligible college expenses for valuable education credits up to 2 500 So do not discard this form What are the education tax credits 1 The AOTC American Opportunity Tax Credit can help pay for the first four years of college if you attend at least half time A 1098 T form or tuition statement is an American IRS tax form filed by eligible education institutions to report payments received and payments due from paying students The institution is required to report a form for every student who is currently enrolled and paying qualifying tuition and related expenses to attend their

Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details the amounts paid for qualified tuition and related expenses which are essential for calculating potential education tax credits With a 1098 T the business your college reports how much qualified tuition and expenses you or your parents paid it during the tax year The IRS uses these forms to match data from information returns to income deductions and credits reported on individual income tax returns

More picture related to what is 1098 t tax form used for

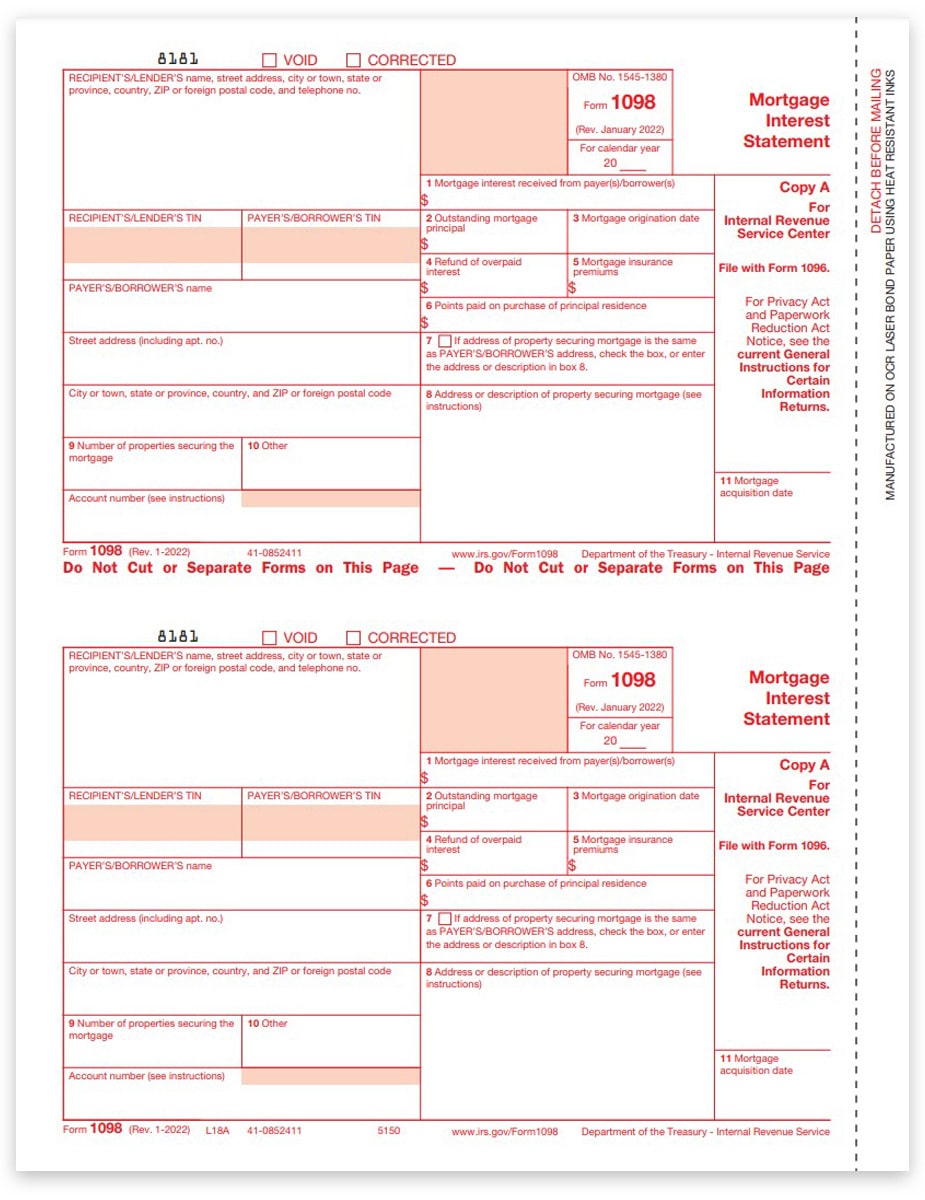

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

What s A 1098 T How To Pay For College

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

Form 1098 T contains helpful instructions and other information you ll need to claim education credits on your federal tax form These credits help offset your out of pocket expenses for tuition and fees books and equipment Form 1098 T Tuition Statement is an American IRS tax form filed by eligible education institutions or those filing on the institution s behalf to report payments received and payments due from the paying student The institution has to report a form for every student that is currently enrolled and paying qualifying tuition and related expenses

Form 1098 T Tuition Statement explained Schools must make Form 1098 T available to any student who paid in the previous tax year qualified educational expenses Tuition any fees that are required for enrollment and course materials the student was required to buy from the school are qualified expenses It is a form that is used by colleges and universities to report the amount of qualified tuition and related expenses paid by a student or on their behalf during the tax year The form also includes scholarships and grants received by the student during the tax year

Frequently Asked Questions About The 1098 T The City University Of

https://www.cuny.edu/wp-content/uploads/sites/4/page-assets/financial-aid/tax-benefits-for-higher-education/form1098t/gopaperless/1098t_go_paperless.png

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

what is 1098 t tax form used for - Why Form 1098 T is important to you It helps you identify eligible college expenses for valuable education credits up to 2 500 So do not discard this form What are the education tax credits 1 The AOTC American Opportunity Tax Credit can help pay for the first four years of college if you attend at least half time