who gets a 1098 tax form A 1099 form is a tax statement you may receive from a bank a broker a business or another entity paying you nonemployee compensation

Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage

who gets a 1098 tax form

who gets a 1098 tax form

https://play.vidyard.com/KGoecG7Wjzkq5J8z8pgQhj.jpg?

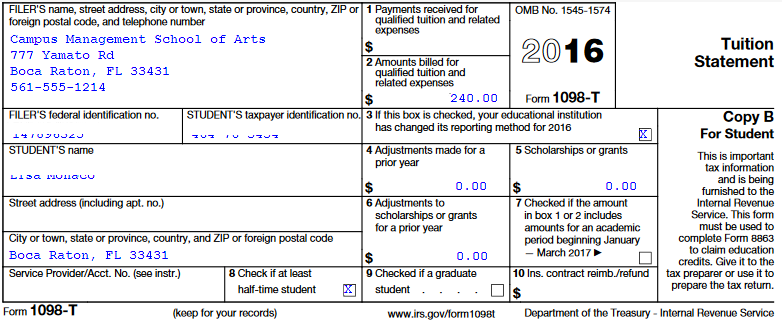

View 1098T

https://help.campusmanagement.com/PRT/22.3/Student/Content/Resources/Images/1098t.png

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

A form 1098 Mortgage Interest Statement is used to report mortgage interest including points of 600 or more paid to a lender for a mortgage For federal income tax purposes a mortgage is Filing Form 1098 is mandatory if your business received at least 600 in mortgage interest payments Lenders must send you this form by January 31st so you have plenty of time to gather your documentation and submit

IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form What is Form 1098 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders

More picture related to who gets a 1098 tax form

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

There are seven IRS 1098 forms If you receive one it could help you take certain tax deductions you may be eligible for Who receives Form 1098 Lenders send out Form 1098 to anyone who has a mortgage on their home and has paid more than 600 toward interest during the tax year Whether your mortgage is for your primary residence a

Now let s talk about Form 1098 A form 1098 reports the amounts to the IRS and you receive a copy of the form that you may be able to deduct on your tax return If you have Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or

Tax Form 1098 T Office Of The Bursar

https://bursar.utk.edu/wp-content/uploads/sites/37/2022/04/1098-t-e1651503267111.png

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

who gets a 1098 tax form - Mortgage lenders need to file Form 1098 with the IRS if the borrower paid more than 600 in a given year and send you a copy which you can frame if you so choose They