what form is 1098 Form 1098 is issued to homeowners by mortgage lenders to report mortgage interest payments and other payments like mortgage premiums

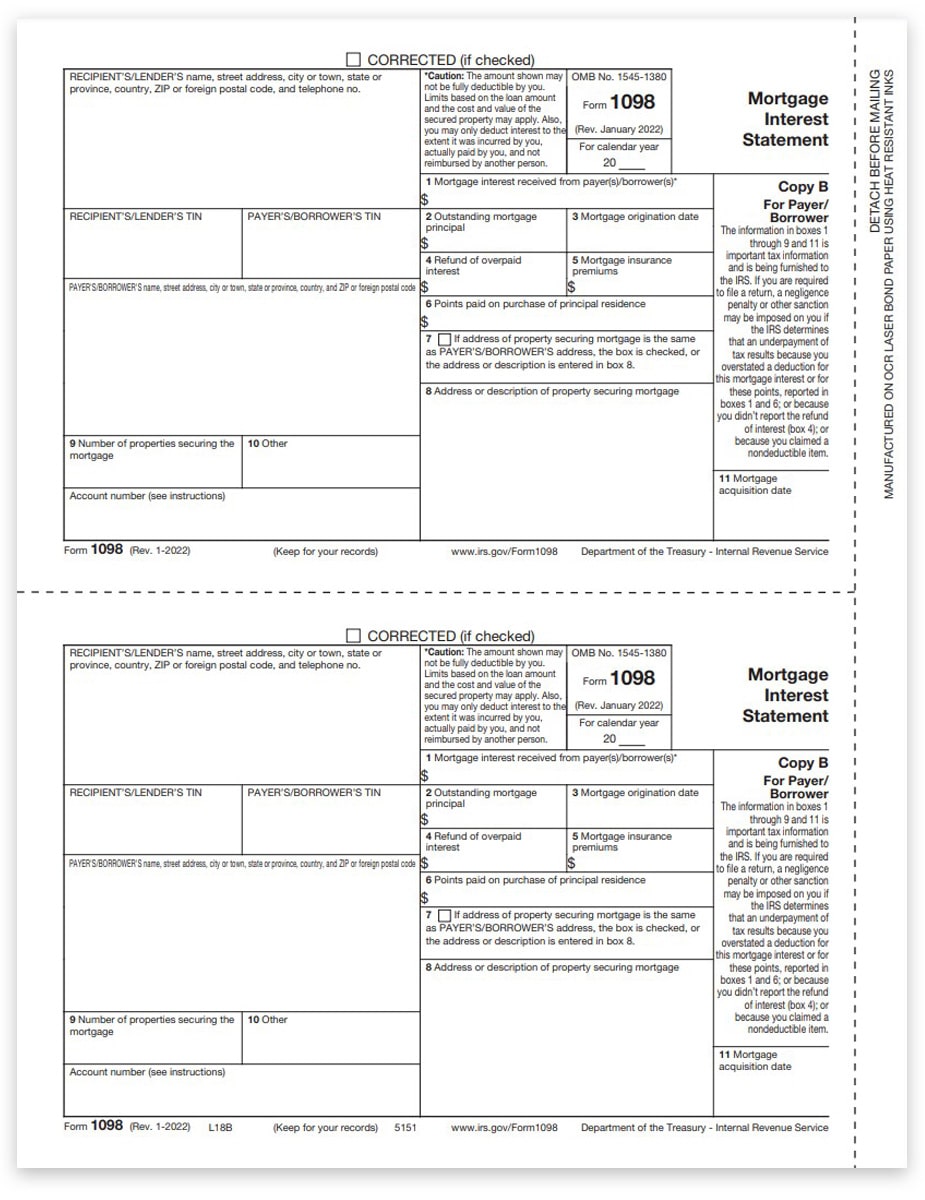

What is Form 1098 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or

what form is 1098

what form is 1098

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

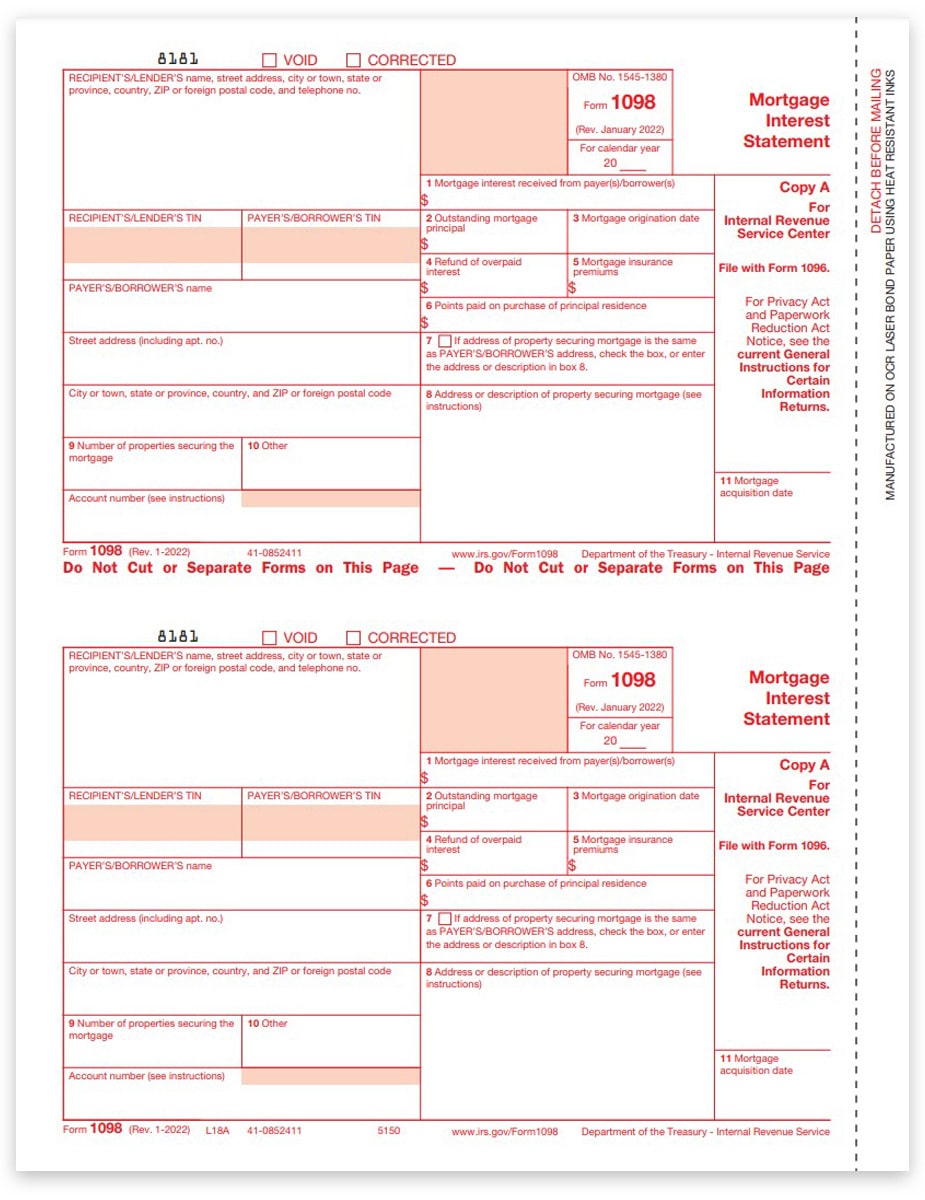

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

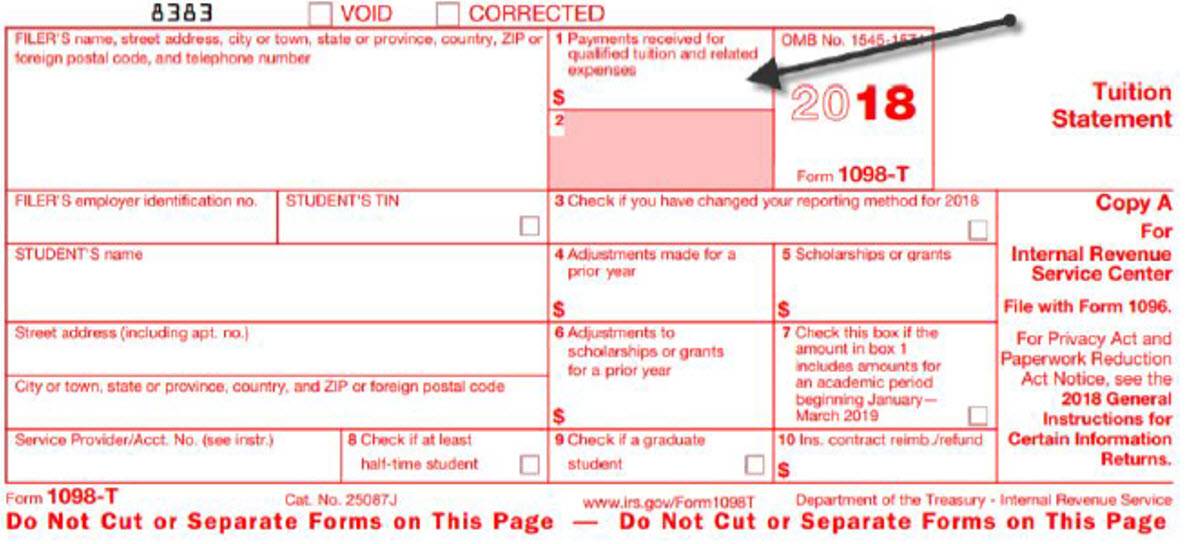

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

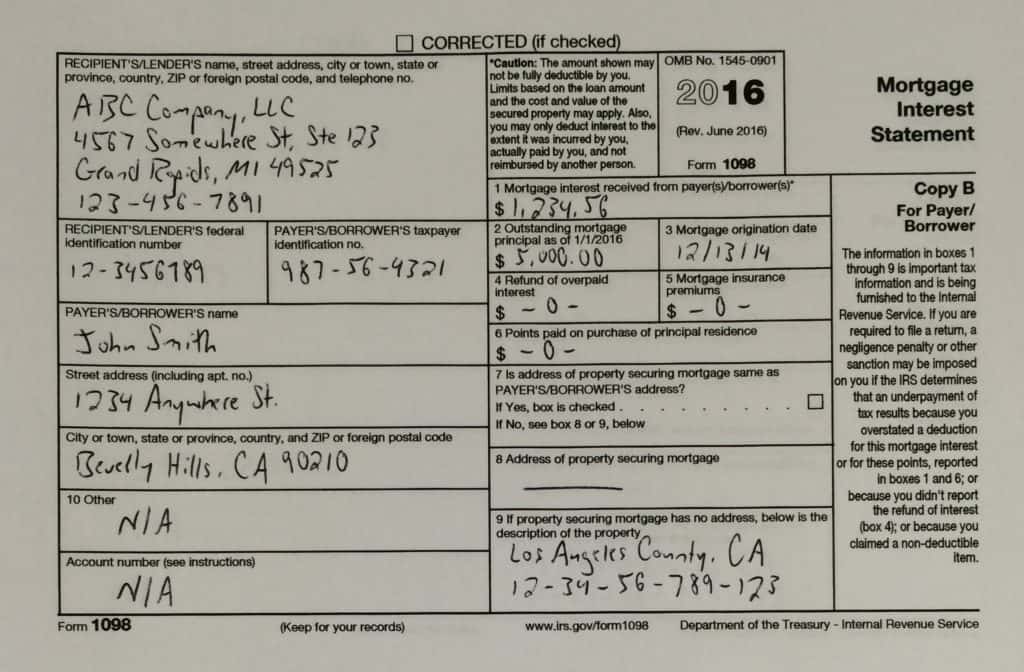

IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage interest is less than 600 your lender doesn t have to send you this form File

Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or What is the IRS Form 1098 The IRS Form 1098 is used to report payments on mortgage interest and mortgage insurance premiums MIP of 600 or more Form 1098 reports this information to the IRS for two reasons

More picture related to what form is 1098

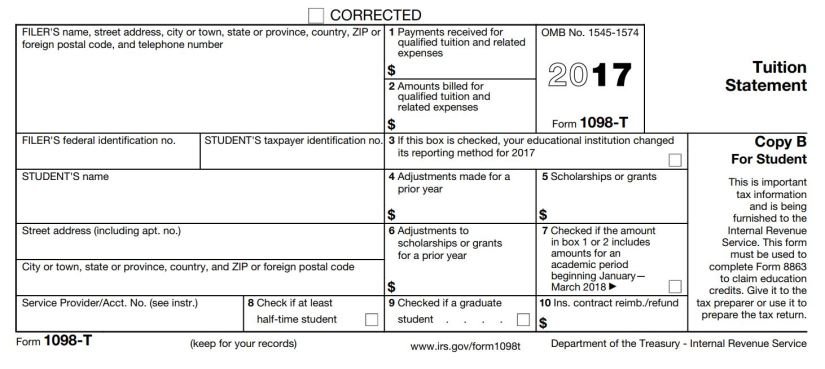

What Is Form 1098 T Who Should File Form 1098 T

https://d2rcescxleu4fx.cloudfront.net/images/1098-T.jpg

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

What s A 1098 T How To Pay For College

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

In a Nutshell There are seven different types of IRS 1098 forms You might get one if you ve made certain types of payments like mortgage or student loan payments or took some other action like donating a vehicle to IRS form 1098 is issued to report mortgage interest tuition charitable donations or other payments by the taxpayer Learn more about 1098s and your taxes

A form 1098 Mortgage Interest Statement is used to report mortgage interest including points of 600 or more paid to a lender for a mortgage Form 1098 is used by lenders to report the amount of mortgage interest mortgage insurance premiums or points you paid if it s 600 or more If you do not meet the 600 threshold your

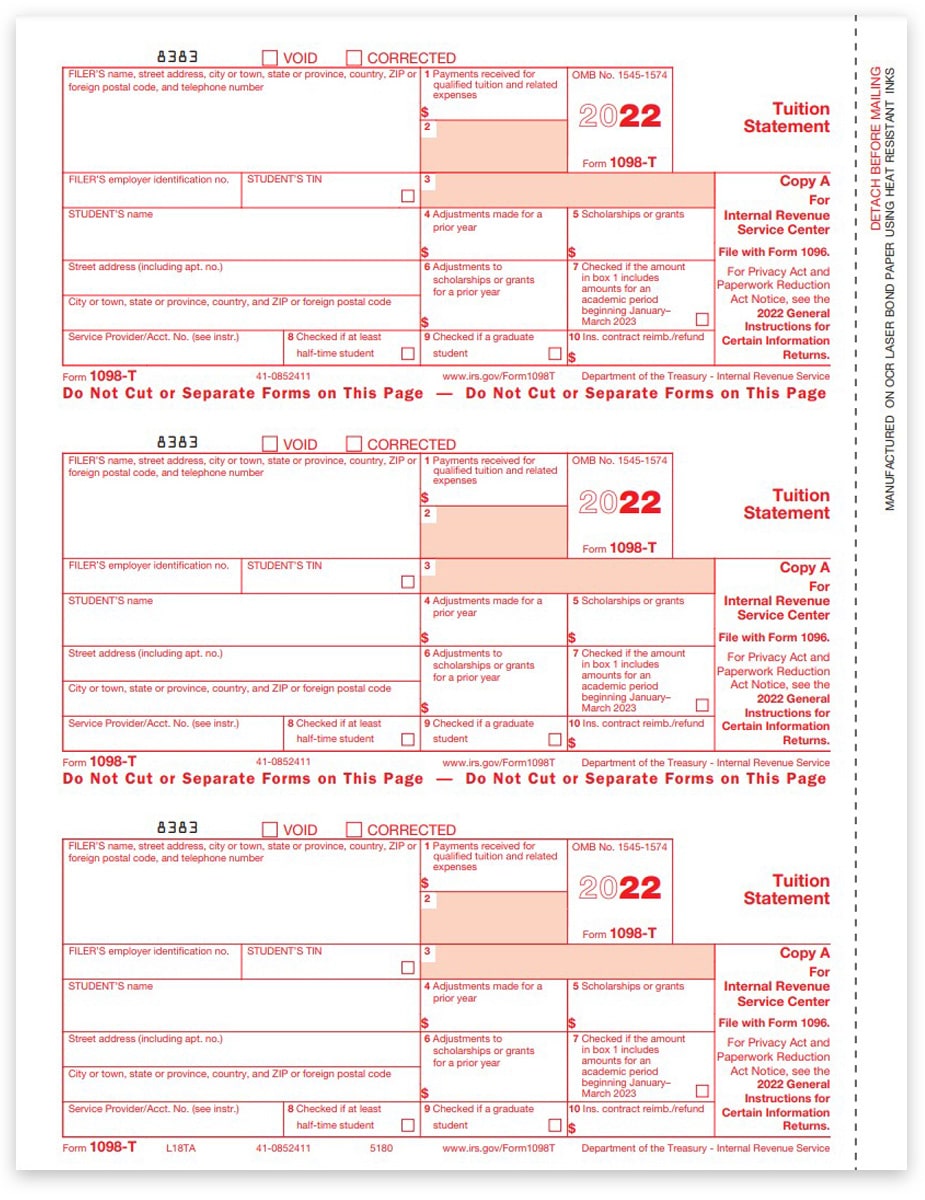

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

what form is 1098 - Lenders such as banks and financial institutions must file IRS Form 1098 Mortgage Interest Statement to report mortgage interest payments of 600 or more received