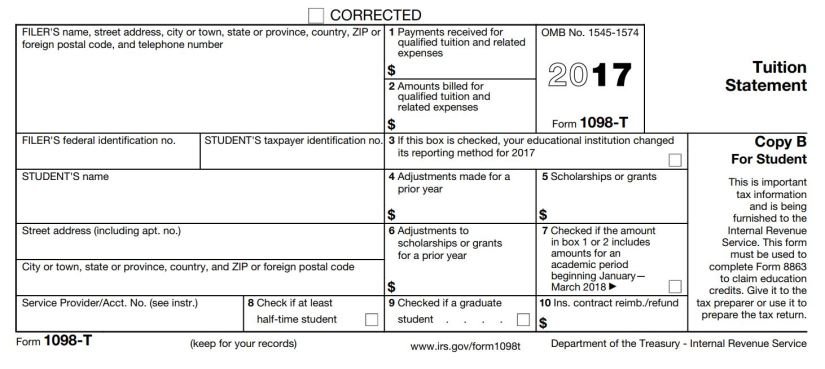

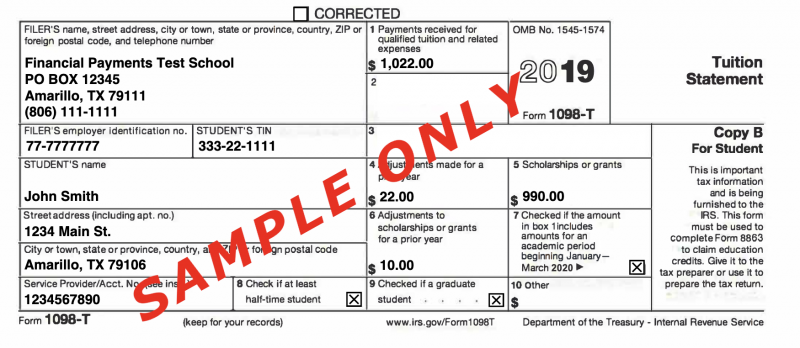

what is a 1098 tax form used for school Form 1098 T is a Tuition Statement used to help you understand which education credits you may qualify for relating to tuition and other school related expenses paid during the tax year

Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax year 1098 E Student Loan Interest Statement If you made federal student loan payments in 2022 you may be eligible to deduct a portion of the interest you paid on your 2022 federal tax return

what is a 1098 tax form used for school

what is a 1098 tax form used for school

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

Information about Form 1098 T Tuition Statement including recent updates related forms and instructions on how to file Form 1098 T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments Schools are supposed to give a Form 1098 T to students by Jan 31 of the calendar year following the tax year in which the expenses were paid Here s what to know about this form and what to do with it when you file your federal income tax return

Learn what the 1098 T form is how it affects your taxes and where to get it from your school or loan servicer Most students receive a Form 1098 T Tuition Statement from their educational institution Form 1098 T contains helpful instructions and other information you ll need to claim education credits on your federal tax form

More picture related to what is a 1098 tax form used for school

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

Schools must make Form 1098 T available to any student who paid in the previous tax year qualified educational expenses Tuition any fees that are required for enrollment and course materials the student was required to You may use Form W 9S Request for Student s or Borrower s Taxpayer Identification Number and Certification to obtain the student s or borrower s name address TIN and student loan certification to be used when filing Form 1098 E or 1098 T Use of Form W 9S is optional you may collect the information using your own forms such as

Form 1098 Mortgage Interest Statement reports how much you paid in interest during the tax year including prepaid points of interest The form will be sent to you by the company that services your mortgage loan There are seven different types of IRS 1098 forms You might get one if you ve made certain types of payments like mortgage or student loan payments or took some other action like donating a vehicle to charity that could qualify you for a tax deduction or tax credit

Tax Form 1098 T Office Of The Bursar

https://bursar.utk.edu/wp-content/uploads/sites/37/2022/04/1098-t-e1651503267111.png

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

what is a 1098 tax form used for school - Learn what the 1098 T form is how it affects your taxes and where to get it from your school or loan servicer