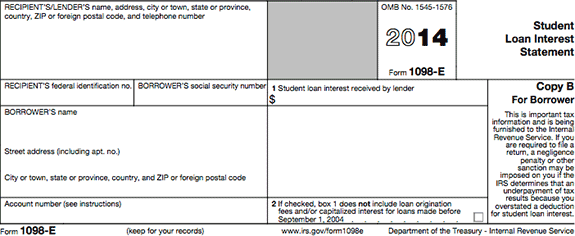

what is a 1098 e tax form You can use Form 1098 E to find out how much student loan interest you paid during the tax year You can deduct up to 2 500 of student loan interest from your taxable income if you meet certain conditions

Information about Form 1098 E Student Loan Interest Statement Info Copy Only including recent updates related forms and instructions on how to file File this form if The 1098 E tax form reports the amount of interest you paid on student loans in a calendar year Loan servicers send a 1098 E to anyone who pays at least 600 in student loan interest

what is a 1098 e tax form

what is a 1098 e tax form

https://www.moneycrashers.com/wp-content/uploads/2011/03/1098-e-black.png

![]()

What Is The 1098 E Student Loan Statement

https://collegeaftermath.com/wp-content/uploads/2022/07/icons8-team-FcLyt7lW5wg-unsplash-768x1152.jpg

1098 Tax Forms Lender Copy C ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-C-Recipient-Lender-State-L18C-FINAL-min.jpg

The IRS only requires federal loan servicers to report payments on IRS Form 1098 E if the interest received from the borrower in the tax year was 600 or more although some federal loan servicers still send 1098 E s to borrowers File Form 1098 E if you are a financial institution governmental unit or any of its subsidiary agencies educational institution or any other person who receives student loan interest of

IRS Form 1098 E is a tax form you get from the lender if you paid 600 or more in interest on your student loans during the tax year Key Takeaways Form 1098 E is issued by lenders to report student loan interest This tax form also known as the student loan interest statement is typically sent by lenders via post or email to any borrower who has paid more than 600 in interest payments

More picture related to what is a 1098 e tax form

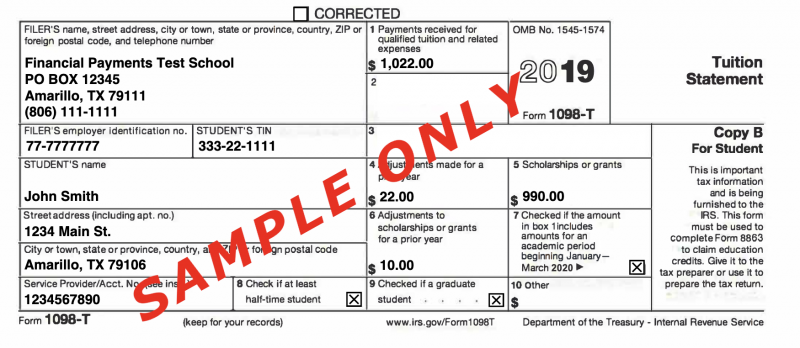

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

1098 T Form 2023 Printable Forms Free Online

https://www.utsouthwestern.edu/education/students/assets/1098.jpg

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

Instructions for Borrower A person including a financial institution a governmental unit and an educational institution that receives interest payments of 600 or more during the year on one What is the 1098 E form The 1098 E Student Loan Interest Statement is provided by your lender s either electronically or by mail and shows how much interest you have paid

Any interest that you paid on qualifying student loans is generally reported to you on Form 1098 E Student Loan Interest Statement by the financial institution to which you made the Form 1098 E is your Student Loan Interest Statement It will include information about your student loan lender name and address and the amount of student loan interest

1098 Tax Forms For Mortgage Interest IRS Copy A DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

Tax Form 1098 T Office Of The Bursar

https://bursar.utk.edu/wp-content/uploads/sites/37/2022/04/1098-t-e1651503267111.png

what is a 1098 e tax form - Form 1098 E Student Loan Interest Statement If you paid at least 600 in interest on one or more qualified student loans lenders must provide you with this form that