1098 e tax form Learn how to get your 1098 E Student Loan Interest Statement if you made federal student loan payments in 2022 Find out if you are eligible for tax benefits for education

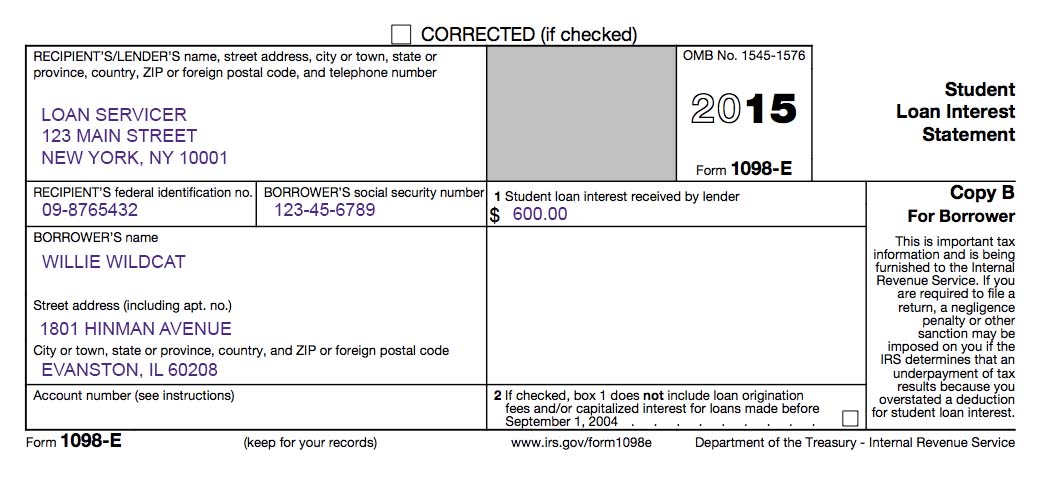

Learn how to file Form 1098 E if you receive 600 or more in student loan interest from an individual in your trade or business Find the current revision instructions and other The 1098 E tax form reports the amount of interest you paid on student loans in a calendar year Loan servicers send a 1098 E to anyone who pays at least 600 in student loan interest If you

1098 e tax form

1098 e tax form

https://d2rcescxleu4fx.cloudfront.net/images/1098-E.jpg

1098 E Tax Form Printable Printable Forms Free Online

https://i1.wp.com/frugaling.org/wp-content/uploads/2014/01/StudentLoan1098-E.jpg

1098 E Student Loan Interest Statement Financial Wellness

https://www.northwestern.edu/financial-wellness/images/1098-e.jpg

This is the official IRS form for reporting interest received on qualified student loans in 2022 It includes information for borrowers and lenders and explains how to file and furnish the form Below are some questions and answers to help you learn more about reporting student loan interest payments from IRS Form 1098 E on your 2023 taxes and potentially get this

The 1098 E form is the Student Loan Interest Statement that your servicer uses to report student loan interest payments to you and the IRS Your loan servicer should send you a 1098 E form Form 1098 E shows how much interest you paid on a qualified student loan in a year You can use it to claim a tax deduction of up to 2 500 if you meet certain conditions based on your income and filing status

More picture related to 1098 e tax form

1098 T Form How To Complete And File Your Tuition Statement

https://blog.pdffiller.com/app/uploads/2016/02/1098-T-form-tuition-statement.png

Form 1098 E Student Loan Interest Statement IRS Copy A

https://www.phoenixphive.com/images/products/detail/1098ECOPYA.1.jpg

1098 E Software Printing Electronic Reporting E File TIN Matching

https://www.idmsinc.com/images/screenshots/1098E.gif

Learn what form 1098 E is who receives it and how it can help you reduce your taxable income Find out who qualifies for the student loan interest deduction and how to report it on your tax return Learn how to use the 1098 E form to deduct student loan interest from your taxes Find out who qualifies how much you can deduct and how the student loan pause affects your eligibility

Learn how to file and furnish Forms 1098 E and 1098 T which report student loan interest and tuition payments Find out who must file what loans are qualified and how to use Form W 9S 1098 E tax documents are available for borrowers who paid interest in the tax year Borrowers can access their tax documents from CollegeAveServicing by

ECSI Student Loan Tax Incentives

https://www.ecsi.net/img/1098t.gif

1098 E Tax Form Student Loan Interest Statement

https://www.thecollegemonk.com/images/loan/1098-e-tax-form65.jpg

1098 e tax form - Form 1098 E shows how much interest you paid on a qualified student loan in a year You can use it to claim a tax deduction of up to 2 500 if you meet certain conditions based on your income and filing status