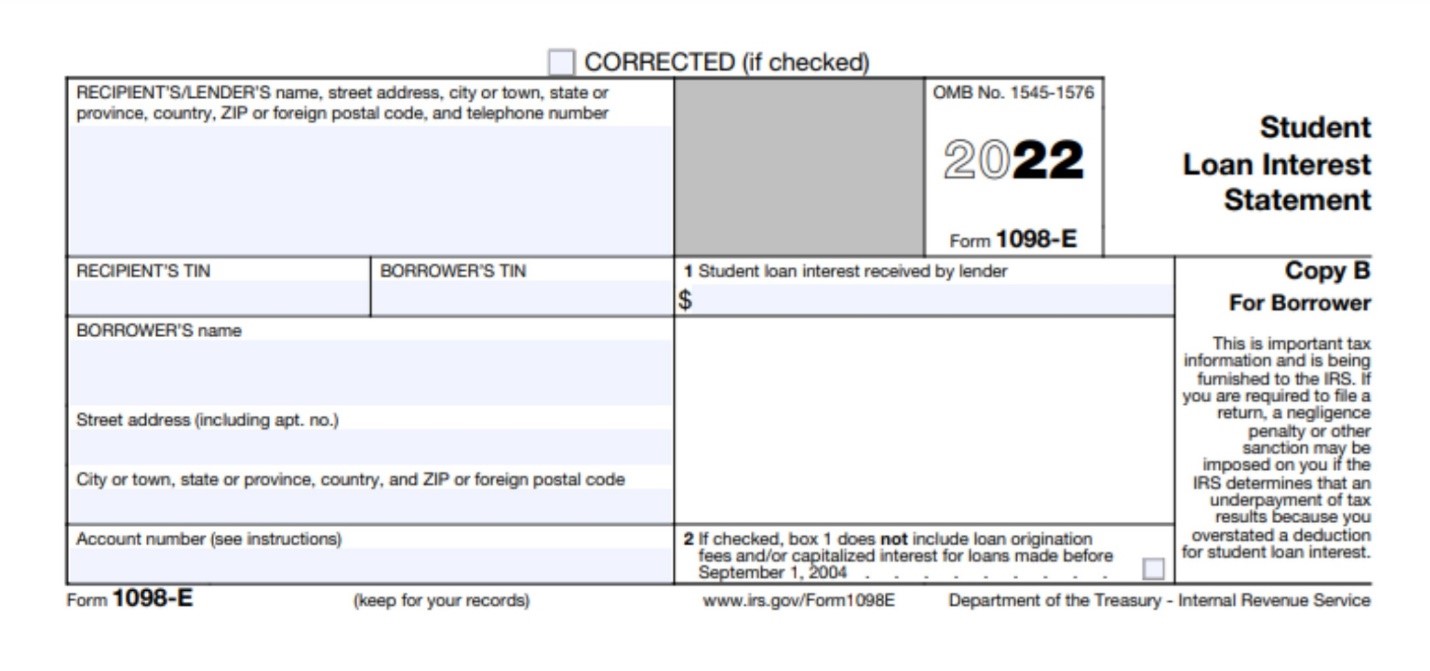

what is a 1098 e form You can use Form 1098 E to find out how much student loan interest you paid during the tax year You can deduct up to 2 500 of student loan interest from your taxable income if you meet certain conditions

Information about Form 1098 E Student Loan Interest Statement Info Copy Only including recent updates related forms and instructions on how to file File this form if File Form 1098 E Student Loan Interest Statement if you receive student loan interest of 600 or more from an individual during the year in the course of your trade or business The 600

what is a 1098 e form

what is a 1098 e form

https://www.taxdefensenetwork.com/wp-content/uploads/2022/02/form-1098-e-instructions.jpg

What Is A 1098 E Form What You Need To Know About The Student Loan

https://s.yimg.com/ny/api/res/1.2/6cMowBRaxpaYaVe_haTMPA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD02Nzk-/https://media.zenfs.com/en/usa_today_money_325/009c6ac47159f7f2267e42574f14d0ca

What Is A 1098 Tax Form 1098 C 1098 E 1098 T

https://www.moneycrashers.com/wp-content/uploads/2011/03/1098.png

How can I get my 1098 E form The 1098 E tax form reports the amount of interest you paid on student loans in a calendar year Loan servicers send a 1098 E to anyone who pays at least IRS Form 1098 E is a tax form you get from the lender if you paid 600 or more in interest on your student loans during the tax year Key Takeaways Form 1098 E is issued by lenders to report student loan interest

What is IRS Form 1098 E IRS Form 1098 E is the Student Loan Interest Statement that your federal loan servicer will use to report student loan interest payments to both the Internal The 1098 E form is a student loan interest statement It states how much interest you paid on student loans within a year and you may find out you are eligible for deductions A 1098 E

More picture related to what is a 1098 e form

What Is A 1098 E Form Student Loan Interest Statement H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2019/11/college-student-graduate-loans-768x505.jpg

What Is A 1098 E Form What You Need To Know About The Student Loan

https://s.yimg.com/ny/api/res/1.2/_ZbcGiZyQAE89PCAItCjUQ--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyNDI7aD02OTk-/https://media.zenfs.com/en/aol_usatoday_us_articles_590/ff4b91a41679018c9d1979e1d99d337b

1098 E Software To Create Print E File IRS Form 1098 E

https://www.idmsinc.com/images/screenshots/1098E.png

If you have 10 or more information returns to file you may be required to file e file Go to IRS gov InfoReturn for e file options If you have fewer than 10 information returns to file we If you have student loans chances are you ll encounter the IRS s Form 1098 E This tax form also known as the student loan interest statement is typically sent by lenders via post or

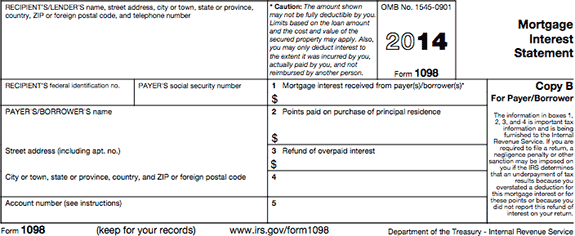

What is the 1098 E form The 1098 E form is the Student Loan Interest Statement that your servicer uses to report student loan interest payments to you and the IRS Your loan servicer Form 1098 is used to report mortgage interest and related expenses paid for the year Lenders must issue Form 1098 when a homeowner has paid 600 or more in mortgage

What Is A 1098 E Form WHEN AND WHY YOU NEED ONE

https://passiveincometoretire.com/wp-content/uploads/2022/07/1098-e-form-720x405.jpg

E file Form 1098 E IRS Form 1098 E Student Loan Interest Statement

https://d2rcescxleu4fx.cloudfront.net/images/1098-E.jpg

what is a 1098 e form - Form 1098 E reports the amount of student loan interest you paid in a year Your loan servicer or lender should send you this form by Jan 31 if you ve paid at least 600 in