who sends you a 1098 form Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or

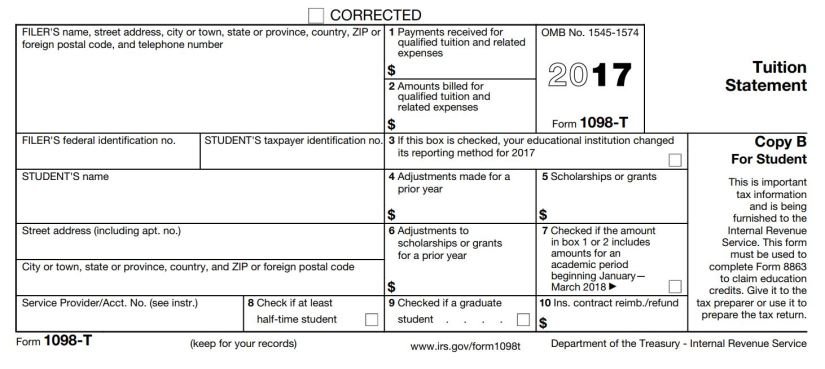

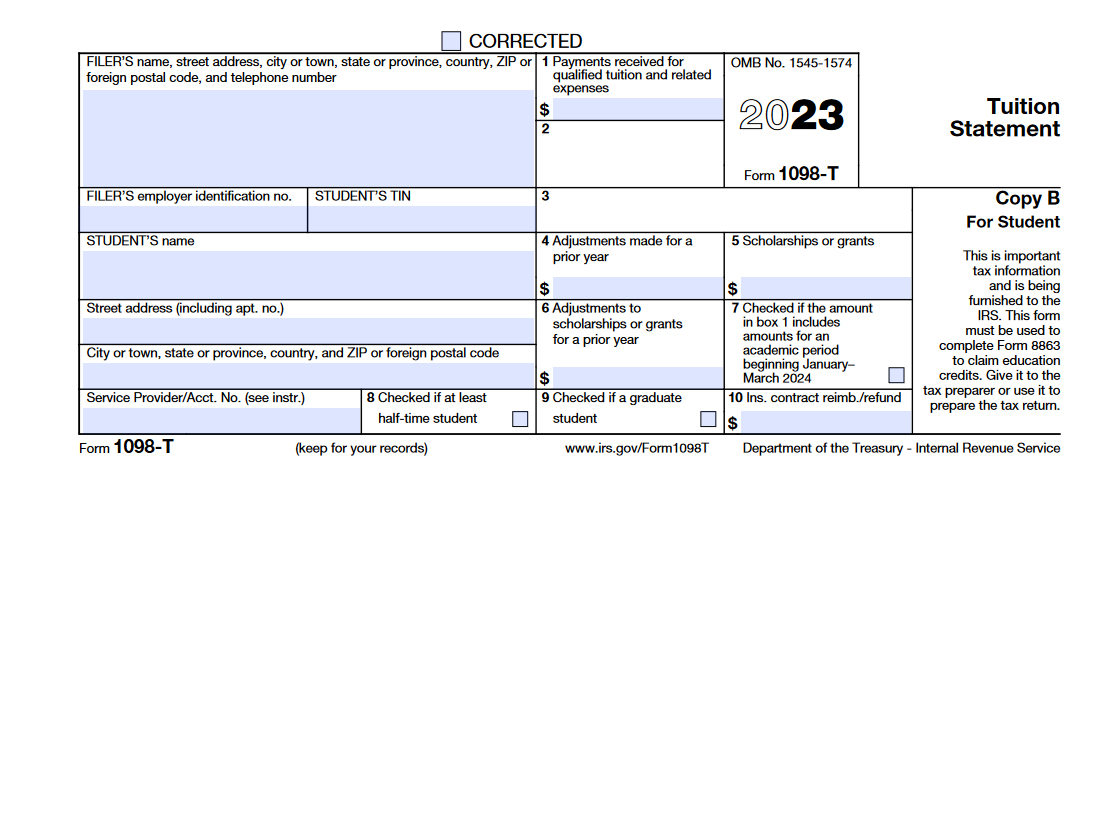

What is Form 1098 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders On your 1098 tax form is the following information Box 1 Interest paid not including points Box 2 Outstanding mortgage principal Box 3 Mortgage origination date Box 4 Refund of overpaid interest Box 5 Mortgage

who sends you a 1098 form

who sends you a 1098 form

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

Where Do I Enter A 1098 Form TurboTax Support Video YouTube

https://i.ytimg.com/vi/q7fVsNkI5Fk/maxresdefault.jpg

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

Form 1098 is issued to homeowners by mortgage lenders to report mortgage interest payments and other payments like mortgage premiums Businesses must file Form 1098 if they receive 600 or more in mortgage IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form

You must file Form 1098 if the interest is received in the United States A U S person is a citizen or resident of the United States a domestic partnership or corporation or a nonforeign estate Who receives Form 1098 Lenders send out Form 1098 to anyone who has a mortgage on their home and has paid more than 600 toward interest during the tax year Whether your mortgage is for your primary residence a

More picture related to who sends you a 1098 form

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

What s A 1098 T How To Pay For College

https://images.squarespace-cdn.com/content/v1/60899df0d143dc1d332002b2/625d2d0b-39e5-411a-a810-de3bf70eb9ec/ex1098t.jpeg

Frequently Asked Questions About The 1098 T The City University Of

https://www.cuny.edu/wp-content/uploads/sites/4/page-assets/financial-aid/tax-benefits-for-higher-education/form1098t/gopaperless/1098t_go_paperless.png

Filing Form 1098 is mandatory if your business received at least 600 in mortgage interest payments Lenders must send you this form by January 31st so you have plenty of time to gather your documentation and Your student loan servicer who you make payments to will send you a copy of your 1098 E via email or postal mail if the interest you paid in 2022 met or exceeded 600

A 1099 form is a tax statement you may receive from a bank a broker a business or another entity paying you nonemployee compensation throughout the year It will For example if you pay tuition to an eligible education institution your school may send you a Form 1098 T If you paid at least 600 in interest on a mortgage your lender will

IRS Form 1098 T Tuition Statement Forms Docs 2023

https://blanker.org/files/images/form-1098t.png

Form 1098 Mortgage Interest Statement Template

https://static-oforms.onlyoffice.com/image2_3cf0e721cb.png

who sends you a 1098 form - Form 1098 Mortgage Interest Statement reports how much you paid in interest during the tax year including prepaid points of interest The form will be sent to you by the