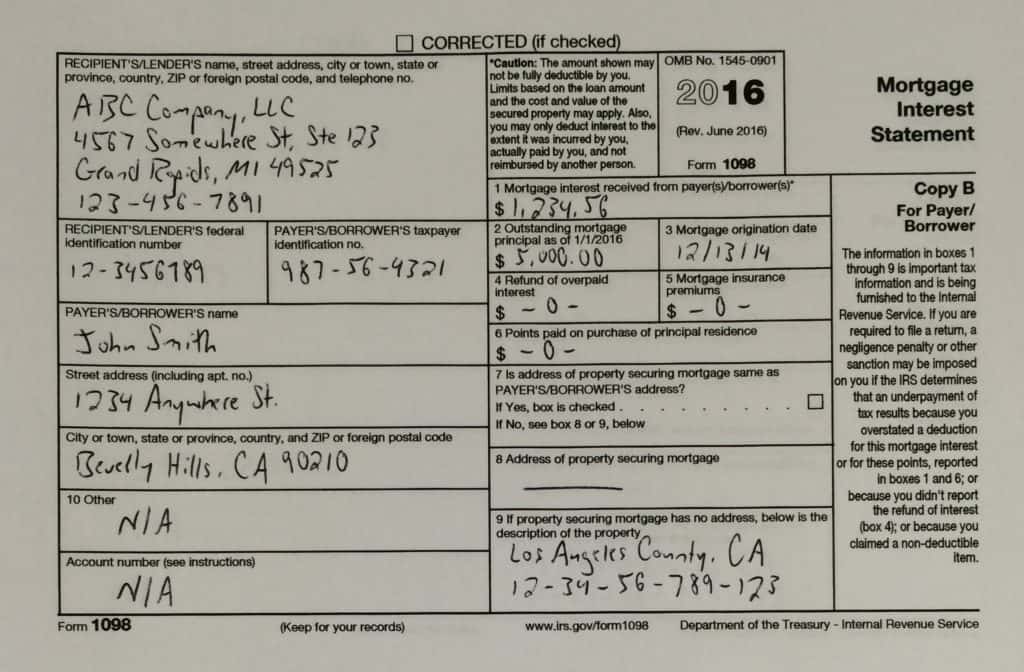

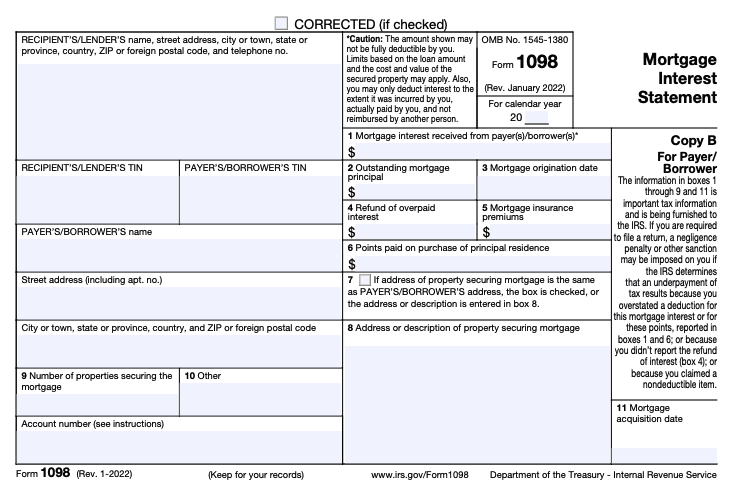

what is 1098 tax statement IRS Form 1098 is a mortgage interest statement It s a tax form used by businesses and lenders to report mortgage interest paid to them of 600 or more

Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or Form 1098 Mortgage Interest Statement reports how much you paid in interest during the tax year including prepaid points of interest The form will be sent to you by the company that services your mortgage loan

what is 1098 tax statement

what is 1098 tax statement

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

IRS Form 1098 Mortgage Interest Deduction Wiztax

https://www.wiztax.com/wp-content/uploads/2023/01/IRS-Form-1098.png

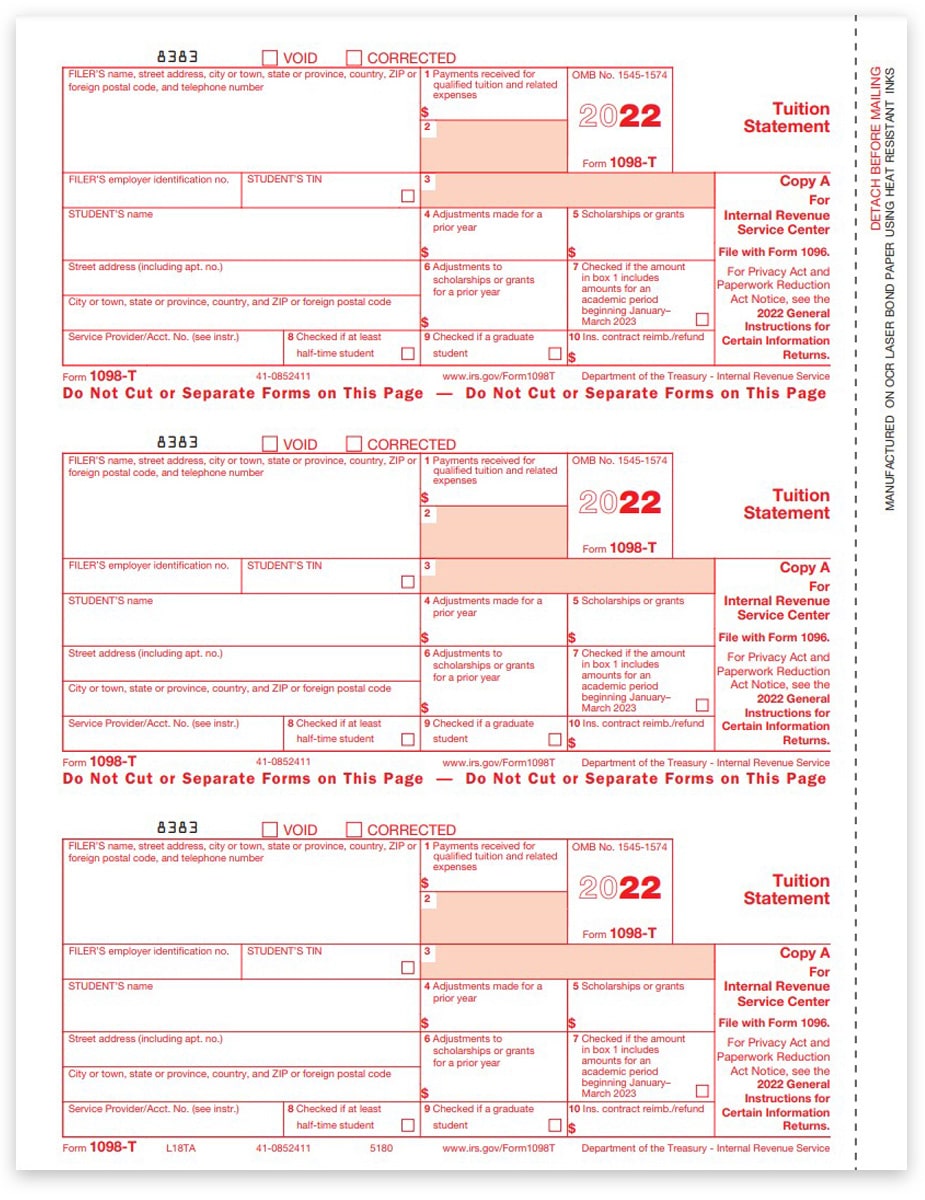

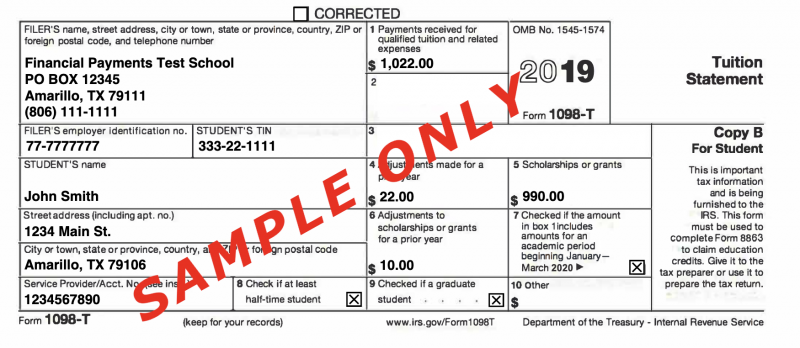

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form What is Form 1098 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders

What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage interest is less than 600 your lender doesn t have to send you this form If you are required to file Form 1098 you must provide a statement to the payer of record For more information about the requirement to furnish a statement to the payer Instructions for

More picture related to what is 1098 tax statement

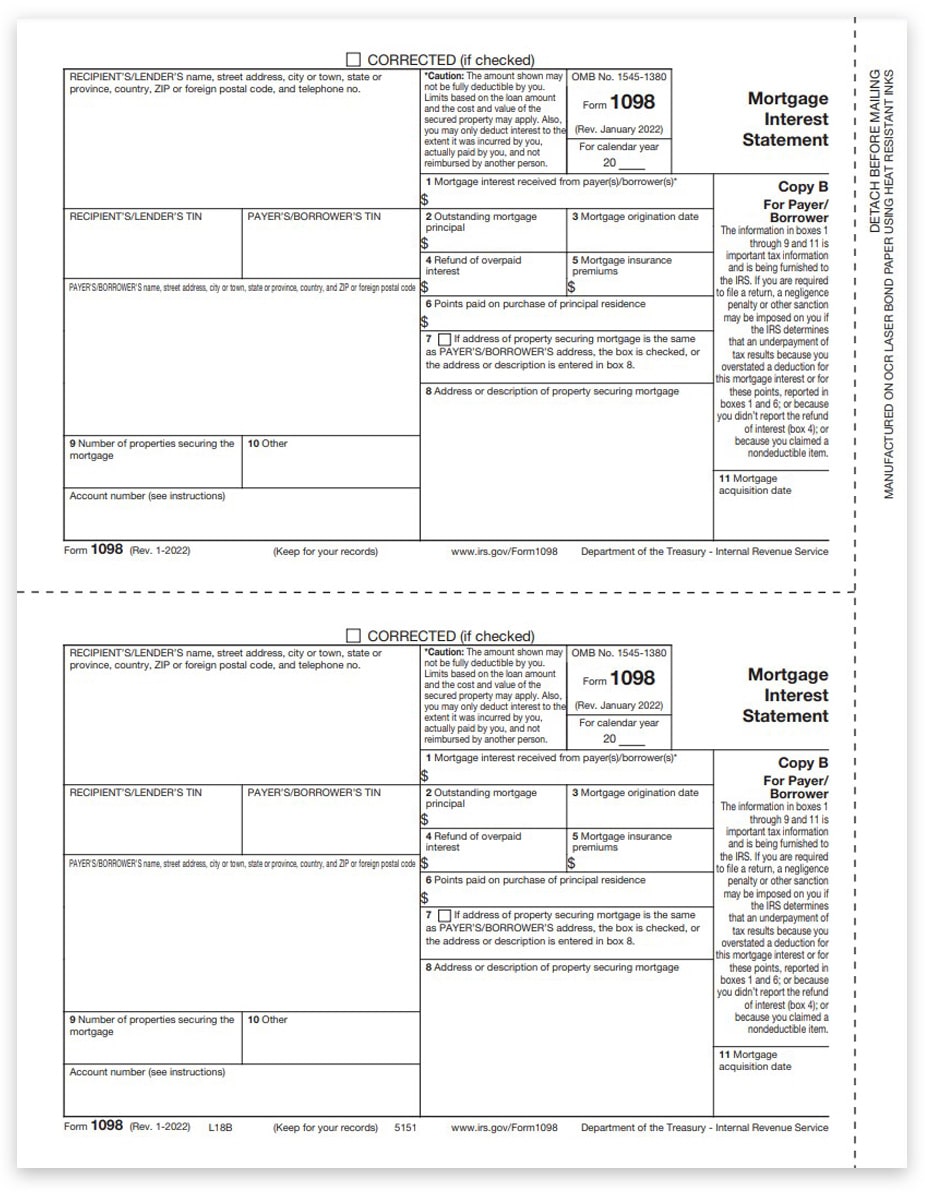

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

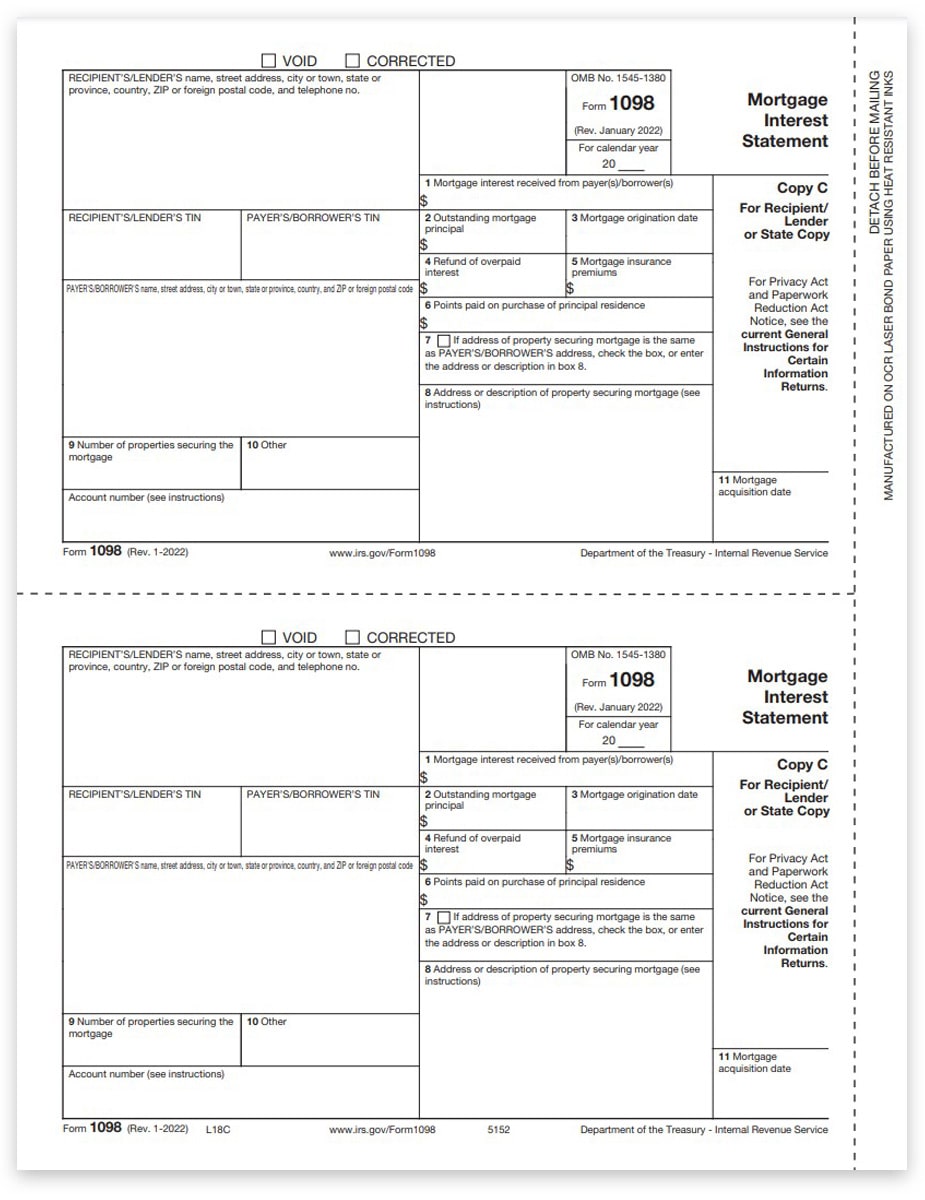

1098 Tax Form Mortgage Interest Copy C For Lender DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-C-Recipient-Lender-State-L18C-FINAL-min.jpg

2019 Updates 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-800x348.png

What is Form 1098 Mortgage Interest Statement So what is Form 1098 Essentially it s a tax form that reports the amount of mortgage interest you paid during the tax year If you have a mortgage on a home or Referred to as the Mortgage Interest Statement the 1098 tax form allows business to notify the IRS of mortgage interest and points received in excess of 600 on a single mortgage For

A form 1098 Mortgage Interest Statement is used to report mortgage interest including points of 600 or more paid to a lender for a mortgage For federal income tax What Is IRS Tax Form 1098 Mortgage Interest Statement The IRS Form 1098 informs you how much interest you paid on your mortgage loan for the last tax year Mortgage

Instructions For Form 1098 Mortgage Interest Statement Lendstart

https://assets.trafficpointltd.com/app/uploads/sites/136/2022/01/02082507/Form-1098.jpg

Form 1098 And Your Mortgage Interest Statement Dark Horse Running

https://i1.wp.com/darkhorserunning.blog/wp-content/uploads/2020/01/1098.jpg?fit=656%2C280&ssl=1

what is 1098 tax statement - What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage interest is less than 600 your lender doesn t have to send you this form