what is a 1098 for taxes Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or

Information about Form 1098 Mortgage Interest Statement including recent updates related forms and instructions on how to file Use Form 1098 to report mortgage Forms that include 1098 in the title contain information about transactions you ve made during a calendar year that could potentially affect your taxes when it s time to file your return in the beginning of the next calendar year

what is a 1098 for taxes

what is a 1098 for taxes

https://assets-global.website-files.com/600089199ba28edd49ed9587/61c1fc0b7d3cddd434a01aee_aXc-wHXrmSqfAm_dyqrgj9P39IAG8UZghdbxFstDxMeZkj_-0Yh5Nw2LcMrbVRmQEDMD3aqbryxnFBcOV4r_uFiQRdcA-Eiwuu0mrIQgfpfdr14uzNN-FdJbh6-JDA89pUe5uoAD.jpeg

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

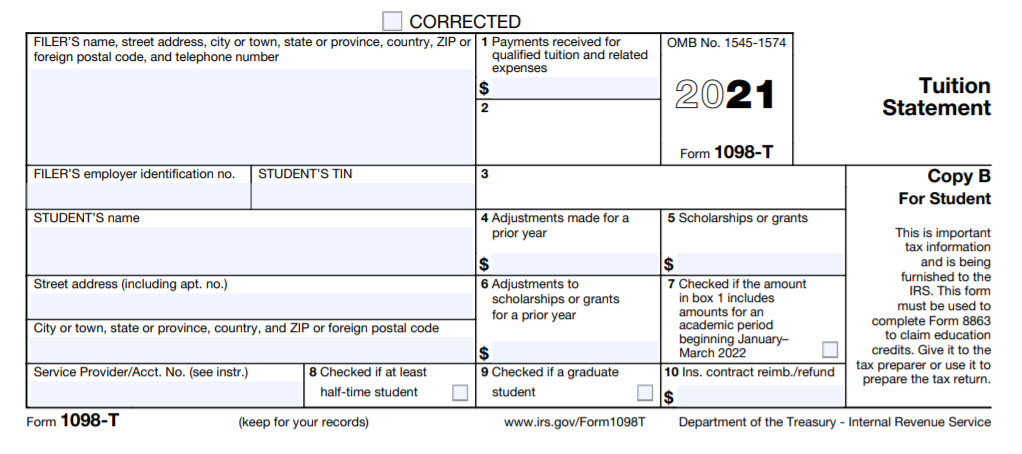

1098 T IRS Tax Form Instructions 1098 T Forms

https://1098tforms.com/wp-content/uploads/2019/02/2019_1098t_sample-1-1200x523.png

Form 1098 is issued to homeowners by mortgage lenders to report mortgage interest payments and other payments like mortgage premiums Businesses must file Form 1098 if they receive 600 or more in mortgage IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form

What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage interest is less than 600 your lender doesn t have to send you this form Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your

More picture related to what is a 1098 for taxes

1098 T Form 2023 Printable Forms Free Online

https://busfin.osu.edu/sites/default/files/2021-1098-t.jpg

Understanding The 1098 T Form Graduate School

https://gradschool.cornell.edu/wp-content/uploads/2018/06/tax-form.jpeg

Understanding The 1098 T Form Graduate School

https://gradschool.cornell.edu/wp-content/uploads/2019/02/2-11-2019-12-10-26-PM.gif

The IRS Form 1098 is used to report payments on mortgage interest and mortgage insurance premiums MIP of 600 or more Form 1098 reports this information to the IRS for two reasons The first is to help A form 1098 reports the amounts to the IRS and you receive a copy of the form that you may be able to deduct on your tax return 1098 Mortgage Interest Statement If you have a mortgage loan you ll get a Form

Form 1098 Mortgage Interest Statement reports how much you paid in interest during the tax year including prepaid points of interest The form will be sent to you by the Form 1098 is a tax form used to report mortgage interest paid by the borrower to the lender The lender is required to file this form with the Internal Revenue Service IRS and provide a copy

The 15 Most Common Tax Forms In 2022 Infographics Tax Guide 101

https://taxguide101.akistepinska.com/wp-content/uploads/2022/04/Taxes-Forms-2021-1098-Blue-1280x853.png

What You Need To Know About The 1098 T Tax Form Adjustment The Albion

https://www.albionpleiad.com/wp-content/uploads/2019/04/1098-t-tax-forms-678x373.jpg

what is a 1098 for taxes - What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage interest is less than 600 your lender doesn t have to send you this form