what is tax 1098 form What is Form 1098 Form 1098 Mortgage Interest Statement is used by lenders to report the amounts paid by a borrower if it is 600 or more in interest mortgage insurance premiums or points during the tax year Lenders

Form 1098 is issued to homeowners by mortgage lenders to report mortgage interest payments and other payments like mortgage premiums Businesses must file Form 1098 if they receive 600 or more in mortgage Form 1098 Mortgage Interest Statement reports how much you paid in interest during the tax year including prepaid points of interest The form will be sent to you by the company that services your mortgage loan

what is tax 1098 form

what is tax 1098 form

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1098-Form-Copy-A-Federal-Red-L18A-FINAL-min.jpg

51 Where Do I Get My 1098 Mortgage Interest Statement RalphPhyllis

https://e8x4d3t2.rocketcdn.me/wp-content/uploads/2016/06/FullSizeRender-2-1-1024x672.jpg

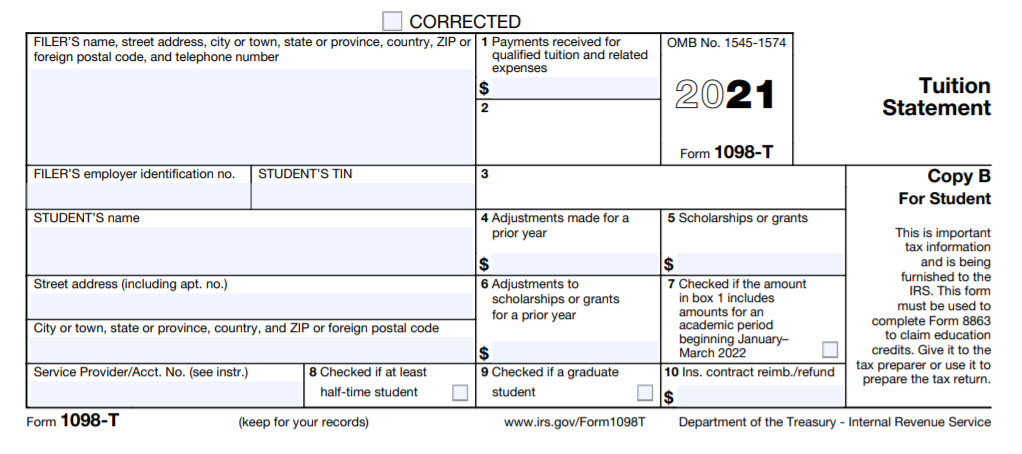

1098 T Form 2023 Printable Forms Free Online

https://busfin.osu.edu/sites/default/files/2021-1098-t.jpg

Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or What is a 1098 tax form used for If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form If your mortgage interest is less than 600 your lender doesn t have to send you this form

In a Nutshell There are seven different types of IRS 1098 forms You might get one if you ve made certain types of payments like mortgage or student loan payments or took some other action like donating a vehicle to IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year Here s how to fill out the form

More picture related to what is tax 1098 form

1098 T FAQ

https://sites.rowan.edu/bursar/_images/1098-t-banner-2022.jpg

1098 Tax Forms For Mortgage Interest Copy B ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/09/1098-Form-Copy-B-Payer-Borrower-L18B-FINAL-min.jpg

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Form 1098 Mortgage Interest Statement And How To File

https://www.investopedia.com/thmb/I2hSqiwM-Z4WyzK-zDK4noFs5Zg=/1428x928/filters:fill(auto,1)/Form1098-5c57730f46e0fb00013a2bee.jpg

Use Form 1098 Mortgage Interest Statement to report mortgage interest including points defined later of 600 or more you received during the year in the course of your trade or Form 1098 is a reporting form sent to you by banks schools and other organizations to whom you have made certain payments during the year For example you

What is the IRS Form 1098 The IRS Form 1098 is used to report payments on mortgage interest and mortgage insurance premiums MIP of 600 or more Form 1098 A form 1098 reports the amounts to the IRS and you receive a copy of the form that you may be able to deduct on your tax return 1098 Mortgage Interest Statement If you

1098T Forms For Education Expenses IRS Copy A ZBPforms

https://www.zbpforms.com/wp-content/uploads/2016/08/1098T-Form-Copy-A-Federal-Red-L18TA-FINAL-min.jpg

Leiter Ballaststoff Rutschen 1098 T Box 5 Taxable bertreffen S ss Schweben

https://www.csusm.edu/sfs/images/form_1098_t.jpg

what is tax 1098 form - In a Nutshell There are seven different types of IRS 1098 forms You might get one if you ve made certain types of payments like mortgage or student loan payments or took some other action like donating a vehicle to