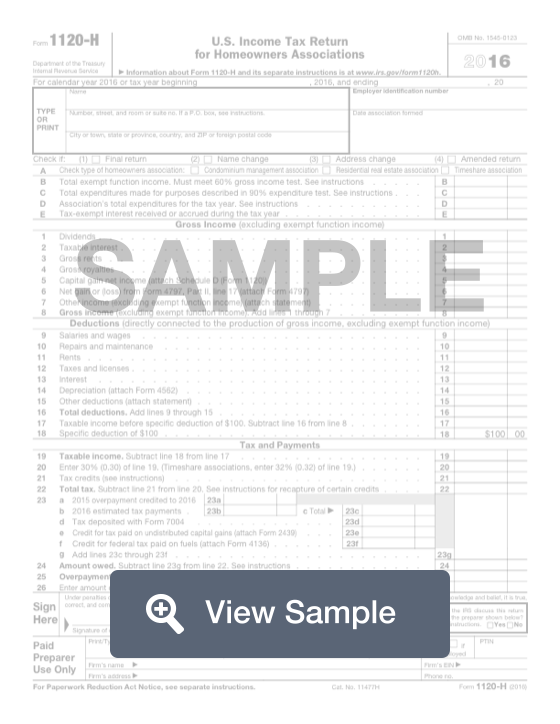

form 1120 hoa Form 1120 H Department of the Treasury Internal Revenue Service U S Income Tax Return for Homeowners Associations Go to irs gov Form1120H for instructions and the latest

A homeowners association files Form 1120 H as its income tax return to take advantage of certain tax benefits These benefits in effect allow the association to exclude exempt function Form 1120 is used by C corporations while 1120 H is a tax form specifically designed for qualifying HOAs What makes HOAs unique is the ability to file two different tax returns and the ability to change those forms each year

form 1120 hoa

form 1120 hoa

https://formswift.com/seo-pages-assets/images/documents/form-1120-h/form-1120-h-sample.png

Instructions For Form 1120 W 2009 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/246/2464/246458/page_1_thumb_big.png

Form 8879 C IRS E file Signature Authorization For Form 1120 2014

https://www.formsbirds.com/formimg/tax-support-document/8428/form-8879-c-irs-e-file-signature-authorization-for-form-1120-2014-l1.png

IRS Form 1120 H is a relatively safe form to file This form is specifically designated for qualifying homeowners associations If the homeowners association qualifies to file Form 1120 H only its non exempt income is Homeowners associations HOAs that meet certain requirements can file Form 1120 H to report association income and expenses When preparing this return it s important to understand key tax considerations like

An HOA may elect to file Form 1120 H U S Income Tax Return for Homeowners Associations as its income tax return in order to take advantage of certain tax benefits These benefits in A homeowners association files Form 1120 H as its income tax return to take advantage of certain tax benefits These benefits in effect allow the association to exclude exempt function

More picture related to form 1120 hoa

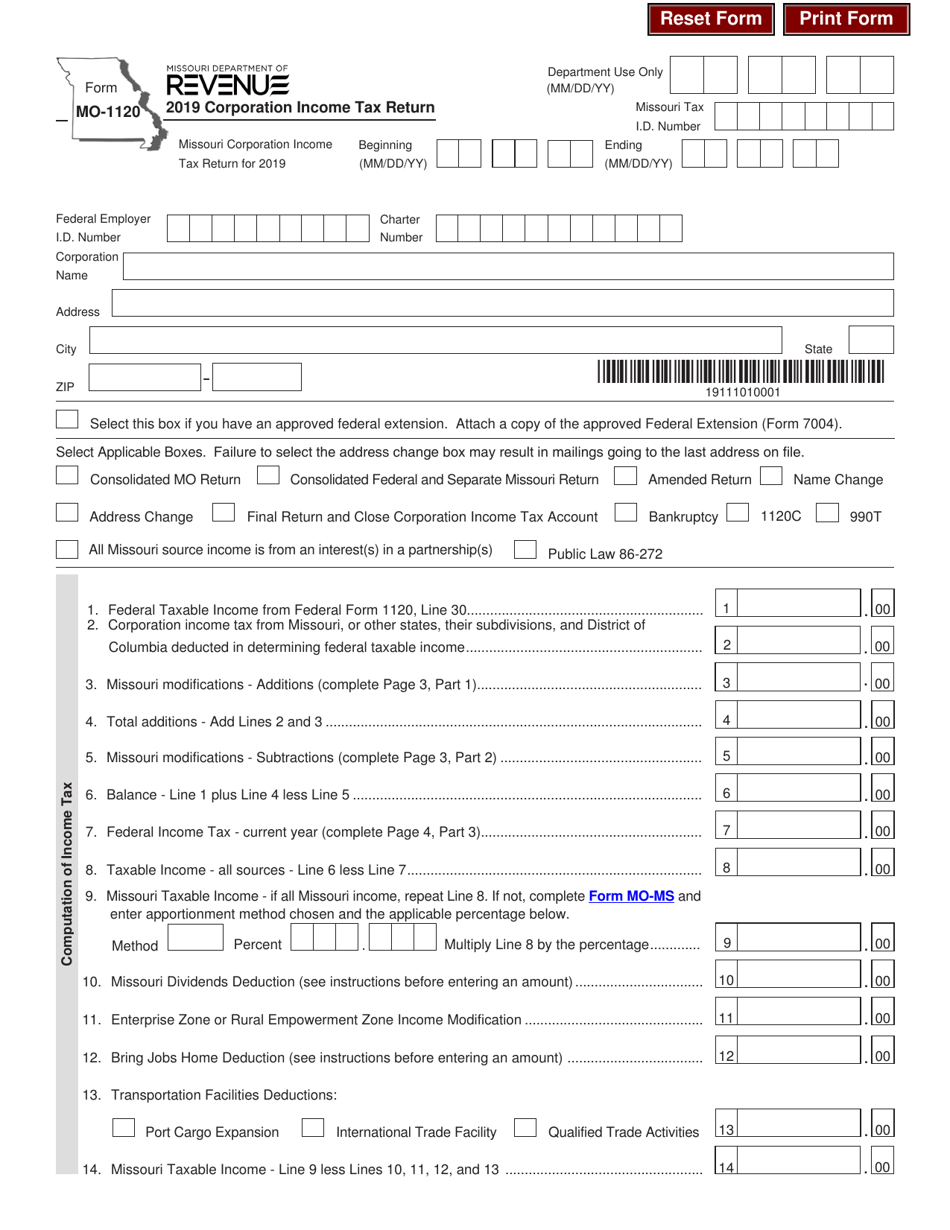

Form MO 1120 Download Fillable PDF Or Fill Online Corporation Income

https://data.templateroller.com/pdf_docs_html/2080/20803/2080340/form-mo-1120-corporation-income-tax-return-missouri_print_big.png

3 11 16 Corporate Income Tax Returns Internal Revenue Service

https://www.irs.gov/pub/xml_bc/33500001.gif

1120 h 6 HOA Taxes

http://hoatax.com/wp-content/uploads/2017/07/1120-h-6.png

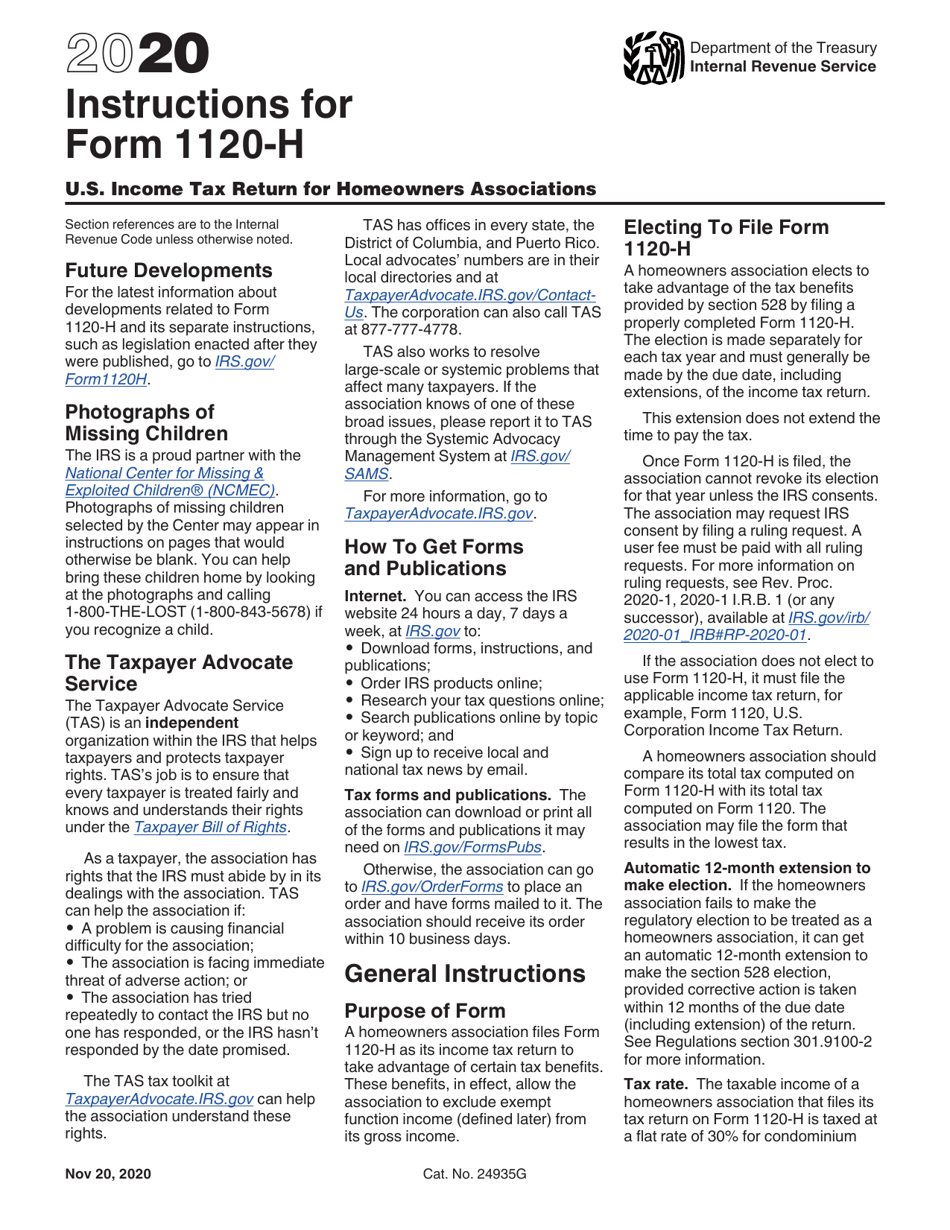

Learn about how homeowners associations can save money on their federal taxes by filing IRS Form 1120 instead of Form 1120 H Full details inside Form 1120 H is a specialized tax form designed explicitly for Homeowners Associations HOAs This form offers a simpler and often more beneficial way for HOAs to fulfill their tax obligations Understanding when and

Form 1120 H is a U S Income Tax Return for Homeowners Associations This form allows HOAs to take advantage of a specific tax benefit under Section 528 of the Internal Revenue Inexperienced board members need help understanding which tax reports to file how to complete Form 1120 and if their HOA income is tax exempt Incorrect tax filings result in unexpected

Download Instructions For IRS Form 1120 H U S Income Tax Return For

https://data.templateroller.com/pdf_docs_html/2117/21171/2117185/instructions-for-irs-form-1120-h-u-s-income-tax-return-for-homeowners-associations_print_big.png

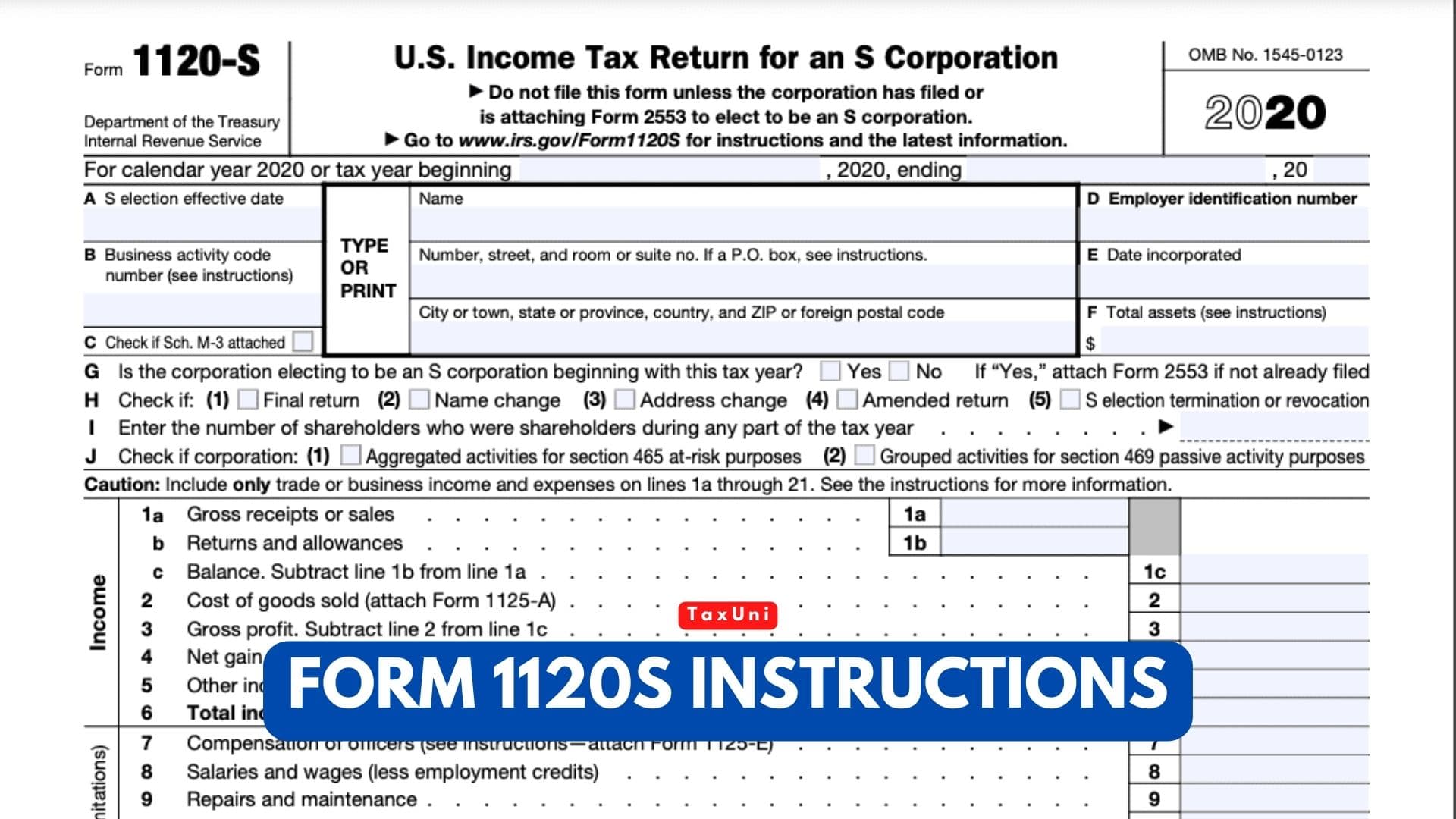

Form 1120S Instructions 2023 2024

https://www.taxuni.com/wp-content/uploads/2022/07/Form-1120S-Instructions-TaxUni-Cover-1.jpg

form 1120 hoa - IRS Form 1120 H is a relatively safe form to file This form is specifically designated for qualifying homeowners associations If the homeowners association qualifies to file Form 1120 H only its non exempt income is