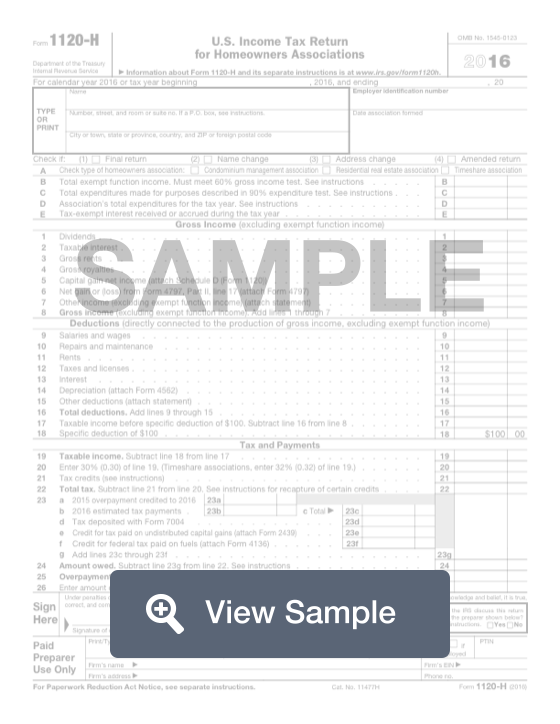

form 1120 h instructions Information about Form 1120 H U S Income Tax Return for Homeowners Associations including recent updates related forms and instructions on how to file A homeowners association files

Learn how to file IRS Form 1120 H a one page tax form for qualifying homeowners associations Find out the requirements benefits pitfalls and differe Following the detailed Form 1120 H instructions for the 2022 tax year can help homeowners associations properly file their returns and comply with IRS regulations Key aspects include tests for qualification income and

form 1120 h instructions

form 1120 h instructions

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

Form 1120 H Fill Out Online Instructions PDF Example FormSwift

https://formswift.com/seo-pages-assets/images/documents/form-1120-h/form-1120-h-sample.png

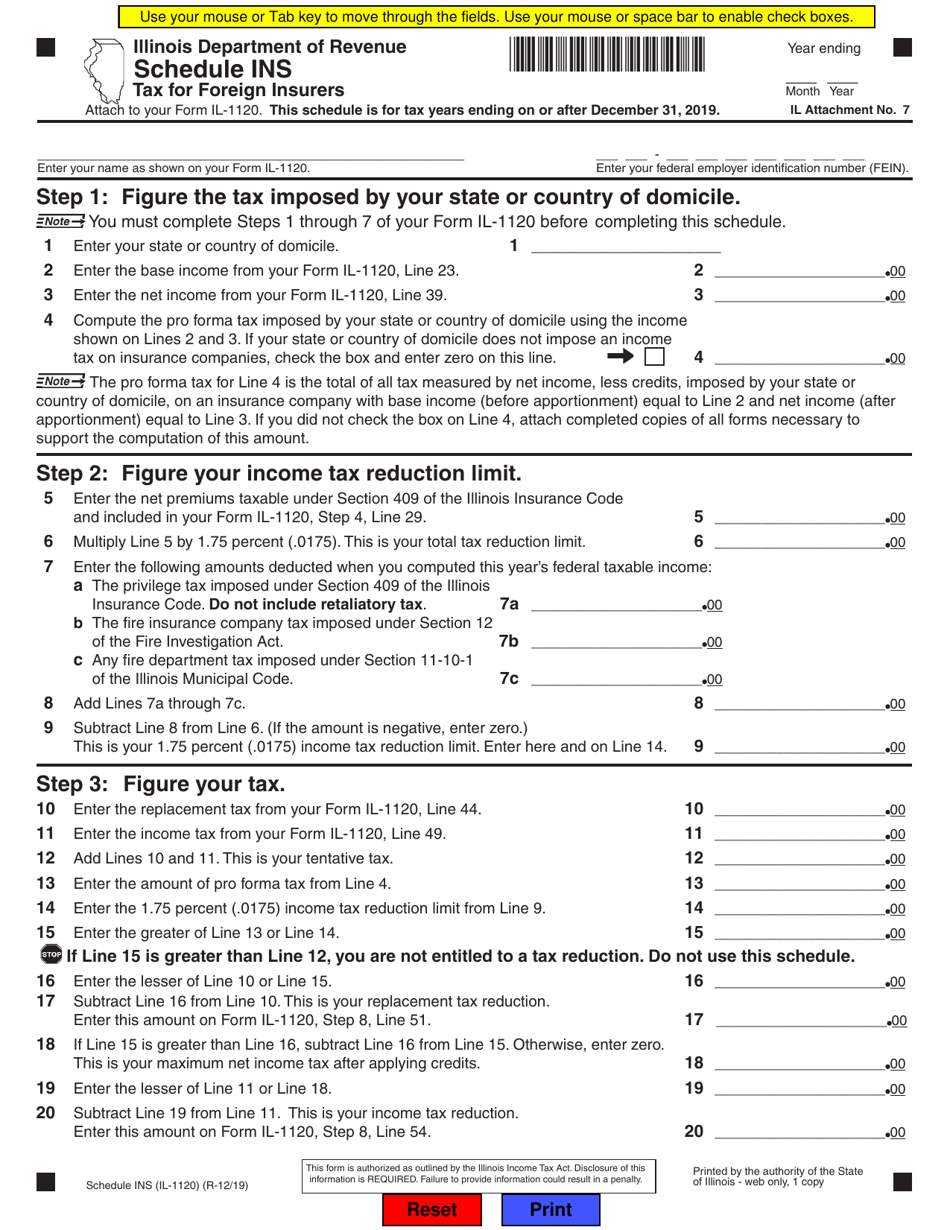

Form IL 1120 Schedule INS Fill Out Sign Online And Download Fillable

https://data.templateroller.com/pdf_docs_html/2024/20243/2024344/form-il-1120-schedule-ins-tax-for-foreign-insurers-illinois_print_big.png

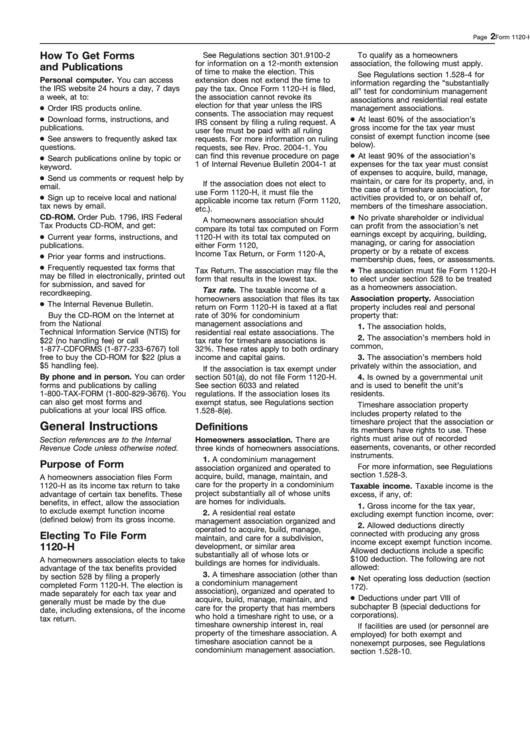

This document offers a comprehensive guide by the Internal Revenue Service IRS for homeowners associations to accurately complete Form 1120 H for the 2023 tax year It A homeowners association files Form 1120 H as its income tax return to take advantage of certain tax benefits These benefits in effect allow the association to exclude exempt function

An HOA may elect to file Form 1120 H U S Income Tax Return for Homeowners Associations as its income tax return in order to take advantage of certain tax benefits These benefits in Looking for a form 1120 H example We walk through the HOA tax return and point out some of the tips and tricks to stay compliant Let s take a look

More picture related to form 1120 h instructions

1120s Due Date

https://www.irs.gov/pub/xml_bc/51221535.gif

1120 h 4 HOA Condo Association CPA

https://hoatax.com/wp-content/uploads/2017/07/1120-h-4-1024x203.png

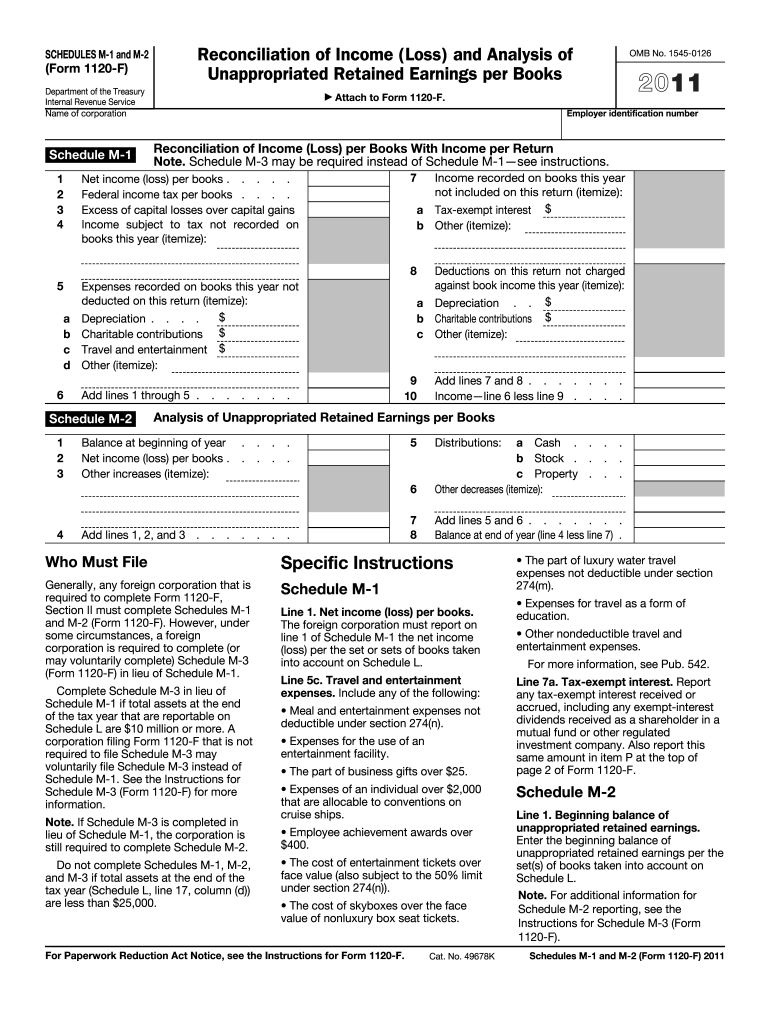

Form 1120 M 2 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/1/649/1649203/large.png

This article will provide clear step by step instructions on completing Schedule B for Form 1120 H simplifying HOA tax reporting You ll learn exactly who must file this form Even though they are non profit organizations all HOAs must still file their income tax return each year To better understand the requirement here s everything you need to know about the homeowners association tax form also known as

HOAs have two forms to choose from 1120 and 1120 H Form 1120 is used by C corporations while 1120 H is a tax form specifically designed for qualifying HOAs What makes HOAs Instructions for Form 1120 H U S Income Tax Return for Homeowners Association Updated February 14 2024 19 27 To access Form 1120 H U S Income Tax Return for Homeowners

Instructions For Form 1120 H 2004 Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/271/2717/271770/page_1_thumb_big.png

1120s Instructions 2023 PDF Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/591/911/591911499/big.png

form 1120 h instructions - An HOA may elect to file Form 1120 H U S Income Tax Return for Homeowners Associations as its income tax return in order to take advantage of certain tax benefits These benefits in