form 1120 h mailing address To amend a previously filed Form 1120 H file a corrected Form 1120 H and check the Amended return box Note If a change in address occurs after the return is filed use Form 8822 B

The Form 1120 H is also known as an U S Income Tax Return for Homeowners Associations Using this form instead of a standard tax return will allow a homeowner s association to take advantage of several tax benefits If you re unsure about the proper mailing address for your 1120 H tax return this article aims to guide you through the process Which Address Should I Use

form 1120 h mailing address

form 1120 h mailing address

http://www.hoatax.com/wp-content/uploads/2017/07/1120h-example-1024x204.png

:max_bytes(150000):strip_icc()/Form1120-S1-ff4821464fa84bac8db1b8f300c0970b.jpg)

Form 1120 S U S Income Tax Return For An S Corporation

https://www.investopedia.com/thmb/4THW408AnVj6xoooguouEdbzbfs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Form1120-S1-ff4821464fa84bac8db1b8f300c0970b.jpg

Form 1120 H 90 Expenditure Test Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/458/73/458073463/big.png

Information about Form 1120 H U S Income Tax Return for Homeowners Associations including recent updates related forms and instructions on how to file A homeowners association files Send the completed forms and other documents by post if possible See the postal addresses You can drop off your documents in the mailbox on the outside wall of the tax office

E file Form 1120 H If Form 1120 H is a standalone return for example not part of a Consolidated return you need to file it on paper However if Form 1120 H is part of a To submit Form 1120 H homeowners associations must first complete the form by following the detailed instructions provided by the Internal Revenue Service Once the form is

More picture related to form 1120 h mailing address

2019 2023 Form IRS 1120 Schedule M 3 Fill Online Printable Fillable

https://www.pdffiller.com/preview/489/187/489187920/large.png

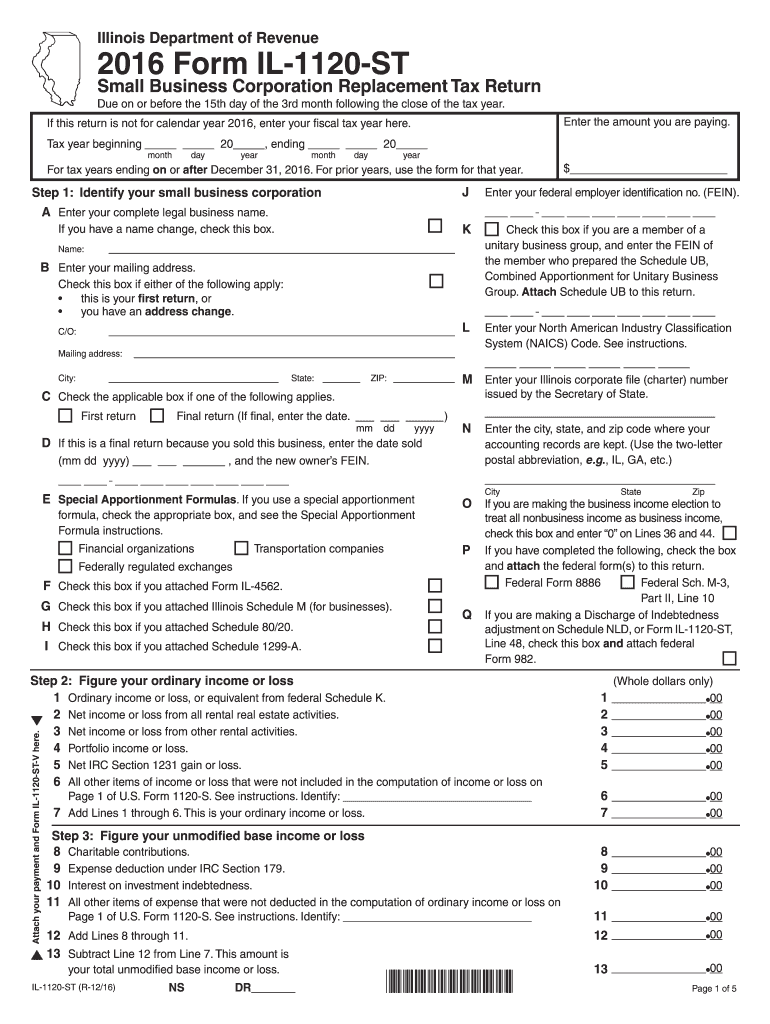

Il 1120 St 2016 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/396/727/396727012/large.png

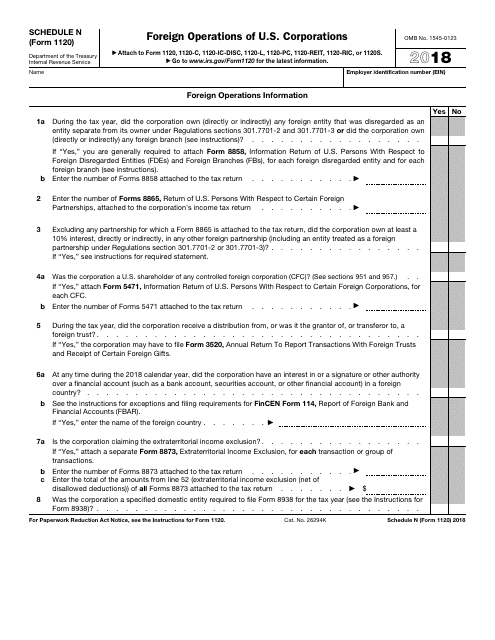

IRS Form 1120 Schedule N Download Fillable PDF Or Fill Online Foreign

https://data.templateroller.com/pdf_docs_html/1862/18622/1862262/irs-form-1120-2018-schedule-n-foreign-operations-u-s-corporations_big.png

The 1120 H must be filled out manually and mailed in for processing Here are a few key points about filing the 1120 H tax return The 1120 H is a special tax return form When To File Generally an association must file Form 1120 H by the 15th day of the 4th month after the end of its tax year However an association with a fiscal year ending June 30 must

File this form at the applicable Internal Revenue Service Center where the corporation filed its original return File at IRS Center where the corporation files its income tax Updated 3 times the Turbo Tax Business software but no access to that particular Form 1120 How do I find it The tax payer in process is a H O A which I understand requires

2023 Form 1120 W Printable Forms Free Online

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

Form 1120 H Example Complete In A Few Simple Steps

http://www.hoatax.com/wp-content/uploads/2017/07/1120-h-3-1024x249.png

form 1120 h mailing address - To submit Form 1120 H homeowners associations must first complete the form by following the detailed instructions provided by the Internal Revenue Service Once the form is