form 1120 h 2023 Regular Corporations Every corporation doing business in this state or deriving income from sources within this state unless exempt by Iowa Code section 422 34 must file an IA 1120

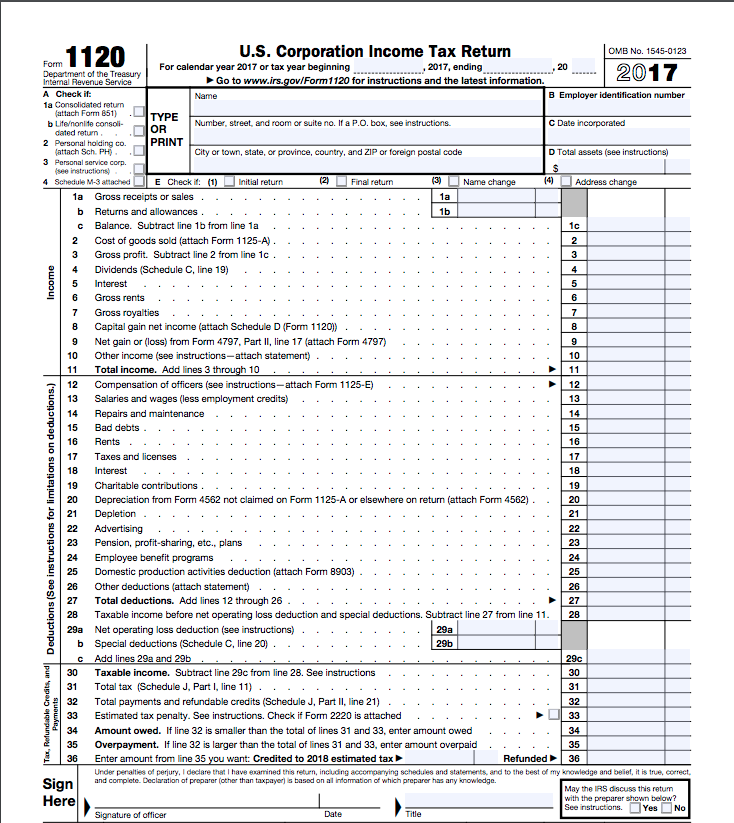

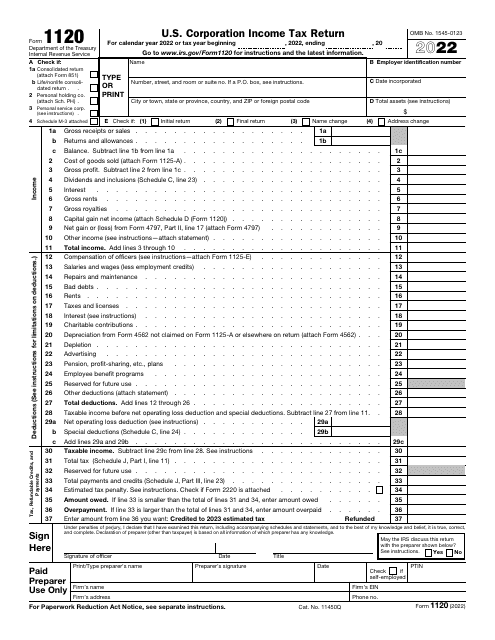

This form is for income earned in tax year 2023 with tax returns due in April 2024 We will update this page with a new version of the form for 2025 as soon as it is made available by the How To Fill Out Form 1120 for Tax Year 2023 With Example Published February 23 2024 WRITTEN BY Tim Yoder Ph D CPA All domestic C corporations C corps must file IRS Form 1120 U S Corporation

form 1120 h 2023

form 1120 h 2023

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

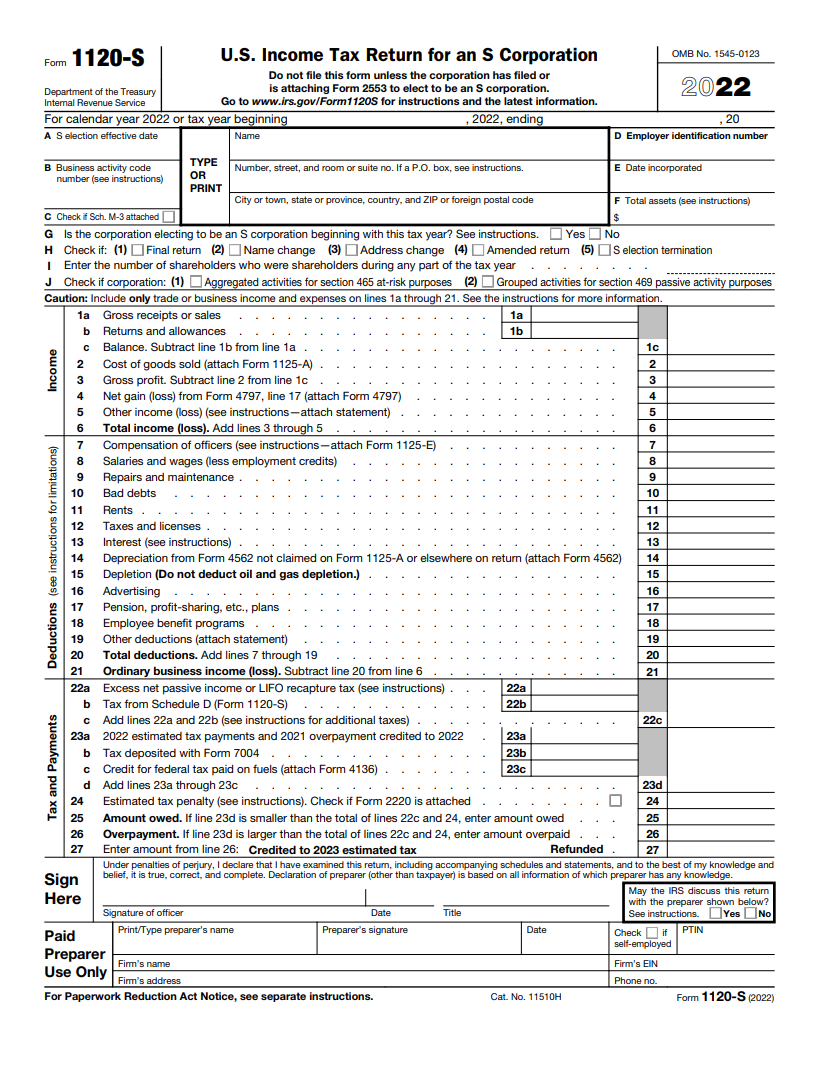

Form 1120s Due Date 2023 Printable Forms Free Online

https://images.ctfassets.net/ifu905unnj2g/4FLzdMpcEuGe2ymQGDQctA/93f56fdd486e39037f08c84294d711c7/2022_Form_1120-S.png

2018 2019 IRS Form 1120 S Editable Online Blank In PDF

https://www.pdffiller.com/preview/459/644/459644748/big.png

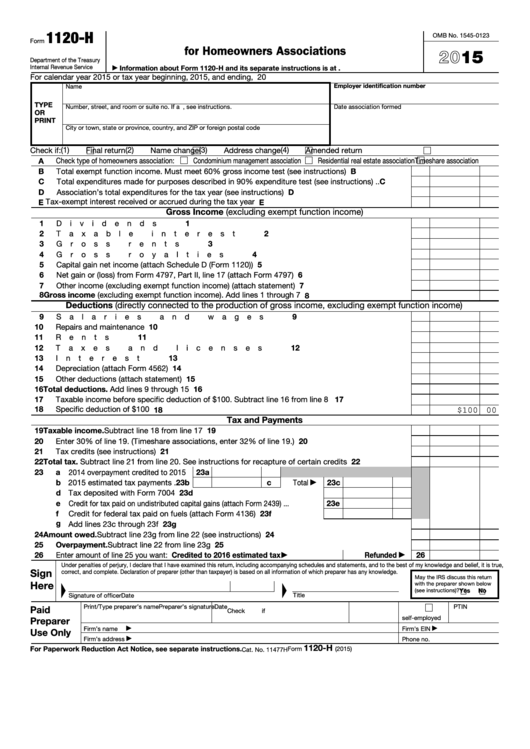

Learn how to file IRS Form 1120 H a one page tax form for qualifying homeowners associations Find out the requirements benefits pitfalls and differences between Form 1120 H and Form 1120 Homeowners associations and timeshare associations are required to file an income tax return Form 1120 H each year This form is used to report all of the organization s taxable income as well as any deductions made

Learn how to choose the right tax form for your homeowners association and save money on taxes Compare the advantages and disadvantages of IRS Forms 1120 and 1120 H and find out when to use them When To File Generally an association must file Form 1120 H by the 15th day of the 4th month after the end of its tax year However an association with a fiscal year ending June 30 must

More picture related to form 1120 h 2023

Tax Form 1120 What It Is How To File It Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/6wUl1N151SGc26O86U2AKg/4656a30dab296bc3f7711449fd9b2dab/IRS_Form_1120.png

IRS Form 1120 Download Fillable PDF Or Fill Online U S Corporation

https://data.templateroller.com/pdf_docs_html/2553/25536/2553670/irs-form-1120-u-s-corporation-income-tax-return_big.png

Top 17 Form 1120 h Templates Free To Download In PDF Format

https://data.formsbank.com/pdf_docs_html/325/3259/325958/page_1_thumb_big.png

Learn about Form 1120 H the income tax return for homeowners associations that excludes exempt function income Find the current revision instructions recent developments and Yes TurboTax Business can handle form 1120H for Homeowners Associations Please read this TurboTax Help topic for more information

Form IL 1120 R12 23 is for tax years ending on or after December 31 2023 and before December 31 2024 For tax years ending before December 31 2023 use the 2022 form Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income Tax Return For calendar year 2023 or tax year beginning 2023 ending 20 Go to

How To File Tax Form 1120 For Your Small Business 2023

https://m.foolcdn.com/media/affiliates/images/Form_1120_-_01_-_Front_Page_rT0vFkj.width-750.png

Fillable Form 1120 H Printable Forms Free Online

https://www.pdffiller.com/preview/6/948/6948286/large.png

form 1120 h 2023 - Customer In March of this year I filed Form 1120 H for 2023 for our lot owners association Today I received a US Treasury check for the entire 69 30 I paid plus 03 in interest My