form 1120 h example If the association does not elect to use Form 1120 H it must file the applicable income tax return for example Form 1120 U S Corporation Income Tax Return A homeowners association

Gross Income excluding exempt function income Deductions directly connected to the production of gross income excluding exempt function income Tax and Payments For Form 1120 H Example A Real World Scenario Let s walk through a sample Form 1120 H for a fictional HOA to understand how numbers are calculated Sunny Skies HOA took in 45 000 in association dues last

form 1120 h example

form 1120 h example

https://formswift.com/seo-pages-assets/images/documents/form-1120s/form-1120s-sample.png

Form 1120 H Example Complete In A Few Simple Steps Infographic

https://hoatax.com/wp-content/uploads/2017/07/hoa-example-2.png

Instructions For Form 1120 H U s Income Tax Return For Homeowners

https://data.formsbank.com/pdf_docs_html/376/3761/376113/page_1_thumb_big.png

Even though they are non profit organizations all HOAs must still file their income tax return each year To better understand the requirement here s everything you need to know about the homeowners association tax form also known as This document offers a comprehensive guide by the Internal Revenue Service IRS for homeowners associations to accurately complete Form 1120 H for the 2023 tax year It

This definition has five basic tests 1 Exempt Function Test 2 Exempt Function Income Test 3 Exempt Function Expense Test 4 No Private Inurement benefit Test and 5 Elect to apply section 528 for that tax year All homeowner associations HOAs must file a tax return every single year But you must pass a few tests in order to file Form 1120H One of the tests is the form 1120H 90 expenditure test This test is not as easy as you think

More picture related to form 1120 h example

Tax Refund Form Ireland

http://ww2.justanswer.com/uploads/wemba02/2011-10-24_010611_just_answers_11203.jpg

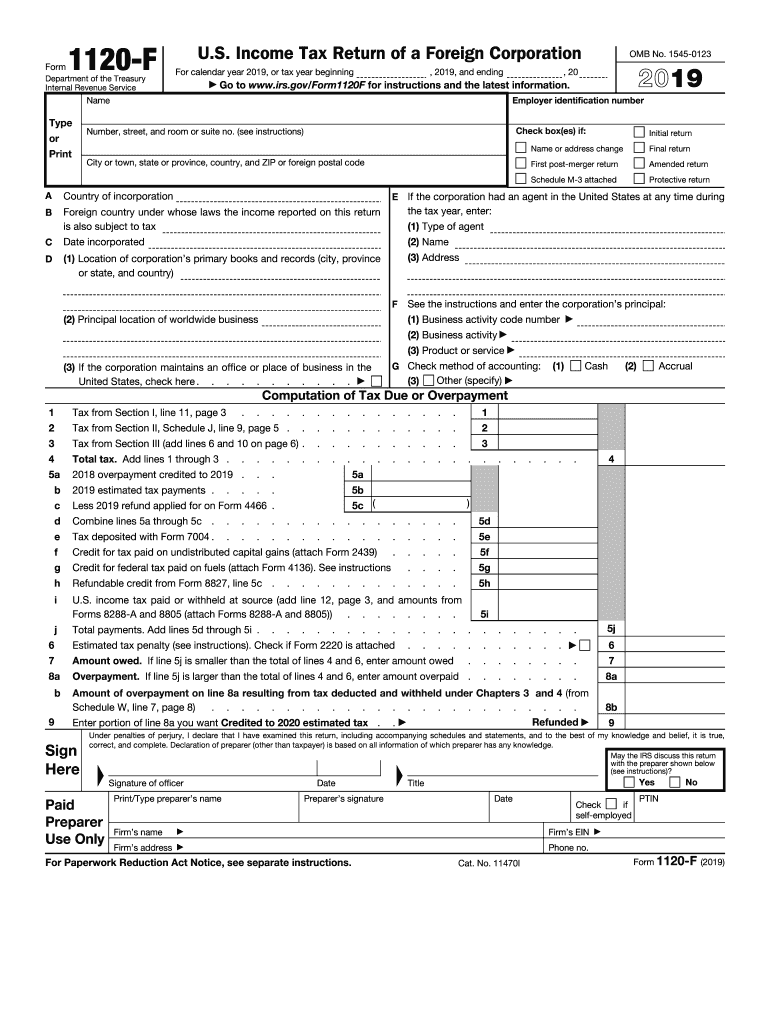

Form 1120f Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/489/187/489187912/large.png

Form 1120 H Example Complete In A Few Simple Steps Infographic

https://hoatax.com/wp-content/uploads/2017/07/1120h-example.png

Few Homeowners Associations qualify as tax exempt organizations and file Form 990 Return of Organizations Exempt From Income Tax Form 1120 H is a tax form specifically created for Information about Form 1120 H U S Income Tax Return for Homeowners Associations including recent updates related forms and instructions on how to file A homeowners association files

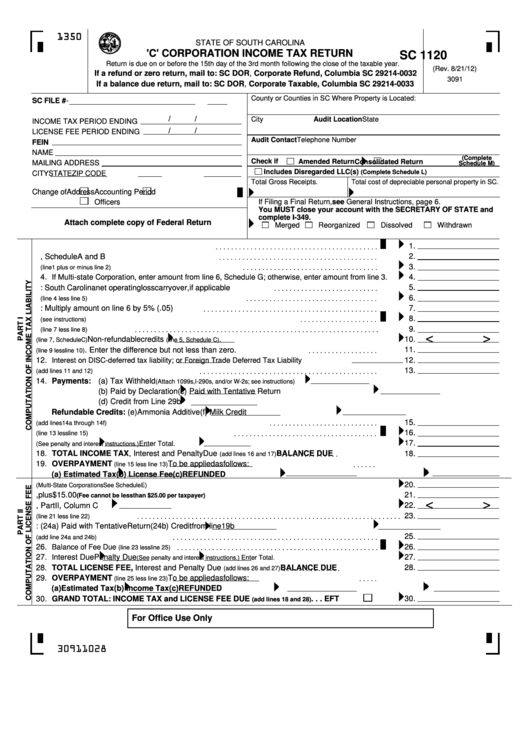

We provide 9 steps along with a detailed example to help you prepare your C corporation s Form 1120 tax return Purpose of Form A homeowners association files Form 1120 H as its income tax return to take advantage of certain tax benefits These benefits in effect allow the association to exclude

Fillable Form Sc 1120 C Corporation Income Tax Return Printable Pdf

https://data.formsbank.com/pdf_docs_html/328/3286/328681/page_1_thumb_big.png

3 11 16 Corporate Income Tax Returns Internal Revenue Service

https://www.irs.gov/pub/xml_bc/33500001.gif

form 1120 h example - This document offers a comprehensive guide by the Internal Revenue Service IRS for homeowners associations to accurately complete Form 1120 H for the 2023 tax year It