form 1120 h 2021 Information about Form 1120 H U S Income Tax Return for Homeowners Associations including recent updates related forms and instructions on how to file A homeowners association files

When To File Generally an association must file Form 1120 H by the 15th day of the 4th month after the end of its tax year However an association with a fiscal year ending June 30 must A homeowners association files Form 1120 H as its income tax return to take advantage of certain tax benefits These benefits in effect allow the association to exclude exempt function

form 1120 h 2021

form 1120 h 2021

https://www.pdffiller.com/preview/578/929/578929624/large.png

IRS 1120 L 2020 Fill Out Tax Template Online US Legal Forms

https://www.pdffiller.com/preview/536/160/536160330/large.png

2016 Form IRS 1120 H Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/393/141/393141920/large.png

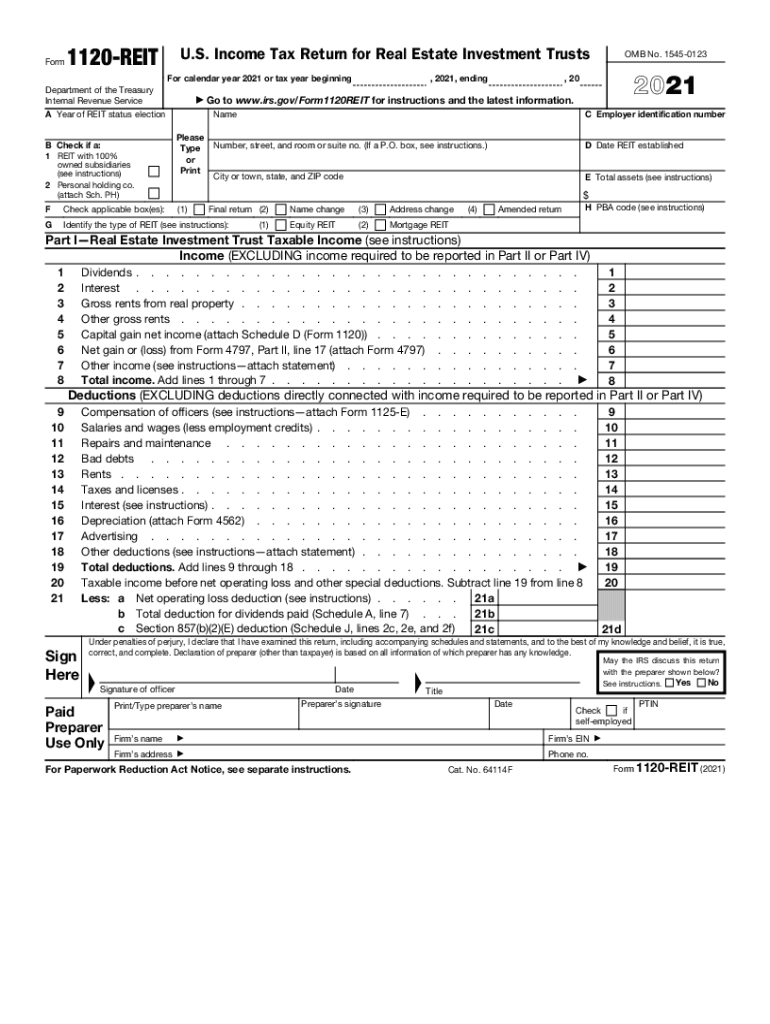

An HOA may elect to file Form 1120 H U S Income Tax Return for Homeowners Associations as its income tax return in order to take advantage of certain tax benefits These benefits in Guide to IRS Form 1120 H for homeowners associations filing criteria deductible expenses due dates and e filing options

The Form 1120 H is also known as an U S Income Tax Return for Homeowners Associations Using this form instead of a standard tax return will allow a homeowner s association to take advantage of several tax benefits HOAs have two forms to choose from 1120 and 1120 H Form 1120 is used by C corporations while 1120 H is a tax form specifically designed for qualifying HOAs What makes HOAs unique is the ability to file two different tax returns

More picture related to form 1120 h 2021

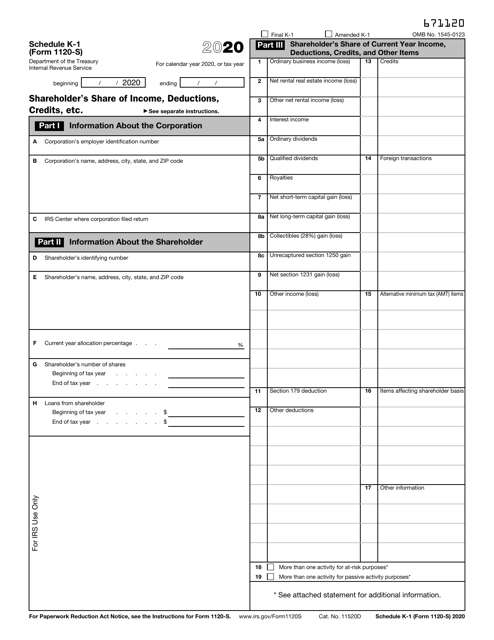

IRS Form 1120 S Schedule K 1 Download Fillable PDF Or Fill Online

https://data.templateroller.com/pdf_docs_html/2117/21172/2117293/irs-form-1120-s-schedule-k-1-shareholder-s-share-of-income-deductions-credits-etc_big.png

:max_bytes(150000):strip_icc()/Form1120-S1-ff4821464fa84bac8db1b8f300c0970b.jpg)

Form 1120 S U S Income Tax Return For An S Corporation

https://www.investopedia.com/thmb/4THW408AnVj6xoooguouEdbzbfs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Form1120-S1-ff4821464fa84bac8db1b8f300c0970b.jpg

3 11 16 Corporate Income Tax Returns Internal Revenue Service

https://www.irs.gov/pub/xml_bc/33500001.gif

The Form 1120 H is filed by a U S domestic homeowners association to report its gross income and expenses Looking for a form 1120 H example We walk through the HOA tax return and point out some of the tips and tricks to stay compliant Let s take a look

To submit Form 1120 H homeowners associations must first complete the form by following the detailed instructions provided by the Internal Revenue Service Once the form is Electing To File Form 1120 H A homeowners association elects to take advantage of the tax benefits provided by section 528 by filing a properly completed Form 1120 H The election is

Form 1120 H Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/1/494/1494045/large.png

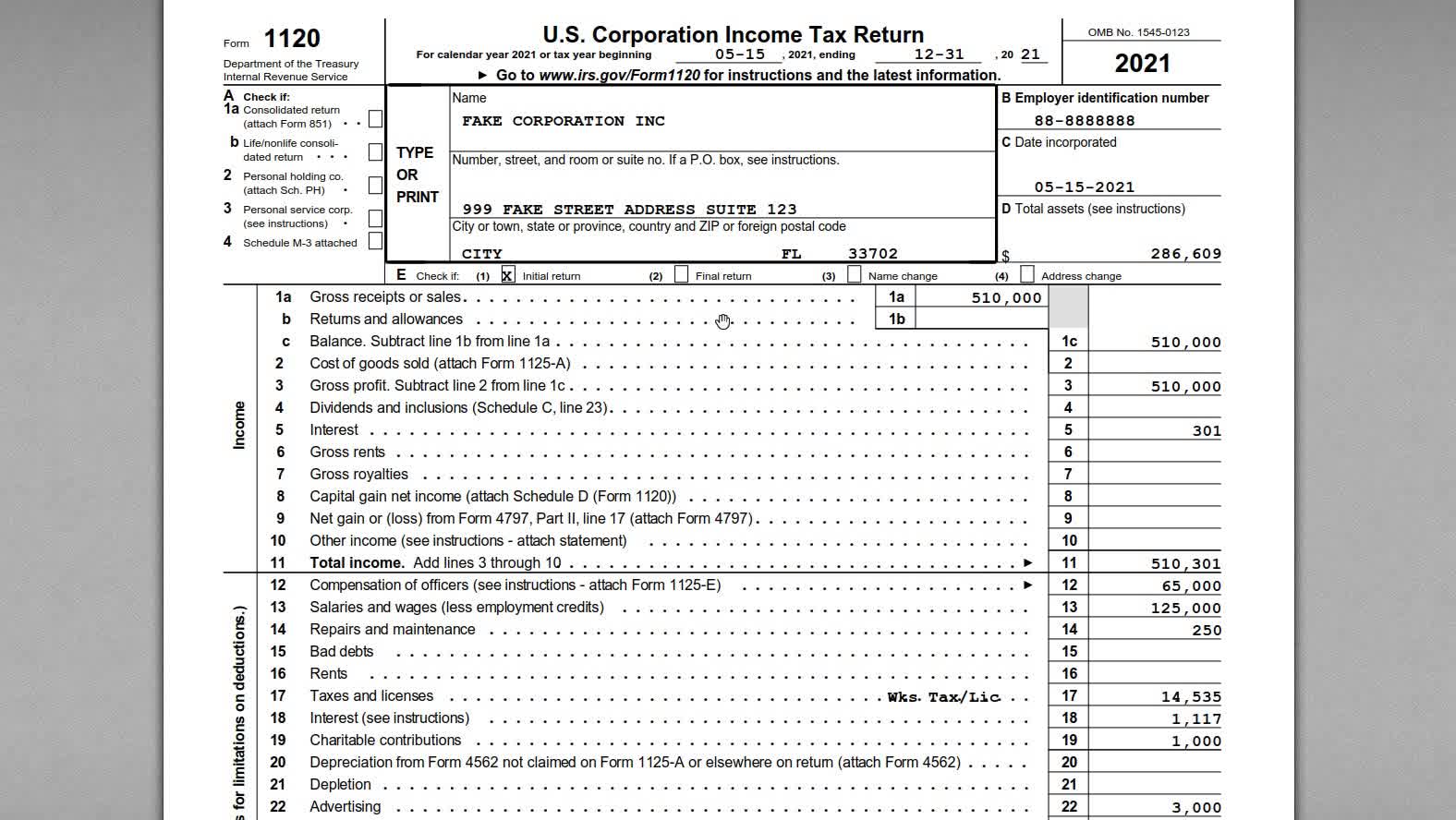

How To Fill Out Form 1120 For 2021 Step by Step Instructions

https://sp.rmbl.ws/s8/6/l/M/q/1/lMq1c.4-ag.jpg

form 1120 h 2021 - HOAs have two forms to choose from 1120 and 1120 H Form 1120 is used by C corporations while 1120 H is a tax form specifically designed for qualifying HOAs What makes HOAs unique is the ability to file two different tax returns