what is 1120s business IRS Form 1120S is the tax return used by domestic corporations that have made an election to be treated as S corporations for that tax year The return reports income losses credits and deductions before they flow

Learn how to file Form 1120 S for an S corporation including what s new who must file and how to make the election Find out about reporting codes credits deductions and more in the Learn how to file Form 1120S the U S Income Tax Return for an S Corporation and report your income deductions and credits Find out the eligibility filing requirements and special tax considerations for S corporations

what is 1120s business

what is 1120s business

https://www.pdffiller.com/preview/584/735/584735907/large.png

Form 1120S S Corporation Income Tax Skill Success

https://www.skillsuccess.com/wp-content/uploads/2020/07/scorp-income-tax-2.jpg

Do I Need To File A Form 1120 If The Business Had No Income

https://d1qmdf3vop2l07.cloudfront.net/friendly-barracuda.cloudvent.net/compressed/_min_/9d1d0ae01a0e9406e2c492f0c33da8a1.png

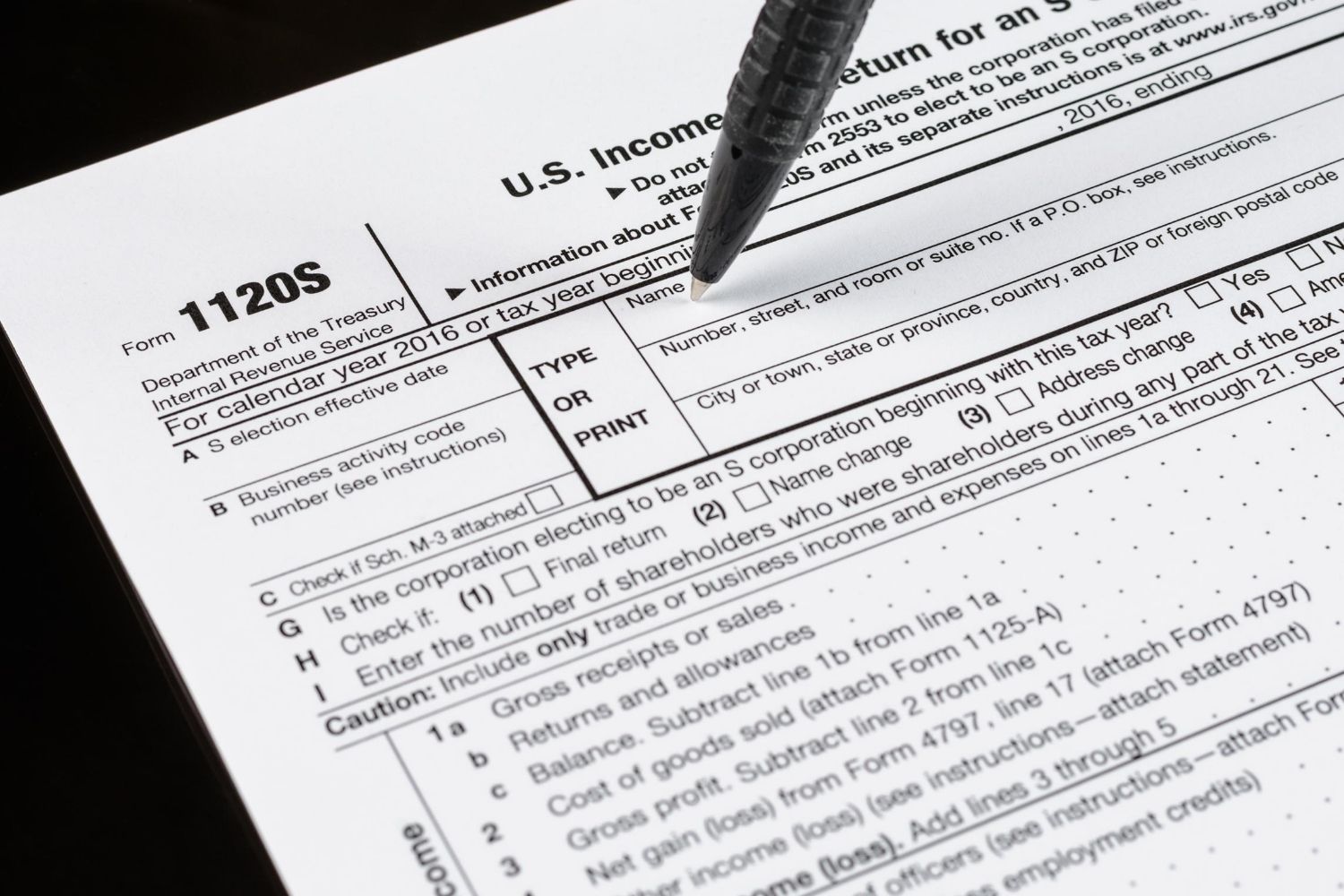

Form 1120 S is the US Income Tax Return for S corporations which pass their income and losses to shareholders Learn what information to include how to file electronically or by mail and the due date and extension Form 1120 S is a tax return form for businesses that are registered as S corporations Here s how to file it

Form 1120 S is crucial in reporting S corporations income losses and deductions It s essential to understand what this form is who needs to file it and how to do it correctly to ensure your business stays compliant Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax year

More picture related to what is 1120s business

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Deadline For K1 Form 2023 Printable Forms Free Online

https://www.investopedia.com/thmb/W6GLzh84o8Vbv2Z7QBTqOnRkFw4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png

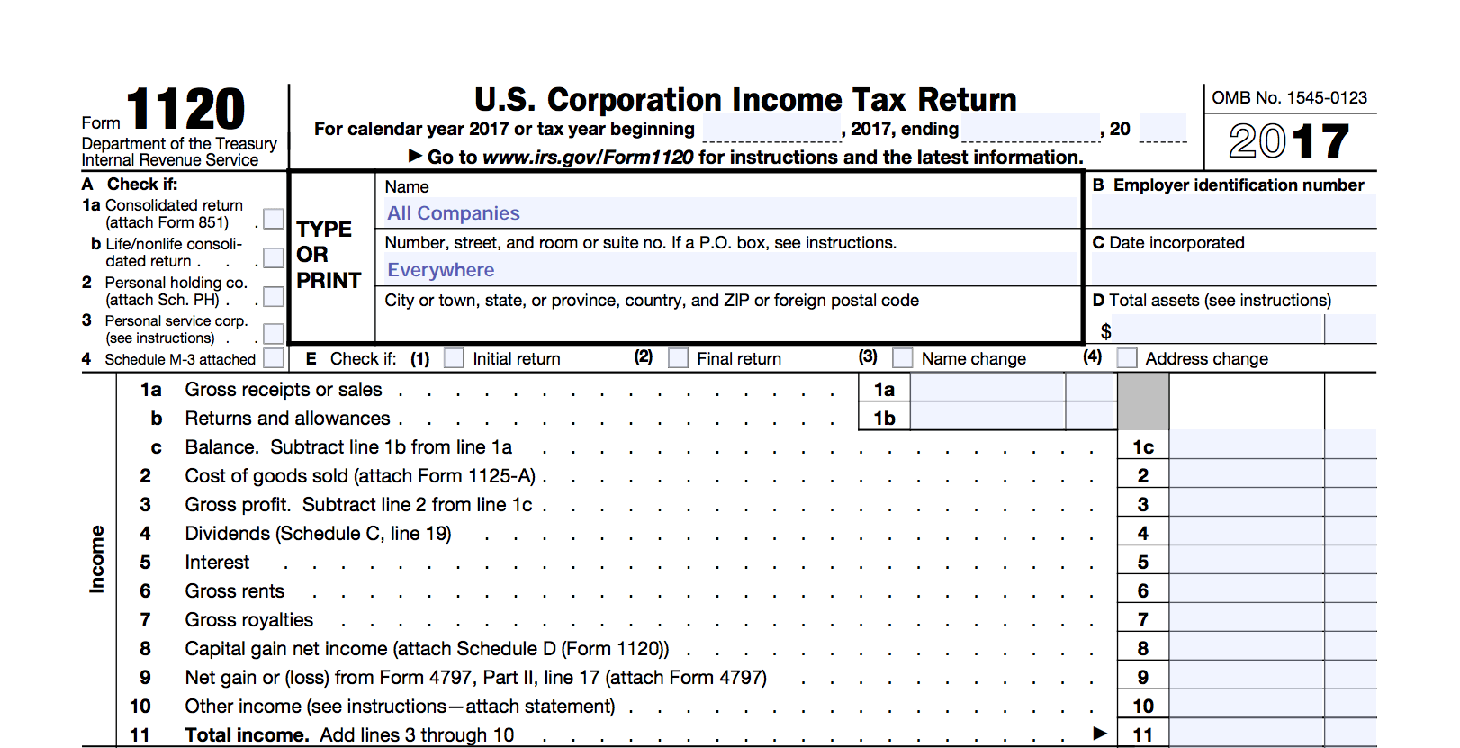

How To Complete Form 1120S Income Tax Return For An S Corp

https://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Tax-and-Payments-Section-1024x275.png

IRS Form 1120 S is the tax form S corporations use to file a federal income tax return This tax form informs the IRS of your total taxable earnings in a tax year It s used to determine an S corporation s business Form 1120 S is the annual tax return for S Corporations that pass through income to shareholders Learn how to prepare mail or file electronically this form and its accompanying K 1s and when to do it by

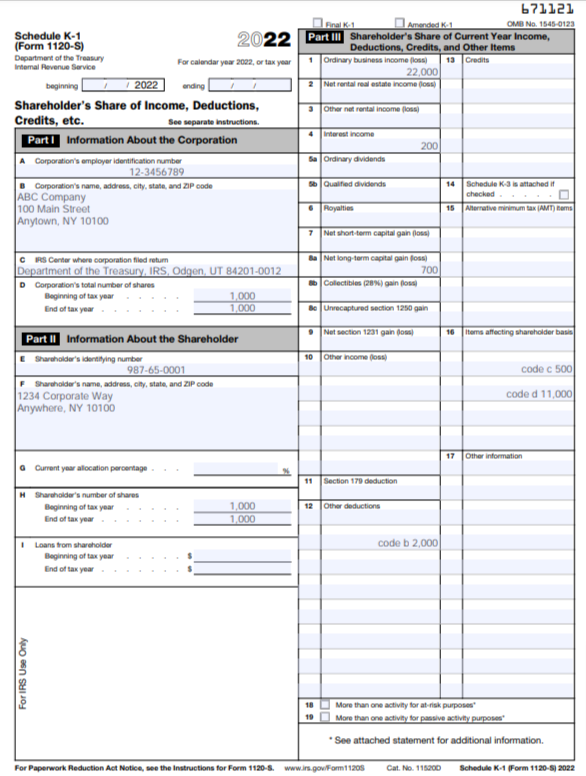

Learn how to fill out Form 1120S the annual return for S corporations and Schedule K 1 the shareholder report Find out what information and documents you need Learn how to complete Schedule K 1 Form 1120S a tax form for owners and investors of S corporations Find out what information you need how to fill out the form and why it s

How To Complete Form 1120S Schedule K 1 Free Checklist app

https://www.webselida.com/wp-content/uploads/2023/03/Screenshot_2022_Schedule_K_1_Form_1120-S.png

Form 1120S Instructions And Who Has To File It

https://assets-blog.fundera.com/assets/wp-content/uploads/2019/01/10164604/shutterstock_1753224083.jpg

what is 1120s business - Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax year