can an llc file an 1120s Learn how to classify your LLC as a corporation or a partnership for federal tax purposes Find out how to file Form 8832 Form 1065 Form 1120 or Form 1120 S depending

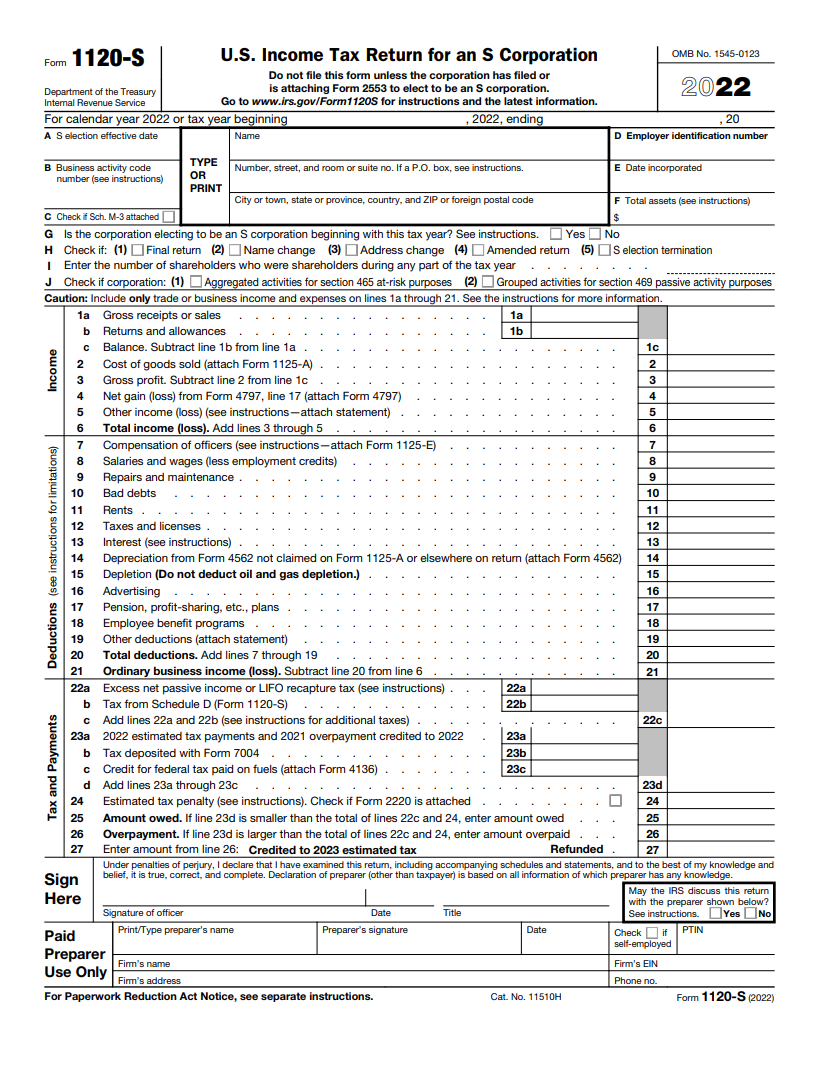

Learn how to file Form 1120 S for an S corporation including what s new who must file and how to make the election Find out about reporting codes credits deductions and more in the Learn the benefits requirements and steps of converting your LLC to an S corp a tax election that can save you on self employment taxes Find out how to file IRS Form 2553 change your

can an llc file an 1120s

can an llc file an 1120s

https://i.ytimg.com/vi/8eyNiyPOwUk/maxresdefault.jpg

A Beginner s Guide To S Corporation Taxes

https://m.foolcdn.com/media/affiliates/images/S_corp_taxes_-_01_-_Form_1120-S_SLI0Nvc.width-750.png

How To File An LLC In California 5 Mins YouTube

https://i.ytimg.com/vi/MsLIDPbxSGI/maxresdefault.jpg

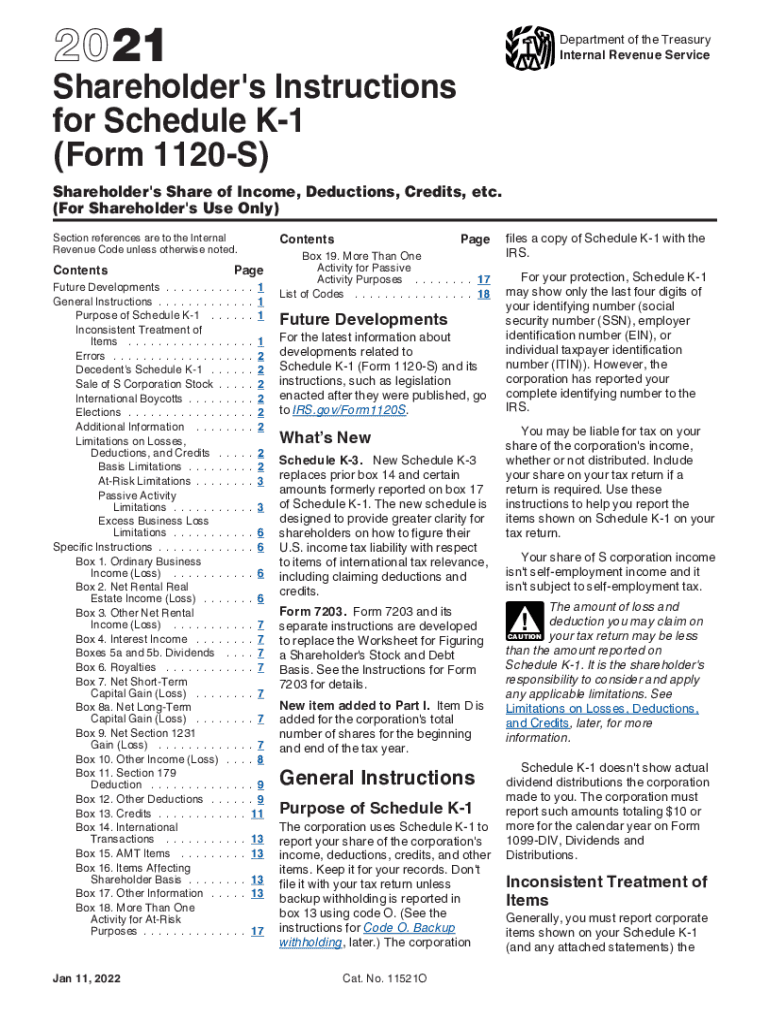

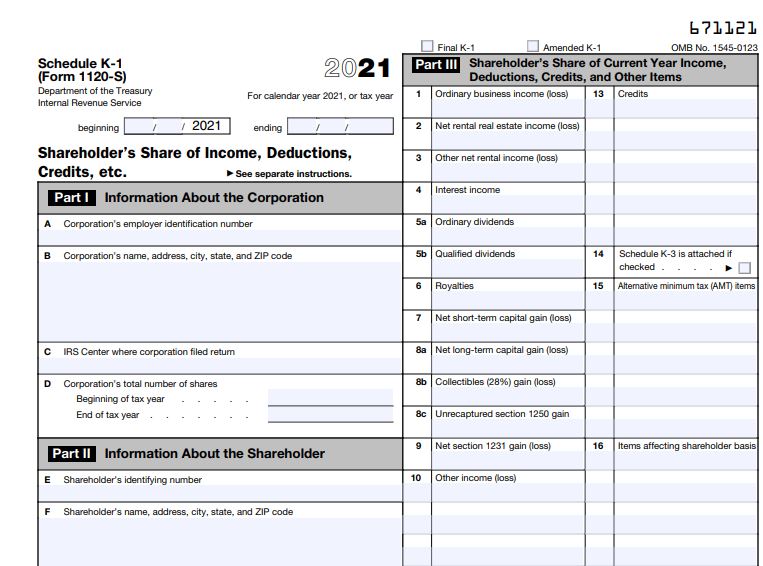

An LLC that has elected to be taxed as an S corporation must file a corporation income tax return on Form 1120S The return is due on March 15 each year or the next business day if March 15 falls on a Saturday Sunday Learn how to file Form 1120 S to report the income gains losses deductions credits etc of a domestic corporation or other entity that is an S corporation Find the current revision

Electing S corporation tax status means you ll have to file additional tax documents each year such as Form 1120S U S Income Tax Return for an S Corporation Both SMLLCs and S Form 1120 S is the US Income Tax Return for S corporations which pass their income and losses to shareholders Learn what information to include how to file electronically or by mail and the due date and extension

More picture related to can an llc file an 1120s

What Is K1 For Taxes 2021 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/584/735/584735907/large.png

3 How To Complete Schedule K 1 Form 1120S For 2021 Nina s Soap

https://ninasoap.com/wp-content/uploads/2022/02/How-to-complete-Schedule-K-1-form-1120S-for-2021.jpg

Form 1120s Due Date 2023 Printable Forms Free Online

https://images.ctfassets.net/ifu905unnj2g/4FLzdMpcEuGe2ymQGDQctA/93f56fdd486e39037f08c84294d711c7/2022_Form_1120-S.png

Learn how to file Form 1120 S the annual income tax return for S corporations and understand its key components schedules and requirements Find out how to calculate and report pass through income deductions credits Learn how to change your LLC s tax status with the IRS by filing Form 2553 also known as Election by a Small Business Corporation Find out the benefits disadvantages requirements and steps of being an S Corporation

An LLC might file their tax return on Schedule C Form 1065 Form 1120S or Form 1120 Learn how LLC taxes work and how to handle them When Do You Need to File Form 1120S If your business is an S Corp or an LLC that has completed Form 2553 to make an S Corp tax election you will need to file Form

Can An LLC File A DBA And Still Do Business Under The LLC Name LegalZoom

https://www.legalzoom.com/sites/lz.com/files/styles/optimized/public/articles/can_an_llc_file_a_dba.webp?itok=WBspl0bD

Michigan Llc Operating Agreement Template Free Printable Form

https://i1.wp.com/eforms.com/images/2016/01/michigan-llc-operating-agreement-template.png?fit=1624%2C2101&ssl=1

can an llc file an 1120s - Form 1120 S is the US Income Tax Return for S corporations which pass their income and losses to shareholders Learn what information to include how to file electronically or by mail and the due date and extension