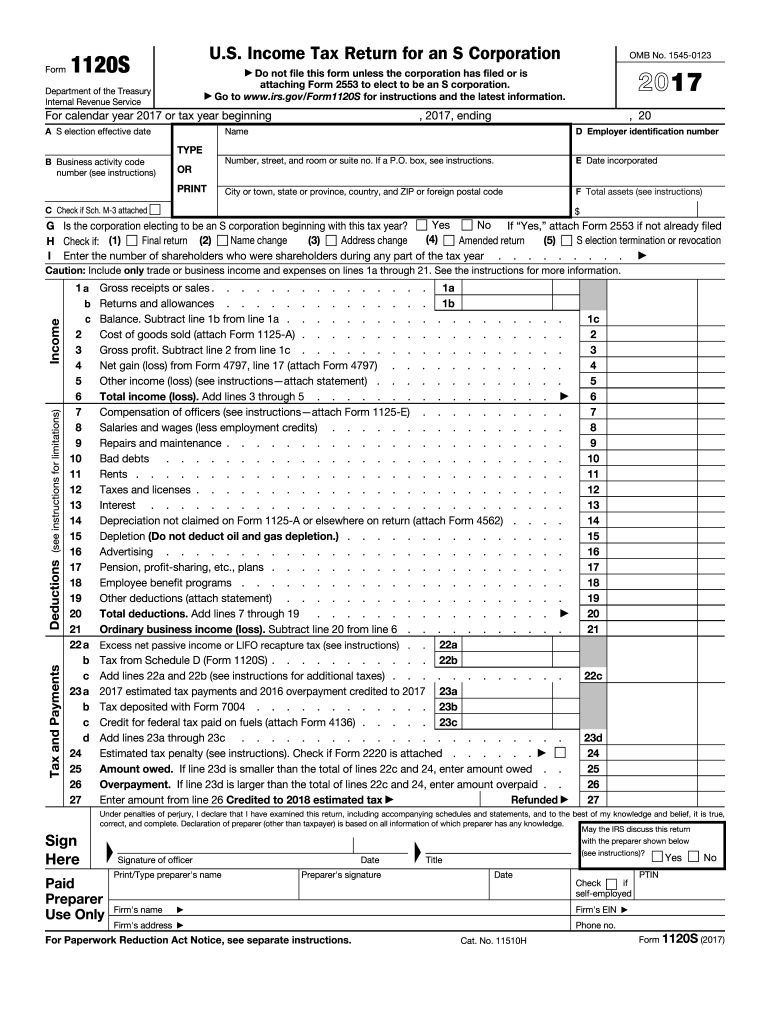

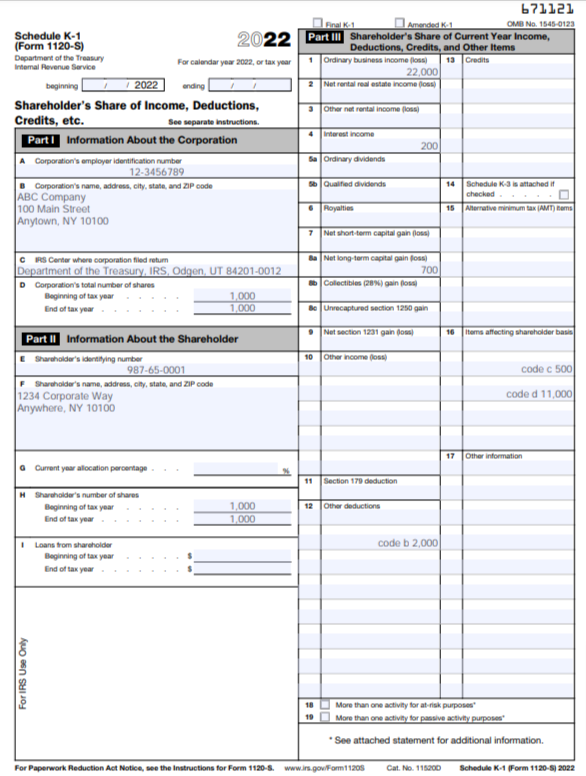

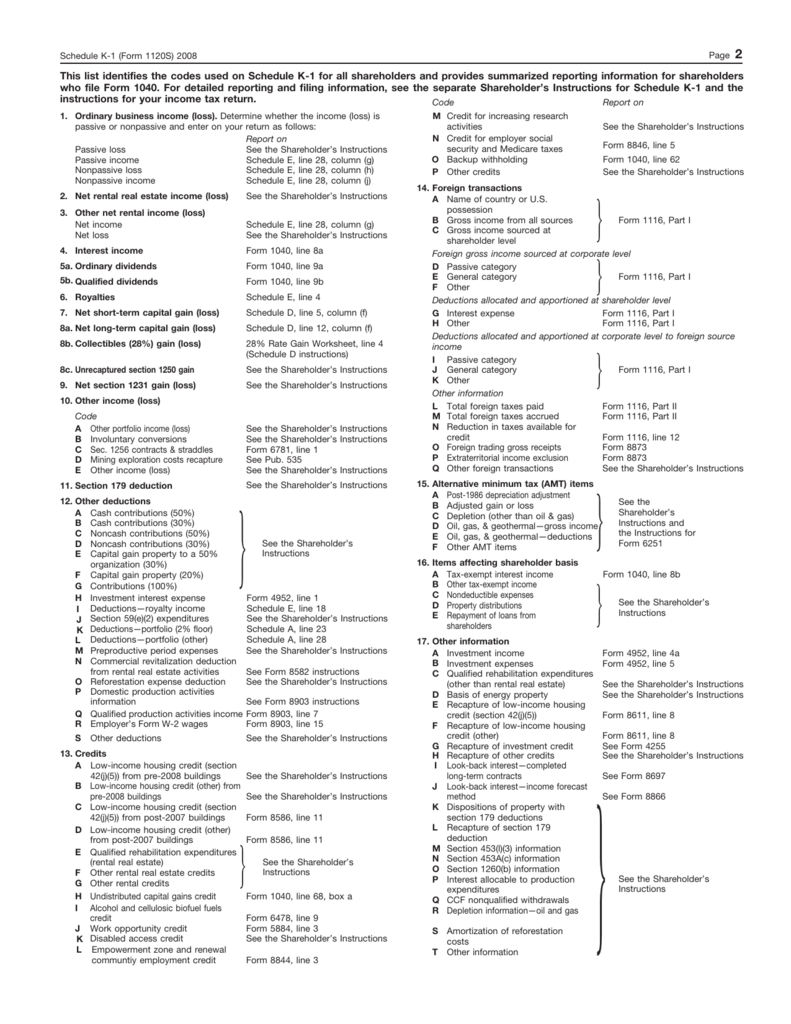

what is a 1120s business code Whenever you receive tax forms that require a principal business code such as Schedule C Form 1040 for sole proprietors Form 1065 for partnerships and Forms 1120 and 1120 S for corporations you ll also be

This list of principal business activities and their associated codes is designed to classify an enterprise by the type of activity in which it is engaged to facilitate Form 1120 S is the annual tax return for businesses that are registered as S corporations The form is used to report income gains losses credits deductions and other information for

what is a 1120s business code

what is a 1120s business code

https://www.signnow.com/preview/425/425/425425022/large.png

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

What Is The Business Code For Sales The Mumpreneur Show

https://fundsnetservices.com/wp-content/uploads/unnamed-68.png

Form 1120 S is an important tax document used by S corporations to report their income gains losses deductions and credits as well as to determine their tax liability Form 1120S is the tax form S corporations use to file their federal income tax return not to be confused with Form 1120 for C corporations Every S corp needs to file one including LLCs that are taxed as S corps

What is a principal business code An IRS principal business code is a designated six digit business code that appears on tax returns It classifies the main type of products or services sold by the business Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax year

More picture related to what is a 1120s business code

Business Activity Code For Taxes FundsNet EU Vietnam Business

https://fundsnetservices.com/wp-content/uploads/unnamed-72.png

What s A Multi Member LLC Gusto

https://gusto.com/wp-content/uploads/2023/02/Schedule-K1-1065-2022-1.png

How To Complete Form 1120S Schedule K 1 Free Checklist app

https://www.webselida.com/wp-content/uploads/2023/03/Screenshot_2022_Schedule_K_1_Form_1120-S.png

Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations Form 1120 S is a tax return form for businesses that are registered as S corporations Here s how to file it

Form 1120 S is the official income tax return for S corporations These entities are unique in that they choose to pass their income losses deductions and credits through to IRS Form 1120 S is the tax form S corporations use to file a federal income tax return This tax form informs the IRS of your total taxable earnings in a tax year It s used to

Schedule K 1 Instructions Examples And Forms

https://s3.studylib.net/store/data/008734590_1-b2e2bdce47e04fa80e970e6f46880c78.png

What Is Form 1120S And How Do I File It Ask Gusto

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-M-1-and-Schedule-M-2-1024x742.png

what is a 1120s business code - 1 The corporation is no longer a small business corporation as defined in section 1361 b This kind of termination of an election is effective as of the day the corporation no longer meets the