what type of company files an 1120 Form 1120 the corporate income tax return requires detailed reporting of income expenses and tax calculations Here are some key components to complete the form Income

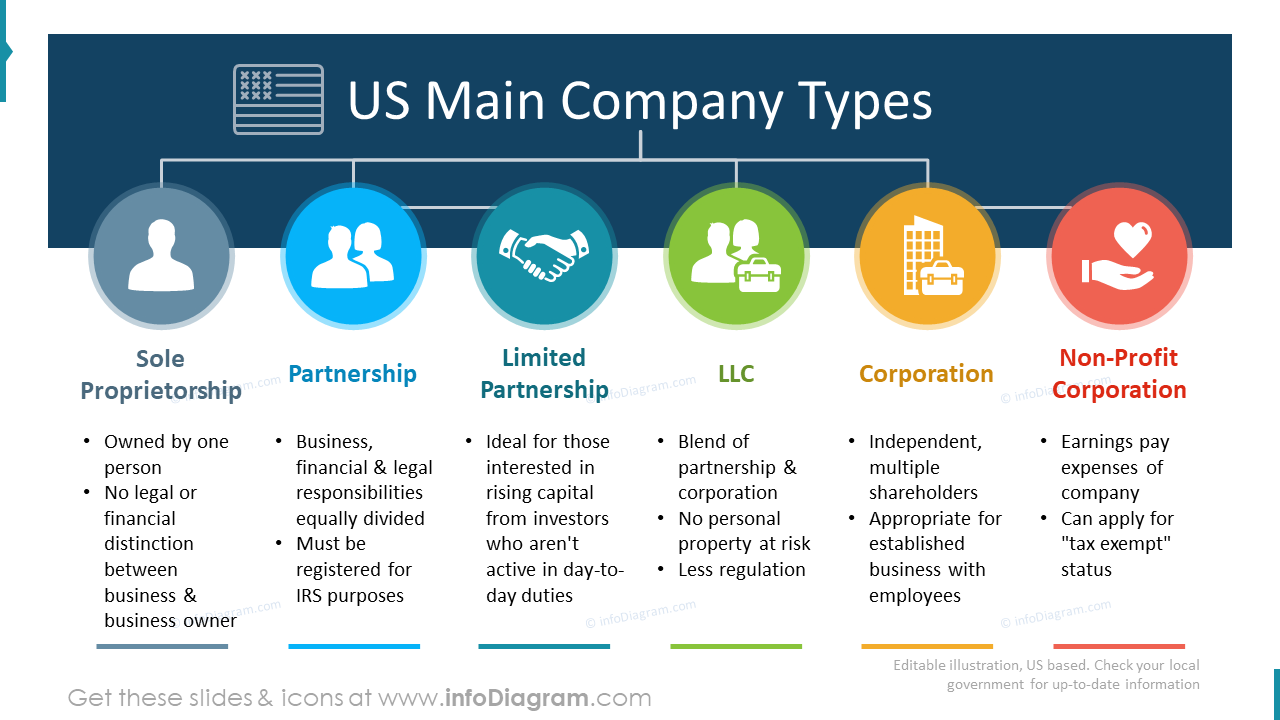

IRS Form 1120 the U S Corporation Income Tax Return is used to report corporate income taxes to the IRS It can also be used to report income for other business entities that have elected to be taxed as corporations such Businesses that are taxed as corporations These are the entities that need to file Form 8832 and further attach it to Form 1120 Limited Liability Companies LLC In case LLCs consider to be taxed as corporations only

what type of company files an 1120

what type of company files an 1120

https://www.signnow.com/preview/584/735/584735907/large.png

Type Of Company In Hindi Company Types Explained YouTube

https://i.ytimg.com/vi/NS4qsQjA1R4/maxresdefault.jpg

Types Of Companies In USA PowerPoint Presentation

https://cdn.infodiagram.com/c/121027/usa-main-company-types-.png

Businesses taxed as C corporations file their business tax return with IRS Form 1120 Think of Form 1120 as the C corporation equivalent to personal tax Form 1040 Unlike other business What is Form 1120 and Who Needs to File It Understanding Form 1120 Tax Form 1120 or IRS Form 1120 in its simplest form is the corporate income tax return It is used by C corporations C corp to report their

C Corporations are the only type of business that must file Form 1120 C Corps are corporations with multiple shareholders each of which own a portion of the business Form 1120 is the tax form C corporations and LLCs filing as corporations use to file their income taxes Once you ve completed Form 1120 you should have an idea of how much your corporation needs to pay in taxes

More picture related to what type of company files an 1120

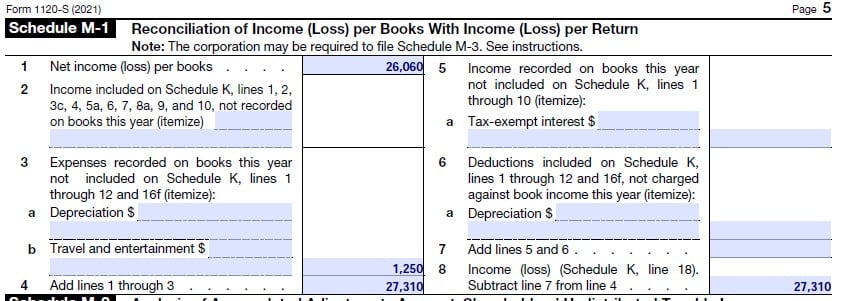

Tax Table M1 Instructions Brokeasshome

https://fitsmallbusiness.com/wp-content/uploads/2022/01/Screenshot_Schedule_M-1_for_IRS_Form_1120S.jpg

How To Choose The Right Business Entity In Estonia BBCTallinn O

https://www.bbctallinn.ee/wp-content/uploads/2023/02/bbctallinn_blog_how_to_choose_the_right_entity.jpg

What Types Of Opt Ins Should Your Website Have

https://webilize-core-webcms-staging.s3.amazonaws.com/upload/images/What-types-of-opt-ins-should-your-website-have20221229195031962.png

Form 1120 is used by corporations in the United States to report their income and calculate their taxes The form is also used to report any gains or losses and any deductions or credits that apply If your business is Form 1120 is used to report the income gains losses deductions and credits of a corporation and to calculate its income tax liability A corporation generally must file its Form

Form 1120 the U S Corporation Income Tax Return is primarily used by C corporations to report their income gains losses deductions credits and calculate their tax If your business is a corporation or files as a corporation you need to file Form 1120 This includes C corporations or C Corps LLCs filing as corporations If you

What Type Of Business Owner Are You Osmos Cloud Blog

https://www.osmoscloud.com/blog/wp-content/uploads/2020/07/image.png

Which Type Of Company Are You Adoptt

https://www.adoptt.com/wp-content/uploads/article-images-15.jpg

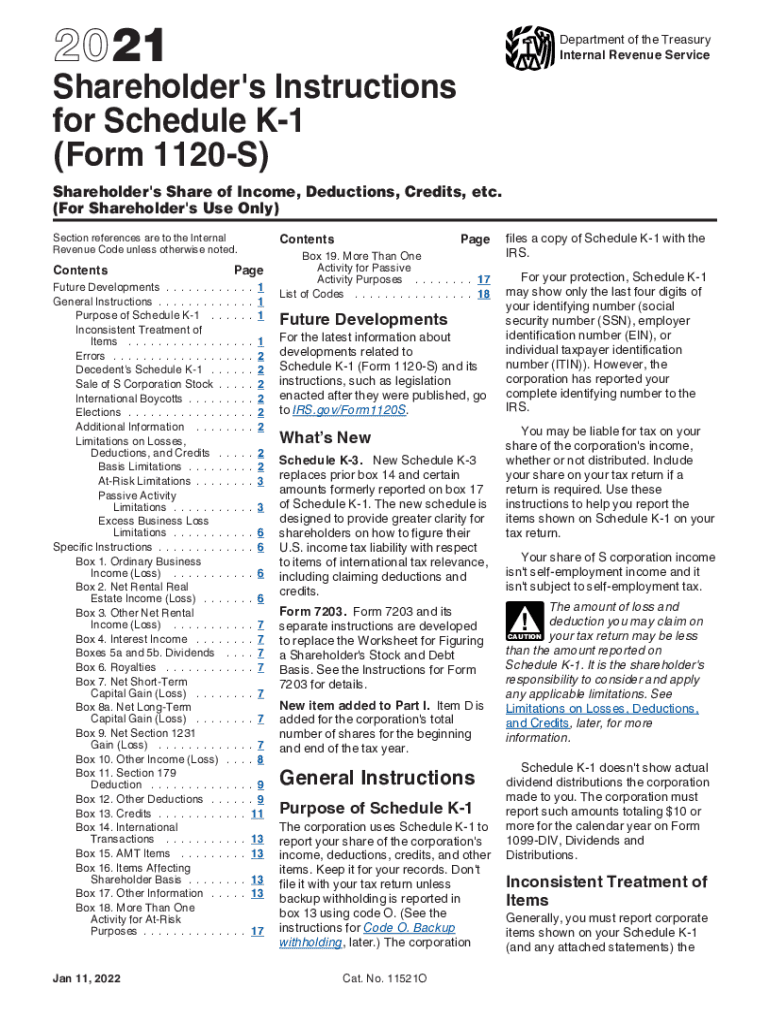

what type of company files an 1120 - Who Files Form 1120 S Form 1120 S is filed by S corporations The form must be filed only after the IRS accepts the election of an S corporation filed by a business with