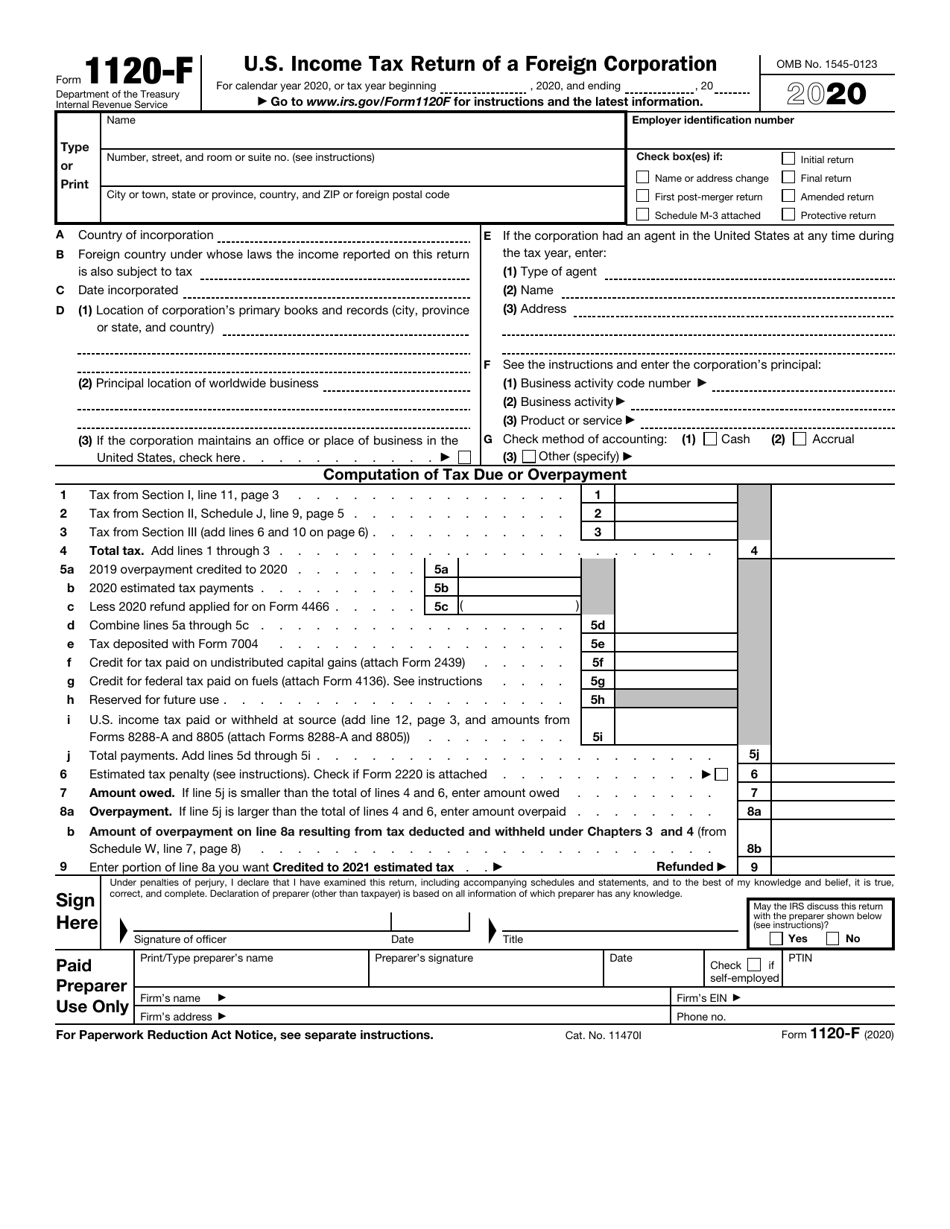

what is 1120 corporation For tax years beginning in 2023 corporations filing Form 1120 and claiming the energy efficient commercial buildings deduction should report the deduction on line 25 See the instructions for

IRS Form 1120 the U S Corporation Income Tax Return is used to report corporate income taxes to the IRS It can also be used to report income for other business entities that have elected to be taxed as corporations such What is Form 1120 and Who Needs to File It Understanding Form 1120 Tax Form 1120 or IRS Form 1120 in its simplest form is the corporate income tax return It is used by C corporations C corp to report their

what is 1120 corporation

what is 1120 corporation

https://data.templateroller.com/pdf_docs_html/2117/21172/2117281/irs-form-1120-f-u-s-income-tax-return-of-a-foreign-corporation_print_big.png

Form 1120 YouTube

https://i.ytimg.com/vi/bvXfOFUQz5s/maxresdefault.jpg

How To Complete Form 1120s S Corporation Tax Return Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/5w14Hif2akkIcgQa6QgSkk/ba522649e4382133bec2ff9301b05ff6/IRS_Form_1120S.png

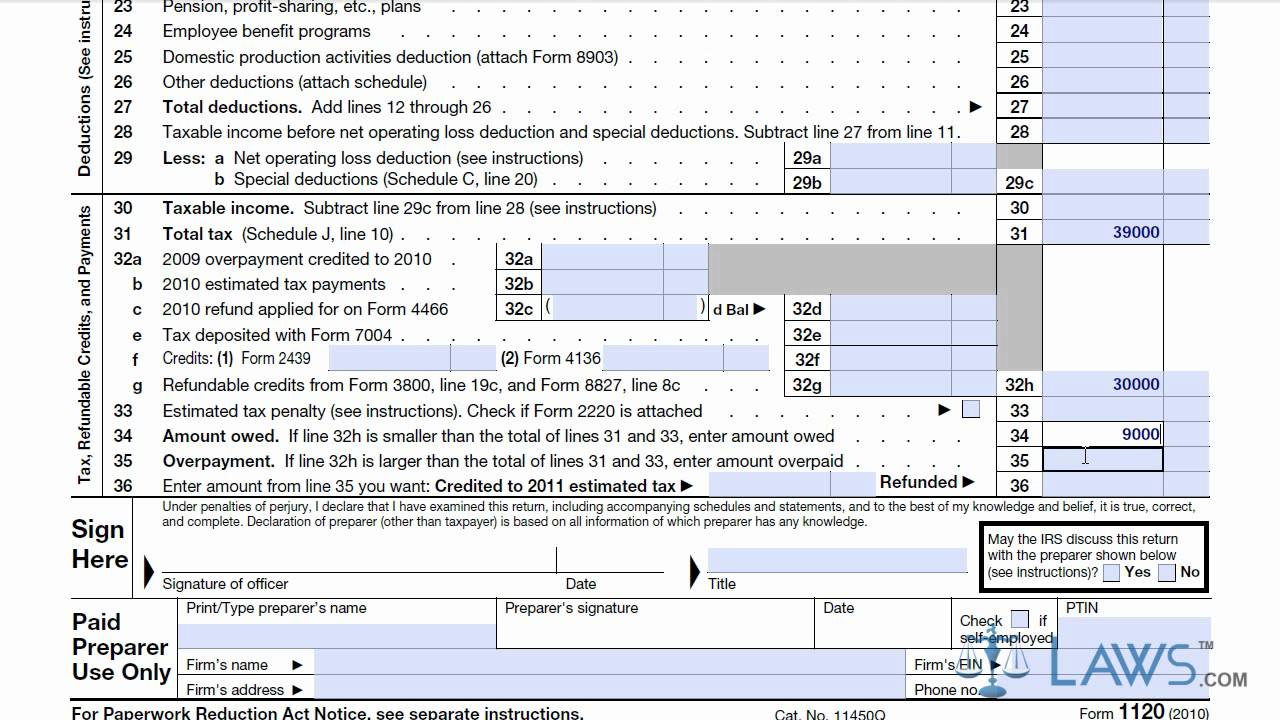

Form 1120 C Corp Purpose The Form 1120 is primarily used by C corporations in order to report their annual tax liability Tax payments The corporation must make all required tax payments directly to the IRS What is Form 1120 Form 1120 is the tax form C corporations and LLCs filing as corporations use to file their income taxes Once you ve completed Form 1120 you should have an idea of how much your corporation needs to pay in

So what is an 1120 tax form or a C corp tax form Form 1120 is used by corporations in the United States to report their income and calculate their taxes The form is also used to report any gains or losses and any What is Form 1120 US Corporation Income Tax Return Form 1120 is the standard document corporations use to conduct a federal tax return in the US They fill in the form with all their income deductions and taxes for the

More picture related to what is 1120 corporation

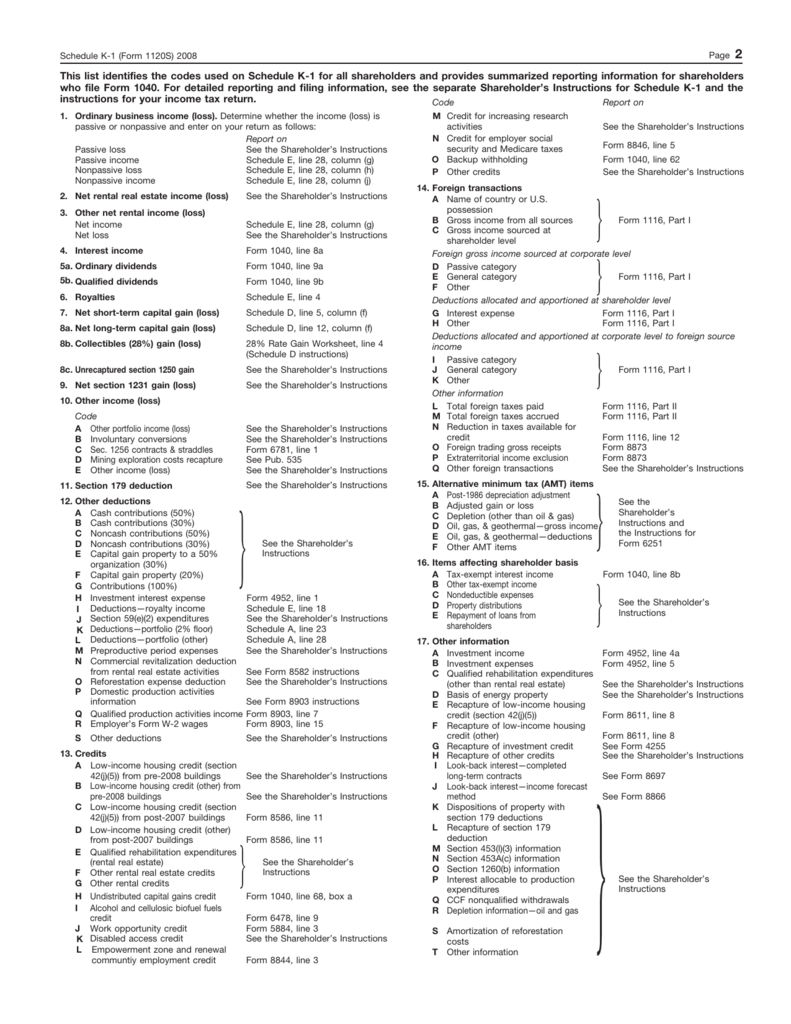

1120 S K 1 Codes

https://s3.studylib.net/store/data/008734590_1-b2e2bdce47e04fa80e970e6f46880c78.png

Federal Gift Tax Form 709 Gift Ftempo ED4

https://www.irs.gov/pub/xml_bc/33500001.gif

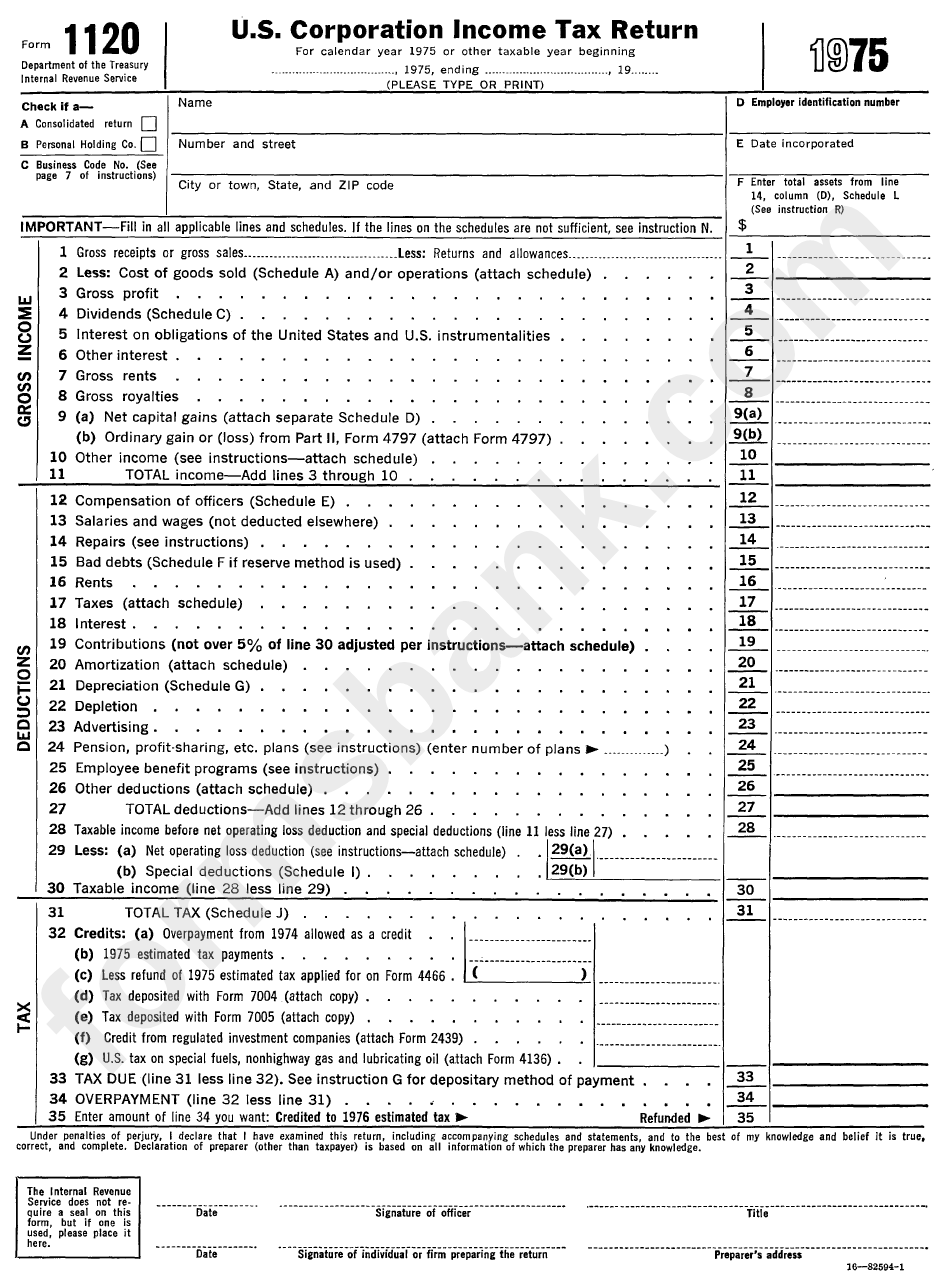

Form 1120 U s Corporation Income Tax Return 1975 Printable Pdf

https://data.formsbank.com/pdf_docs_html/280/2805/280505/page_1_bg.png

Go to irs gov Form1120 for instructions and the latest information OMB No 1545 0123 Form 1120 Department of the Treasury Internal Revenue Service U S Corporation Income Form 1120 U S Corporate Income Tax Return is the form corporations must use to report income gains losses deductions and credits Business owners also use Form 1120 to figure out their income tax liability

Overview What is Form 1120 Businesses taxed as C corporations file their business tax return with IRS Form 1120 Think of Form 1120 as the C corporation equivalent What is the 1120 Form Taxes are paid by corporations by filing Form 1120 Businesses must abide by the regulations that apply to them while filing returns Corporate income taxes are

2023 Form 1120 W Printable Forms Free Online

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

Tax Return Bank2home

https://www.pdffiller.com/preview/539/32/539032318/big.png

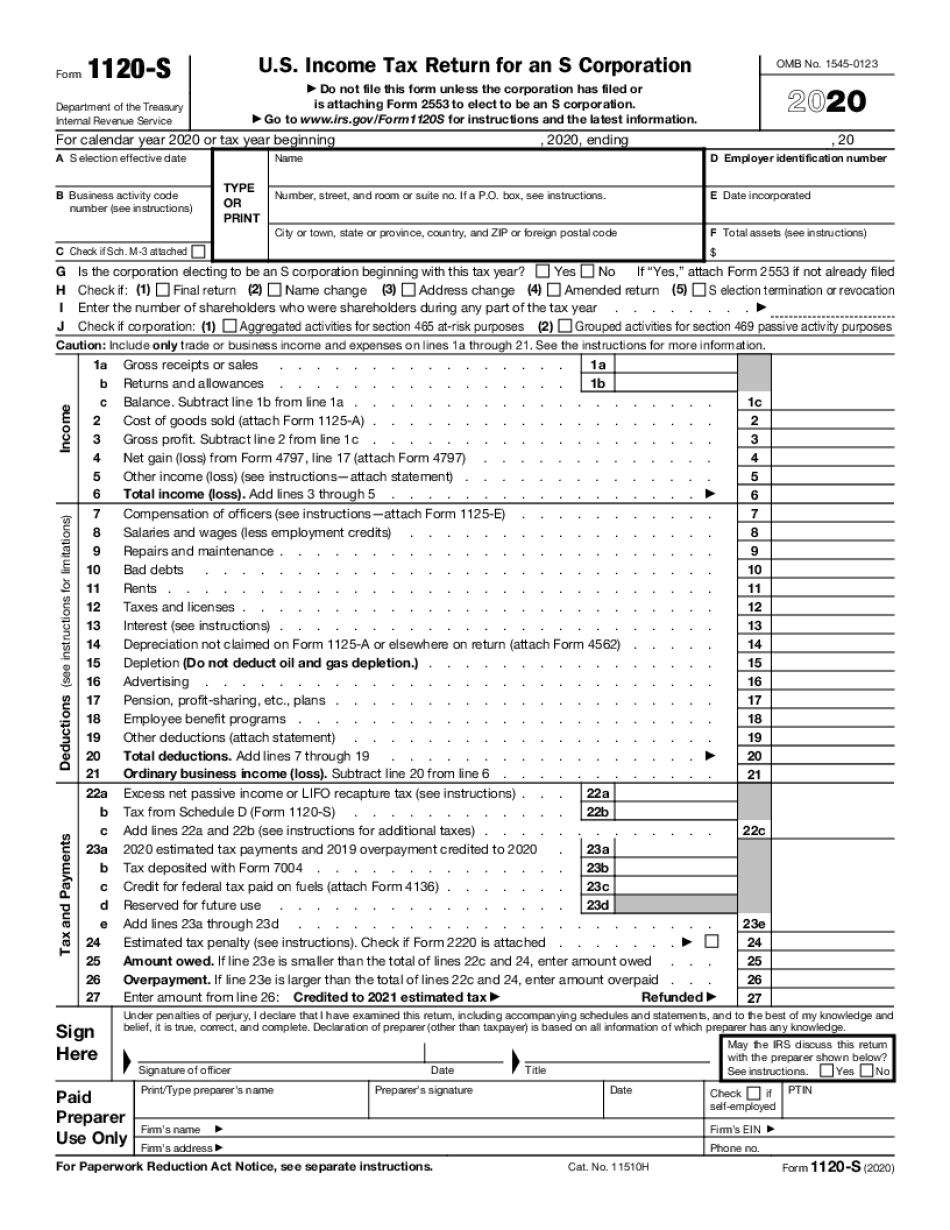

what is 1120 corporation - Form 1120 S is the tax return for S corporations As such it is used by S corporations to report their income profits losses tax credits deductions and other