relief u s 89 income tax Section 89A of the Income Tax Act provides an option to a resident individual to defer the payment of tax on the income earned from foreign retirement benefits accounts from the year of accrual to the year of withdrawal

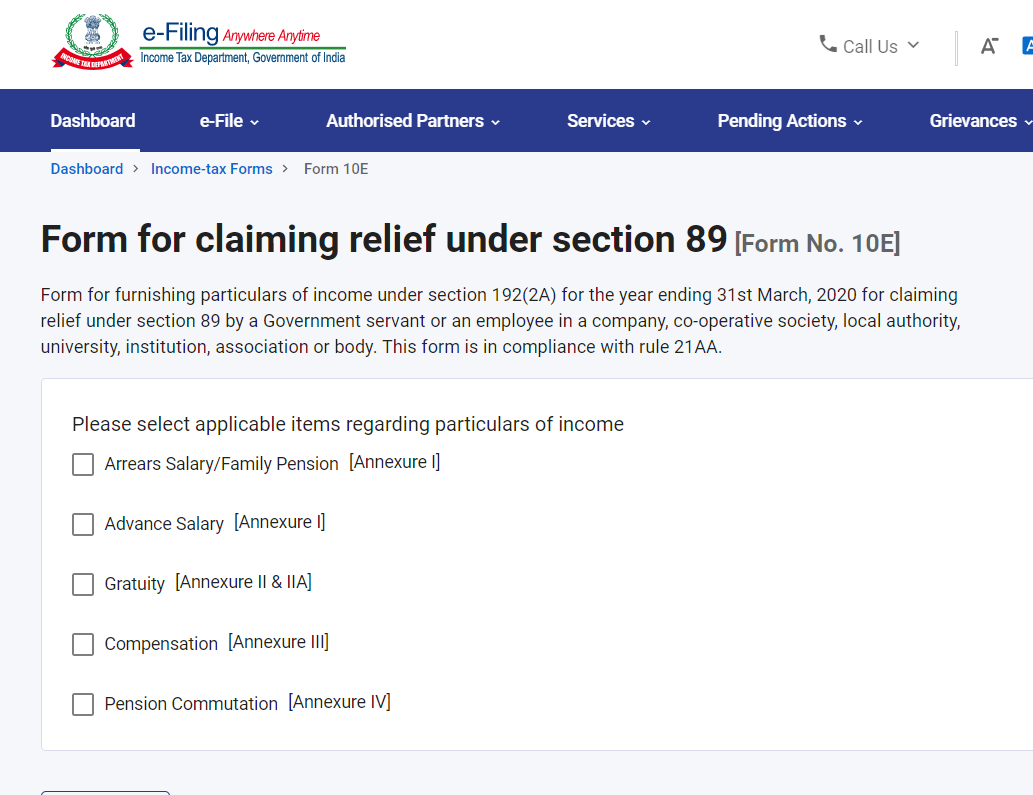

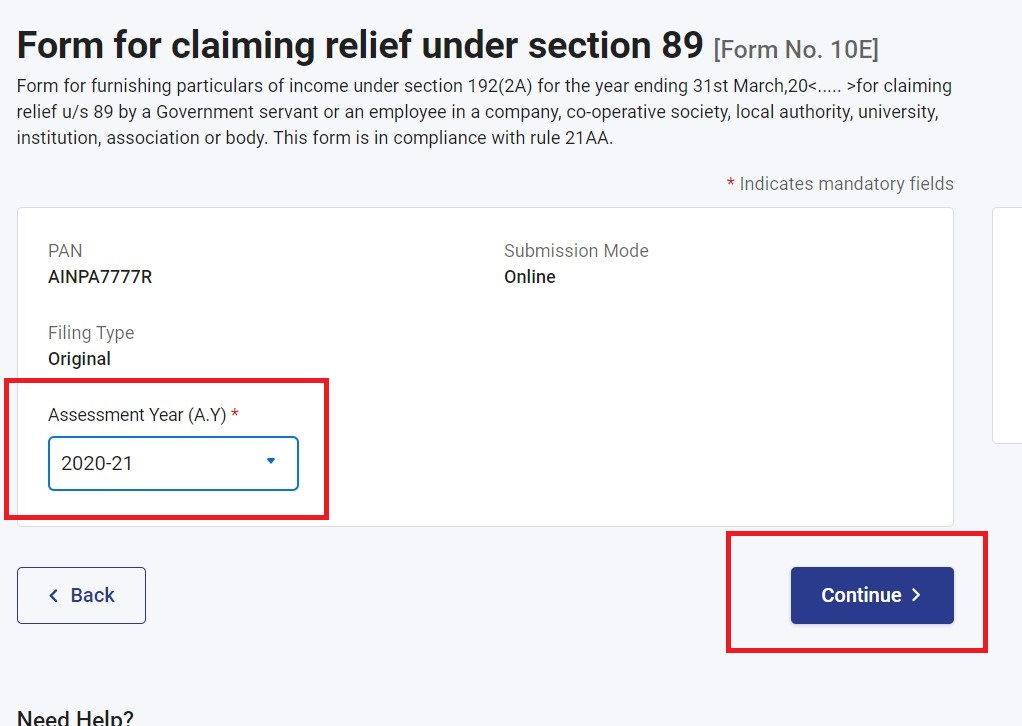

An employee who has received arrears in salary can save tax on such additional income in the following ways Calculate the relief u s 89 1 File Form 10E to claim relief u s 89 1 It is mandatory to fill out Form 10E when an individual wants to claim tax relief under Section 89 1 of the Income Tax Act 1961 Section 89 1 provides tax relief for delayed salary received in the form of arrears or

relief u s 89 income tax

relief u s 89 income tax

https://1.bp.blogspot.com/-QyfjTlwqo4c/YHaVGkR9nHI/AAAAAAAAIFk/P1cVPtiNzo4oOoVdIz8eOGwRd6DPQPD-ACLcBGAsYHQ/s600/relief%2Bunder%2Bsection%2B89%2B%25281%2529-min.png

2 Relief U s 89 Income Tax Bcom Mcom Nta Net Jrf YouTube

https://i.ytimg.com/vi/853oZEDhZac/maxresdefault.jpg

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174644_e.png

The Income Tax Act u s 89 provides relief to an assessee for any salary or profit in lieu of salary or family pension received by an assessee in advance or arrears in a Financial Year This relief is granted as the total income assessed is at a In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E It is advisable that

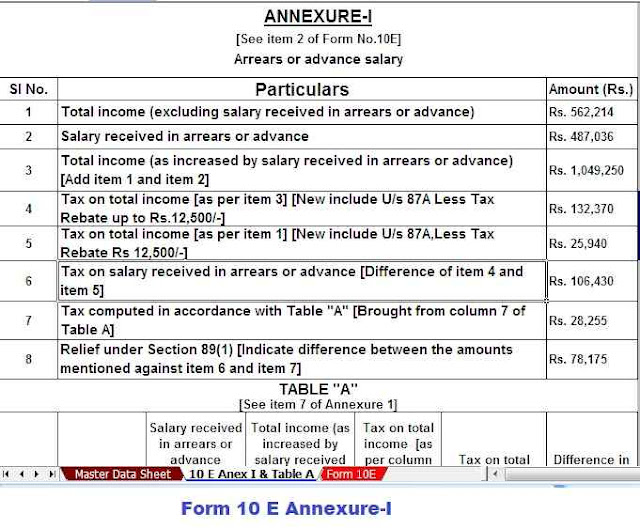

Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is received Calculate tax Section 89 of the Income Tax Act 1961 provides relief to taxpayers who receive arrears of salary or profits in lieu of salary in a particular financial year This relief is designed to reduce the tax burden on individuals who might face higher tax

More picture related to relief u s 89 income tax

What Is Relief U s 89 1 Tax Relief On Arrear U s 89 1 AY 21 22

https://i.ytimg.com/vi/NSFQNfIoeTw/maxresdefault.jpg

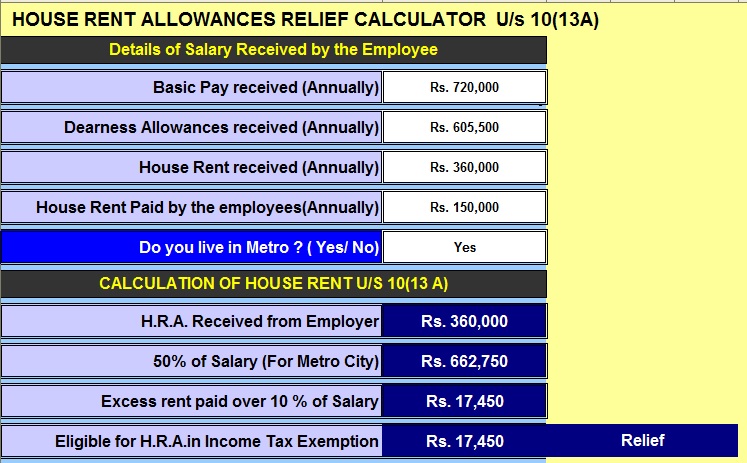

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://www.caclubindia.com/editor_upload/671907_20211129141629_hra_calculator.jpg

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

https://i.ytimg.com/vi/EF-Mx98SOnY/maxresdefault.jpg

Detailed insights into Section 89 of the Income Tax Act 1961 which offers tax relief on arrears or advance salary pension or compensation Learn about eligibility conditions Understand the tax implications of arrears of salary and explore relief options under Section 89 1 Learn the calculation process for tax relief and the importance of filing

Relief Under Section 89 helps you to claim salary arrears Our comprehensive guide covers everything from eligibility to filing Form 10E online ITR filing Form 10E submission is mandatory to claim income tax relief on delayed payments under section 89 1 of the income tax act Income tax return ITR filing

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174413_d.png

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://www.caclubindia.com/editor_upload/671907_20211129141713_form_10_e_annexure_i.jpg

relief u s 89 income tax - The Income Tax Act u s 89 provides relief to an assessee for any salary or profit in lieu of salary or family pension received by an assessee in advance or arrears in a Financial Year This relief is granted as the total income assessed is at a