relief u s 89 on salary Here are the steps to calculate relief under section 89 1 of the Income tax Act 1961 Calculate tax payable on total income including arrears in the year in which it is received Calculate tax

An employee can claim Section 89 relief if during the year he is liable to pay tax in respect of the following receipts a Advance Salary b Arrears of salary c Family Pension d Withdrawal from a PF account before An employee who has received arrears in salary can save tax on such additional income in the following ways Calculate the relief u s 89 1 File Form 10E to claim relief u s 89 1

relief u s 89 on salary

relief u s 89 on salary

https://1.bp.blogspot.com/-QyfjTlwqo4c/YHaVGkR9nHI/AAAAAAAAIFk/P1cVPtiNzo4oOoVdIz8eOGwRd6DPQPD-ACLcBGAsYHQ/s600/relief%2Bunder%2Bsection%2B89%2B%25281%2529-min.png

What Is Relief U s 89 1 Tax Relief On Arrear U s 89 1 AY 21 22

https://i.ytimg.com/vi/NSFQNfIoeTw/maxresdefault.jpg

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of previous financial years It is mandatory to fill out Form 10E when an individual wants to claim tax relief under Section 89 1 of the Income Tax Act 1961 Section 89 1 provides tax relief for delayed salary received in the form of arrears or

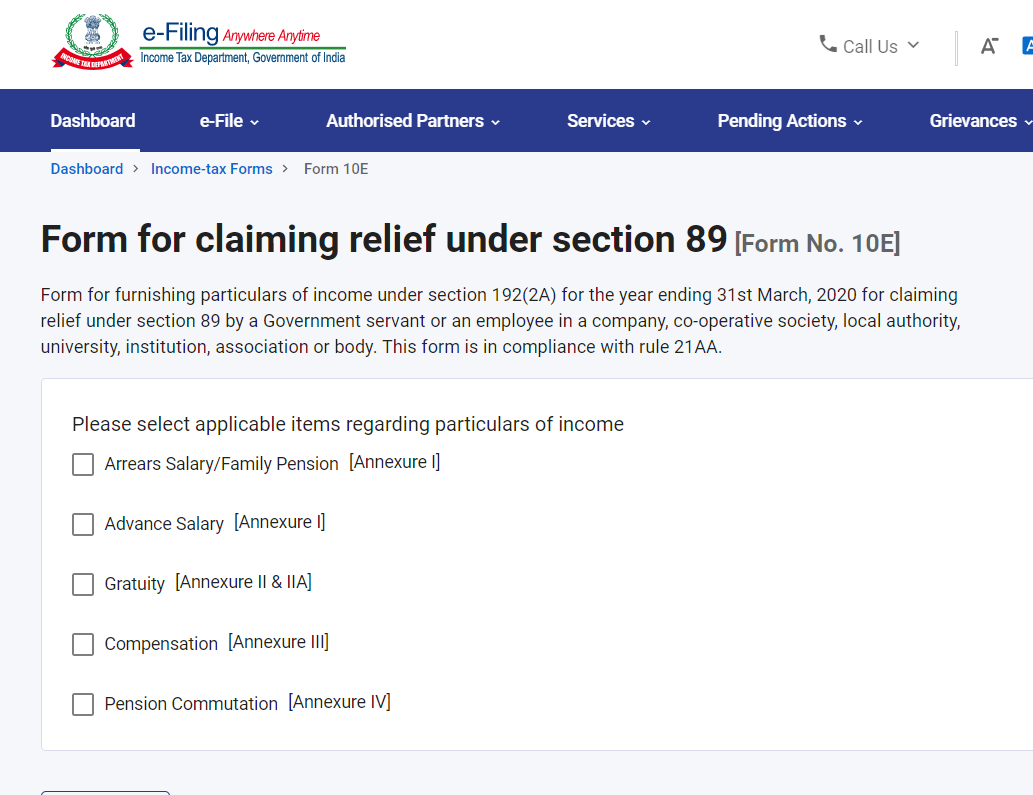

If Form 10E is not filed and the taxpayer claims relief u s 89 the ITR filed will be processed but the relief claimed will not be allowed It is mandatory to file Form 10E to claim a tax relief on arrear advance income under Salary In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E The Form must be filed before filing the Return of Income

More picture related to relief u s 89 on salary

Relief U s 89 Of The Income Tax Act 1961

https://1.bp.blogspot.com/-uSy9203S7VE/X4wDy7DEUyI/AAAAAAAAAJk/GPUsuuJnrlsXG5P7LYJBQloeSOVUcGkAQCLcBGAsYHQ/s548/Relief89.jpg

Whether Relief U s 89 1 Is Available To Arrears Of Family Pension

https://thetaxtalk.com/wp-content/uploads/2021/11/Untitled-4856.jpg

Income From Salary Relief U S 89 YouTube

https://i.ytimg.com/vi/n1WjO0Z-6BM/maxresdefault.jpg

Arrears of Salary Relief u s 89 Understand relief u s 89 in cases where salary received in arrears or advance arrears from family pension commuted pension gratuity received compensation after layoff or termination What is Form 10E In case of receipt in arrears or advance of any sum in the nature of salary relief u s 89 can be claimed In order to claim such relief the assessee has to file Form 10E It

Section 89 of the Income Tax Act 1961 provides relief to taxpayers who receive arrears of salary or profits in lieu of salary in a particular financial year This relief is designed to reduce the tax Understand the tax implications of arrears of salary and explore relief options under Section 89 1 Learn the calculation process for tax relief and the importance of filing

U S 89 Sanpete County Between Salina And Gunnison Utah Flickr

https://live.staticflickr.com/1177/1119759114_24a534076f_b.jpg

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174644_e.png

relief u s 89 on salary - If Form 10E is not filed and the taxpayer claims relief u s 89 the ITR filed will be processed but the relief claimed will not be allowed It is mandatory to file Form 10E to claim a tax relief on arrear advance income under Salary