what is tax relief u s 89 A Relief can be claimed u s 89 1 if gratuity is received in excess of limits specified The cases in which the relief is admissible is divided into three categories

For this reason the provision of relief u s 89 comes in An employee must meet certain conditions to claim relief under Section 89 1 Salary is received in Relief under section 89 1 according to Income Tax Act saves you from additional tax burden if there is a delay in receiving income An employee must meet certain conditions to claim relief under this section To start

what is tax relief u s 89

what is tax relief u s 89

https://newsobserver.wp.moneyresearchcollective.com/wp-content/uploads/sites/5/2022/08/media-temp-14720220804-9360-cu6oiy.jpg

What Is Tax Relief And How Does It Work The Ultimate Guide Tax Debt

https://alleviatetax.com/wp-content/uploads/2019/09/ATAX-What-is-Tax-Relief-and-How-Does-it-Work-e1568693943636.jpeg

Tax Reliefs How To Reduce Your Tax Bill Which

https://media.product.which.co.uk/prod/images/original/bc58709fbb5a-tax-relief.jpg

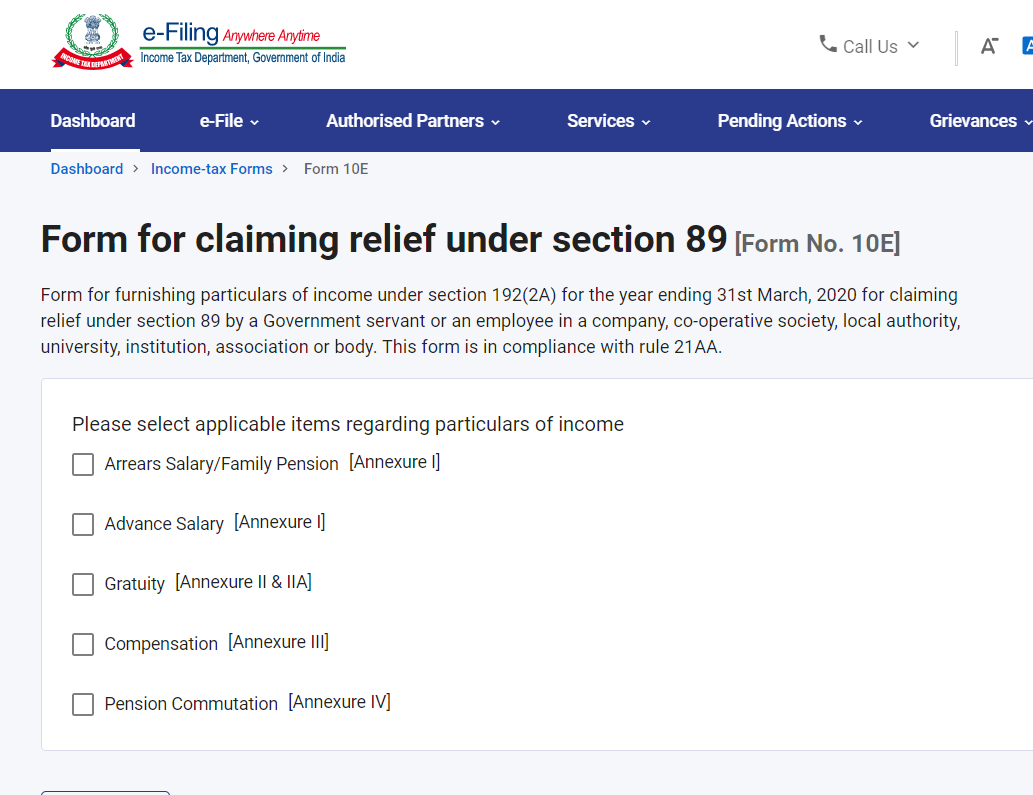

How to claim tax relief on Salary Arrears under Section 89 1 Arrears or Salary advances are taxable in the year of receipt The income tax department allows tax relief u s 89 of the Income Tax Act to Section 89 1 An Overview What is Income Tax Arrears Above all Eligibility for Relief 1 Received Arrears 2 Taxable in the Year of Receipt How to Calculate Relief 1

Understand relief u s 89 in cases where salary received in arrears or advance arrears from family pension commuted pension gratuity received compensation after layoff or termination This Imagine receiving arrears in the current year that were rightfully due in preceding years leading to an inflated income for the present financial year and subsequently higher tax

More picture related to what is tax relief u s 89

Income Tax Relief Programs Services USA Tax Settlement

http://usataxsettlement.com/wp-content/uploads/2021/01/Tax-Relief.jpeg

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174644_e.png

Claiming Tax Relief On Pension Contributions OpenMoney

https://assets-global.website-files.com/5dd513f5a9fd3b299dca6eae/5dfba4647e73df335a2388b9_Tax_relief_Thumb.png

As per the Income Tax Act 1961 the Income Tax Section 89 1 a taxpayer can receive relief of salary relevant to the previous year s earning Section 89 1 is prominent since the 6th Pay Commission of Learn how to calculate tax relief under Sections 89 and 89A for arrears gratuity and foreign retirement benefits Understand the steps and eligibility criteria

Tax relief under section 89 enables us to tackle such a situation It provides for relief in a case where the employee is in a higher tax bracket at the time of the Now Mr X is eligible to avail relief u s 89 1 for the extra tax burden due to arrears of his salary here below is the detailed calculation Step 1 Calculate the tax

What Is Employment Tax Bullseye Tax Relief

https://www.bullseyetaxrelief.com/wp-content/uploads/2020/10/tax-relief-img-20-2048x1366.jpg

:max_bytes(150000):strip_icc()/TaxRelief-5eb635a3dc0b422083e983c5f14f1bde.jpg)

What Is Tax Relief How It Works Types And Example

https://www.investopedia.com/thmb/5HV1IzAmBfKzdfnAQwNBPzEyXpM=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/TaxRelief-5eb635a3dc0b422083e983c5f14f1bde.jpg

what is tax relief u s 89 - This tax relief is known as Section 89 1 relief This relief is available both in the case of salary arrears as well as family pension arrears How to calculate tax