relief u s 89 income tax act When will Relief under Section 89 1 of Income Tax Act 1961 become available Salary received in arrear or in advance Rule 21A 2 Receipt of Gratuity for Past Service Rule

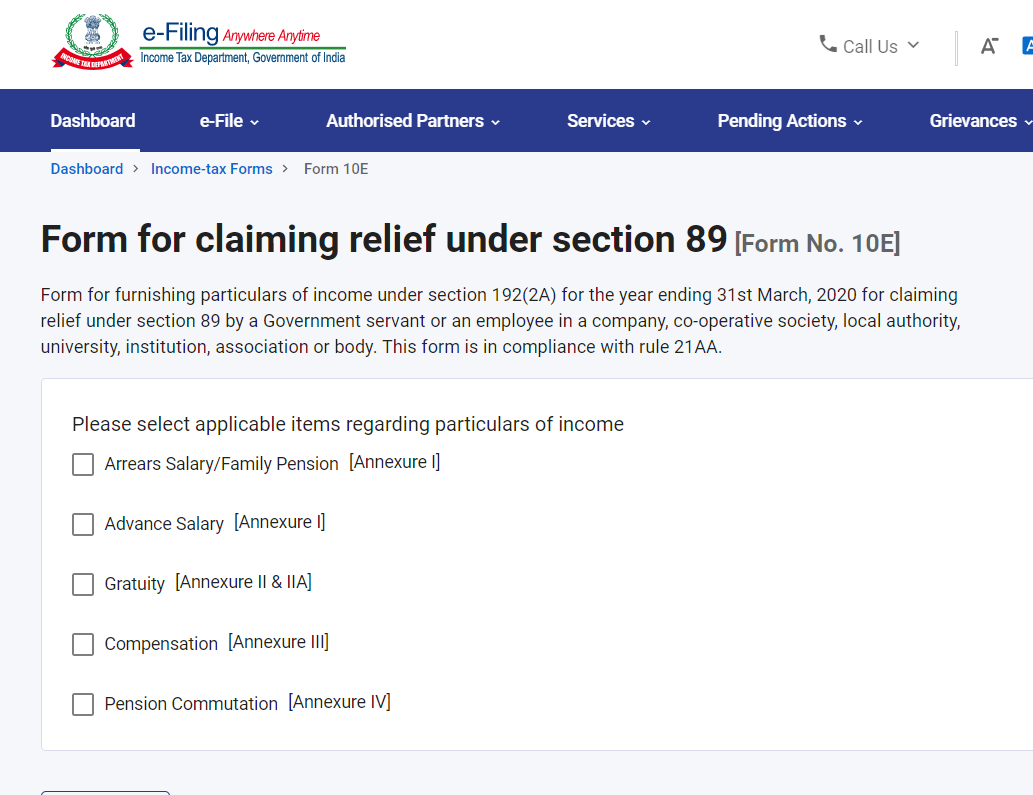

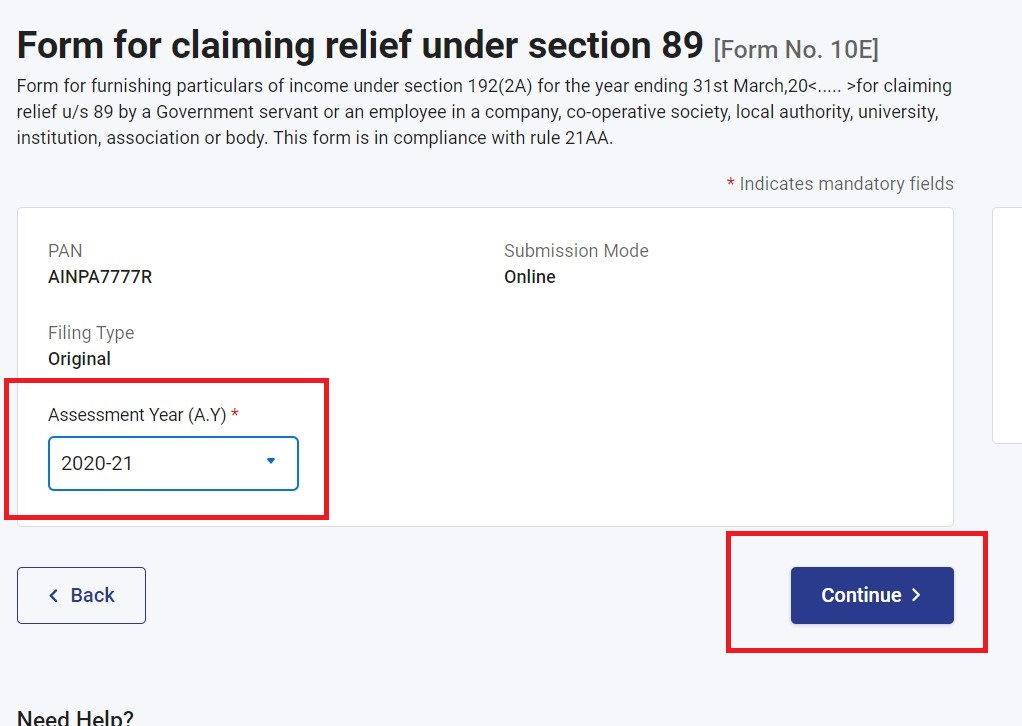

These advances or arrears can affect your taxes and are reflected in the year of the receipt In that case relief under Section 89 1 of the Income Tax Act 1961 can help you The government to avoid the problem of over taxation due to advance or arrear of salary allows you to claim a tax relief u s 89 To claim this relief Form 10E is required There

relief u s 89 income tax act

relief u s 89 income tax act

https://www.caclubindia.com/editor_upload/685154_20210823174644_e.png

What Is Relief U s 89 1 Tax Relief On Arrear U s 89 1 AY 21 22

https://i.ytimg.com/vi/NSFQNfIoeTw/maxresdefault.jpg

How To Calculate Relief U s 89 1 Of The Income Tax Act

https://www.caclubindia.com/editor_upload/685154_20210823174413_d.png

3 1 Purpose The Income Tax Act u s 89 provides relief to an assesse for any salary or profit in lieu of salary or family pension received by an assesse in advance or arrears in Section 89 1 An Overview What is Income Tax Arrears Above all Eligibility for Relief 1 Received Arrears 2 Taxable in the Year of Receipt How to Calculate Relief 1

Detailed insights into Section 89 of the Income Tax Act 1961 which offers tax relief on arrears or advance salary pension or compensation Learn about eligibility The income tax department allows tax relief u s 89 of the Income Tax Act to save the taxpayer from the additional tax burden Thus the employer will calculate relief u s 89

More picture related to relief u s 89 income tax act

Power Conferred By Section 254 2 Of Income Tax Act Does Not Extend

https://legiteye.com/media/uploads/legiteyeindian/Income-Tax-Act.jpg

Income Tax Relief Under Section 89 1 Read With Rule 21A With

https://1.bp.blogspot.com/-NfC7vVdLCss/WfQvjk7wqdI/AAAAAAAAFtA/l58RcloHSosIKsLbvc_gpycm49-JzfVNgCLcBGAs/w1200-h630-p-k-no-nu/Arrears%2BRelief%2BPage%2B1.jpg

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

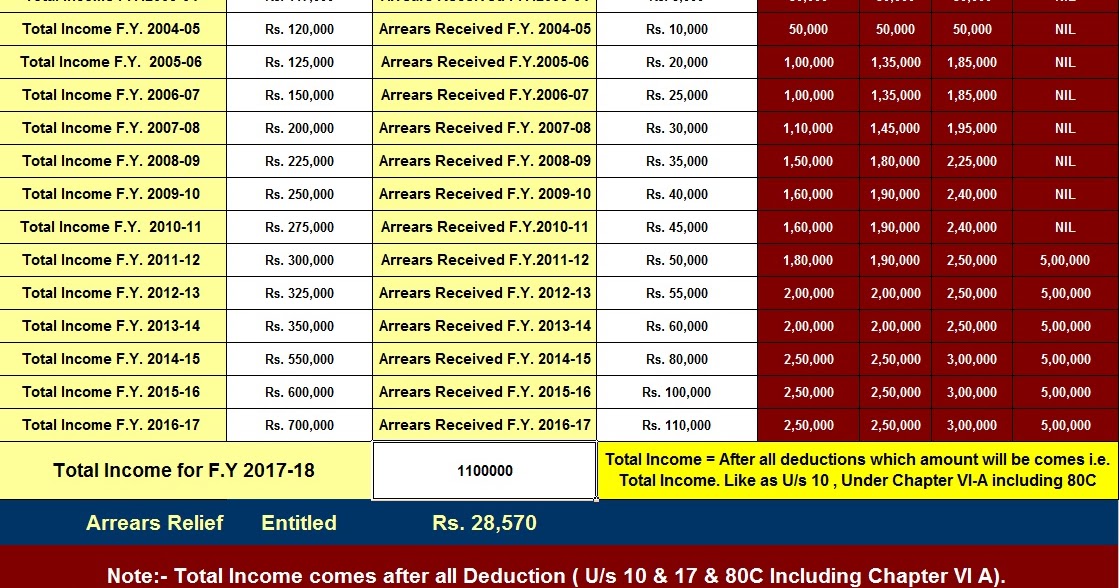

Admin Download 89 1 Arrears Relief Calculator From F Y 2000 01 to F Y 2022 23 If you are in arrears in the 2022 2023 tax year relating to the previous year s then your tax The following is the best approach for calculating the exemption under Section 89 1 of the Income Tax Act 1961 1 Calculate the tax to be paid on the total income reviewing

Learn how to calculate tax relief under Sections 89 and 89A for arrears gratuity and foreign retirement benefits Understand the steps and eligibility criteria Income Tax March 5 2023 Section 89 of the Income Tax Act of 1961 provides relief to taxpayers who have received arrears of salary or pension This section allows such taxpayers to

44ae Of Income Tax Act Everything You Need To Know

https://housing.com/news/wp-content/uploads/2023/01/Provisions-under-Section-44AE-of-the-Income-Tax-Act-that-you-must-know.jpg

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

https://i.ytimg.com/vi/EF-Mx98SOnY/maxresdefault.jpg

relief u s 89 income tax act - The Finance Act 2021 inserted a new Section 89A in the Income Tax Act 1961 ITA to provide relief to residents who have income from foreign retirement benefits accounts