Relief U S 89 1 Of Income Tax Act - Worksheets have actually progressed right into functional and crucial devices, dealing with diverse demands throughout education, business, and individual administration. They give organized layouts for different tasks, ranging from basic mathematics drills to intricate company analyses, hence enhancing discovering, planning, and decision-making processes.

What Is Relief U s 89 1 Tax Relief On Arrear U s 89 1 AY 21 22

What Is Relief U s 89 1 Tax Relief On Arrear U s 89 1 AY 21 22

Worksheets are structured documents used to arrange data, info, or jobs methodically. They offer a graph of ideas, permitting users to input, control, and examine information efficiently. Whether in the classroom, the conference room, or in the house, worksheets improve procedures and boost productivity.

Worksheet Varieties

Educational Worksheets

Worksheets are very useful tools for both teachers and pupils in academic settings. They incorporate a selection of activities, such as math jobs and language tasks, that permit technique, reinforcement, and evaluation.

Work Vouchers

In the business world, worksheets serve numerous functions, including budgeting, job planning, and information analysis. From financial declarations to SWOT analyses, worksheets assist businesses make notified decisions and track progress toward goals.

Individual Task Sheets

Personal worksheets can be a beneficial tool for accomplishing success in various elements of life. They can assist people established and function towards goals, handle their time properly, and check their development in locations such as physical fitness and finance. By giving a clear framework and feeling of accountability, worksheets can help people stay on track and achieve their goals.

Advantages of Using Worksheets

Worksheets provide various benefits. They stimulate involved discovering, increase understanding, and nurture logical thinking capabilities. Additionally, worksheets support structure, increase performance and allow teamwork in team situations.

How To Calculate Relief U s 89 1 Of The Income Tax Act

Section 13 OF THE INCOME TAX ACT

What Is Meant By Section 194IB Of Income Tax Act

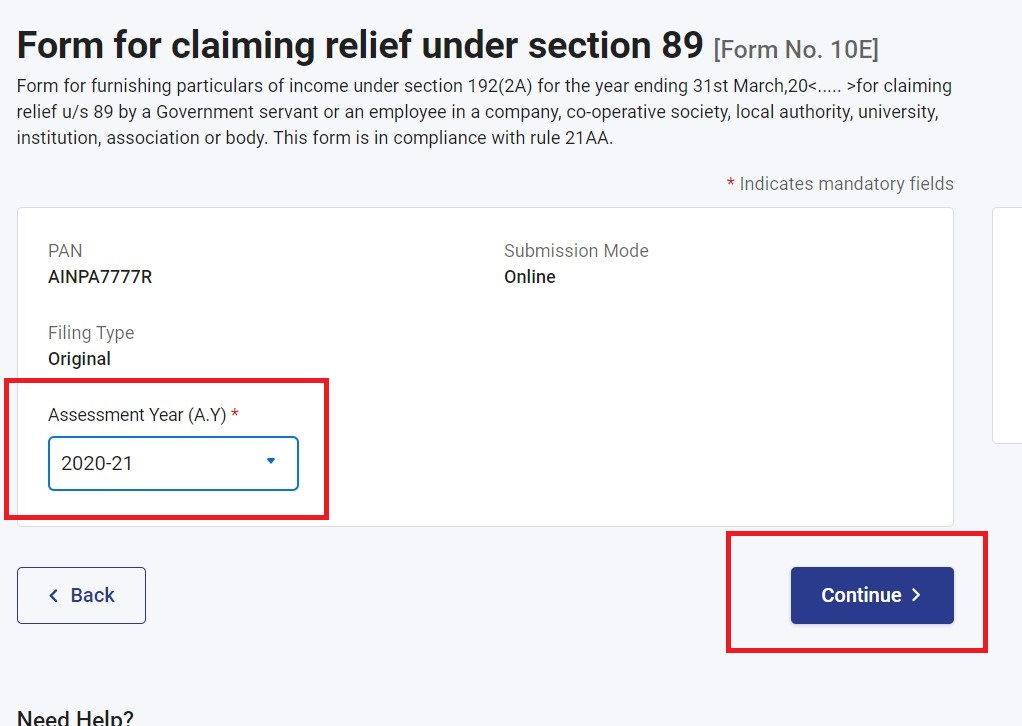

Relief U s 89 1 Disallowed While Processing ITR How To Claim Relief U

Relief Under Section 89 1 For Arrears Of Salary Itaxsoftware

Section 194M Of Income Tax Act 1961 Sorting Tax

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

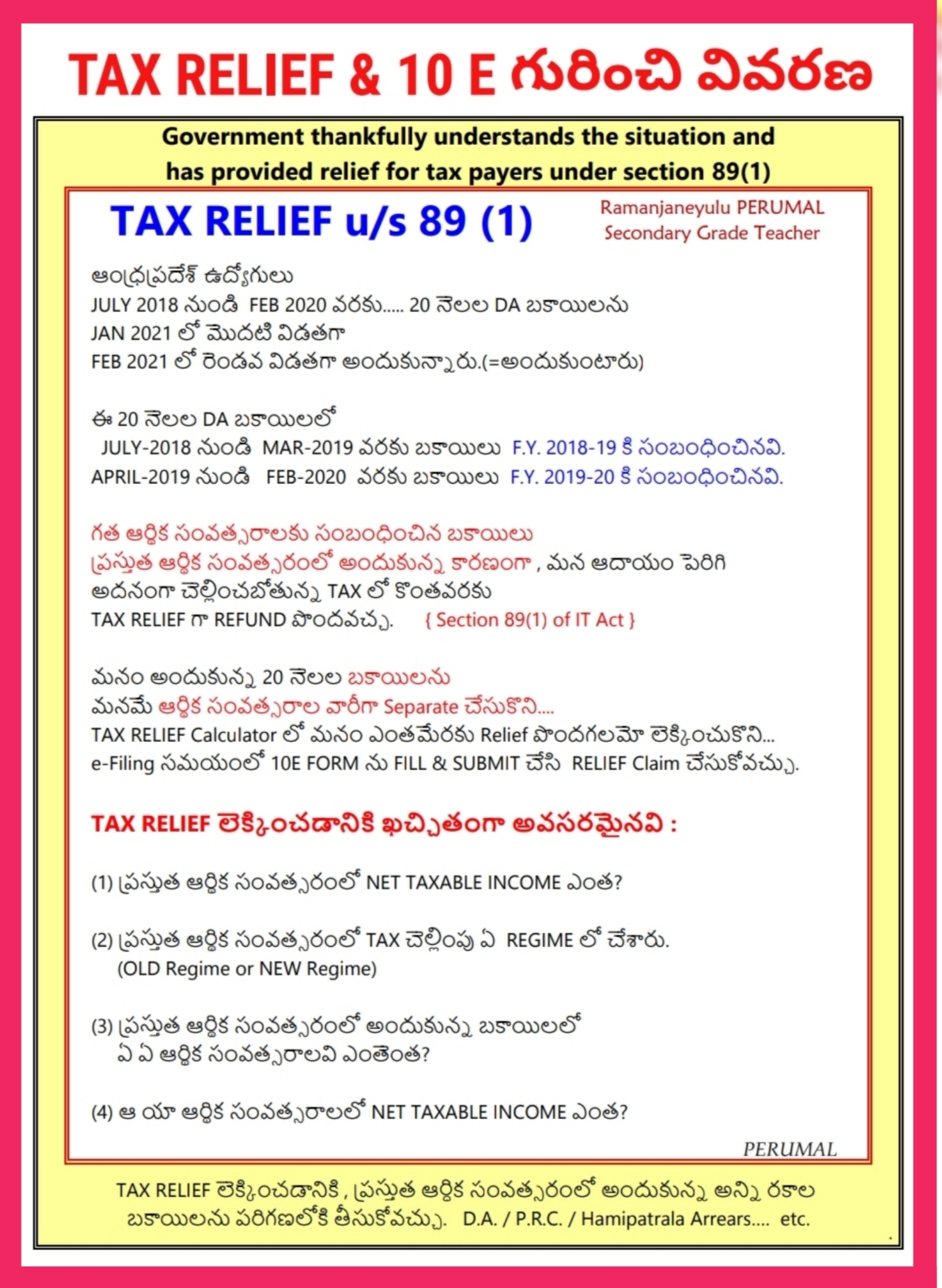

TAX RELIEF U S 89 1 APEdu

Specified Business Section 35AD Part 1 Of Income Tax Act 1961 CMA

Income Tax TDS Deducted But ITR Not Filed Here s What Professionals