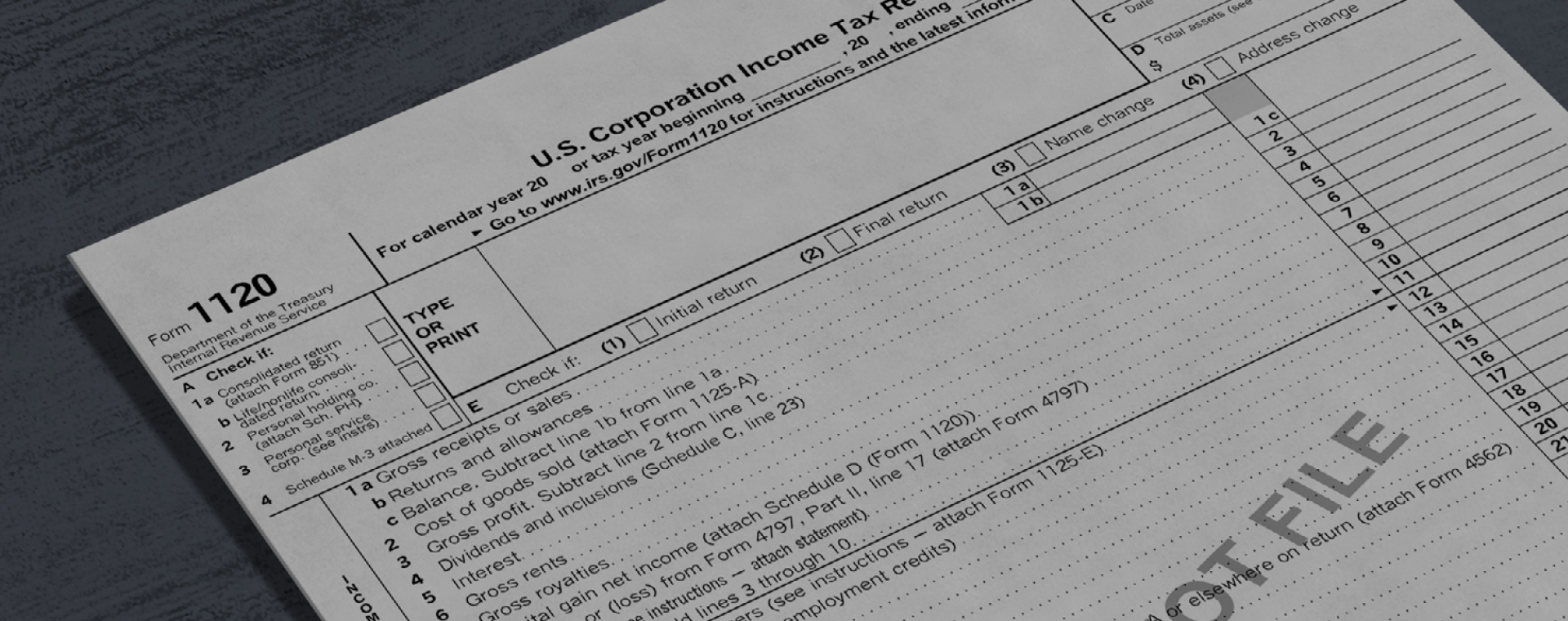

is form 1120 for c corporations Corporations can generally electronically file e file Form 1120 related forms schedules and attachments Form 7004 automatic extension of time to file and Forms 940 941 and 944 employment tax returns

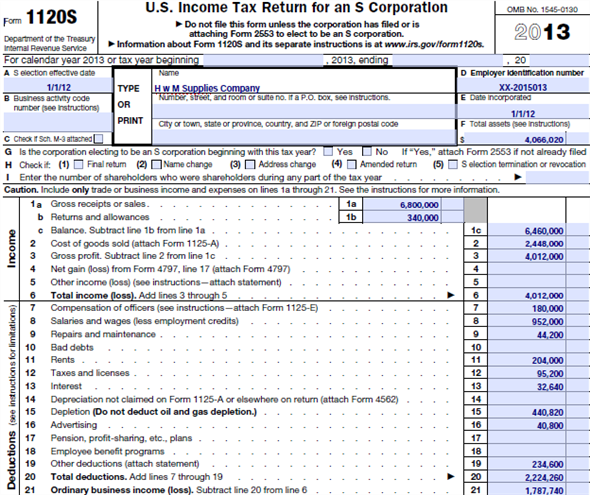

Form 1120 is for C corporations and Form 1120S is for S corporations Each form is set up to record the information needed to report income and calculate taxes based on the What is IRS Form 1120 Form 1120 is the U S Corporation Income Tax Return C corporations C corps and some limited liability companies LLCs must file this form to report

is form 1120 for c corporations

is form 1120 for c corporations

https://aloncpa.com/wp-content/uploads/2020/03/1120-1.png

Solved Chapter 11 C Problem 64TFP Solution Prentice Hall s Federal

https://media.cheggcdn.com/study/c6b/c6bf5cff-49ec-4045-b6fa-654849c3893e/13833-11.C-64TFP-i1.png

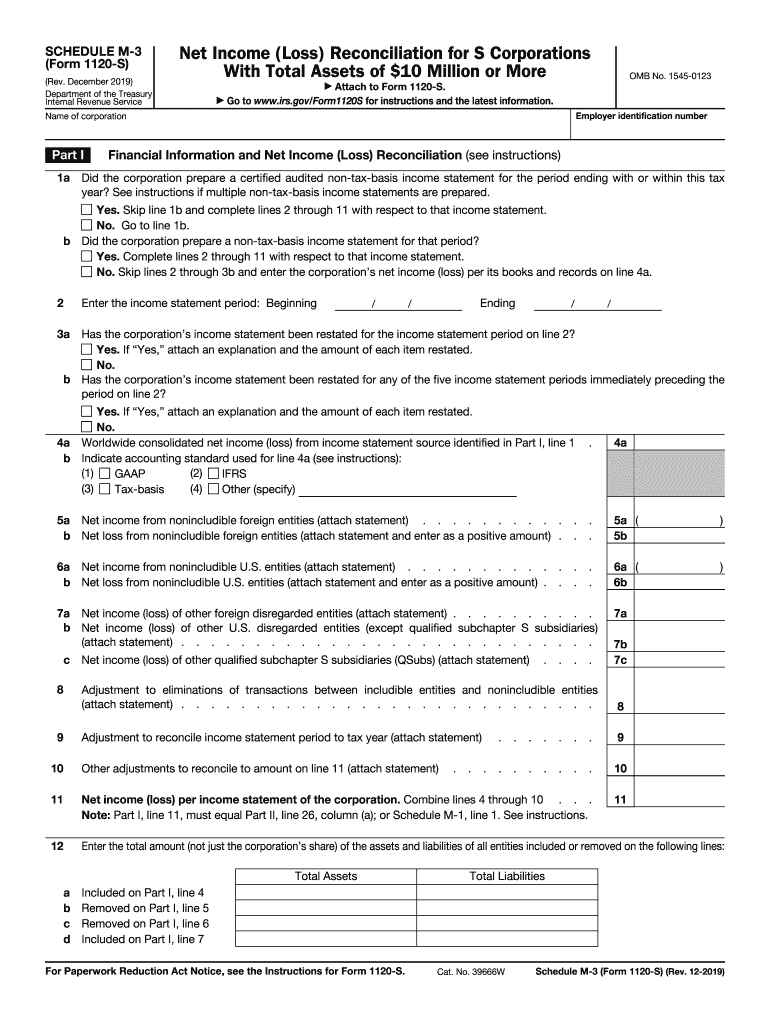

1120s Schedule M 3 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/488/93/488093794/large.png

Tax Form 1120 or IRS Form 1120 in its simplest form is the corporate income tax return It is used by C corporations C corp to report their corporate income tax deductions and liabilities to the IRS Form 1120 is the tax form C corporations and LLCs filing as corporations use to file their income taxes Once you ve completed Form 1120 you should have an idea of how much your corporation needs to pay in taxes

C corporations use Form 1120 to report their income gains losses deductions and credits All U S corporations must file Form 1120 as long as their Federal Employer So what is an 1120 tax form or a C corp tax form Form 1120 is used by corporations in the United States to report their income and calculate their taxes The form is also used to report any gains or losses and any

More picture related to is form 1120 for c corporations

IRS Form 1120 W Download Fillable PDF Or Fill Online Estimated Tax For

https://data.templateroller.com/pdf_docs_html/2059/20596/2059608/irs-form-1120-w-estimated-tax-for-corporations_big.png

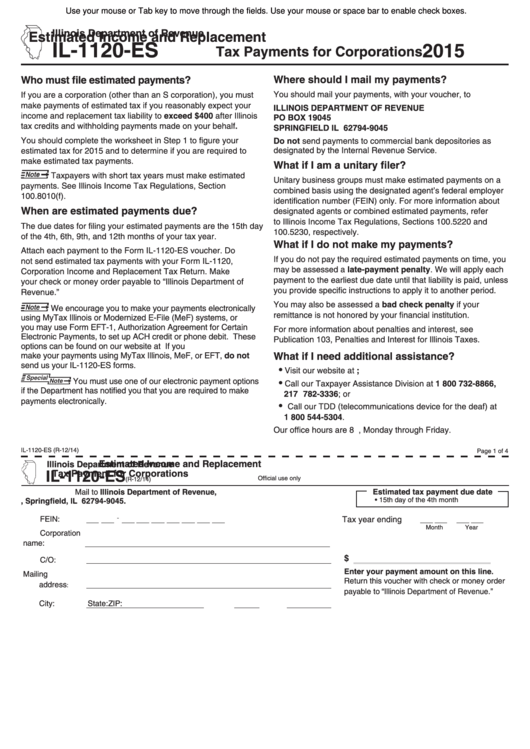

Fillable Form Il 1120 Es Estimated Income And Replacement Tax

https://data.formsbank.com/pdf_docs_html/335/3355/335553/page_1_thumb_big.png

Form 1120 F Schedule M 3 Net Income Reconciliation For Foreign

https://www.formsbirds.com/formimg/corporate-income-tax/7836/form-1120-f-schedule-m-3-net-income-reconciliation-for-foreign-corporations-2014-l3.png

C corps file federal income taxes using IRS Form 1120 the U S Corporation Income Tax Return These taxes are based on net earnings which are calculated after allowable deductions are taken Any corporation operating on a cooperative basis under section 1381 and allocating amounts to patrons on the basis of business done with or for such patrons should file Form 1120 C

Form 1120 also known as the US Corporation Income Tax Return is a crucial document for C corporations reporting their income gains losses deductions credits and income tax liability to the Internal Revenue Service IRS Form 1120 is the tax form that C corporations and LLCs filing as corporations use to report their income taxes to the IRS It helps these entities figure out their tax liability based

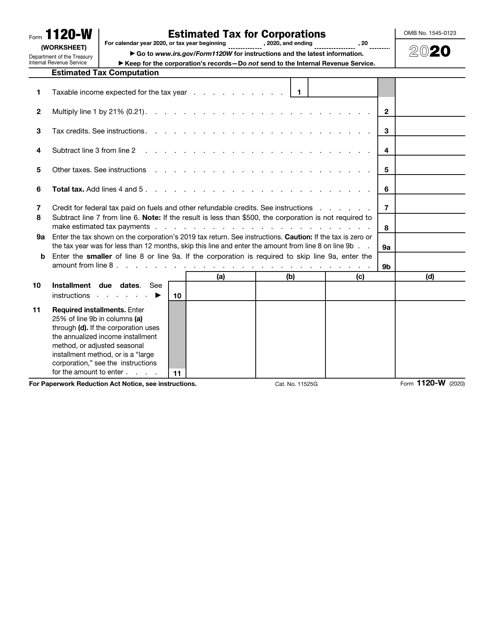

Who Should Use IRS Form 1120 W

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

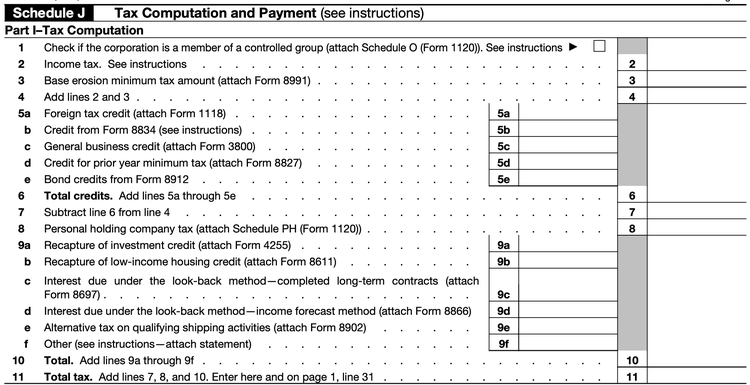

How To File Tax Form 1120 For Your Small Business

https://m.foolcdn.com/media/affiliates/images/Form_1120_-_02_-_Schedule_J_2jOhqtP.width-750.png

is form 1120 for c corporations - Tax Form 1120 or IRS Form 1120 in its simplest form is the corporate income tax return It is used by C corporations C corp to report their corporate income tax deductions and liabilities to the IRS