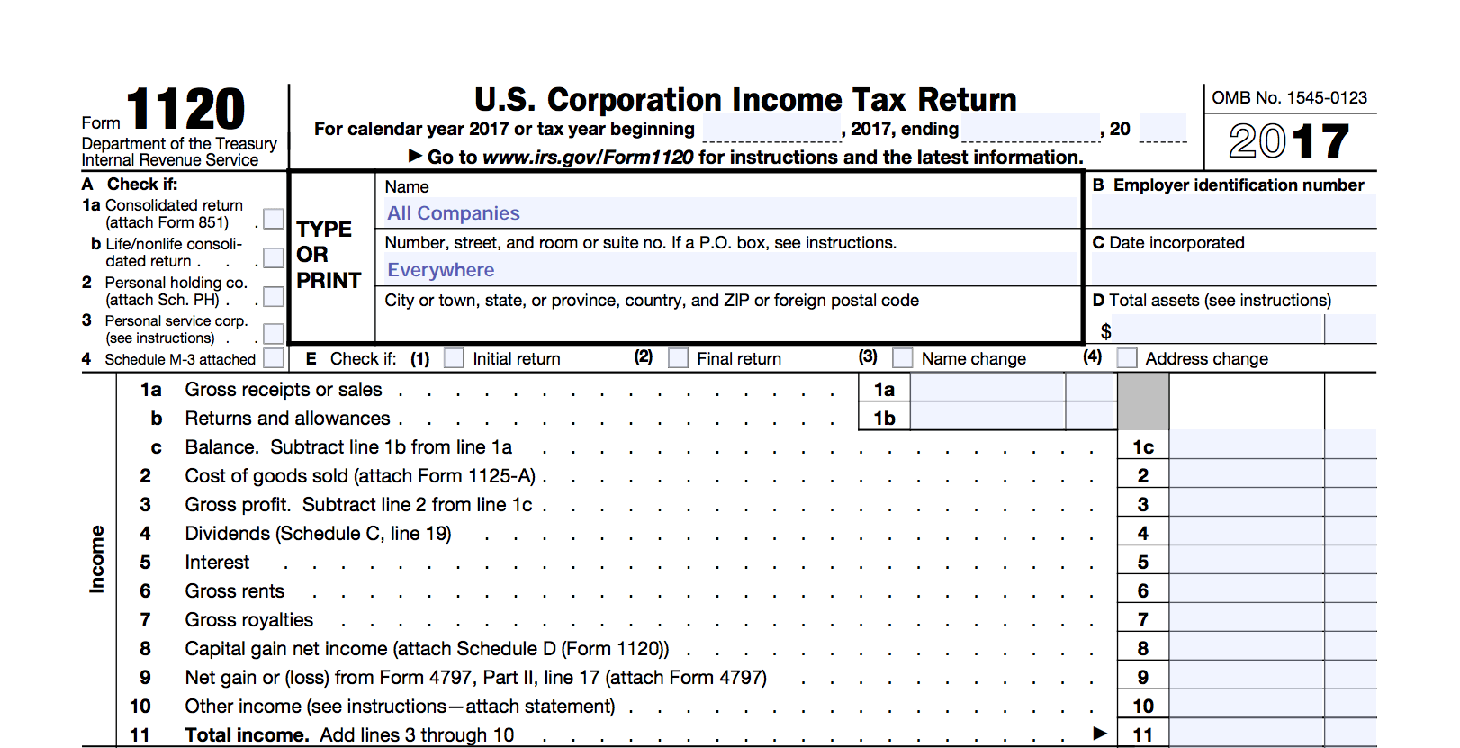

is form 1120 c corp Corporations can generally electronically file e file Form 1120 related forms schedules and attachments Form 7004 automatic extension of time to file and Forms 940 941 and 944

If a C corp cannot meet its initial tax deadline it can file for a six month extension using IRS Form 7004 In 2024 the extension deadline for calendar year businesses is Oct 15 For fiscal year businesses the deadline Instructions for Form 1120 C Introductory Material Future Developments What s New Increase in penalty for failure to file Expiration of 100 business meal expense deduction Corporate

is form 1120 c corp

is form 1120 c corp

https://d1qmdf3vop2l07.cloudfront.net/friendly-barracuda.cloudvent.net/compressed/_min_/9d1d0ae01a0e9406e2c492f0c33da8a1.png

2020 Form 1120 Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/538/822/538822777/large.png

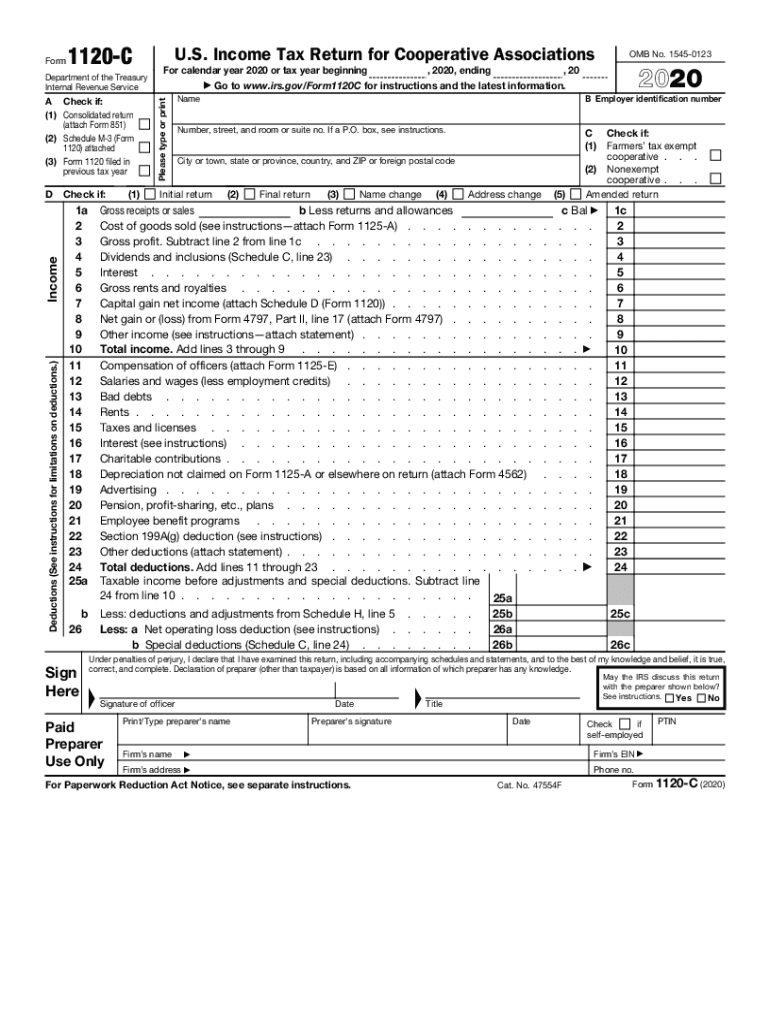

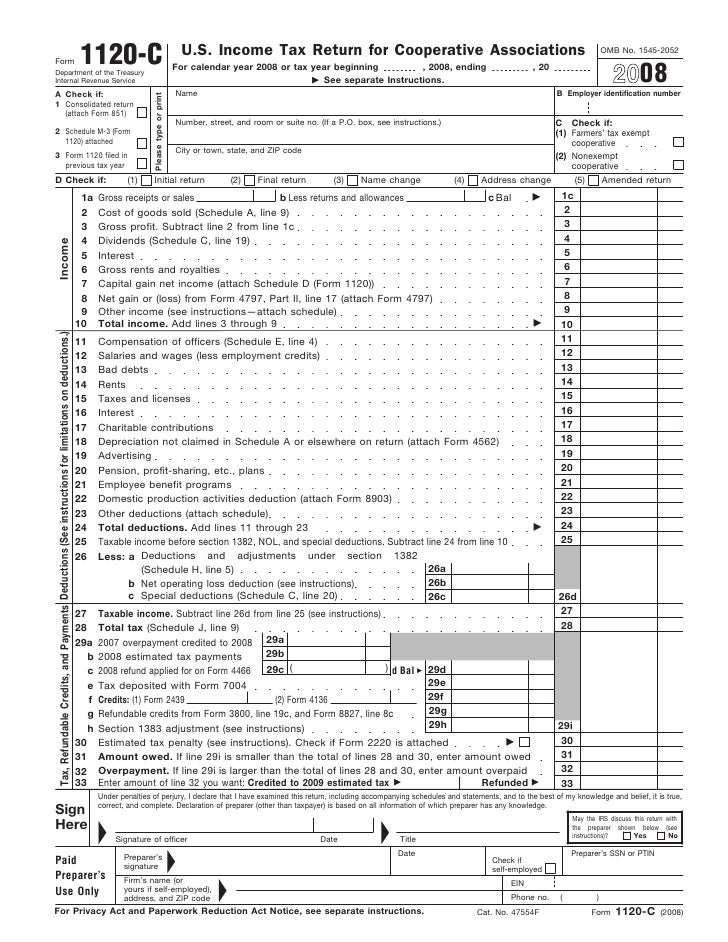

Form 1120 C U S Income Tax Return For Cooperative Associations

https://image.slidesharecdn.com/1272628/95/form-1120cus-income-tax-return-for-cooperative-associations-1-728.jpg?cb=1239358960

A C corporation or C corp is a legal structure for a corporation in which the owners or shareholders are taxed separately from the entity C corporations the most prevalent of Form 1120 is the tax form that C corporations and LLCs filing as corporations use to report their income taxes to the IRS It helps these entities figure out their tax liability based

Form 1120 C is the annual U S income tax return that must be filed by cooperative associations This form reports income gains losses deductions credits and other tax related information to calculate the So what is an 1120 tax form or a C corp tax form Form 1120 is used by corporations in the United States to report their income and calculate their taxes The form is also used to report any gains or losses and any

More picture related to is form 1120 c corp

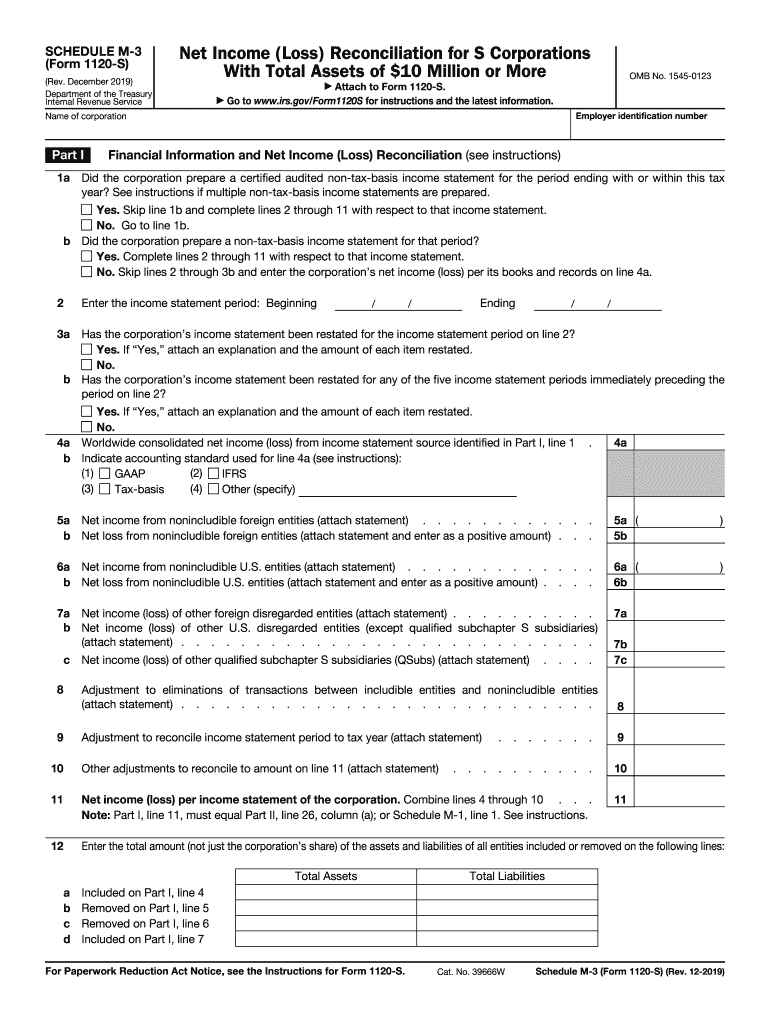

1120s Schedule M 3 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/488/93/488093794/large.png

Sample K1 Tax Form Verhotline

https://www.irs.gov/pub/xml_bc/33347002.gif

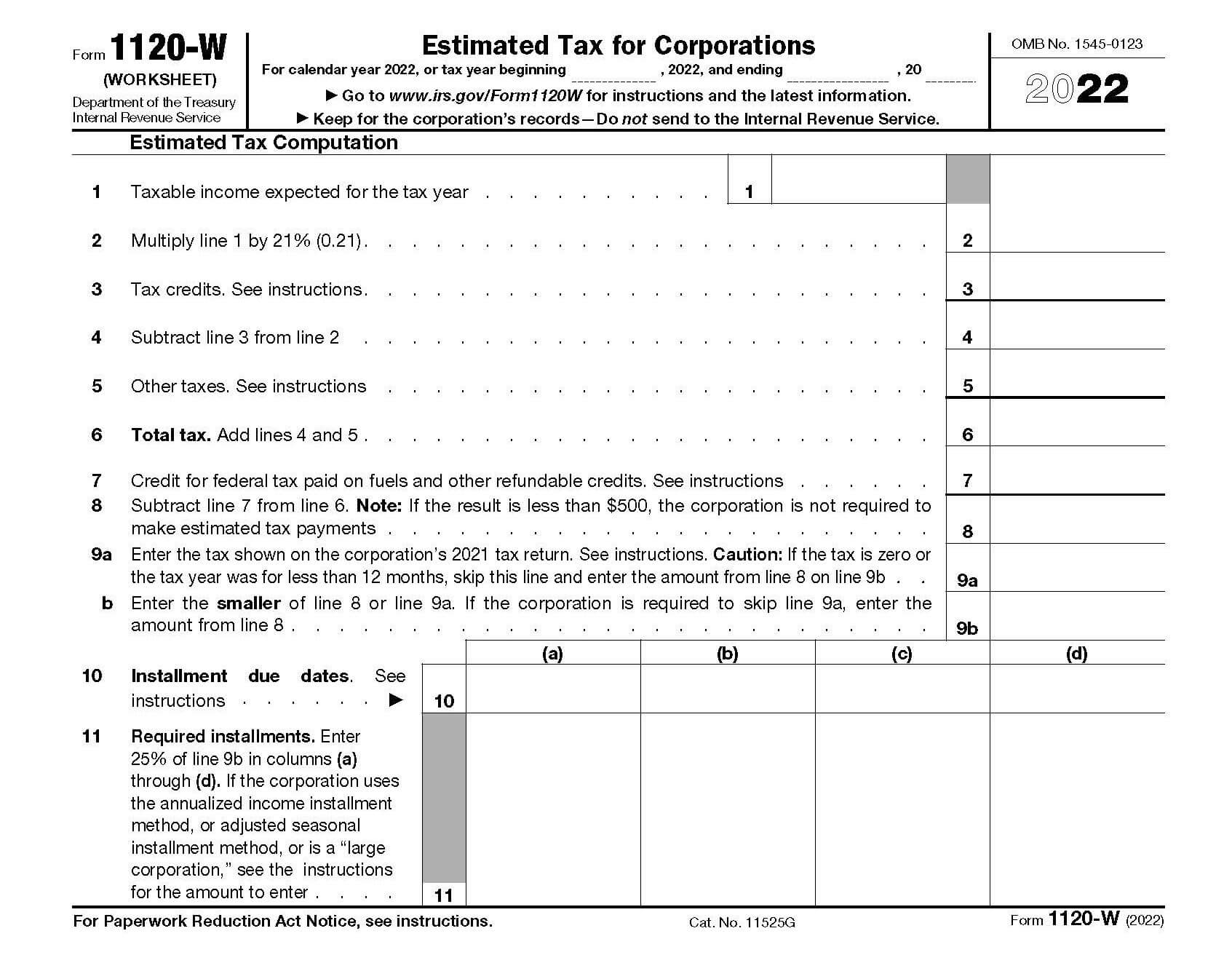

2023 Form 1120 W Printable Forms Free Online

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

Tax Form 1120 or IRS Form 1120 in its simplest form is the corporate income tax return It is used by C corporations C corp to report their corporate income tax deductions and liabilities to the IRS Both C and S corporations must file a federal income tax return C corporations use Form 1120 to calculate their taxes due S corporations use Form 1120S as an information return S corporations must also prepare a form 10 K 1 for

Still wondering which documents you need to file an 1120 C Corporation tax return Refer to our tax preparation checklist to easily file your taxes IRS Form 1120 is the U S Corporation Income Tax Return It s also used by partnerships but not by S corporations Find out how to complete and file it

Tax Table M1 Instructions 2021 Brokeasshome

https://fitsmallbusiness.com/wp-content/uploads/2022/01/Screenshot_-IRS_Form_1120S.jpg

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

is form 1120 c corp - Form 1120 is a U S Corporation Income Tax Return form It is used to report income gains losses deductions and credits and to determine the income tax liability of a