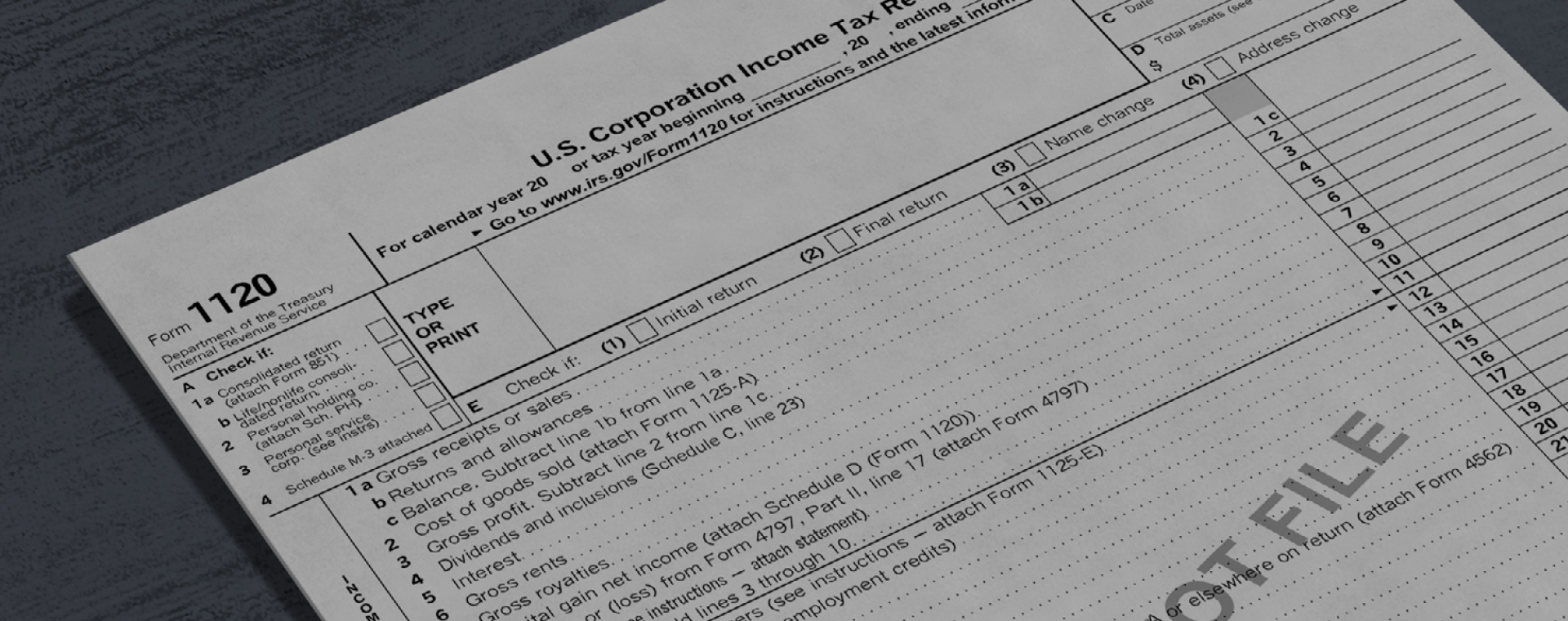

is form 1120 for c corp or s corp Both C and S corporations must file a federal income tax return C corporations use Form 1120 to calculate their taxes due S corporations use Form 1120S as an information return S corporations must also prepare a form 10 K 1 for

When a business is legally structured as a corporation it must also choose between a C Corp or an S Corp status In the U S C corporations report their tax information using Form 1120 A business organized as an S How does Form 1120 differ from Form 1120S Form 1120 is for C corporations and Form 1120S is for S corporations Each form is set up to record the information needed to

is form 1120 for c corp or s corp

is form 1120 for c corp or s corp

https://m.foolcdn.com/media/affiliates/images/S_corp_taxes_-_01_-_Form_1120-S_SLI0Nvc.width-750.png

Delaware C Corp And S Corp How To Determine HazelNews

https://hazelnews.com/wp-content/uploads/2022/05/what-is-the-difference-between-s-corp-and-c-corp-visual.jpg

How To File Tax Form 1120 For Your Small Business 2023

https://m.foolcdn.com/media/affiliates/images/Form_1120_-_01_-_Front_Page_rT0vFkj.width-750.png

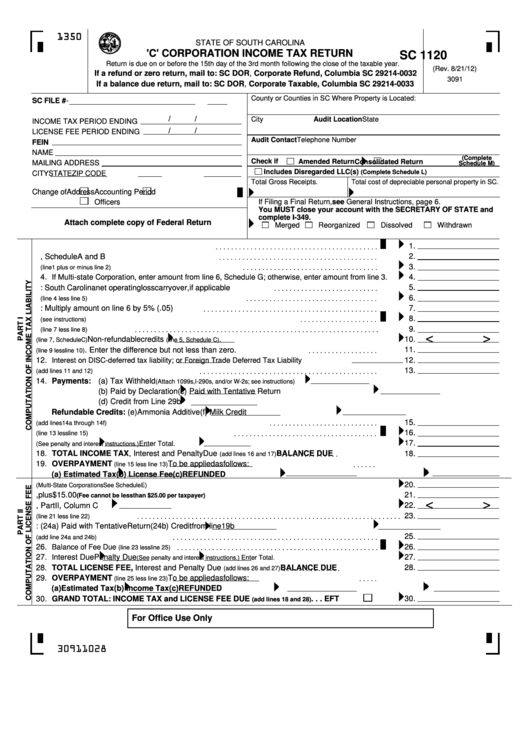

Information about Form 1120 U S Corporation Income Tax Return including recent updates related forms and instructions on how to file Use this form to report the income gains losses Tax requirements are the key attributes that make a C corp a C corp and an S corp an S corp A corporate income tax is first paid by a C corp with a federal return Form

Use Form 1120 S to report the income gains losses deductions credits etc of a domestic corporation or other entity for any tax year covered by an election to be an S corporation They file a corporate tax return Form 1120 and pay taxes at the corporate level They also face the possibility of double taxation if corporate income is distributed to business

More picture related to is form 1120 for c corp or s corp

C Corp Vs S Corp Differences Benefits Comparison Table Mailchimp

https://eep.io/images/yzco4xsimv0y/3EAhKproiQJSpgvH4AT4KV/54fecae83c21708f04b847d95c89b945/MailChimp_Blog_Post_-17_graphic_-1-01__1_.png?w=980&q=70

Fillable Form Sc 1120 C Corporation Income Tax Return Printable Pdf

https://data.formsbank.com/pdf_docs_html/328/3286/328681/page_1_thumb_big.png

LLC S corp Or C corp Guide To Choosing A Business Structure

https://gordonlawltd.com/wp-content/uploads/2021/10/LLC-vs-C-corp-infographic.png

A corporation or other entity must file Form 1120 S if a it elected to be an S corporation by filing Form 2553 b the IRS accepted the election and c the election remains in effect After filing Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax

C corporations or c corps are considered separate entities to their owners shareholders therefore owners do not include the corporation s income tax as part of their So what is an 1120 tax form or a C corp tax form Form 1120 is used by corporations in the United States to report their income and calculate their taxes The form is

Form 1120 C Corp Alon Aharonof CPA

https://aloncpa.com/wp-content/uploads/2020/03/1120-1.png

1120s Due Date

https://www.irs.gov/pub/xml_bc/51221503.gif

is form 1120 for c corp or s corp - Key differences pros and cons and how they are taxed A guide to help decide which type is right for you and steps on how to start a corporation or LLC