what is an 1120 c corporation Any corporation operating on a cooperative basis under section 1381 and allocating amounts to patrons on the basis of business done with or for such patrons should file Form 1120 C

For tax years beginning in 2023 corporations filing Form 1120 and claiming the energy efficient commercial buildings deduction should report the deduction on line 25 See the instructions A C corporation or C corp is a legal structure for a corporation in which the owners or shareholders are taxed separately from the entity C corporations the most prevalent

what is an 1120 c corporation

what is an 1120 c corporation

https://m.foolcdn.com/media/affiliates/images/Form_1120_-_01_-_Front_Page_rT0vFkj.width-750.png

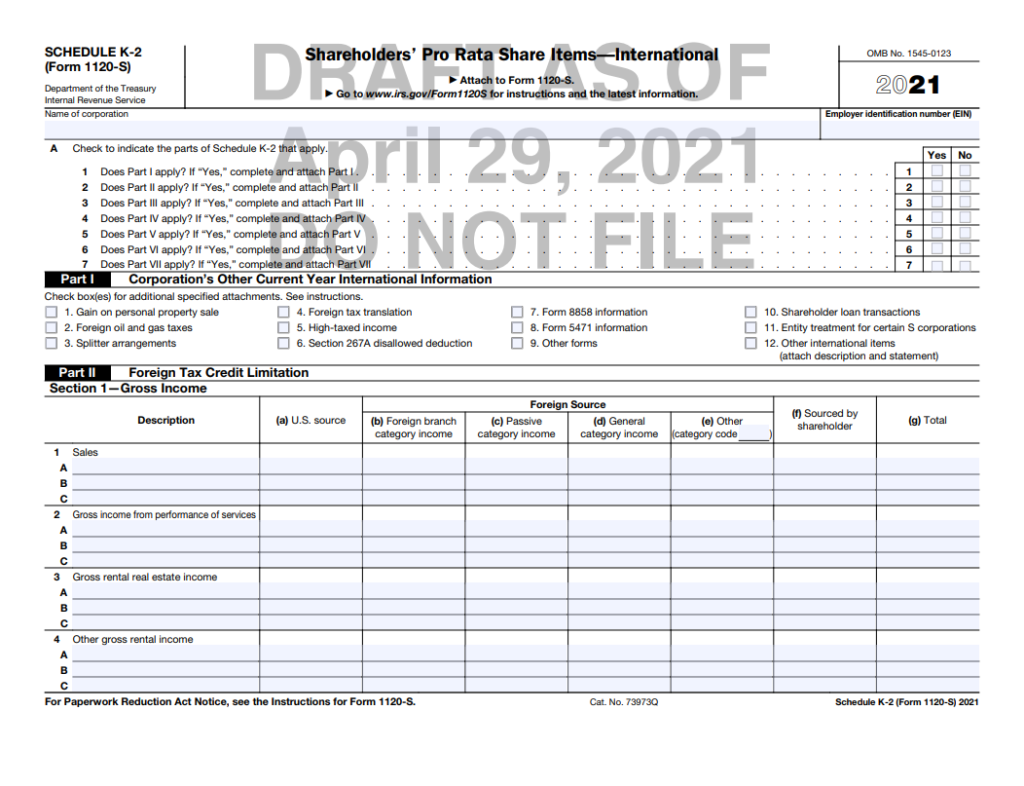

S Corporations Designed For Small Business Reporting Now Directed By

https://cdn-www.westerncpe.com/wp-content/uploads/2022/04/Sched.K-2-Draft-1024x786.png

How To Complete Form 1120s S Corporation Tax Return Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/5w14Hif2akkIcgQa6QgSkk/ba522649e4382133bec2ff9301b05ff6/IRS_Form_1120S.png

Form 1120 C is the annual U S income tax return that must be filed by cooperative associations This form reports income gains losses deductions credits and other tax related information to calculate the Still wondering which documents you need to file an 1120 C Corporation tax return Refer to our tax preparation checklist to easily file your taxes

So what is an 1120 tax form or a C corp tax form Form 1120 is used by corporations in the United States to report their income and calculate their taxes The form is also used to report any gains or losses and any What Is Form 1120 A corporation pays income tax by filing a corporate tax return on Form 1120 and paying the taxes as indicated by this return

More picture related to what is an 1120 c corporation

How To Complete Form 1120S Income Tax Return For An S Corp

https://fitsmallbusiness.com/wp-content/uploads/2017/02/Form-1120S-Schedule-B-Other-Information.png

Us Gov Tax Forms 2020 Form Resume Examples Kw9kDZKYJN

https://www.contrapositionmagazine.com/wp-content/uploads/2020/07/pdf-tax-forms.jpg

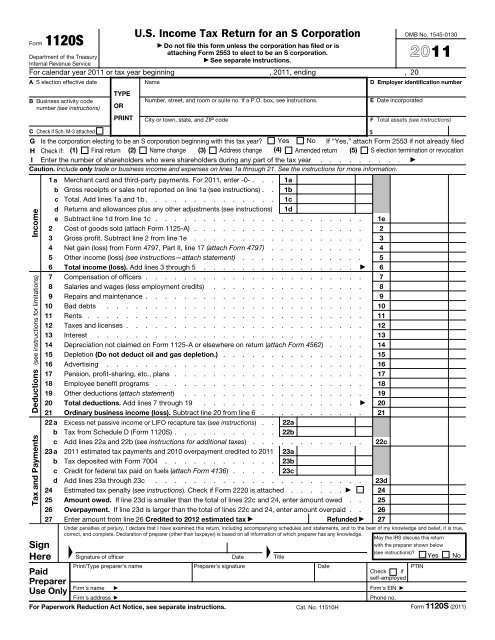

U S Income Tax Return For An S Corporation IRS Video Portal

https://img.yumpu.com/36003600/1/500x640/us-income-tax-return-for-an-s-corporation-irs-video-portal.jpg

What is Form 1120 Form 1120 the U S Corporation Income Tax Return is the form used by C corporations to report their income gains losses deductions and credits to Use Screen 54 2 Cooperative Associations 1120 C to enter information for Form 1120 C Click the links below to see solutions for frequently asked questions concerning

An S corp is a pass through entity that reports its profits on the owners personal taxes and ownership is restricted to up to 100 shareholders If you structure The IRS requires C Corps to file Form 1120 by April 15th of each year and neglecting to file Form 1120 on time can result in late filing penalties late payment penalties interest

How To Fill Out Form 1120S Or U S Income Tax Return For An S

https://i.ytimg.com/vi/gn4p9cF3MJ4/maxresdefault.jpg

What Is The Purpose Of Schedule M 1 On Form 1120 YouTube

https://i.ytimg.com/vi/emJ0fkv-xzA/maxresdefault.jpg

what is an 1120 c corporation - Still wondering which documents you need to file an 1120 C Corporation tax return Refer to our tax preparation checklist to easily file your taxes