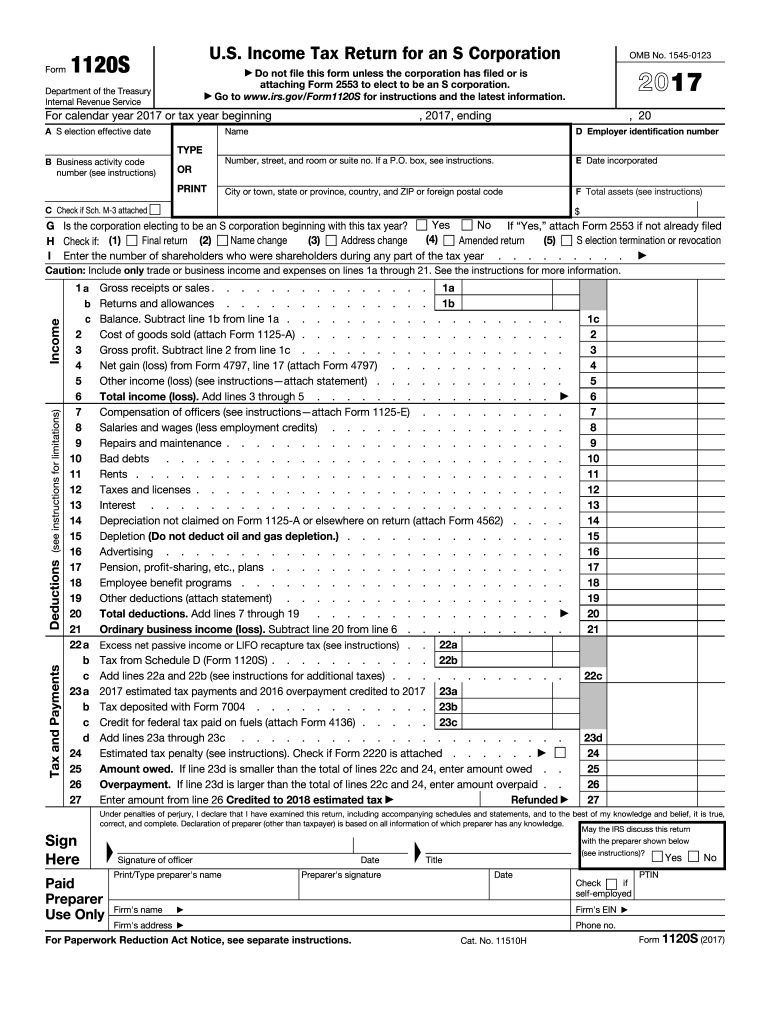

form 1120 s example Form 1120 S Department of the Treasury Internal Revenue Service U S Income Tax Return for an S Corporation Do not file this form unless the corporation has filed or is attaching Form

Form 1120 S is a U S Income Tax Return form used by S Corporations S corps to report income gains losses deductions and credits to the Internal Revenue Service IRS A sample 1120 S form is available S corporations can generally electronically file e file Form 1120 S related forms schedules statements and attachments Form 7004 automatic extension of time to file and Forms 940

form 1120 s example

form 1120 s example

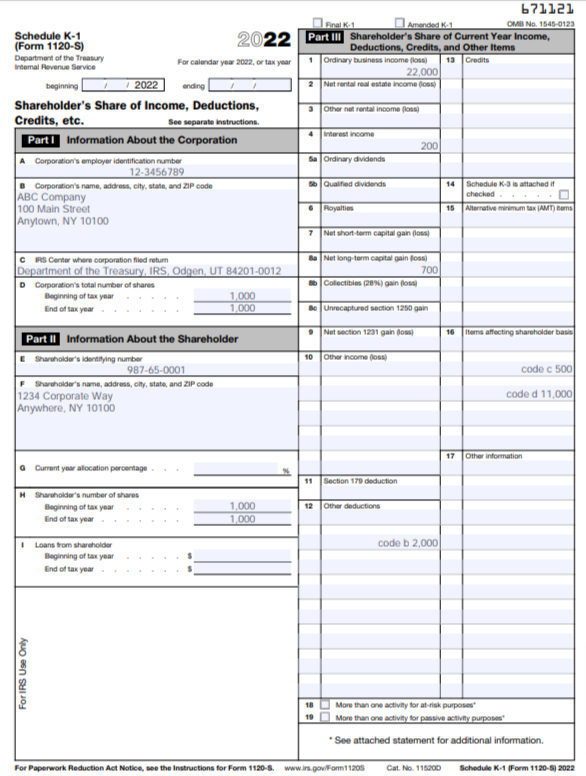

https://fitsmallbusiness.com/wp-content/uploads/2023/03/Screenshot_2022_Schedule_K_1_Form_1120-S.png

Form 1120S TRUiC

https://cdn.startupsavant.com/images/how-to-guides/s-corp/screenshot-1120s.jpg

How To Fill Out Form 1120 S

https://s36394.pcdn.co/wp-content/uploads/2023/02/Untitled-design-2.jpg

IRS Form 1120 S is specifically designed to report the income gains losses deductions credits and other financial information of a domestic corporation or other entity that has elected to be an S Corporation in the United States If you own an S corp or share ownership in one with others you ll use Schedule K 1 Form 1120S to report your share of income from the S corp at the end of the year If you are an owner of an LLC that has elected to be taxed as an S corp

Form 1120S is the tax form S corporations use to file their federal income tax return not to be confused with Form 1120 for C corporations Every S corp needs to file one including LLCs that are taxed as S corps Form 1120 S is used by S corporations to report their annual income gains losses deductions and credits to the IRS The form facilitates the pass through taxation unique to S corporations where income is taxed at the

More picture related to form 1120 s example

1120s Form Fill Out And Sign Printable PDF Template AirSlate SignNow

https://www.signnow.com/preview/425/425/425425022/large.png

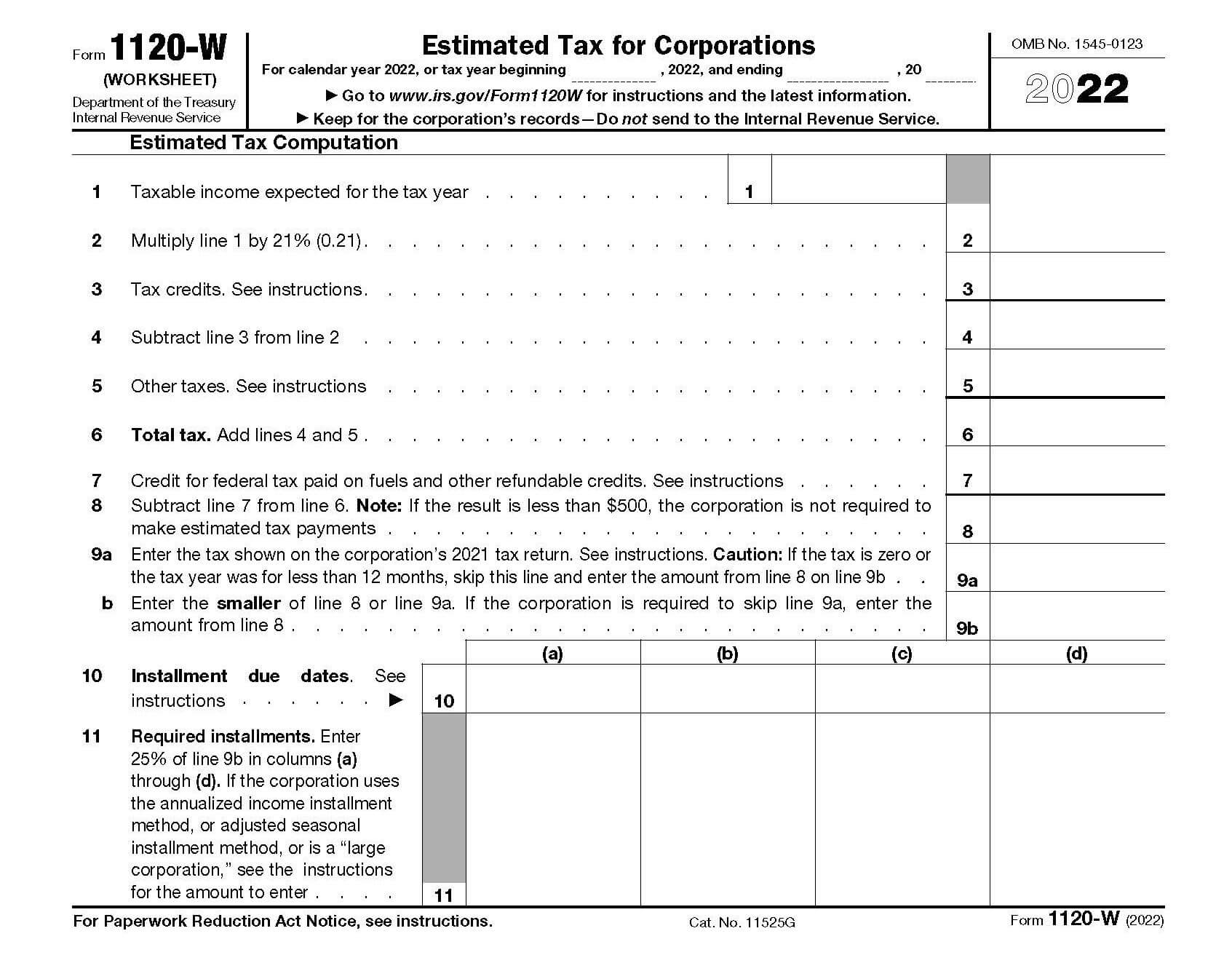

Who Should Use IRS Form 1120 W

https://www.taxdefensenetwork.com/wp-content/uploads/2022/03/f1120w-instructions.jpg

Free IRS Tax Form 1120 S Template Google Sheets Excel LiveFlow

https://assets-global.website-files.com/61f27b4a37d6d71a9d8002bc/63ec45b850c0540c81facd19_IRS Tax Form 1120-S Template.png

So if your business is an S corp or taxed as one you ll have to file Form 1120 S as your company s federal income tax return Specifically this form tells the IRS how much your company earned your business income deductions and tax Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax

Form 1120 S requires you to report the income gains losses deductions and credits of your S corporation in addition to the distributions and allocations the corporation Learn how to file Form 1120S and Schedule K 1 for shareholders with step by step instructions for your tax return Make the most of your S Corp election when filing form 1120 S

:max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png)

IRS Form 1120 What Is It

https://www.thebalancemoney.com/thmb/-wWRc3-qPvbfC-d8ZzAm86DCMq4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Screenshot45-f76774c4039648ed86335a5aaa861e8f.png

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

form 1120 s example - To have a better understanding of how taxes work and how to maximize deductions take a look at IRS Form 1120 S that I completed for my S Corp this year