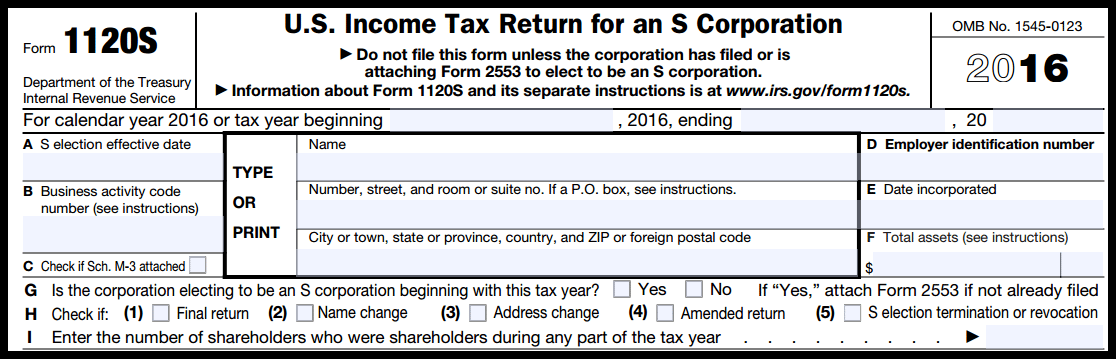

form 1120 s instructions Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations

Learn how to fill out Form 1120S the annual return for S corporations and Schedule K 1 the shareholder report Get a free checklist financial statements an If you ve made an adjustment on your S corp return you will need to submit Form 1120 S Learn how to amend an S corp return with Form 1120 S in five steps

form 1120 s instructions

form 1120 s instructions

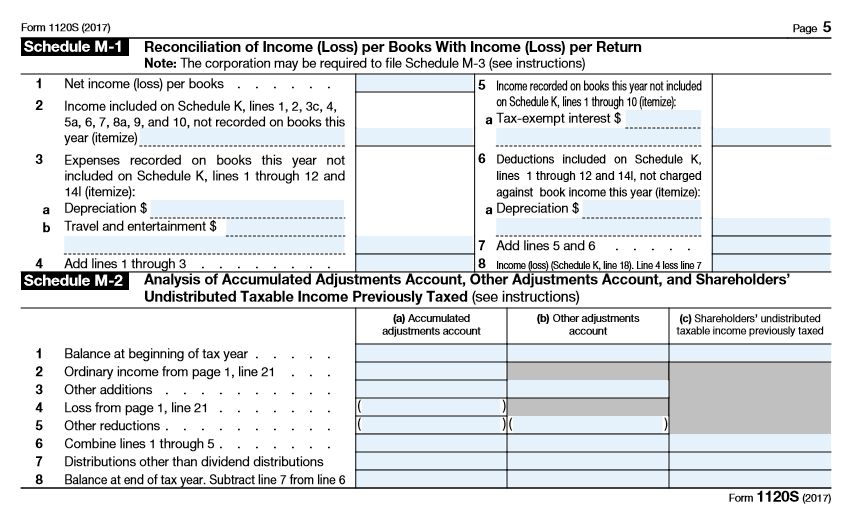

http://static1.squarespace.com/static/54a14f8ee4b0bc51a1228894/54a14fdbe4b0bcb26c29e8c6/61ec03a5dd3bd571875aad40/1642857784229/f1120s_Page_5.jpg?format=1500w

Draft 2019 Form 1120 S Instructions Adds New K 1 Statements For 199A

https://images.squarespace-cdn.com/content/v1/54a14f8ee4b0bc51a1228894/1571479831011-9ULUZI2UVXHZVXTT13YU/ke17ZwdGBToddI8pDm48kIqi_qRMM7ZLWpsx2eKQykoUqsxRUqqbr1mOJYKfIPR7LoDQ9mXPOjoJoqy81S2I8N_N4V1vUb5AoIIIbLZhVYy7Mythp_T-mtop-vrsUOmeInPi9iDjx9w8K4ZfjXt2dsYdNxArdx1V9qzwUVh9aeeY0DPUrvSrXniQIaIXpsF23WUfc_ZsVm9Mi1E6FasEnQ/Instructions%2BForm%2B1120-S%2B199A%2BChecklist.jpg

Fill Out The 1120S Form Including The M 1 M 2 With Chegg

https://media.cheggcdn.com/media/e63/e63bdf49-a965-4ee6-b546-748f7b0fb889/phpzQ34qC.png

Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and other credits for the tax year Form 1120 S is used by S corporations to report their annual income gains losses deductions and credits to the IRS The form facilitates the pass through taxation unique to S corporations where income is taxed at the

This guide will walk through step by step instructions for filling out Form 1120S with key strategies to file accurately and avoid common mistakes Use Form 1120 S to report the income gains losses deductions credits and other information of a domestic corporation or other entity for any tax year covered by an

More picture related to form 1120 s instructions

IRS Form 1120S Definition Download Filing Instructions

https://fitsmallbusiness.com/wp-content/uploads/2018/02/form-1120s-general-info-section.png

Instructions For IRS Form 1120S Schedule M 3 Net Income Loss Fill

https://www.pdffiller.com/preview/488/93/488093794/big.png

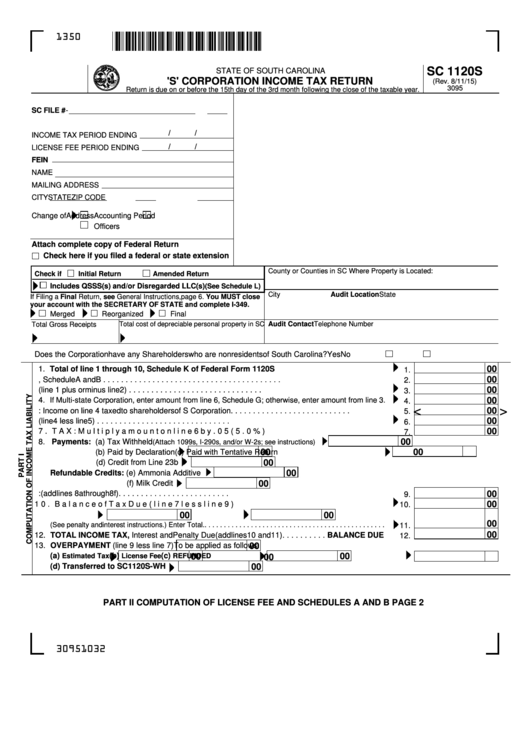

Form Sc 1120s S Corporation Income Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/327/3279/327953/page_1_thumb_big.png

Use Form 1120 U S Corporation Income Tax Return to report the income gains losses deductions credits and to figure the income tax liability of a corporation Form 1120 S is the annual tax return for S corporations It must be filed with the IRS by the 15th of the third month following the end of the corporation s tax year

Need instructions for Form 1120S If your business is an S corp or taxed as one you will have to file Form 1120S as your company s federal income tax return Form 1120 S is an Internal Revenue Service form that S Corporations use to report the company s financial activity for each tax year Learn how to file in 2023

1120s 2014 Form Form Resume Examples goVLr409va

http://www.contrapositionmagazine.com/wp-content/uploads/2020/03/1120s-2014-form.jpg

How Do I Fill Out Form 1120S Gusto

https://gusto.com/wp-content/uploads/2019/06/Form-1120S-instructions-Schedule-B.png

form 1120 s instructions - Form 1120 Schedule M 2 Increases and Decreases Canceling the appropriated retained earnings for the cost of treasury stock will increase unappropriated retained earnings