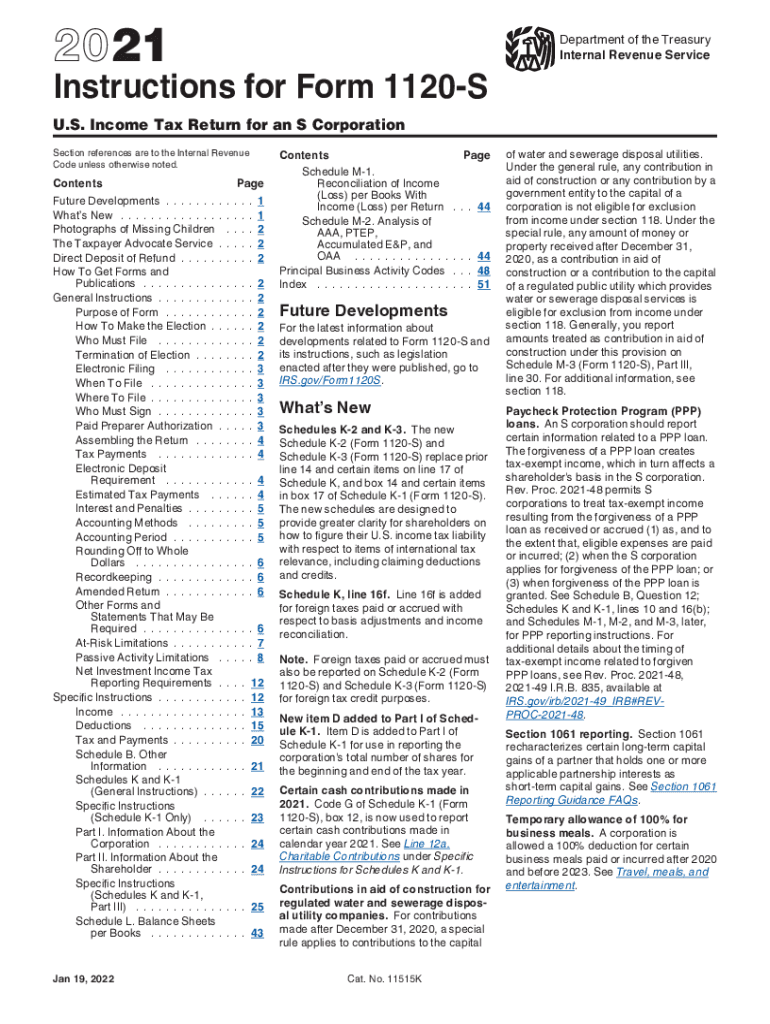

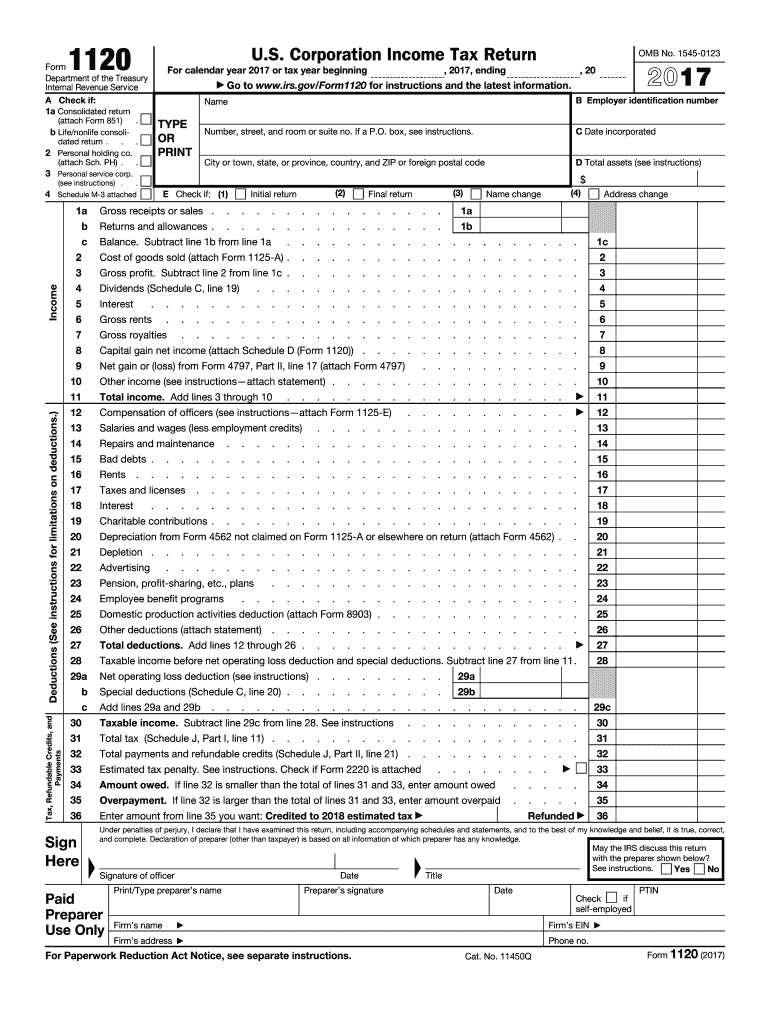

irs form 1120 s instructions 2021 Corporations must file Form 1120 unless they are required or elect to file a special return See Special Returns for Certain Organizations later Entities electing to be taxed as corpo rations

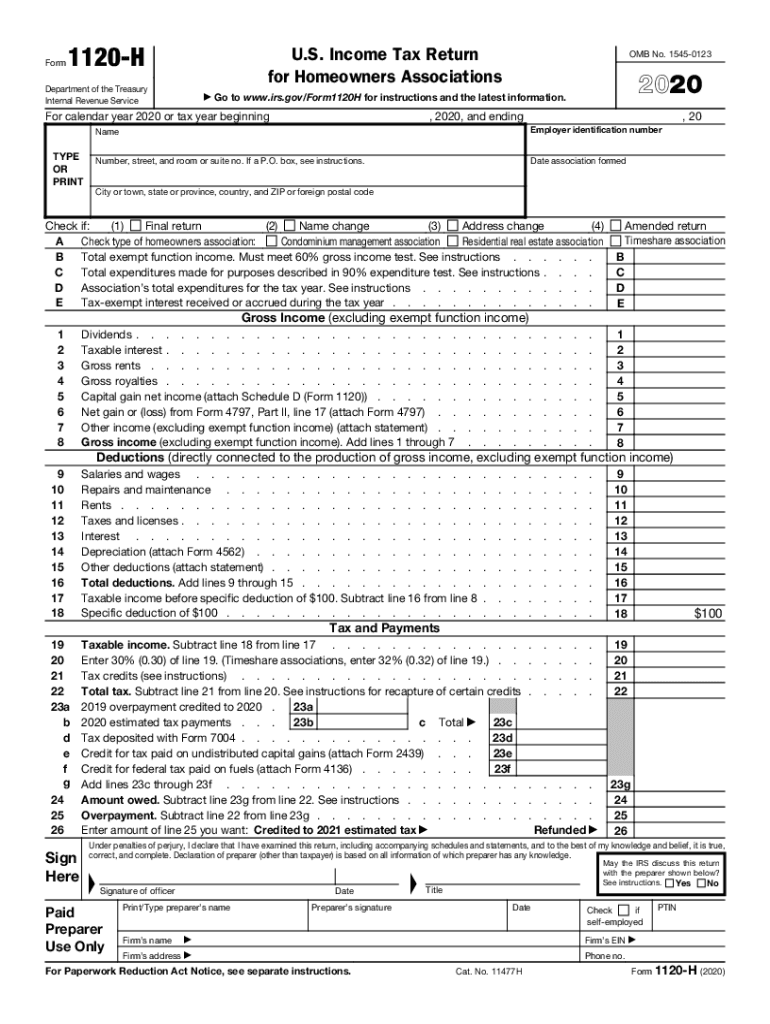

Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations If you own an S corp or share ownership in one with others you can expect to receive Form 1120S K 1 at the end of the year Here s how you use it

irs form 1120 s instructions 2021

irs form 1120 s instructions 2021

https://www.pdffiller.com/preview/590/443/590443099/large.png

Irs Tax Forms 2021 Printable Example Calendar Printable Gambaran

https://www.pdffiller.com/preview/535/780/535780954/large.png

1120s Due Date

https://www.irs.gov/pub/xml_bc/51221503.gif

IRS Form 1120S Information you ll need to file Form 1120S Before you jump in to the form you ll need to have the following items handy Your date of incorporation A list of your products or services Your business activity code The IRS has issued the final Form 1120 S U S Income Tax Return for an S Corporation for use in tax years beginning in 2020 as well as draft instructions for the form

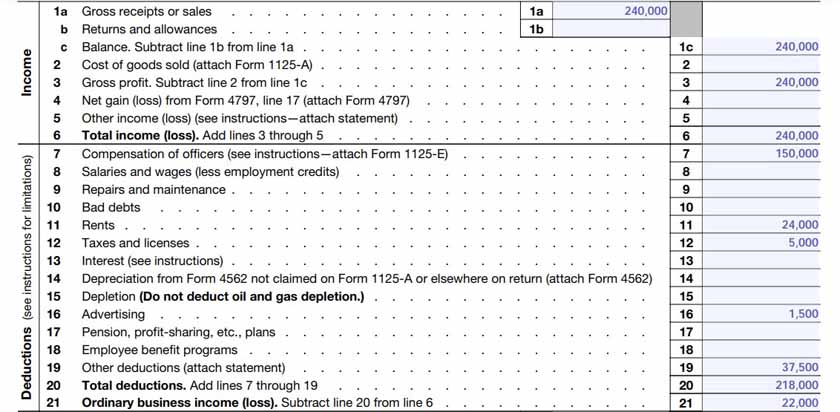

Learn to complete Form 1120S including detailed instructions on how to answer the questions on Schedule B Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax

More picture related to irs form 1120 s instructions 2021

How To Complete Form 1120S Schedule K 1 Free Checklist

https://fitsmallbusiness.com/wp-content/uploads/2023/03/Screenshot_IRS_1120_S_lline__-through_21.jpg

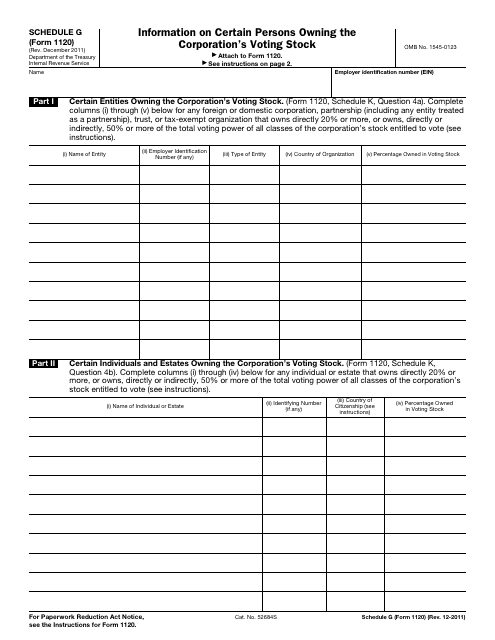

IRS Form 1120 Schedule G Fill Out Sign Online And Download Fillable

https://data.templateroller.com/pdf_docs_html/605/6056/605691/irs-form-1120-schedule-g-information-on-certain-persons-owning-the-corporation-s-voting-stock_big.png

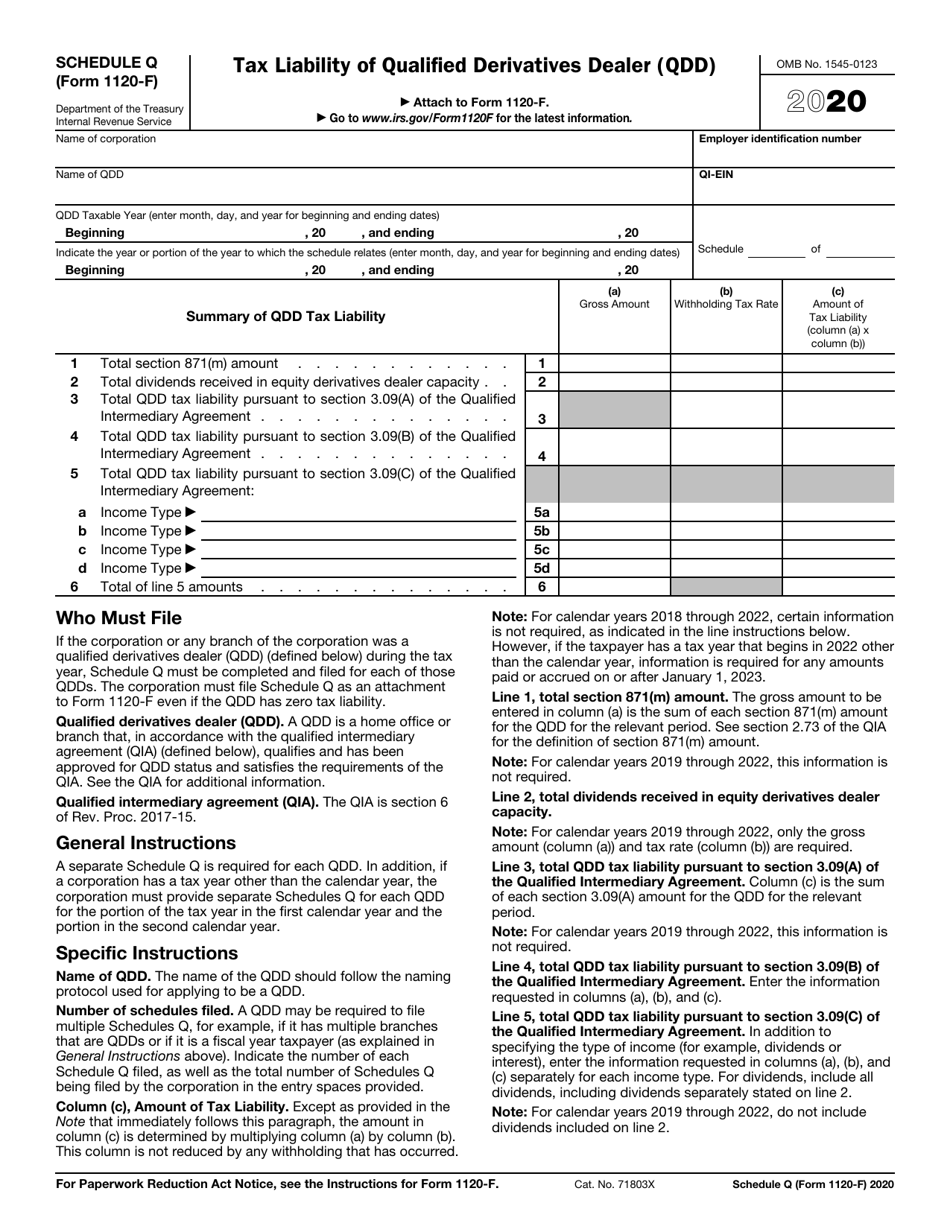

IRS Form 1120 F Schedule Q Download Fillable PDF Or Fill Online Tax

https://data.templateroller.com/pdf_docs_html/2117/21172/2117285/irs-form-1120-f-schedule-q-tax-liability-of-qualified-derivatives-dealer-qdd_print_big.png

Schedule K 1 Form 1120 S and its instructions such as legislation enacted after they were published go to IRS gov Form1120S What s New Schedule K 3 New Schedule K 3 replaces Form 1120 S is the annual tax return for S corporations It must be filed with the IRS by the 15th of the third month following the end of the corporation s tax year

IRS Form 1120 S is specifically designed to report the income gains losses deductions credits and other financial information of a domestic corporation or other entity that has elected to be an S Corporation in the United States Step by Step Instructions YouTube For more Form 1120 S tutorials youtube playlist list PLTdpzKOWNutQW Aofody 1p5EyeaB9MkVHow

1120 For Year 2020 2023 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/533/156/533156818/large.png

Irs Form 1120 Fill Out And Sign Printable PDF Template AirSlate SignNow

https://www.signnow.com/preview/431/171/431171310/large.png

irs form 1120 s instructions 2021 - IRS Form 1120S Information you ll need to file Form 1120S Before you jump in to the form you ll need to have the following items handy Your date of incorporation A list of your products or services Your business activity code