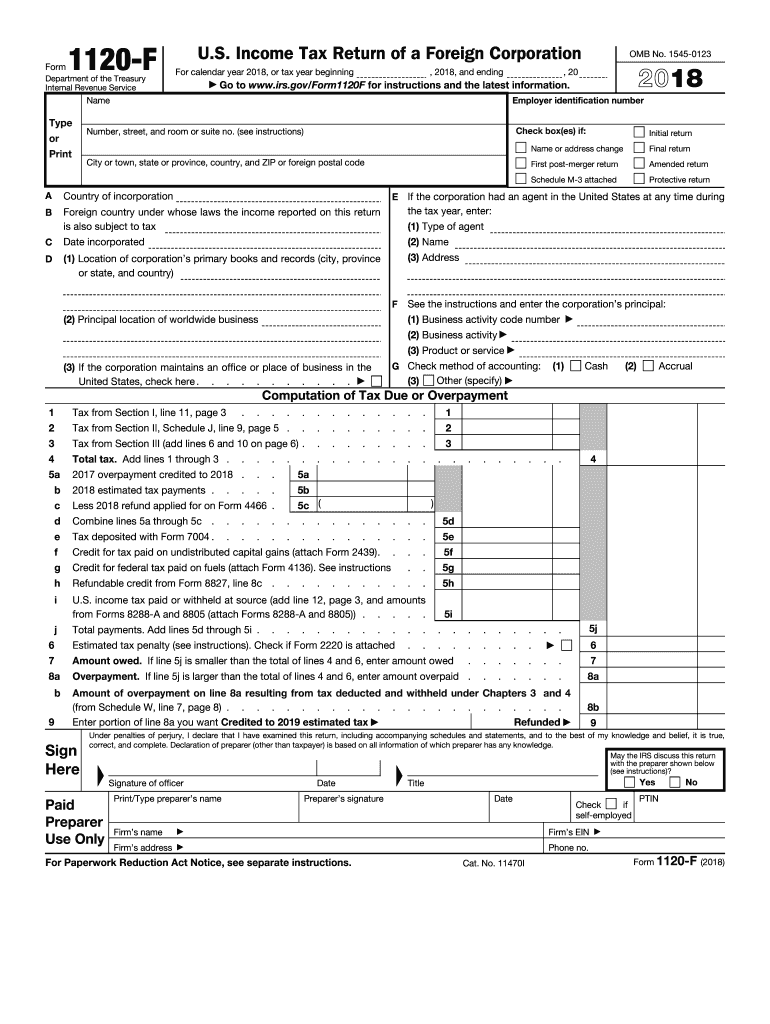

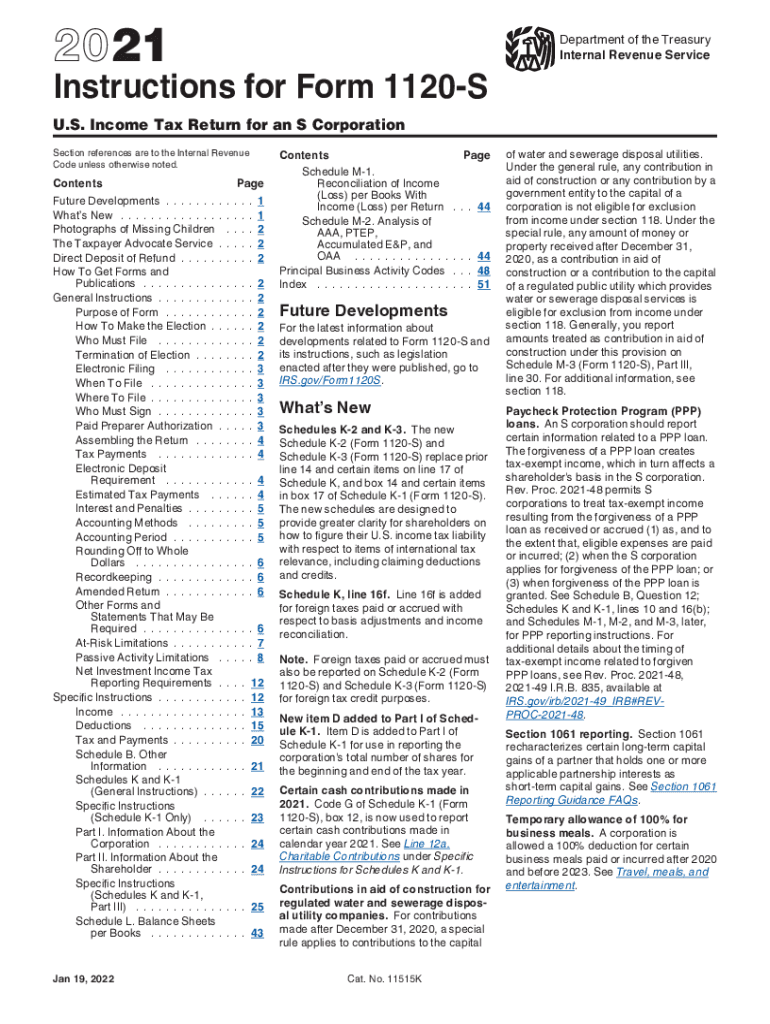

form 1120 s instructions 2020 The IRS has issued the final Form 1120 S U S Income Tax Return for an S Corporation for use in tax years beginning in 2020 as well as draft instructions for the form

IRS Form 1120S 2020 U S Income Tax Return for an S Corporation This form is used to report the income gains losses deductions credits and other relevant financial information of a domestic corporation or eligible entity that has Department of the Treasury 2020 Internal Revenue Service Shareholder s Instructions for Schedule K 1 Form 1120 S Shareholder s Share of Income Deductions Credits etc For Shareholder s Use Only Section references are

form 1120 s instructions 2020

form 1120 s instructions 2020

https://support.taxslayer.com/hc/article_attachments/17604583957133

How To Fill Out Schedule K 1 Form 1120 S YouTube

https://i.ytimg.com/vi/GCzfxDlWGSY/maxresdefault.jpg

1120s Due Date

https://www.irs.gov/pub/xml_bc/51221535.gif

Learn to complete Form 1120S including detailed instructions on how to answer the questions on Schedule B S corporations can generally electronically file e file Form 1120 S related forms schedules statements and attachments Form 7004 automatic extension of time to file and Forms 940

Form 1120 S is the annual tax return for S corporations It must be filed with the IRS by the 15th of the third month following the end of the corporation s tax year Information about Form 1120 S U S Income Tax Return for an S Corporation including recent updates related forms and instructions on how to file Form 1120 S is used by corporations

More picture related to form 1120 s instructions 2020

Irs 1120 2018 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/460/871/460871940/large.png

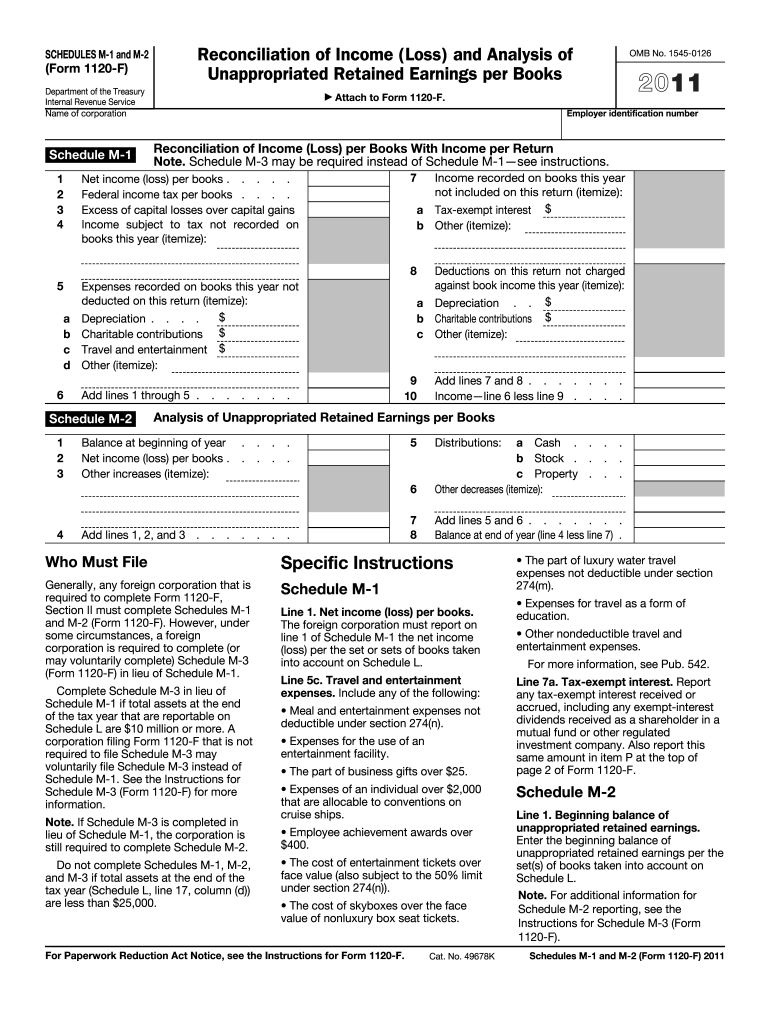

Form 1120 M 2 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/1/649/1649203/large.png

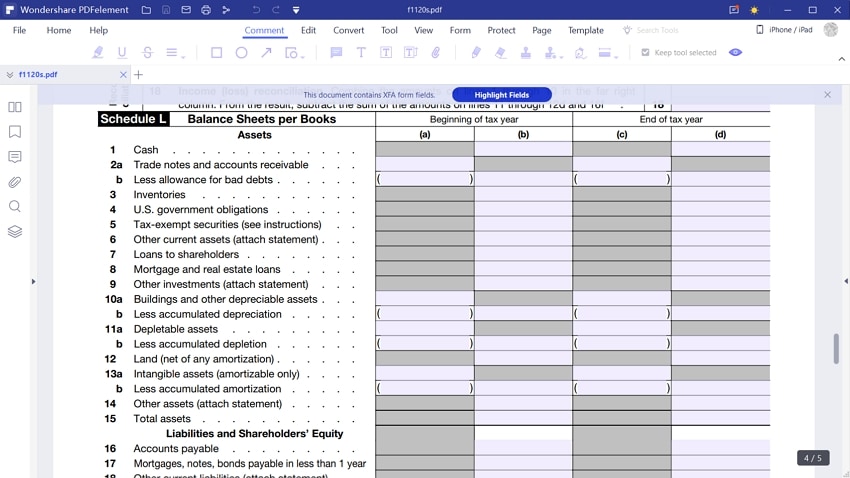

IRS Form 1120S Instructions To Fill It Right

https://images.wondershare.com/pdfelement/pdfelement/guide/irs-form-1120s-05.jpg

Form 1120 S is the vehicle through which an S corporation declares its income losses deductions and credits for the tax year It s the instrument by which the corporation calculates its taxable income and tax To have a better understanding of how taxes work and how to maximize deductions take a look at IRS Form 1120 S that I completed for my S Corp this year

Form 1120 S is the income tax return form for businesses that have elected to be taxed as S Corps It is used to report the company s income gains losses deductions and Form 1120 S is an important tax document used by S corporations to report their income gains losses deductions and credits as well as to determine their tax liability

2021 Form IRS Instructions 1120S Fill Online Printable Fillable

https://www.pdffiller.com/preview/590/443/590443099/large.png

IRS Form 1120S Schedule K 1 2020 Shareholder s Share Of Income

https://lh3.googleusercontent.com/5_zpuYMba3N7eazY7Z9ySHRJKB5cQ1jdZRduV6EZqGmJeKrUYBbSozNM-zkOOAs=w1200-h630-p

form 1120 s instructions 2020 - Form 1120 S is the annual tax return for S corporations It must be filed with the IRS by the 15th of the third month following the end of the corporation s tax year