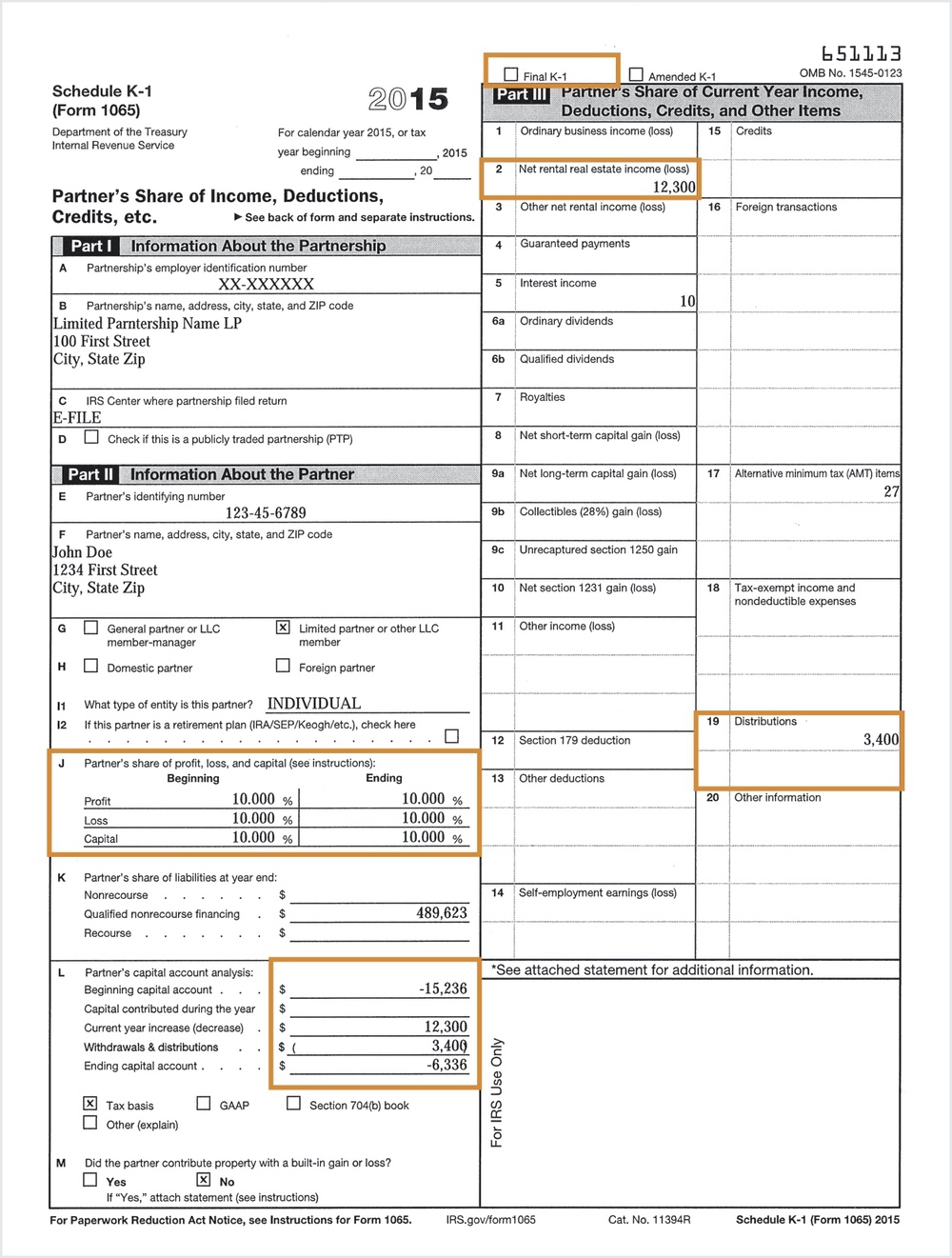

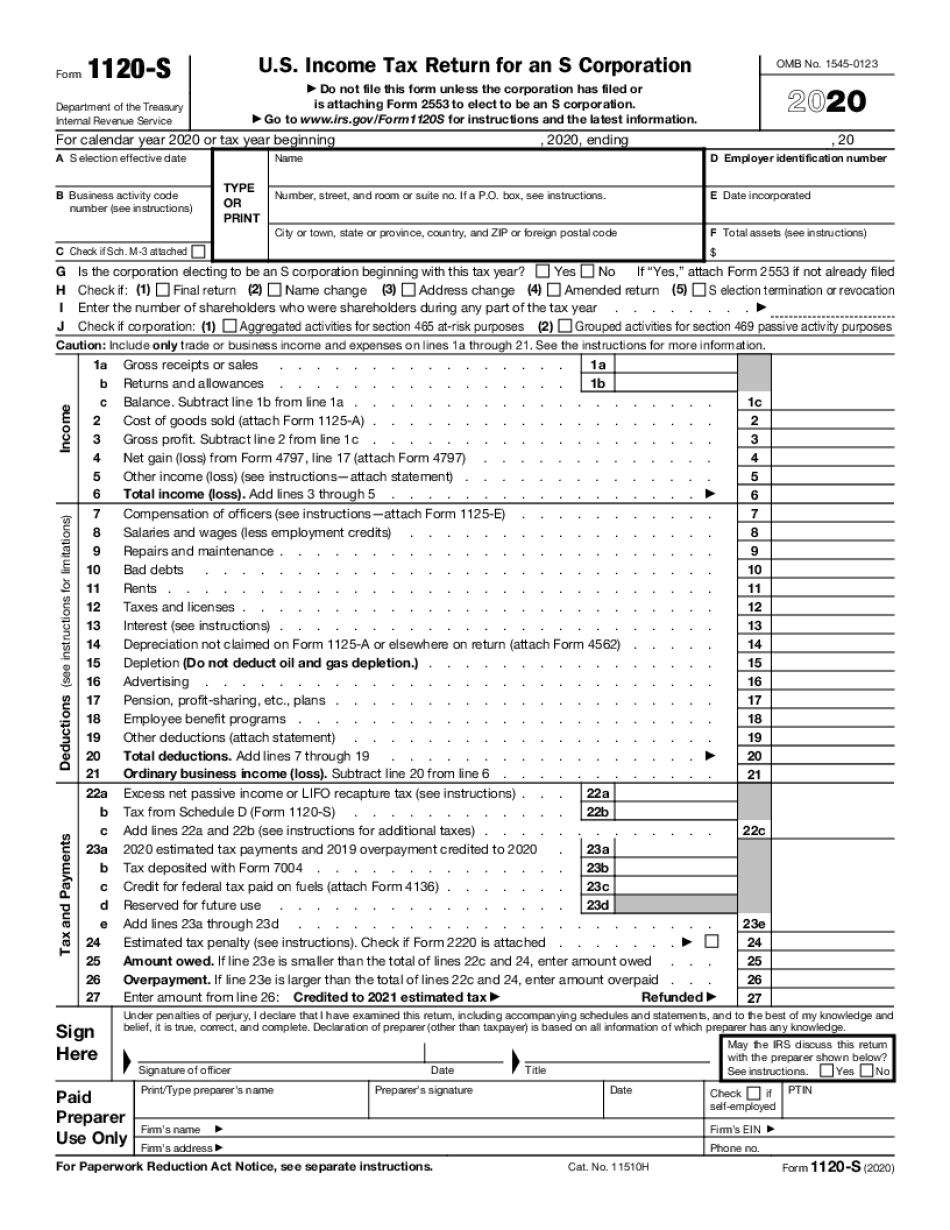

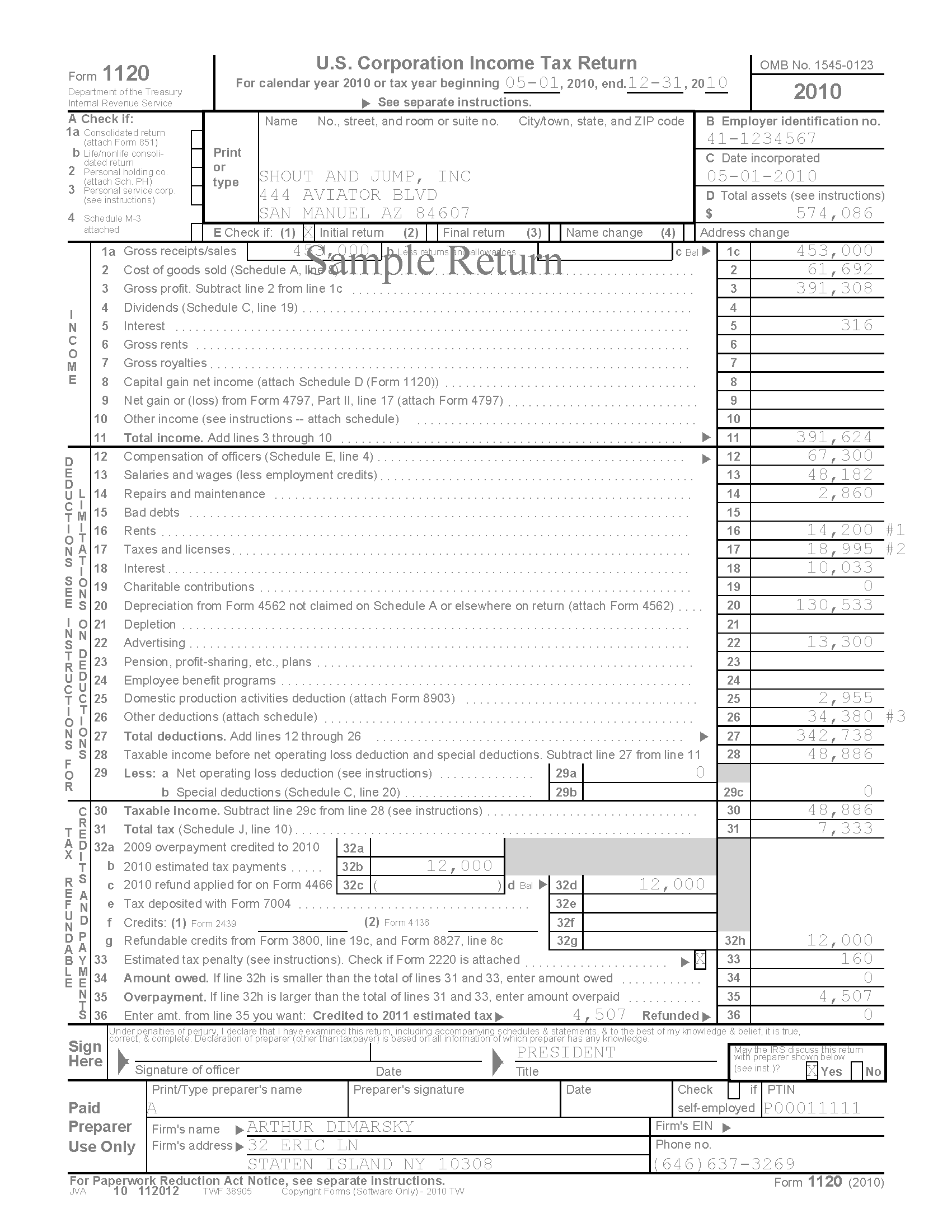

what is k1 1120s 1120S K 1 formally known as Schedule K 1 Form 1120S is an IRS tax form used by owners and investors of S corporations You can find a blank copy of the Schedule K 1 for Form 1120S on

Schedule K 1 is a federal tax document used to report the income losses and dividends for a business or financial entity s partners or an S The 1120 S Schedule K 1 reports a shareholder s allocated share of income losses deductions and credits from an S corporation Understanding how to read and

what is k1 1120s

what is k1 1120s

https://lh3.googleusercontent.com/5_zpuYMba3N7eazY7Z9ySHRJKB5cQ1jdZRduV6EZqGmJeKrUYBbSozNM-zkOOAs=w1200-h630-p

Printable K 1 Tax Form

https://lpequity.com/wp-content/uploads/2021/02/K1-Blank-ExampleC.jpg

2020 1120s Editable Online Blank In PDF

https://www.pdffiller.com/preview/539/32/539032318/big.png

Form 1120S Schedule K 1 is issued to shareholders of an S corporation detailing their share of the corporation s income deductions credits and other tax related Each shareholder is provided a Schedule K 1 by the corporation The K 1 reflects the shareholder s share of income deductions credits and other items that the shareholder will

Learn how to file Form 1120S and Schedule K 1 for shareholders with step by step instructions for your tax return Make the most of your S Corp election when filing form 1120 S Schedule K 1 is an Internal Revenue Service IRS tax form issued annually to the individuals in business partnerships The purpose of Schedule K 1 is to report each partner s share of the

More picture related to what is k1 1120s

1120S Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

https://kb.drakesoftware.com/Site/Uploads/Images/10411 image 1.jpg

Tax Return K1 Tax Return

http://servicesfortaxpreparers.com/wp-content/uploads/2011/08/Pages-from-1120-SAMPLE.png

1120s Due Date

https://www.irs.gov/pub/xml_bc/51221535.gif

This article focuses solely on the entry of the Items Affecting Shareholder Basis which are found on Box 16 of the Schedule K 1 Form 1120S Shareholder s Share of Income Deductions Schedule K 1 Form 1120 S 2023 Department of the Treasury Internal Revenue Service For calendar year 2023 or tax year beginning 2023 ending Shareholder s Share of Income

Schedule K 1 Form 1120 S is a source document that is filed with the S corporation income tax return Form 1120 S After filing Form 1120 S the corporation gives each shareholder their But the key thing to remember is that S Corporations still need to file tax returns the details of which are outlined below The tax forms that are required of S Corporations include

1120S Entering Officer Information Form 1125 E

https://kb.drakesoftware.com/Site/Uploads/Images/16986 image 1.jpg

S Corp Schedule K 1 Form 1120S A Simple Guide Accracy Blog

https://assets-global.website-files.com/645d153299ce00e5b32eb70b/64beb81b962a9cd20f6b8ed6_2021_Schedule_K1.png

what is k1 1120s - Schedule K 1 Form 1120 S and its instructions such as legislation enacted after they were published go to IRS gov Form1120S What s New Schedule K 3 New Schedule K 3 replaces