what is line 16b on 1120s k1 Don t include any tax exempt income on lines 1a through 5 A corporation that receives any tax exempt income other than interest or holds any property or engages in any activity that

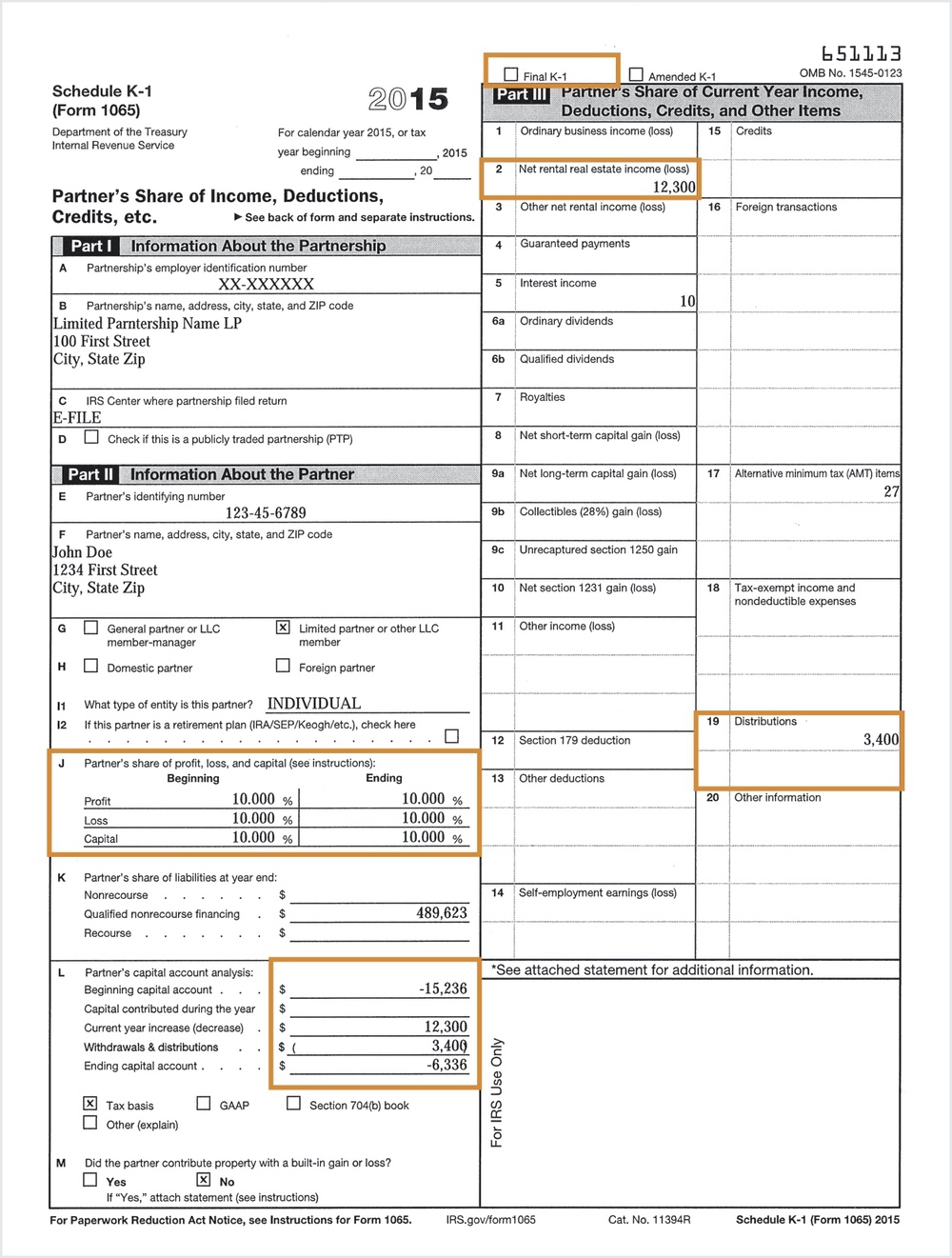

Line 16B Other Tax Exempt Income This amount represents the taxpayer s other tax exempt income This amount is not reported on the Form 1040 Instead the taxpayer Line 16b Gross Income From all Sources Code B Enter the partnership s gross income from all sources both U S and foreign Enter the total gross income of the partnership that is

what is line 16b on 1120s k1

what is line 16b on 1120s k1

https://images.ctfassets.net/ifu905unnj2g/7iN95exYWHPQtCKOneyc2W/0cc26d39d8d25dd1298bcf8c5eb8dbab/2021_Schedule_K1.png

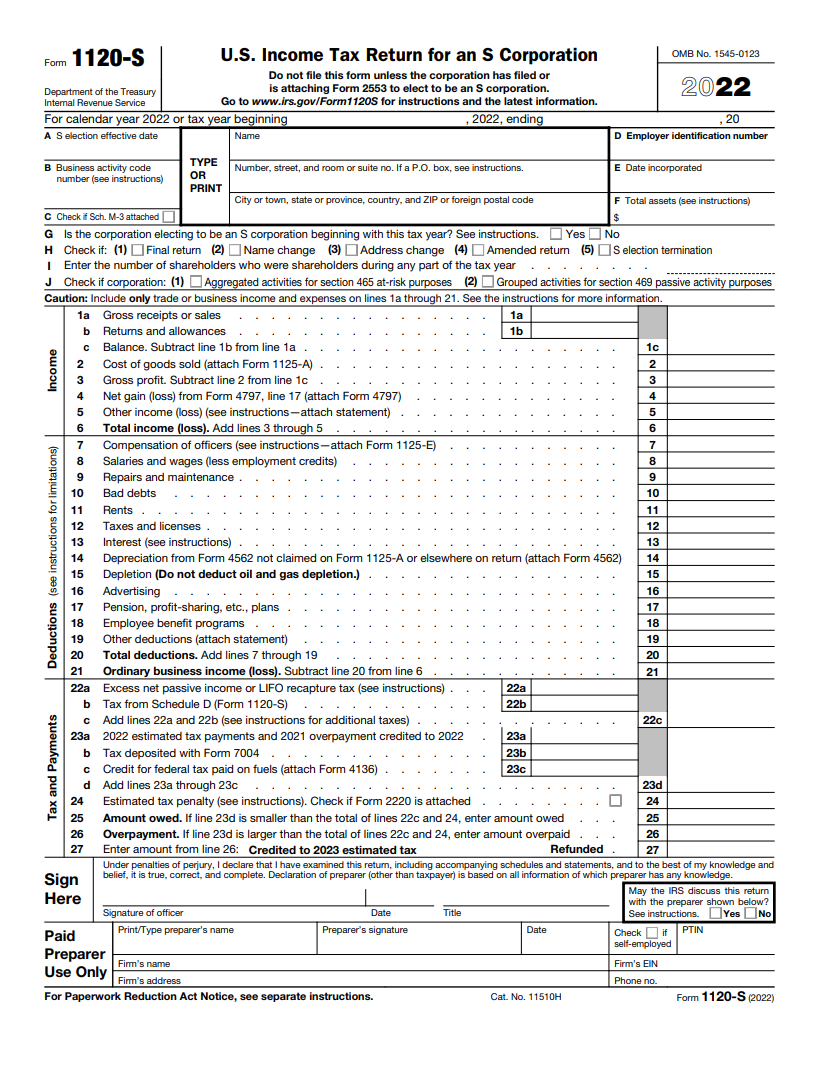

Form 1120s Due Date 2023 Printable Forms Free Online

https://images.ctfassets.net/ifu905unnj2g/4FLzdMpcEuGe2ymQGDQctA/93f56fdd486e39037f08c84294d711c7/2022_Form_1120-S.png

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Deadline For K1 Form 2023 Printable Forms Free Online

https://www.investopedia.com/thmb/W6GLzh84o8Vbv2Z7QBTqOnRkFw4=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png

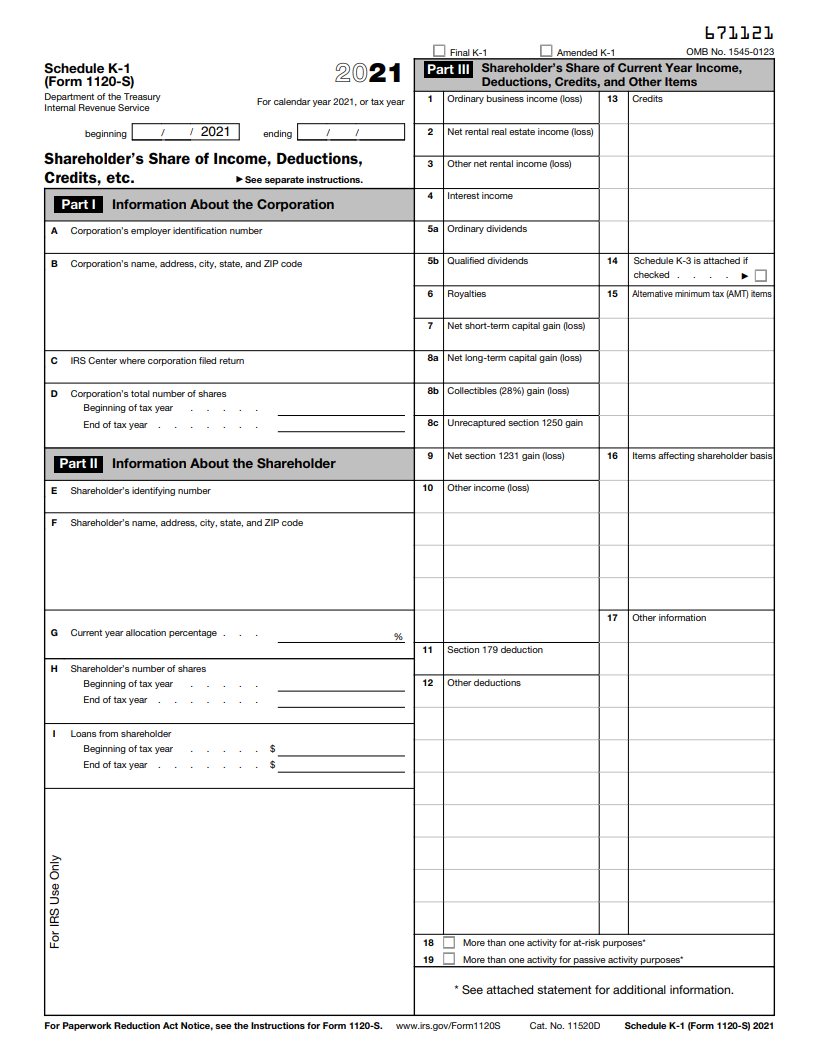

What is Schedule K 1 Form 1120S 1120S K 1 formally known as Schedule K 1 Form 1120S is an IRS tax form used by owners and investors of S corporations You can find a blank copy of the Schedule K 1 for Form 1120S on the IRS Loan repayments to shareholders are reported on Schedule K Line 16e and on each individual shareholder s Schedule K 1 line 16 with E as the reference code Payments to

Schedule K 1 Form 1120 S Credits AMT and Items Affecting Basis Boxes 13 16 Box 13 Credits Code O Backup Withholding Taxpayer s share of the credit for backup withholdings While the 2020 instructions still appear to be in draft form the coding for this item remains the same as that in 2019 You will use code D on line 16 of the Schedule K 1

More picture related to what is line 16b on 1120s k1

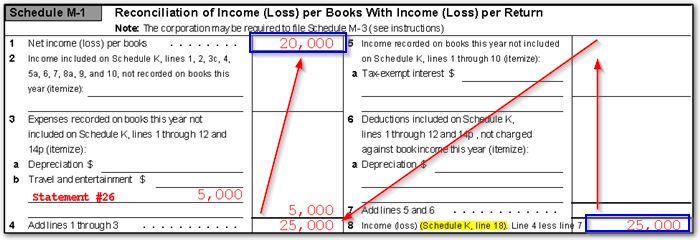

1120S Calculating Book Income Schedule M 1 And M 3 K1 M1 M3

https://drakesoftware.com/Site/Uploads/Images/10411 image 1.jpg

1040 Distributions In Excess Of Basis From 1120S

https://kb.drakesoftware.com/Site/Uploads/Images/16511 image 2.jpg

2023 K1 Form Printable Forms Free Online

https://lpequity.com/wp-content/uploads/2021/02/K1-Blank-ExampleC.jpg

I ve been looking at 1120s and couldn t find where to report shareholder capital contributions I see there is Schedule L line 23 but that s only for when assets receipts are 250k What Title 2022 Shareholder s Instructions for Schedule K 1 Form 1120 S Author brenda Created Date 2 1 2023 1 37 48 PM

The K 1 1120 S Edit Screen has a line for each box on found on the Schedule K 1 Form 1120 S that the taxpayer received A description of the items contained in boxes 11 and 12 including The corporation files a copy of Schedule K 1 with the IRS For your protection Schedule K 1 may show only the last four digits of your identifying number social security number SSN

All About Schedule K 1 Filling Of Form 1065

https://www.deskera.com/blog/content/images/2021/12/kelly-sikkema-wDghq14BBa4-unsplash.jpg

Schedule K 1 Form 1120 S Shareholder s Share Of Income Overview

https://support.taxslayer.com/hc/article_attachments/17604583957133

what is line 16b on 1120s k1 - The K 1 1120S Edit Screen has two distinct sections entitled Heading Information and Income Deductions Credits and Other Items See KB Articles on 1120S Income 1120S