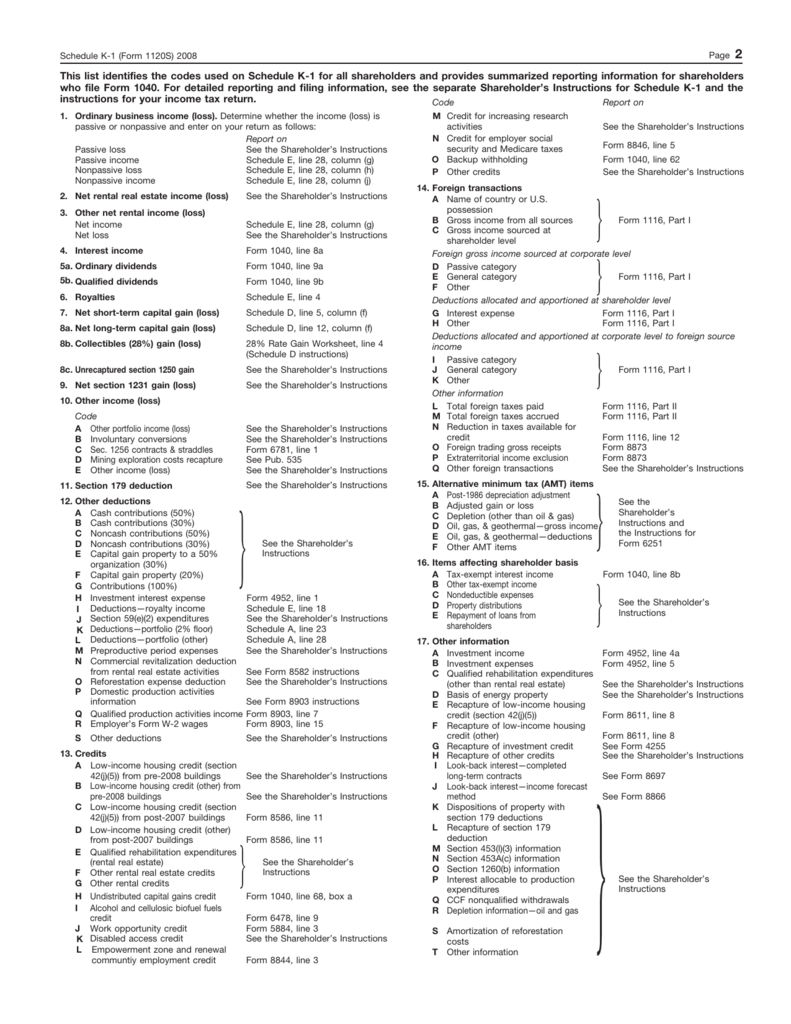

does 1120 have a k1 1120S K 1 formally known as Schedule K 1 Form 1120S is an IRS tax form used by owners and investors of S corporations You can find a blank copy of the Schedule K 1 for Form 1120S on the IRS website

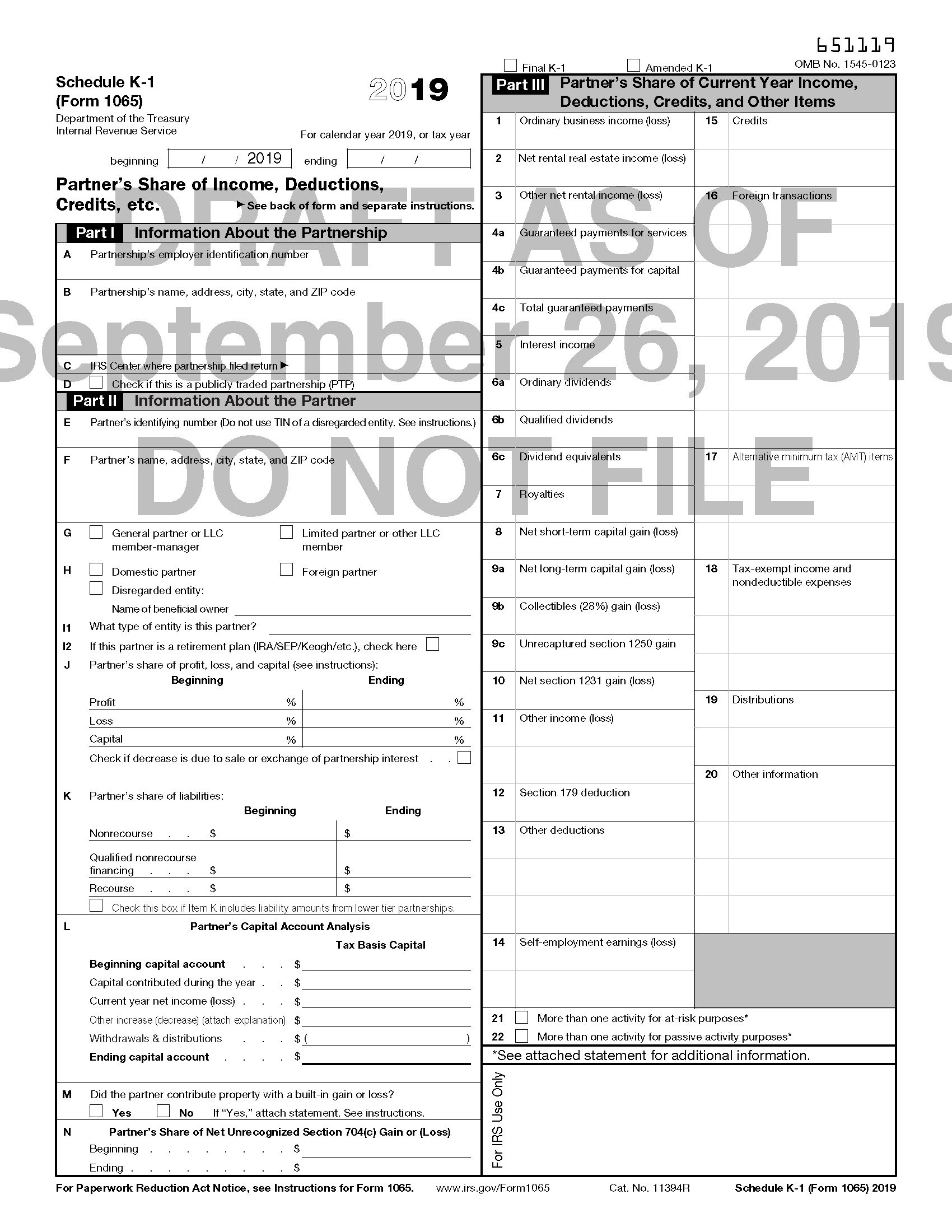

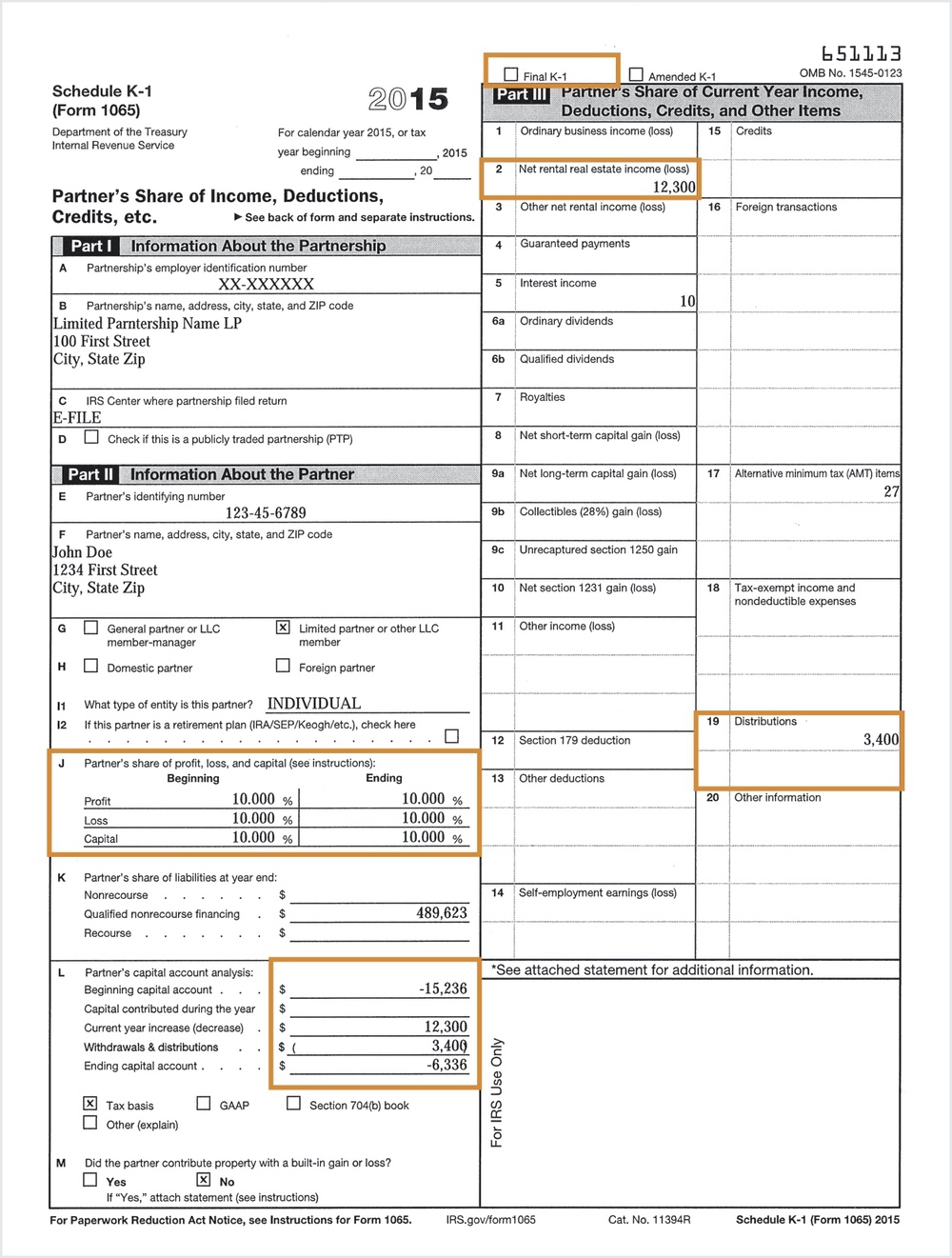

An S corporation reports activity on Form 1120 S Trusts and estates report the K 1 form activity on Form 1041 Key Takeaways Business partners S corporation shareholders and investors in The K 1 form is filed with the S Corp s tax return Form 1120S and provides the necessary information for completing your personal tax return Form 1040 The K 1 represents your

does 1120 have a k1

does 1120 have a k1

https://i.ytimg.com/vi/GCzfxDlWGSY/maxresdefault.jpg

FAQ On Taxes When Are You Required To File A Schedule K 1 Camino

https://img.caminofinancial.com/wp-content/uploads/2019/11/28174328/k1-1120.png

Schedule K 1 Instructions Examples And Forms

https://s3.studylib.net/store/data/008734590_1-b2e2bdce47e04fa80e970e6f46880c78.png

Learn how to file Form 1120S and Schedule K 1 for shareholders with step by step instructions for your tax return Make the most of your S Corp election when filing form 1120 S Schedule K 1 Form 1120S is prepared by a corporation as part of the filing of their tax return Each shareholder is provided a Schedule K 1 by the corporation

Schedule K 1 is a tax document used to report each shareholder s share of an S corporation s income deductions credits and other financial information It is an integral part of Form 1120 S the annual tax return that S The 1120 S Schedule K 1 reports a shareholder s allocated share of income losses deductions and credits from an S corporation Understanding how to read and utilize the information on Schedule K 1 is key

More picture related to does 1120 have a k1

Drafts Of 2019 Forms 1065 And 1120S As Well As K 1s Issued By IRS

https://images.squarespace-cdn.com/content/v1/54a14f8ee4b0bc51a1228894/1569938249555-6764N9ELJMSKNZCFBOKH/image-asset.jpeg

Sample K1 Tax Form Verhotline

https://www.irs.gov/pub/xml_bc/33347002.gif

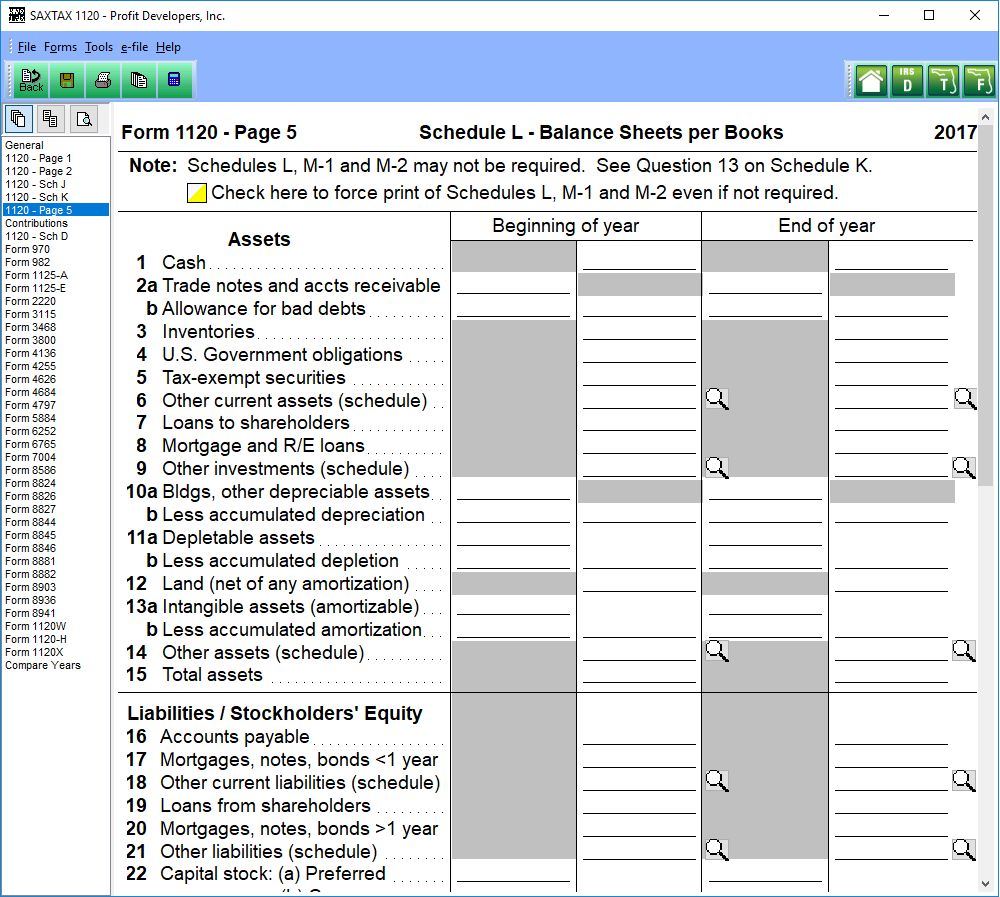

1120 Program SAXTAX

https://saxtax.com/wp-content/uploads/2018/10/Form1120_Page5.png

After filing Form 1120 S the corporation gives each shareholder their Schedule K 1 The K 1 reflects a shareholder s share of income deductions credits and other items that the I thought my question was a better question than the loud one but I got marked as not helpful Would it have been a better question to ask if the shouter has ever prepared an

A complete text of Exchange rules can be found online in the NYSE Listed Company Manual Listed Company Manual We have included items that are new below with important This article focuses solely on the entry of the Items Affecting Shareholder Basis which are found on Box 16 of the Schedule K 1 Form 1120S Shareholder s Share of Income Deductions

A Beginner s Guide To S Corporation Taxes

https://m.foolcdn.com/media/affiliates/images/S_corp_taxes_-_01_-_Form_1120-S_SLI0Nvc.width-750.png

2023 K1 Form Printable Forms Free Online

https://lpequity.com/wp-content/uploads/2021/02/K1-Blank-ExampleC.jpg

does 1120 have a k1 - Schedule K 1 is a tax document used to report each shareholder s share of an S corporation s income deductions credits and other financial information It is an integral part of Form 1120 S the annual tax return that S