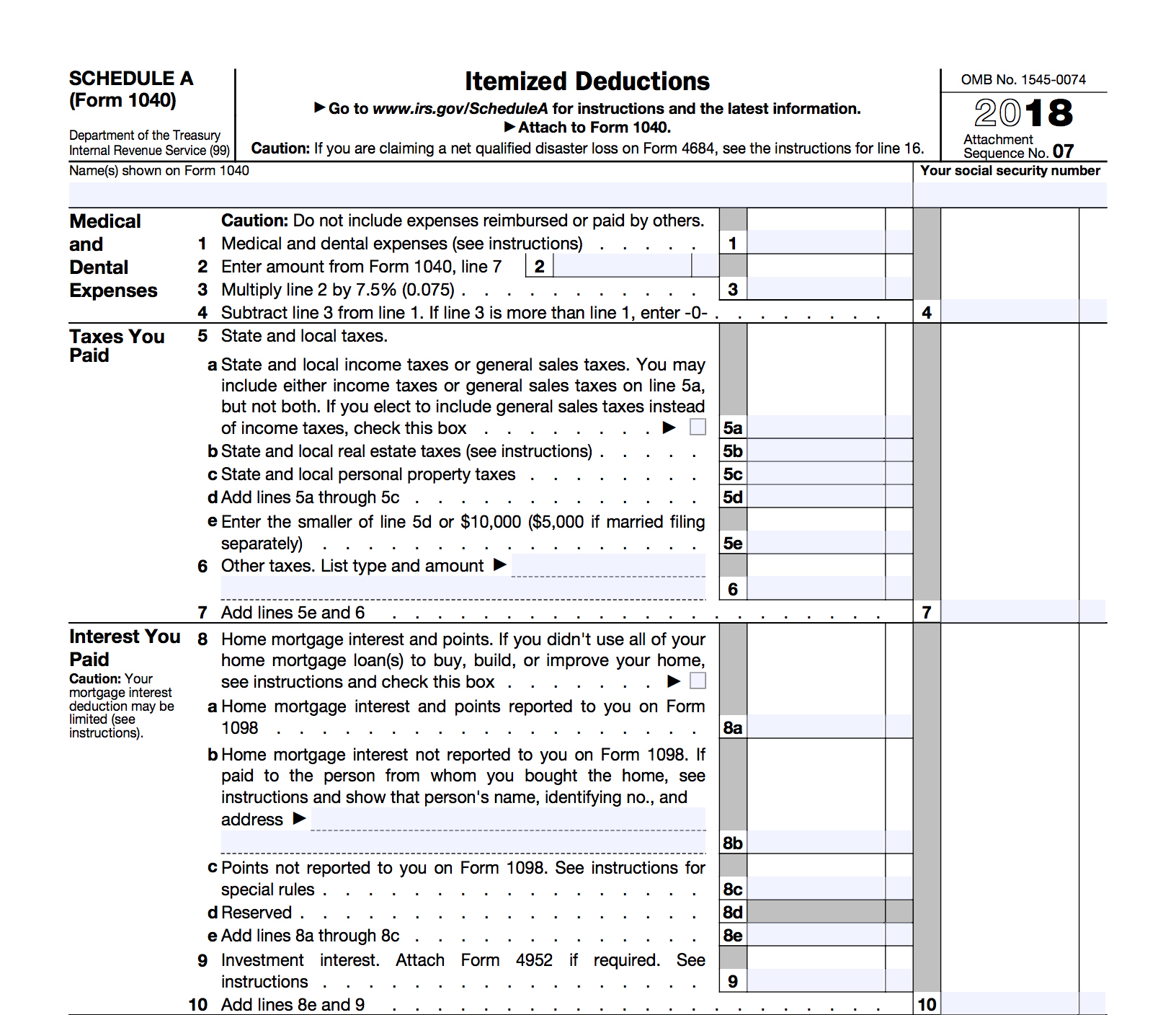

what is a deduction worksheet Use Schedule A Form 1040 or 1040 SR to figure your itemized deductions In most cases your federal income tax will be less if you take the larger of your itemized deductions or your

Introduction This publication discusses some tax rules that affect every person who may have to file a federal income tax return It answers some basic questions who must file who should Schedule A Itemized Deductions TaxSlayer Navigation Federal Section Deductions Itemized Deductions Medical and Dental Expenses If MFS and spouse itemizes taxpayer must also

what is a deduction worksheet

what is a deduction worksheet

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

10 Hair Stylist Tax Deduction Worksheet Worksheets Decoomo

https://i.pinimg.com/originals/d1/cc/34/d1cc3440c2d9554d9b23652b32649ea1.jpg

Publication 929 Tax Rules For Children And Dependents Tax Rules For

https://www.unclefed.com/TaxHelpArchives/2002/HTML/graphics/64349y02.gif

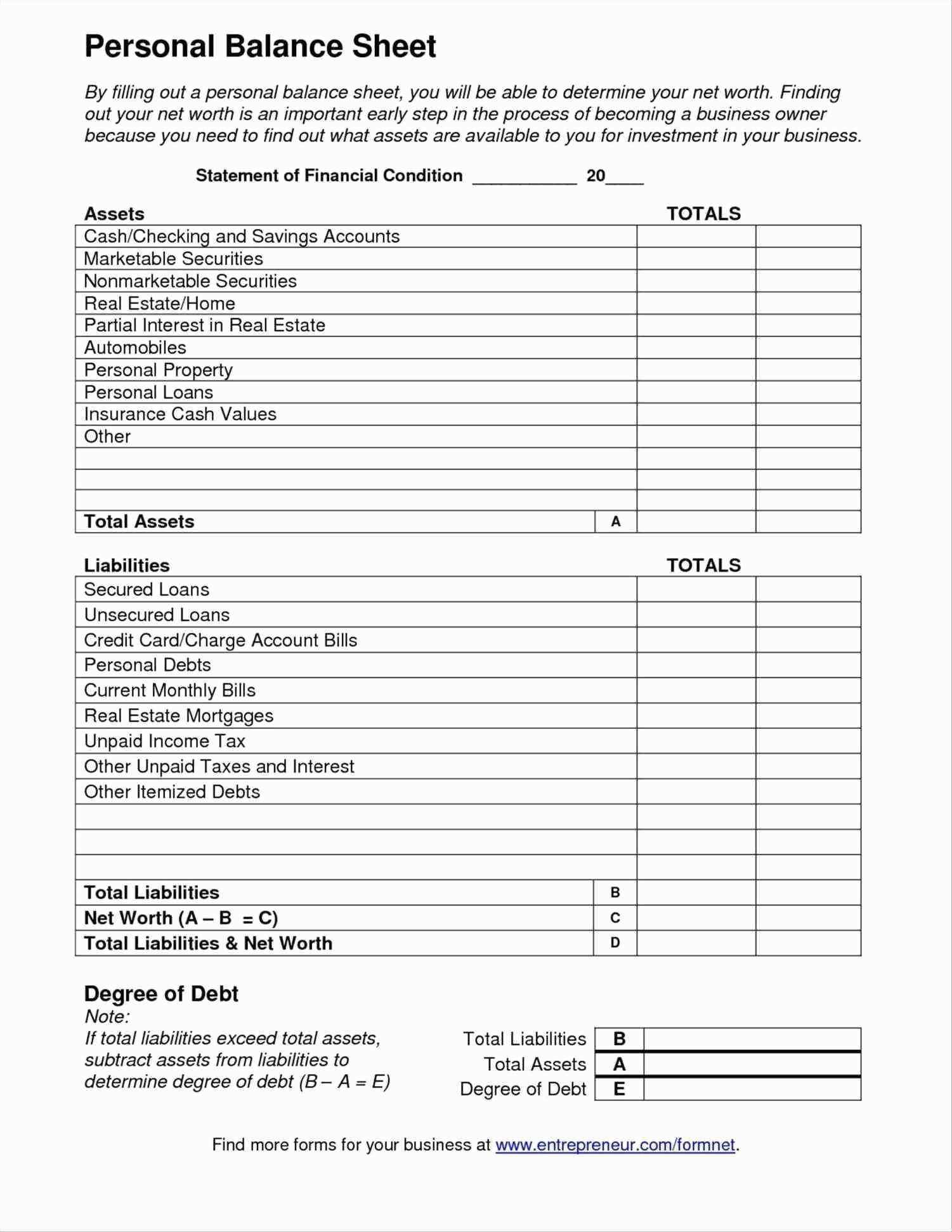

Itemized deductions are subtractions from a taxpayer s Adjusted Gross Income AGI that reduce the amount of income that is taxed Most taxpayers have a choice of taking a standard Schedule A Itemized Deductions continued Select for mortgage interest reported on Form 1098 Enter amount from Form 1098 Box 1 and Box 2 if applicable Private mortgage

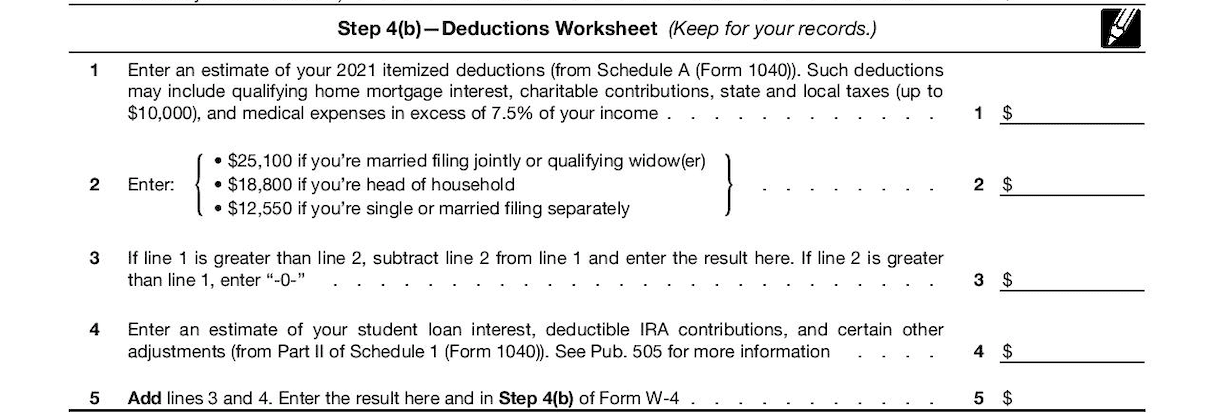

How to Calculate Deductions Adjustments on a W 4 Worksheet When you work for an employer in practically any industry you are required to fill out and submit a W 4 form which tells your employer how much taxes they Complete Form W 4 so that your employer can withhold the correct federal income tax from your pay If too little is withheld you will generally owe tax when you file your tax return and may

More picture related to what is a deduction worksheet

Standard Deduction Worksheet For Dependents

https://www.unclefed.com/TaxHelpArchives/2000/1040Instrs/wrksht_pg33.gif

Self Employed Tax Deductions Worksheet 2020 Form Jay Sheets

https://i.pinimg.com/originals/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

Qualifying Home Mortgage Interest W4 W 4 Form Complete The W 4 Form

https://millennialmoney.com/wp-content/uploads/2021/02/Deductions-W4.png

Key Takeaways Reviewing what you can deduct each year is important to make your business as profitable as possible if you re self employed You can calculate a deduction for a home office and Itemized Deductions Worksheet You will need Tax information documents Receipts Statements Invoices Vouchers for your own records Otherwise reporting total figures on

Deductions are subtractions from a taxpayer s AGI They reduce the amount of income that is taxed Most taxpayers have a choice of taking a standard deduction or itemizing their The Form W 4 instructions include worksheets to help you estimate certain tax deductions you might have coming

Itemized Deductions Spreadsheet Printable Spreadshee Itemized

http://db-excel.com/wp-content/uploads/2019/01/itemized-deductions-spreadsheet-in-business-itemized-deductions-worksheet-tax-deduction-worksheet-for.jpg

1040 Deductions 2016 2021 Tax Forms 1040 Printable

https://1044form.com/wp-content/uploads/2020/08/1040-deductions-2016.jpg

what is a deduction worksheet - Schedule A Itemized Deductions continued Select for mortgage interest reported on Form 1098 Enter amount from Form 1098 Box 1 and Box 2 if applicable Private mortgage