what is interest deduction worksheet Student loan interest is interest you paid during the year on a qualified student loan It includes both required and voluntarily prepaid interest payments You

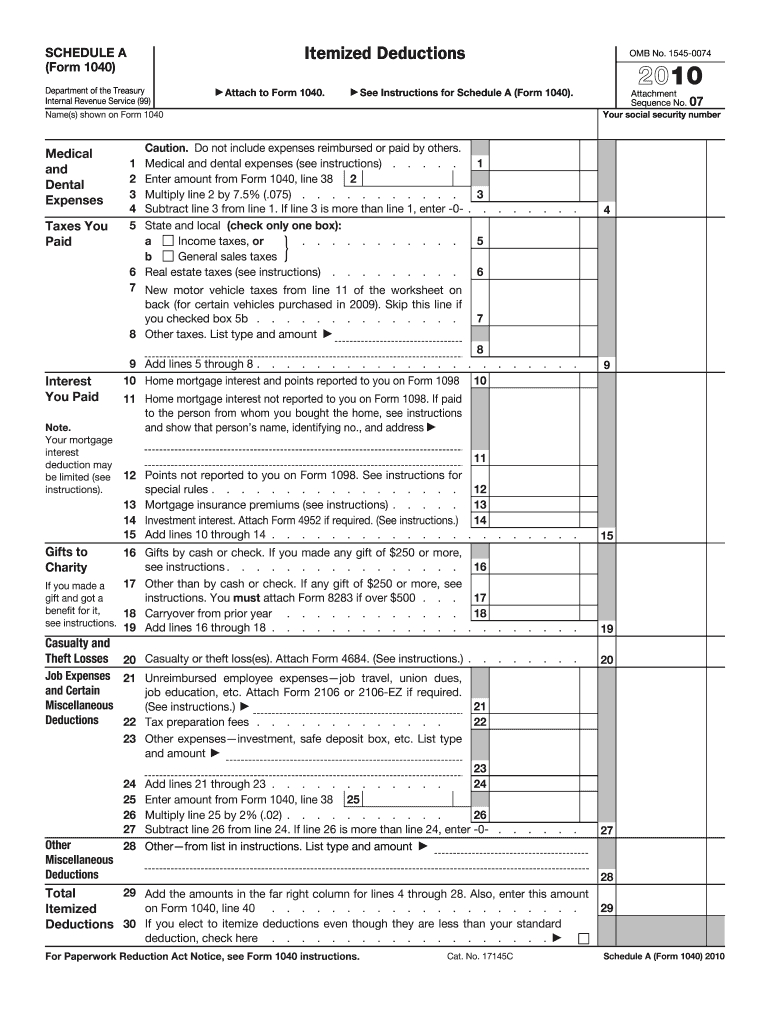

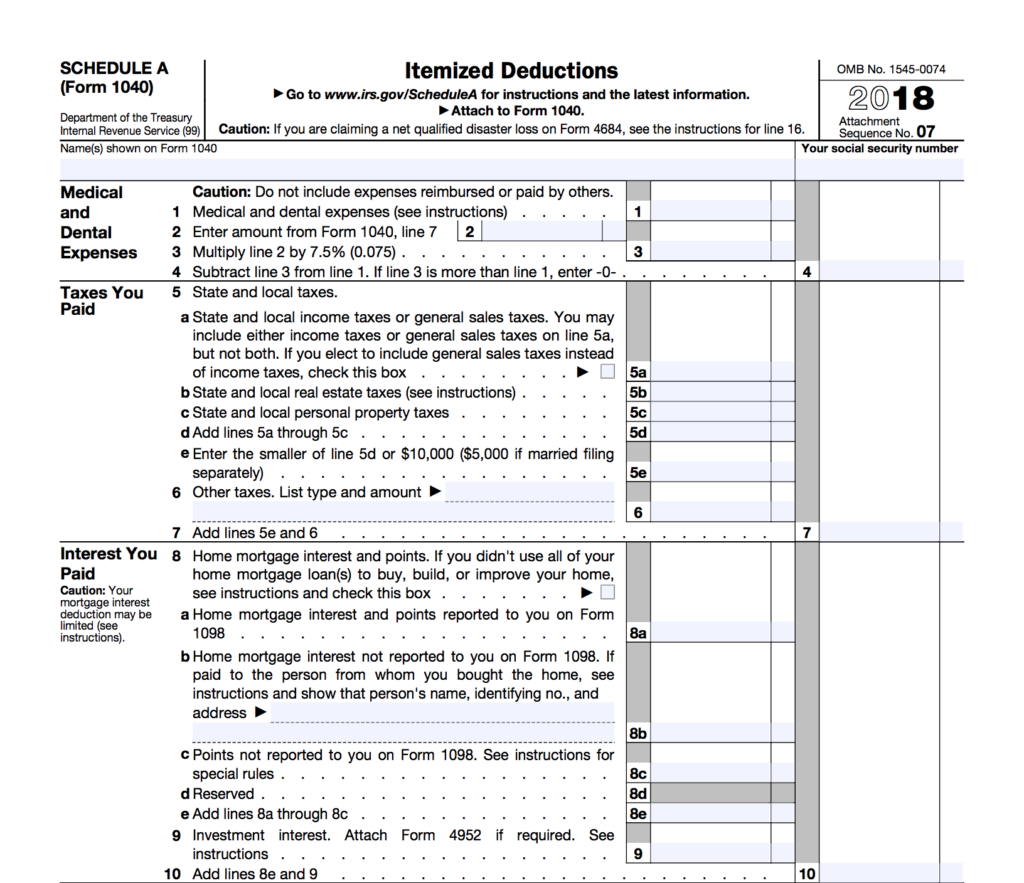

The tax and interest deduction worksheet is used if you are going to itemized deductions on a Form 1040 Schedule A If it is not applicable to your situation To calculate your deduction you can use the student loan interest deduction worksheet included in the IRS instructions for Form 1040

what is interest deduction worksheet

what is interest deduction worksheet

https://financegourmet.com/blog/wp-content/uploads/2010/01/deduct-property-taxes-550x452.jpg

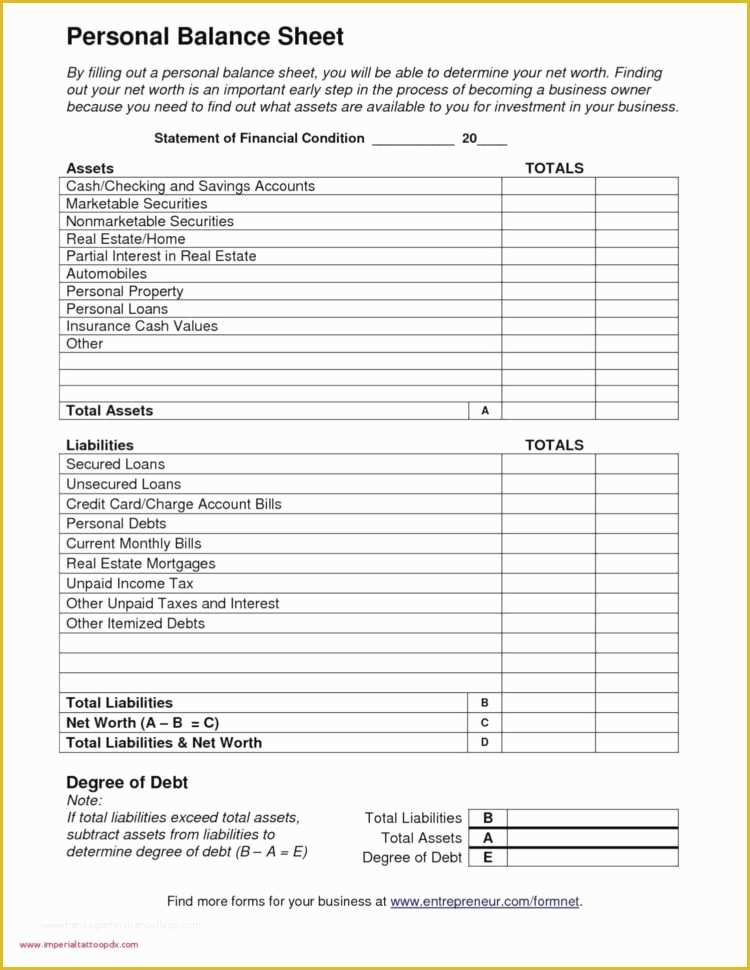

Itemized Deductions Worksheet 2017 Printable Worksheets And

https://i0.wp.com/db-excel.com/wp-content/uploads/2019/01/itemized-deductions-spreadsheet-in-business-itemized-deductions-worksheet-tax-deduction-worksheet-for.jpg

Free Accounts Payable Template Of 12 Excel General Ledger Templates

https://www.heritagechristiancollege.com/wp-content/uploads/2019/05/free-accounts-payable-template-of-accounts-payable-ledger-template-of-free-accounts-payable-template.jpg

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types The student loan interest deduction allows borrowers to deduct up to 2 500 of the interest paid on a loan for higher education directly on Form 1040 Eligibility for the

Student Loan Interest Deduction Worksheet Schedule 1 Line 33 Figure any write in adjustments to be entered on the dotted line next to Schedule 1 line 36 see the Interest Deduction A deduction for taxpayers who pay certain types of interest Interest deductions reduce the amount of income subject to tax The two main types of interest deductions are for

More picture related to what is interest deduction worksheet

2010 Form 1040 Schedule A Fill Online Printable Db excel

https://db-excel.com/wp-content/uploads/2019/09/2010-form-1040-schedule-a-fill-online-printable.png

Nurse Tax Deduction Worksheet Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/391/382/391382225/large.png

Publication 929 Tax Rules For Children And Dependents Standard Deduction

http://www.jdunman.com/ww/business/sbrg/graphics/64349y02.gif

Student loan interest deduction worksheet Use this to calculate the deduction You can find it in Schedule 1 of Form 1040 You determine that 15 000 of the interest can be deducted as home mortgage interest The interest you can allocate to your business is the smaller of The amount on Table 1 line 16 of the worksheet 15 000 or

IRS Form 1098 E is the Student Loan Interest Statement that your federal loan servicer will use to report student loan interest payments to both the Internal Revenue Service IRS Taxpayers can deduct student loan interest up to 2 500 in 2023 The deduction can be claimed as an adjustment to income Here s what you need to know

5 Itemized Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2010/07/schedule-c-tax-deduction-worksheet_449335.png

Irs Standard Deduction 2019 Over 65 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/how-to-reduce-your-tax-bill-with-itemized-deductions-bench-2-1024x883.png

what is interest deduction worksheet - Understanding the Deductible Home Mortgage Interest Worksheet in ProSeries SOLVED by Intuit 42 Updated January 04 2024 The Deductible Home